Regarding selecting future arrangements of trades, there are so many factors available that market participants consider. Some may focus on the chart, trying to find trends, whereas others look for the increasing demand of any particular asset. So, this becomes evident that there are two general categories of analysis:

- Fundamental

- Technical

Before placing any trades in the market, market participants analyze the facts and decide whether to go with the trade. While determining the entry and exit time, many use only one type of analysis; others combine both. It hardly falls into one classification alone in most cases since traders derive information from all sources.

Technical analysis analyses the price movements of an asset to utilize the data for anticipating the upcoming price movements. On the other hand, fundamental analysis focuses on the financial and economic features that impact the business.

Three things to know before starting:

- The technical analysis seeks future price movement based on past performance.

- The fundamental analysis depends on economic events and news.

- Traders can build a trading strategy using both analysis.

What is fundamental analysis?

This analysis assesses the inherent value of assets by studying everything, including market conditions, financial power, and management of different companies. Fundamental analysts evaluate everything such as assets and liabilities, incomes and expenditures through the fundamental analysis.

This type of analysis is ideal for assessing the definite and abstract characteristics of any trades by publicly utilizing the available data. However, long-term traders rely upon fundamental analysis. The main target of fundamental analysis is to determine if the asset is overrated or underrated.

The undertaking of the fundamental analysis

Fundamental analysis is an all-encompassing system that finely investigates every detail impacting the price of an asset to reach a final opinion. The fundamental analyst makes the way to an effortless understanding of the asset prices regarding the extensive market.

Moreover, the fundamental analysis considers the factor of macroeconomics and microeconomics, which may impact the price of the asset to accelerate the complete analysis. As previously mentioned, fundamental analysts endeavor to obtain an absolute result by studying the overall industrial and economic condition and the financial and managerial strength to define the prices of certain assets.

According to the fundamental analysis, if the market price is more than the inherent price, then the asset is considered underrated. Contrariwise, if the findings in the fundamental analysis show that the market price is less against its inherent price, it means the asset is overrated. As per this evaluation, traders will buy the underrated trades expecting a high yield outcome in the long term.

On the contrary, institutional traders will go for a short position while the trade is overrated since soon their prices will drop.

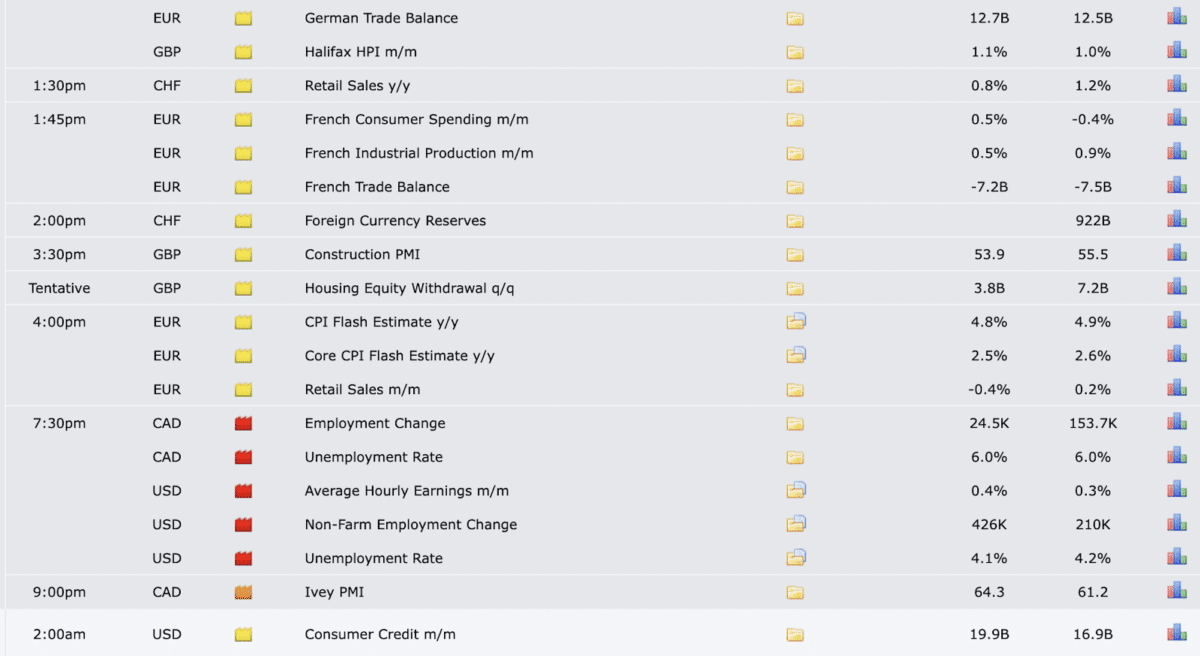

The above image shows an example of an economic calendar where important news and events are shown.

What is technical analysis?

The technical analysis evaluates the asset prices by assessing the statistics of the market activities, historical prices, and volumes. It is a significant distinction between both analyses. Instead of measuring the asset’s inherent value, technical analysis focuses on the chart patterns and indicators that help predict a particular trade’s potential performance.

Technical analysts use various specialized tools and indicators in their charts to have an advantage incorporating suitable strategies and money management. Furthermore, technical analysis allows the traders to trade, exploiting the trend direction. It also promptly identifies the trend reversal so that traders can take positions with perfect timing to complement their trading objectives.

The undertaking of the technical analysis

Technical analysis is designed to give insights into the overall upcoming activities of trades and markets. Traders and analysts endeavor to anticipate the potential market performances using the technical analysis patterns based on historical data. In terms of creating the pattern to foresee the market movement, technical analysis utilizes short-term data.

The traders are inclined to utilize technical analysis in short-term trading since the collection of information is in less duration. Still, it can benefit the long-term trades in merging with the fundamental analysis.

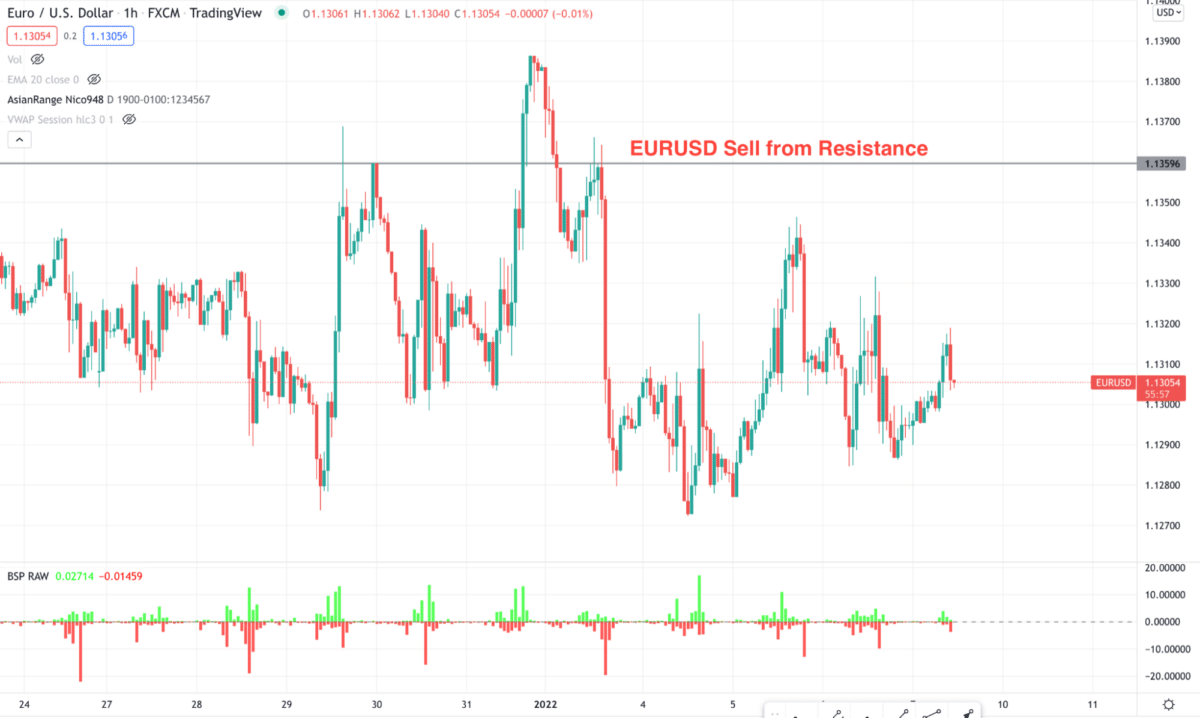

The above image shows how to buy an instrument from the support level. This theory is applicable in any price level, depending on the price context.

How to trade using both analysis?

Although there are some different approaches evident between both analyses, most traders tend to use them in combination due to the different caliber of advantages and disadvantages of each. Nevertheless, applying both of the analyses together needs plenty of expertise. Also, before using the analyses in a trade, the better to define their feasibility.

Generally, fledgling traders are inclined to use fundamental analysis since it has advantages with fewer technicalities, whereas professionals prefer the technical analysis complementing their years of experience. Substantially, different educational references are accessible for novice traders, which may support formulating viable trading strategies that combine both analyses.

The US economy is growing as the Fed showed interest rate hikes while the inflation is under control. In this condition, buying USD has a higher possibility of winning. Therefore, the best approach is to find sell setups in the technical chart of EUR/USD to have higher possible trades.

Pros and cons

| Worth to use | Worth to getaway |

| Technical analysis is time-efficient; hence, trades can be rapidly analyzed and automated to some extent. | Sometimes, technical analysis may give signals after passing the execution period of the trade, and market participants may lose the chance to capture the winning move. |

| Technical analysis is eventually intervened by humans, which implies that it may pay heed to market sentiments helping the analysts to see outdoing the mathematics by tracing the past performances. | It is not suitable for novice traders since it takes plenty of knowledge, skill, time, and experience to decipher the subjective explanations of fundamental analysis correctly. |

| There is no room for being personally biased since fundamental analysis is established on substantial information of a significant nature. | Fundamental analysis is tiring as it demands periodic monitoring of all the financial factors. |

Final thoughts

In a nutshell, though approaching differently in the market, both analysis is beneficial. A trader may utilize any of them or conjoin both to increase the opportunities of winning trades.