Since the past few decades, emerging markets have become the center of investors’ interest for achieving high investment returns. These markets are famous for their fast growth rate and can generate remarkable profits in a short duration.

According to the World Bank’s data, the GDP growth rate of China and South Korea (emerging markets) remained well above the developed economy of the US between 1969 to 2019. China showed a GBP increment of 73.6x compared to the US (3.8x) in this specified period.

The above figures indicate the exceptional potential of emerging or developing markets. So, are you interested in learning about an investment product that focuses on emerging markets stocks?

Then, read this article to understand the working and performance of the Vanguard Emerging Markets Index Fund.

Three things to know before starting:

- VEMAX seeks the results of more than 5000 emerging markets stocks.

- This mutual fund has a considerably lower expense ratio (0.14%) than its counterparts.

- The minimum investment amount for this fund is $3000.

What is the Vanguard Emerging Markets Stock Index Fund (VEMAX)?

Vanguard Emerging Markets Stock Index Fund closely tracks the performance of Spliced Emerging Markets Indexes, which integrate the stocks of large/mid-cap companies of numerous emerging markets. Emerging markets are the rapidly-expanding nations with aggressive growth approaches, including countries like China, Brazil, India, South Korea, and many more.

VEMAX fund is a volatile investment product, providing investors an opportunity to obtain an impressively fast return. As of October 2021, the fund contains around 5250 stocks, with the highest allocation from China (36.9%), followed by Taiwan (18.2%) and India (15.2%)

Moreover, the fund is market-cap weighted, and its largest ten holdings compose 21.30% of the total net assets.

The current top three holdings are:

- Taiwan Semiconductor Manufacturing Co. Ltd.

- Tencent Holdings Ltd.

- Alibaba Group Holding Ltd.

History of the VEMAX

Vanguard Group launched the Vanguard Emerging Markets Fund (VEMAX) in June 2006. Vanguard is a leading US-based investment management company that provides a wide range of investment options.

The group is the largest issuer of mutual funds and the second-largest issuer of ETFs. It also provides investment advisory and related services.

Pricing and performance

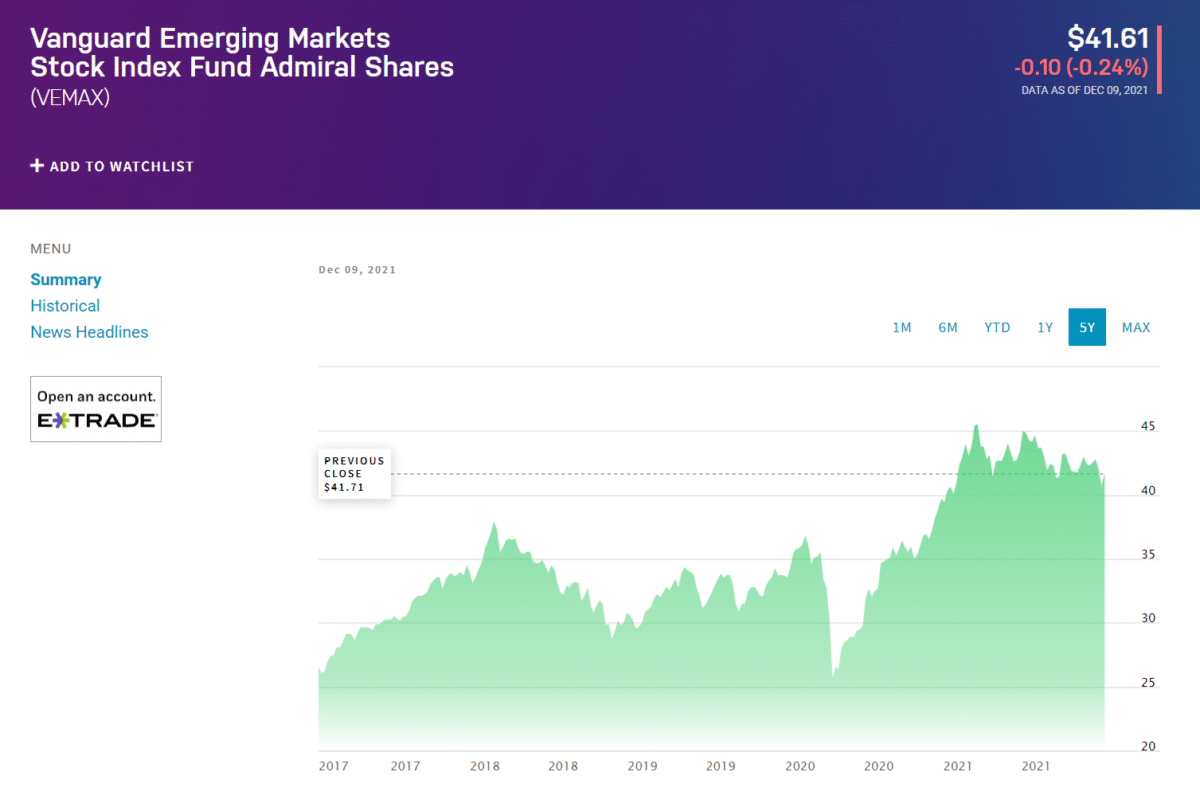

From 2012 to 2016, the VEMAX price remained between $20 to $29 without any significant gains. However, the price started surging in the middle of 2017 and reached around $37 in the first month of 2018.

VEMAX faced a major price dip in the middle of 2020, plunging to $27; nonetheless, the recovery rate was fast and steady. The price broke the previous all-time high and peaked at $45 at the start of 2021. The fund is currently trading around $41.

According to the latest month-end report, the fund showed an average 1-year and 3-year total returns of 5.73% and 10.54%, respectively. However, its YTD- investment return (12/2021) is almost flat at 1.63%.

Moreover, as of October 2021, the median market cap of this fund is $24.6 billion. Its earnings growth rate is about 11.5%, and its price-to-earnings ratio stands at 13.3x.

In addition, the total net assets of the Vanguard Emerging Markets Stock Index Fund (all shares classes) are approximately $110.9 billion.

Strategy and benefits

Vanguard Emerging Markets Index Fund (VEMAX) offers a low-cost equity exposure to emerging markets. This mutual fund is also available as the “Investors shares” class (VEIEX) but has higher costs. However, both funds mimic the performance of the emerging stock markets index.

This index fund is suitable for investors who want investment access to international markets. VEMAX accommodates stocks from various emerging markets leading to portfolio diversification aside from the US stocks.

Moreover, the emerging markets have shown transcending growth rates than the developed markets for the past few decades. It is due to their inherent capacity of developing and growing exponentially.

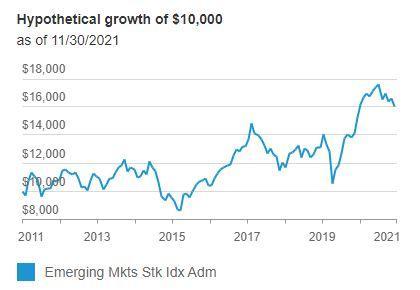

Correspondingly, VEMAX, being an emerging market fund, has elevated growth potential and the capability to generate outstanding returns. According to the recent data, this fund reported an average 10-year return of 6%, though the short-term gains were even higher (10-20%).

Fees

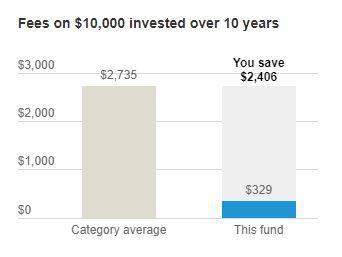

Vanguard Emerging Stock Fund comes under the ‘Diversified emerging markets’ category and has a minimum investment amount of $3000. It has an expense ratio of 0.14%, well below the category average of 1.22%. Moreover, the management charges are 0.11%, which is lower than the average of 0.9%.

The following chart illustrates the fees incurred on a $10,000 VEMAX investment with 9% average annual returns over ten years.

Risks

According to the official Vanguard report, the risk of this index fund is at the five mark (more risk, more reward). The volatility and risk measurements as of September 2021 are as follows:

- Sharpe ratio: 0.44

- Standard deviation: 18.92

- Mean: 0.79

Vanguard Emerging Markets Stock Index Fund 2022 forecast

VEMAX fund has recently shown a strong upward momentum by climbing from $28 to $44 in 12 months. However, the technicals indicate trend neutrality of this fund in the upcoming years.

Though the price can cross the $50 mark by the end of 2022, it also has a possibility of returning to $30. Investors should follow effective risk management if they plan to invest in this fund.

Pros and cons

Vanguard Emerging Markets Stock Index Fund carries significant advantages as well as challenges. Let us have a look at the pros and cons of this fund.

| Worth to use | Worth to getaway |

| Superior growth rate The companies of emerging nations have shown superior and swift growth rates compared to developed economies for the past few years. | Regional risk Economic downturns and political disturbances can negatively impact the prices of securities allocated by the relevant nations. |

| Incorporate undervalued stocks VEMAX contains many undervalued stocks that are not present in traditional index funds. | Currency exchange rate element As the US dollar is the functional currency of this fund, it is prone to currency exchange risk that can reduce the investment returns. |

| International diversification This mutual fund provides regional diversification to the investors’ portfolio and prevents over-reliance on one country. | Volatile and illiquid markets VEMAX holds stocks of volatile markets that can show wild price swings. Moreover, these markets are relatively illiquid with low trading volumes. |

Final thoughts

The most important investment principles are to estimate your personal goals, risk appetite, and investment duration. VEMAX is a cost-effective fund that can diversify your investments along with striking returns.

Moreover, emerging market funds like VEMAX can be an ideal fast-growth addition to the traditional portfolio. However, professionals recommend adopting the emerging equity funds as only a portion of your overall investing strategy, which should also integrate other developed markets’ investment products.