As a trader, it is essential to have the correct trading mindset. Equipping yourself with the required psychological traits will benefit you in the longer run. We have made a list of the five best tips to help change your trading mindset.

Why is the trading mindset important?

In trading, your mindset matters even more than the strategy you are using. Your psychological approach defines how well you will perform in the business. You can learn all the technical skills, use the right indicators, and have the best broker. Still, you will fail if you don’t possess one key attribute: the proper trading mindset.

The next obvious question is, what is the right trading mindset? The perfect trading psychology is to be disciplined, take quick decisions, and exercise control over your emotions when the market goes against you.

Practice persistence, learn to keep yourself humble upon consecutive wins, manifest a hunger for growth, and you will eventually be at the top of your game.

Tip 1. Evaluate yourself regularly

Self-awareness is the first step for becoming a successful trader. To get somewhere, you first need to know where you stand. This is why self-evaluation is so essential.

Ask yourself if you have a business plan. Check if that plan suits your current market needs. Define what trading market can be the best fit for you. What are your risks?

Your trading history shows a certain percentage of monthly gains/losses. First, evaluate whether you are lagging or are you well optimized. If you are lagging, then why and how can you improve it? Answering such questions will give you a clear picture of your position as a trader.

Most of the investors don’t assess themselves.

Why does it happen?

Investors do not optimize their strategy regularly because they never assess themselves in the first place. As a result, they are not aware of their shortcomings, so they are unable to improve.

How to avoid the mistake?

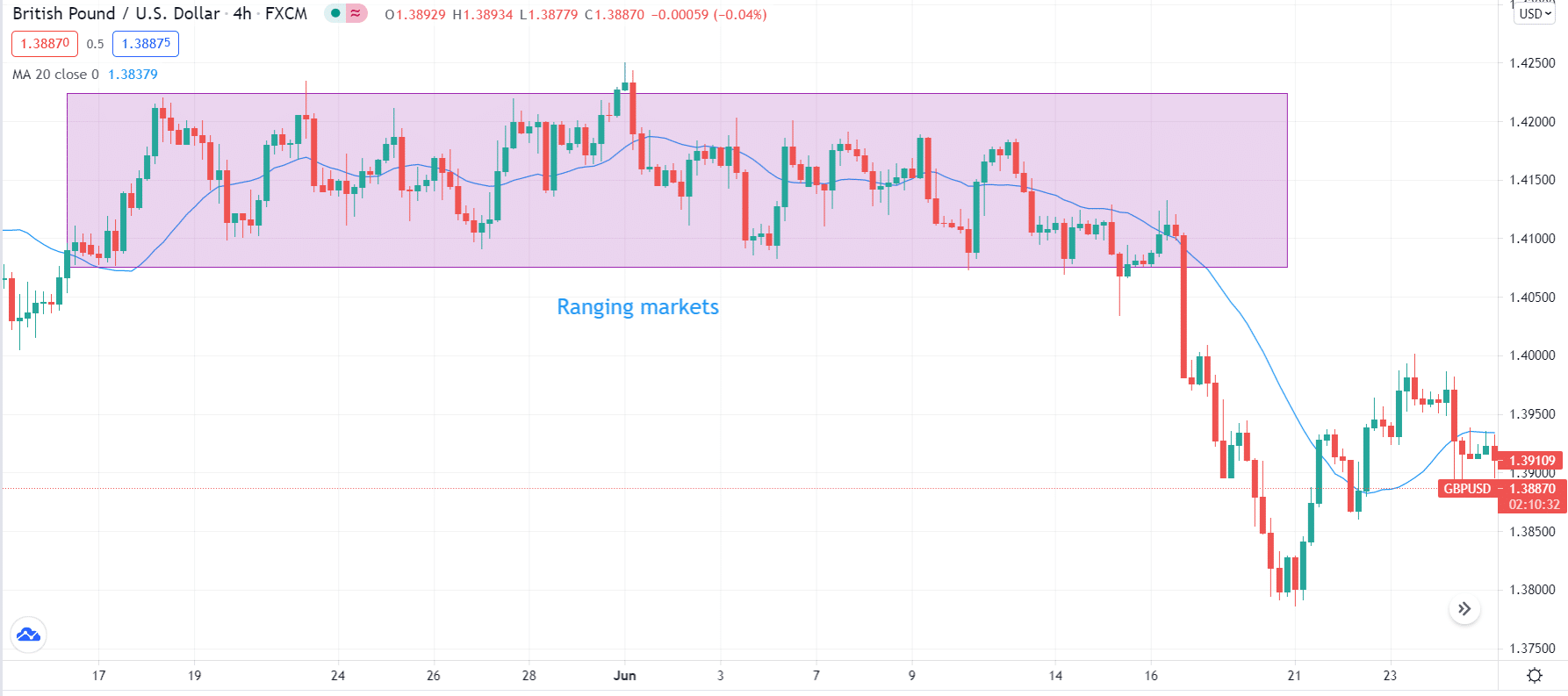

Analyze your last 50 trades. First, check how many of them were closed manually and how many hit the target. Next, rate your trades as good, average, and poor. This will provide you with historical data based on which you can make wiser decisions in the future. For example, if you employ your trading based on 20-SMA (4-hour).

You may find successive losses in the ranging market because moving average works only in trending markets. Hence, it would help if you found another strategy that can work in ranging markets.

Tip 2. Create rules that suit you

As tedious as it sounds, rules add discipline to your life. Creating a set of rules and then sticking to them will put your trading life in order.

Use the information gathered from self-evaluation to define rules that best fit your situation, or you can mold the existing rules to make them more effective.

Traders lose large sums of money because of missing out on such a basic step.

Why does it happen?

If investors don’t set some criteria for entry/exit points, trade management, and money management, they will be trading at random, and the results will also be spontaneous.

There won’t be an identifiable pattern which is why they are more likely to suffer loss.

How to avoid the mistake?

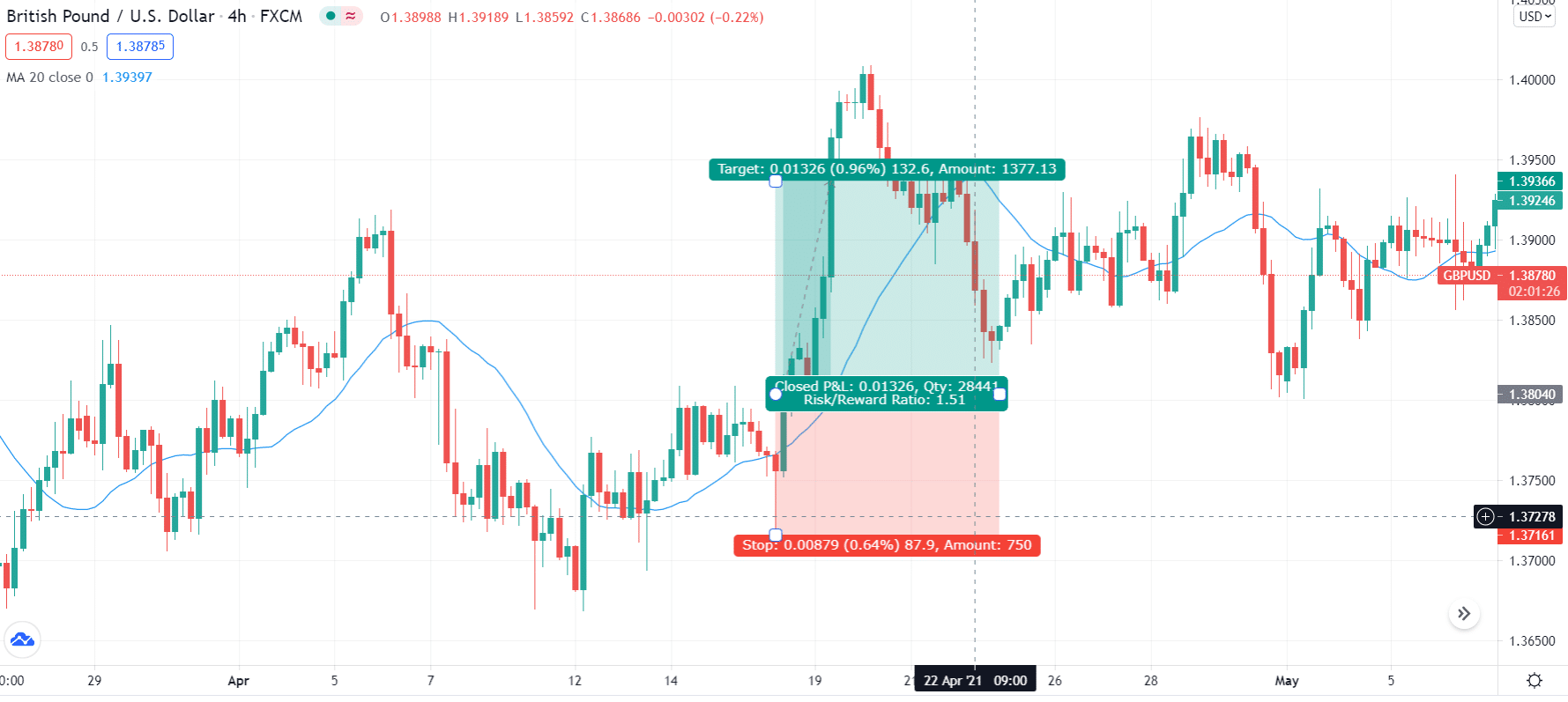

Define some clear rules for yourself and follow them strictly. Next, measure your risk to reward ratio and set a stop-loss. Once you have done that, put your instincts and emotions aside. Intuition can be misleading, so stay away from it. Finally, let’s quote another example of trading moving averages.

Look at the chart above. We got a long signal with a reward 1.5 times greater than the risk. If we get a reward of less than 1.5 the risk, we can stay out of the trade.

Tip 3. Keep a trading journal to assess your moves

Journaling is what separates a professional trader from a beginner. Make a trading journal where you note everything from making a trade to the currency pair you are trading in, what points you enter/exit at, the results, etc.

You must mention minute details like why you decide to enter a particular trade. This will help in evaluating each move and will provide clarity of mind.

Traders either do not journal at all or fail to journal correctly.

Why does it happen?

Investors do not journal because they either think it’s ineffective or they are lazy to start one. This is why they cannot evaluate their performance correctly since there is only so much a person can remember.

Another reason is that they are not regular with their journaling. So they miss certain information, which makes it hard for the pattern to make sense. For example, you entered a trade where you gained 5% and lost 5% as well. So now, you will not have credible information to assess where you are lagging.

How to avoid the mistake?

Keep a journal, maintain it and observe your last 50 trades. Then, analyze them and summarize the results to make strategically better decisions in the future.

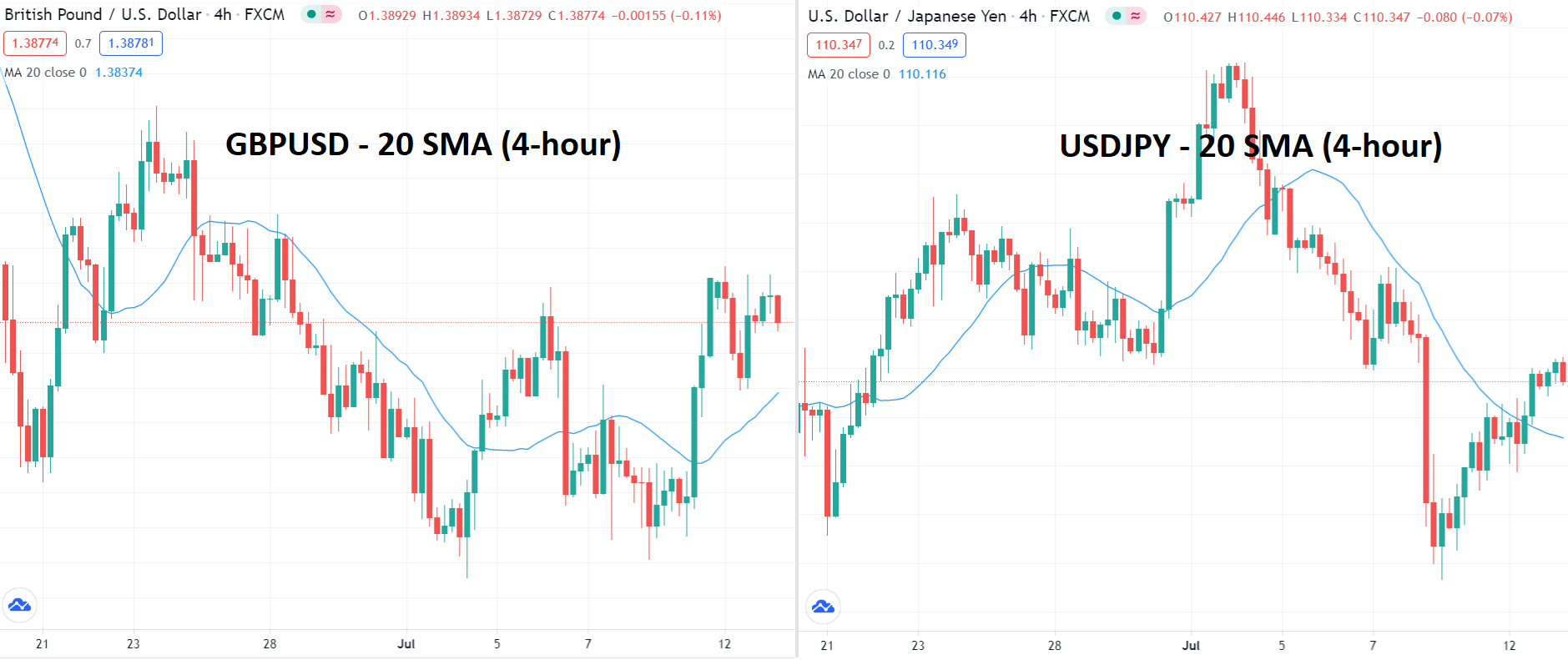

Note the overall perspective of the market. For example, if you invest in the GBP/USD and USD/JPY using the same 20-SMA on the 4-hour chart.

You cannot distinguish which currency pair performed better unless you have a trading journal. This will provide you with a bird eye view of the situation.

Tip 4. Control emotions

Trading is like a roller coaster. One moment you can be at the top of the world, and the very next moment, the tables might turn. It is natural to feel a frenzy of emotions in such situations, but it controls those emotions.

Around 90% of the traders fail because they let their emotions take control of them.

Why does it happen?

Forex is a quick market. Prices rise and fall every second. Problems arise when investors start panic buying or selling with every rise/fall in the market.

How to avoid the mistake?

In tip no.2, we advised you to create rules. That is the safe solution to this problem. Follow the criteria you have set for yourself. This will stop you from making any impulsive decisions.

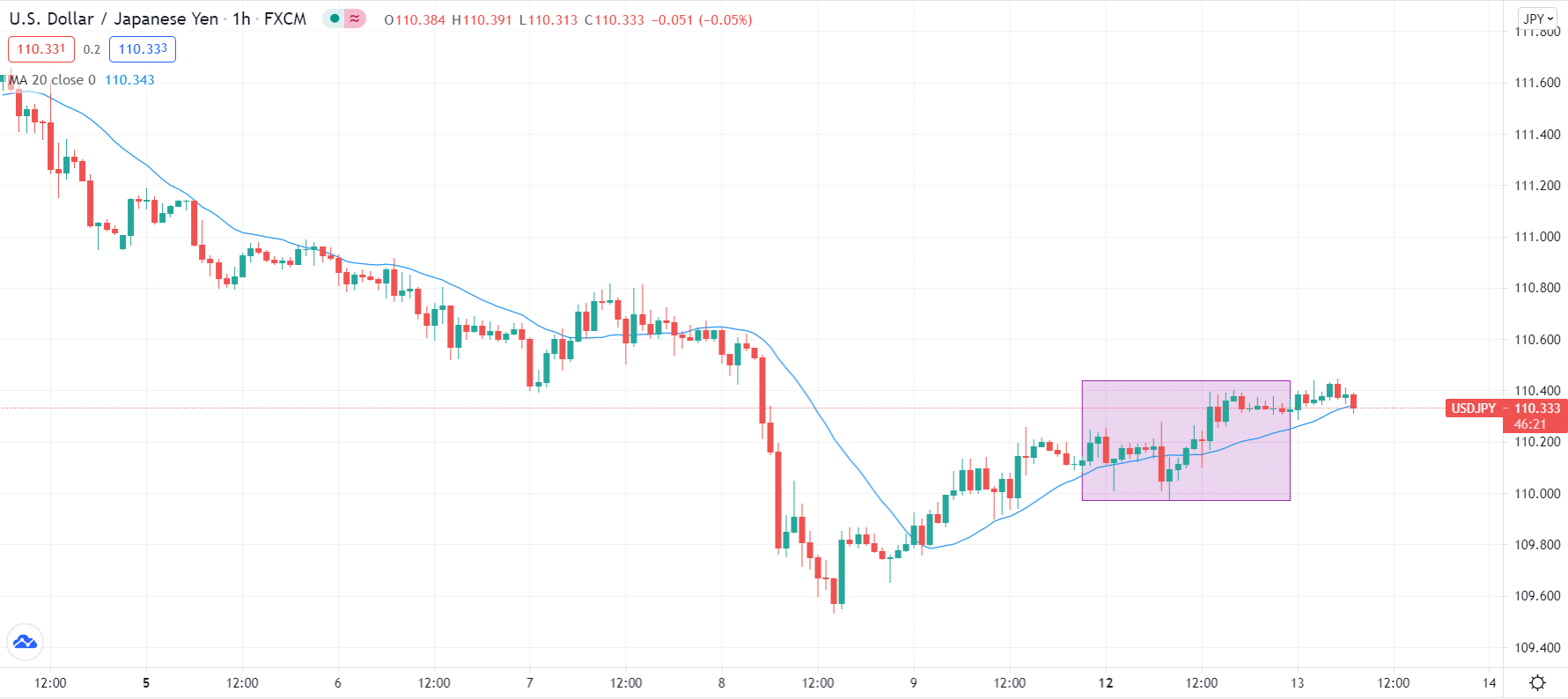

Take charge of your emotions rather than letting them control you. Learn when to take a leap forward and when to take a step back. For example, trading volume is usually low on Monday. If no qualified setup is available, you should remain neutral.

The above chart shows a tight range of USD/JPY on Monday, July 12, 2021 (as shown in the rectangle).

Tip 5. Follow a healthy lifestyle

A healthy lifestyle, though often overlooked, is highly integral to improve your trading mindset. For example, Forex is an around-the-clock market. If you spend 16-18 hours of your day in front of the screen, waiting in hopes of a good entry/exit point, it will hurt your professional life as well as your mental health.

You do not have to monitor trades constantly.

Why does it happen?

This mostly happens when traders fail to establish a balance between their personal and work life.

How to avoid the mistake?

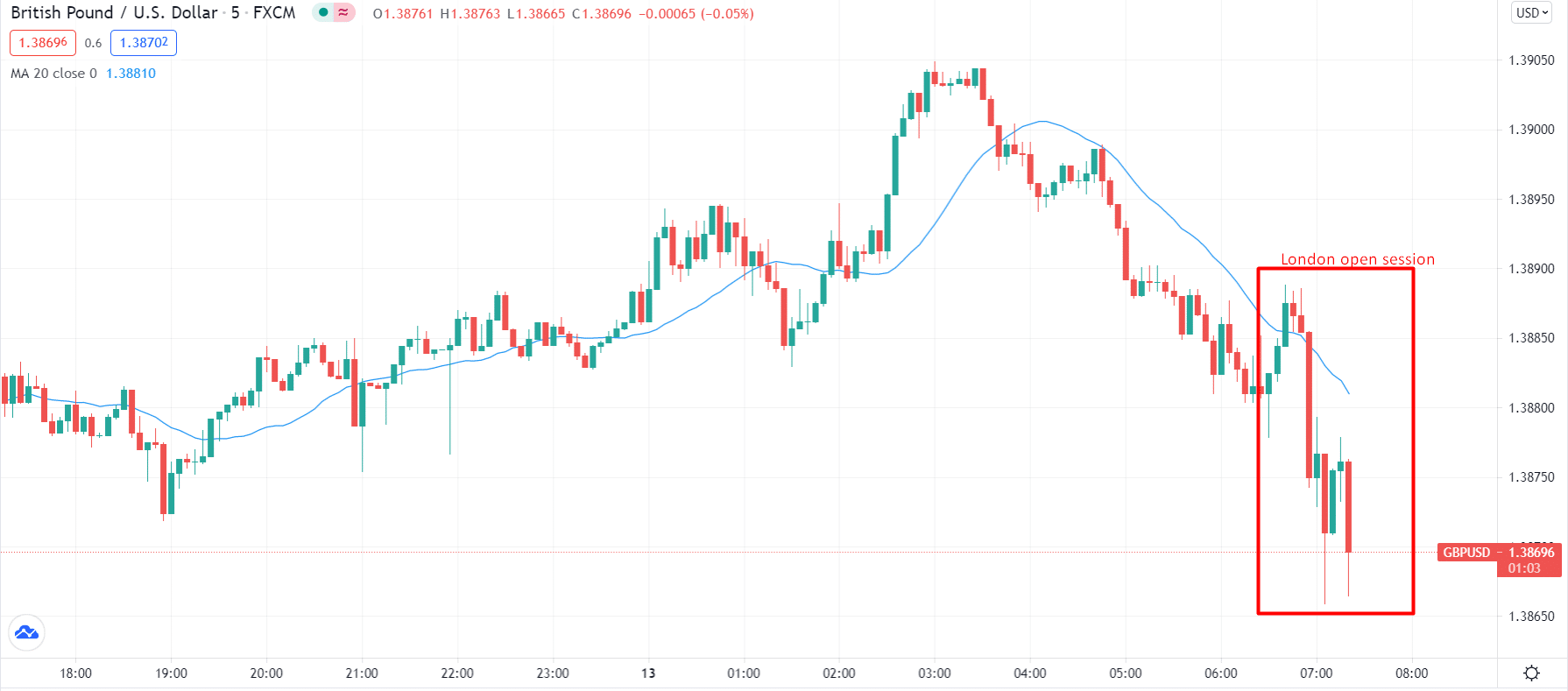

Define profit levels and stop-loss points for yourself. Select a certain time frame for opening your trades. For example, the London session is a high-activity time. Be active in that particular period and then relax.

Avoid sleeplessness, do not skip food, and stay away from overtrading.

Final thoughts

A lot depends on the way you approach your business. Your trading psychology is the biggest obstacle in your way to success. Follow all the tips as mentioned earlier to have the necessary mindset, and you will be successful.