Swing trading is one of the core methods where market participants hold the position for more than a day. In most cases, such traders are fundamentalists because it takes more than seven days to note the fundamentals’ effect on the price chart.

A swing trader aims to seize a percentage of the swing or price movement in the market. Taking trades from price swings needs close attention to how the swings form and pick the best price level.

Let’s see the complete swing trading guide that includes exact buying and selling trading methods.

What is swing trading?

It is a method of trading when market participants hold the position for a few days or weeks after identifying the possible movements. It is a trading system where an upcoming uptrend or downtrend ranging overnight to several weeks is visible by the indicator.

The swing trading technique mainly targets buying and selling in the middle of highs and lows during the generally more significant trends. Traders, who prefer this style use numerous indicators to define the best time for buying or selling a specific asset.

In swing trading, participants should act very fast to boost the chances of profit in the short term. Nevertheless, for defining the price swings and deciding whether the prices will go up or down, different technical analysis indicators are effective. Hence, traders select assets with momentum and the best time for buying and selling.

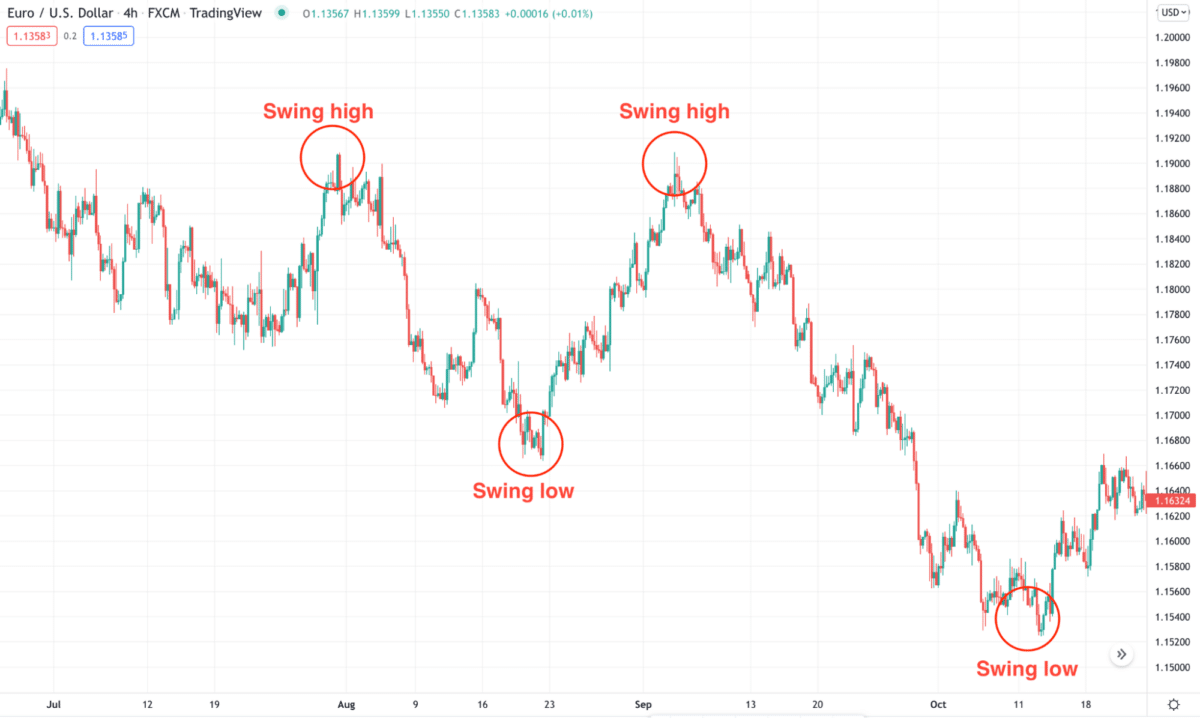

The above image shows the basic structure of price swing, where buying from swing low and selling from swing high is the main aim of a trader.

What is an analysis of swing trading?

The below chart depicts a period Apple (APPL) had a full price moving higher. It was shown by the small cup and handle pattern that mainly indicates a continuance of the price increase in case the stock moves over the high of the handle.

Consequently, the price increased over the handle, activating possible buy closer to $192.70. Here, putting a stop-loss is under the handle that is pointed through the rectangle closer to $187.50.

Also, the approximate risk of the trade is $5.20 per share ($192.70 – $187.50) based on the entry and stop-loss. In case of finding a potential reward which is a minimum of doubled the risk, any price more than $203.10 ($192.70 + (2 * $5.20) will come up with this.

Swing trading example on the APPL

The trader could use different exit strategies apart from the risk-reward and stand-by until the price makes a new low. But in this technique, the exit signal was not come till $216.46, while the price dribbled under the previous pullback low. The technique may have ended up in a profit of $23.76 per share. In exchange for risk lower than 3%, it is 12% of the profit, and the swing trade took around two months.

How to trade using a swing trading strategy?

Swing trading works best in the trending market. It is the most reliable trading system based on price action. Thus, the market participant can enter when the price takes minor retracements before continuing the trend.

This trading strategy will use a dynamic level of 20 EMA indicators for entry and exit. This swing strategy is straightforward, but the downside is after an impulsive bullish move when the price retraces. On the contrary, sell when the price retraces upside after a sudden bearish move.

Bullish trade setup

Entry

Enter a buy trade when the price retraces downside after an impulsive bullish move and creates a high low.

Stop loss

Place stop-loss order below the last swing level with at least 5-10 pips buffer.

Take profit

Take the profit when the price had a bearish candle close below the dynamic level of 20 EMA.

Bearish trade setup

Entry

Enter a sell trade when the price retraces upside after an impulsive bearish move and creates a low high.

Stop loss

Place stop-loss order above the last swing level with at least 5-10 pips buffer.

Take profit

Take the profit when the price had a bullish candle close above the dynamic level of 20 EMA.

Pros and cons

| Worth to use | Worth to getaway |

| The swing trading method is simple compared to others, and only technical analysis can be used to analyze the trades. | This method can be stressful while trades move adversely. |

| It requires less time for trading. | Due to the random movement of the market, swing trading timings become more challenging. |

| It may potentially end up with a high annual return rate if traders can manage to make continuous small profits. | A more extended period can result in massive losses due to leverage. |

Final thoughts

To conclude, swing trading is the method for traders who prefer short-term trading but can not give enough time. It takes a great deal of adherence to be a swing trader and make a profit within a short period.

However, trading in the financial market has some unavoidable risks. Hence, before starting swing trading, traders must have a firm understanding of technical analysis and the market fundamentals to get a desirable outcome.

The swing trading method comes forth as a stock chart that helps traders figure out the major patterns developing in the market. In swing trading, market participants must pay heed to place a stop-loss as the news impacts the market direction.