The popularity of exchange-traded funds has been due to their low expense ratio, ease of trading and investing diversification, and the belief that the economy will grow. The truth of the matter is that for ETFs, growth might be inevitable in the long run, but there are market downturns in the course of this growth.

Thus in the 2020 pandemic year, the SPY had returns of +18.4% despite a decline of 34% between February and March of the same year.

Is there a way that investors could have leveraged against this momentary drop and make money? Let’s look at the excellent opportunity.

What are inverse ETFs?

Traditional ETFs consist of a pool of assets that track the economy’s sections with a view of making money off the growth in the long term. As for inverse ETFs, they mint money off a decline in asset value in the short term. As such, they come with higher investment risk and associated investment expenses. However, when played right, inverse ETFs have the potential to offset momentary portfolio losses and give an investor extra earnings.

How are inverse ETFs constituted?

Like traditional ETFs, inverse ETFs are made up of underlying holdings of the index they track. However, inverse funds invest in future contracts on their constituent holdings rather than invest via the current market rates.

Therefore, inverse ETFs work on the premise of either the market going up or down and coming up with a predetermined future price to sell the held asset. For example, if an investor believes that the SPY value will fall, investing in the SH is a way of setting a future contract to sell the SPY share at a higher price than the market rate when the value drops.

In 2020 when the SPY lost 34% between Feb and April, investors hedged against this market downturn by investing in the ProShares Short S&P 500 ETF, SH, more than recouped their profits; SH gained 39.09% in the same period.

Three inverse ETFs to leverage against market sell-off

In times of market downturn, short-selling stocks result in higher associated costs such as margin calls. The downturn of an individual stock can also go on longer than the invested capital. Rather than deal with these issues, the ideal way to hedge against a bear asset is to use inverse ETFs.

Inverse ETFs through their composition, eliminate margin calls and the associated costs, while their diversification protects investors against unlimited downturn as opposed to individual equities.

Therefore, the following three inverse ETFs will ensure enhanced returns are used to hedge against market downturns as the investment world recovers post-pandemic.

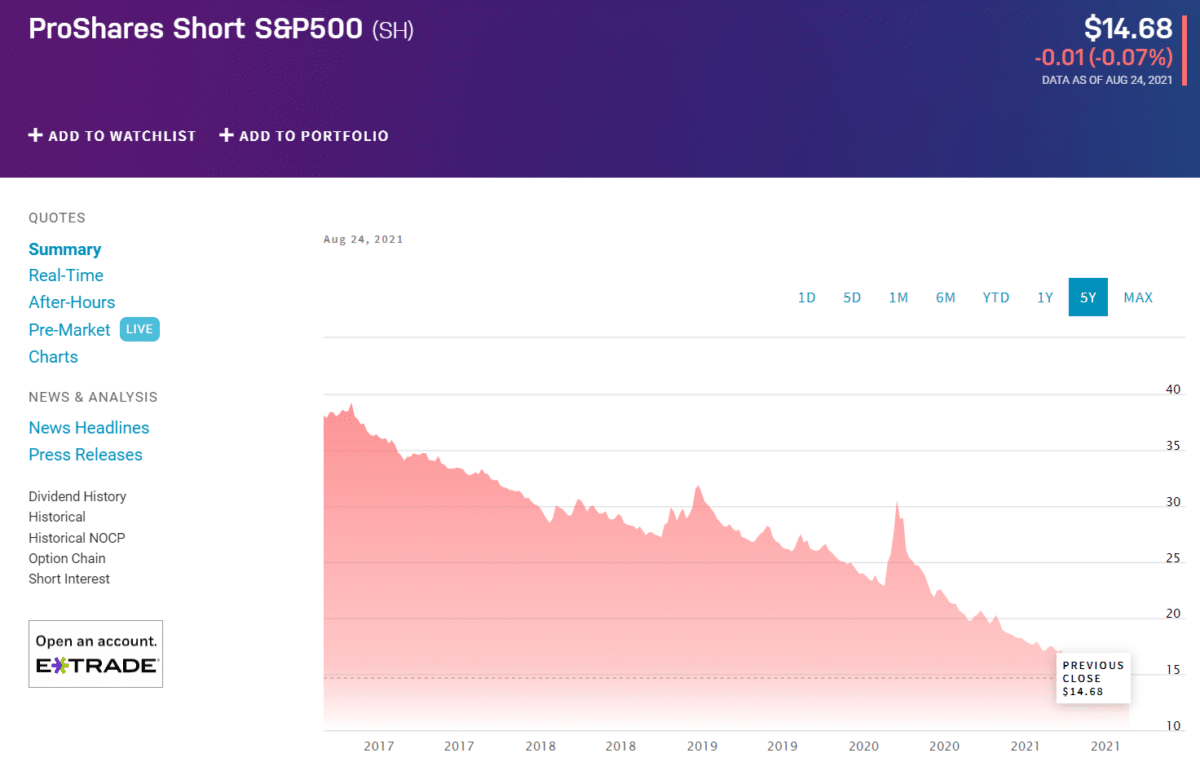

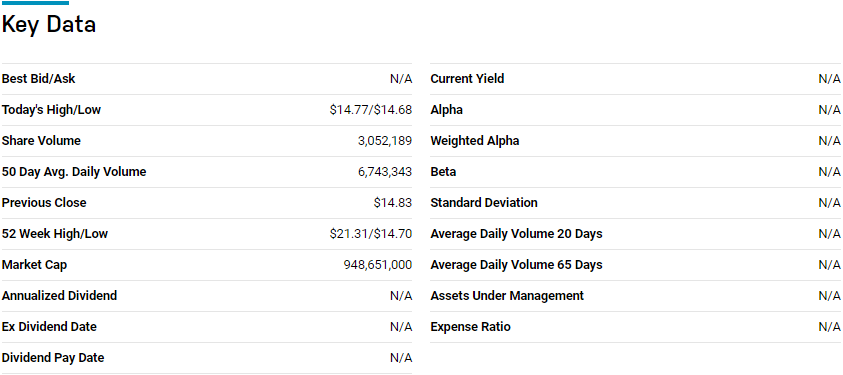

№ 1. ProShares Short S&P 500 (SH)

Price: $14.68

Expense ratio: 0.75%

Introduced to investors in 2006, those who had an inkling of inverse ETF trading made money in the stock depression of 2008 by using the SH to hedge. It is a non-diversified fund that tracks the performance of the S&P 500 index, with a view of giving its investors the same performance as the index but in the opposite direction.

Therefore, it is an ideal hedge investment for investors with positions in the S&P 500 equities, the US largest 500 companies.

With $1.37 billion in assets under management, the SH is one of the most significant inverse ETFs. For an investment of $10.000, investors have to part with $95 in expense fees. If jittery about the slowing down of economic recovery as a whole, the SH is the fund to hedge against falling equities of the top companies in the US company.

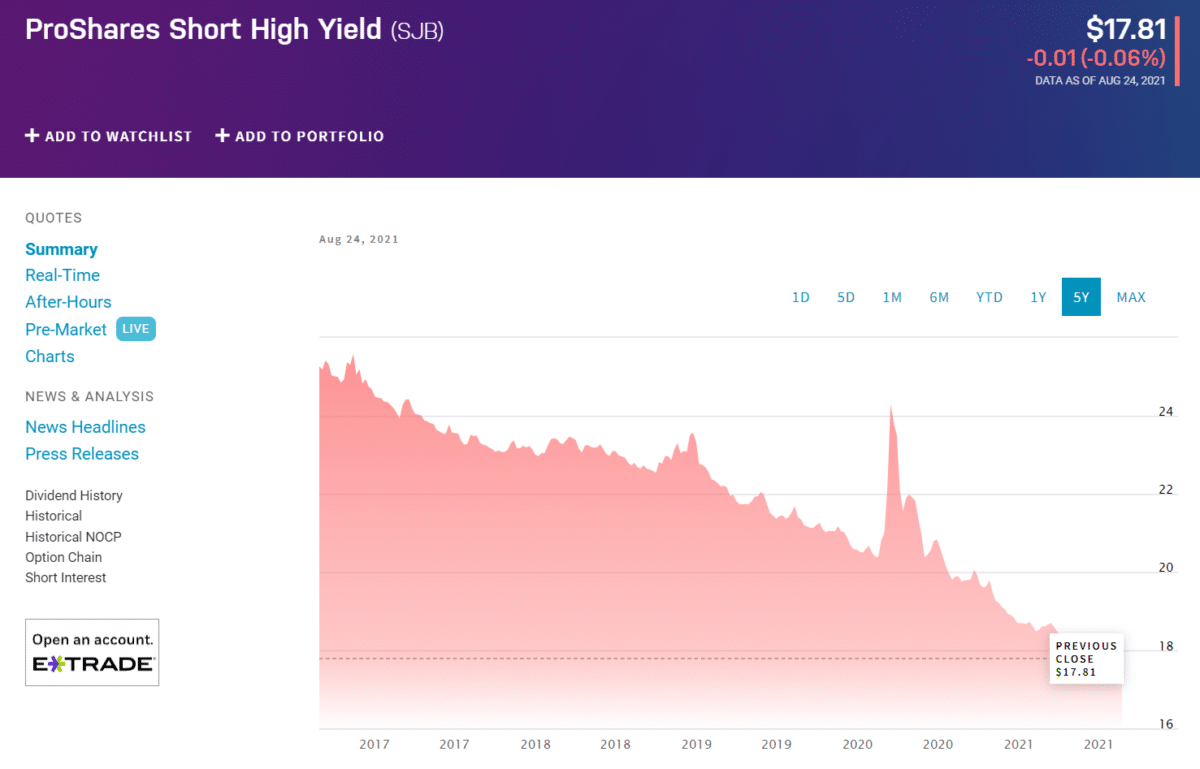

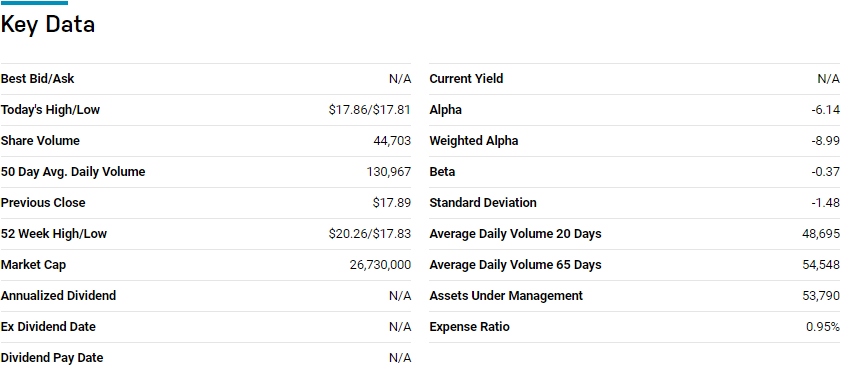

№ 2. ProShares Short High Yield (SJB)

Price: $17.81

Expense ratio: 0.95%

This inverse ETF tracks the Markit iBoxx $Liquid High Yield Index, with a view of providing investors a hedge asset in times of market downturn. The objective is inverse results to its underlying index, ensuring investors gain exposure to the most liquid high-yield corporate boards in the US economy.

Organizations are pretty in a pickle due to the shutdown or downsizing during the pandemic. As organizations look for funding to ensure full capacity post-pandemic, these inverse ETFs are in pole position to take advantage of the higher interest rates that come with the less-than-ideal economic conditions. The SJB has 58.82 million in assets under management, with an expense ratio of 0.95%.

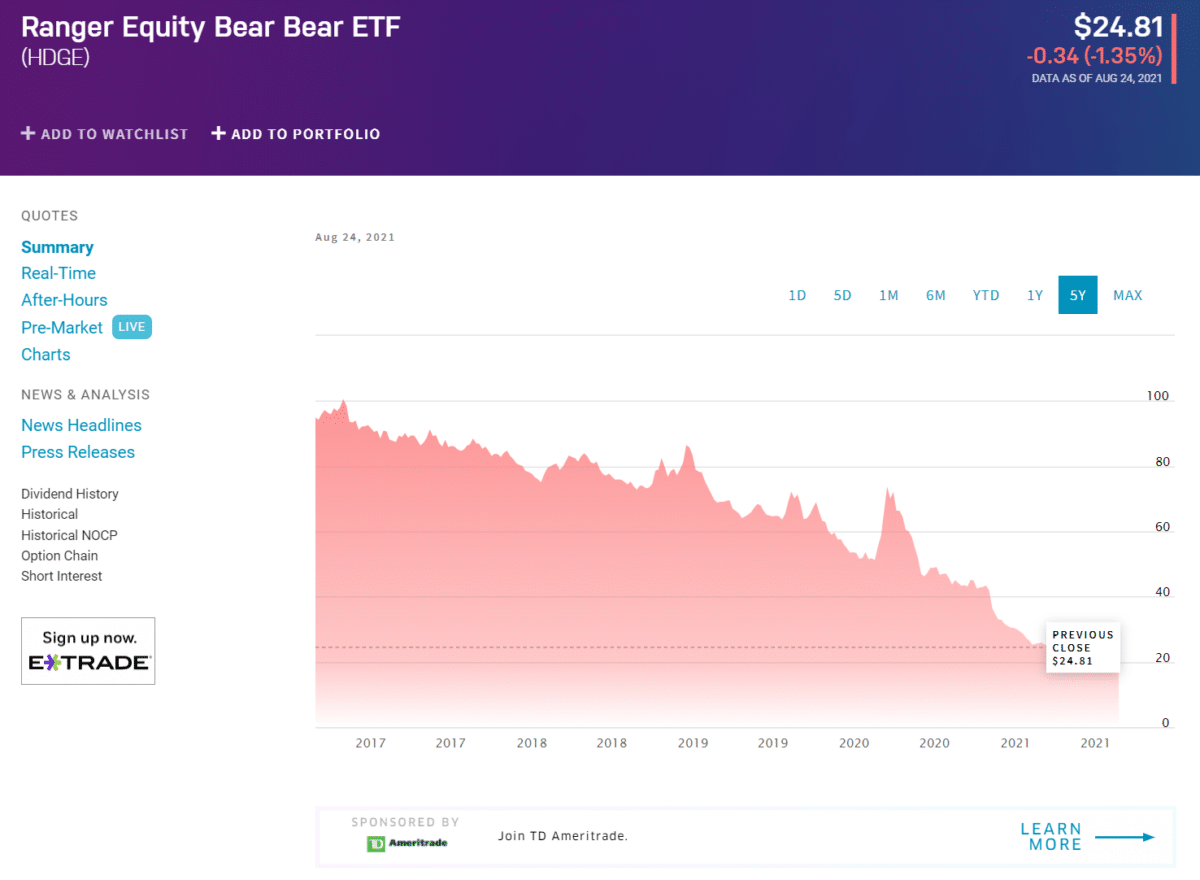

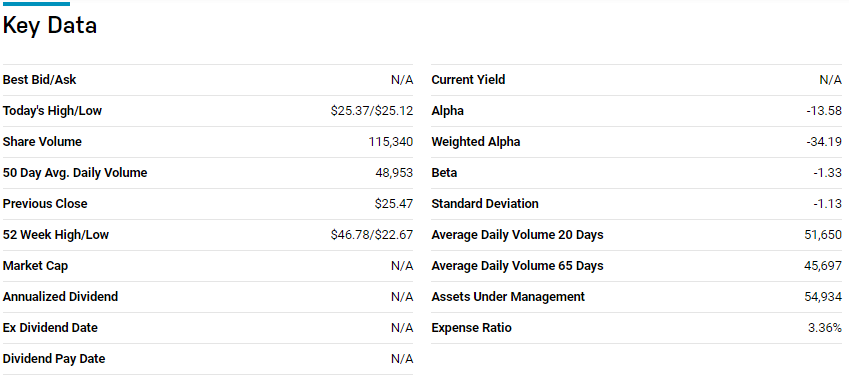

№ 3. AdvisorShares Ranger Equity Bear (HDGE)

Price: $22.81

Expense ratio: 3.36%

If on the lookout for wealth appreciation through short-selling US domestic equities, this inverse ETF is worth looking at. The HDGE invests in investment research to identify highly liquid securities in pole position for short selling; small and mid-cap organizations, exchange-traded funds, and exchange-traded notes.

This inverse ETF has $56.6 million in assets under management. Being a diversified but actively managed inverse ETF, this inverse ETF has one of the highest expense ratios for an exchange-traded fund, 3.36%. However, active management of this fund comes with the inherent risk of the fund managers picking the wrong stocks. For investors looking for a different approach to equity hedging, this is the ETF to invest in.