Industrial base metals such as copper, iron, and aluminum are essential building blocks for infrastructure, buildings, appliances, vehicles, and other equipment. Many metals are also becoming crucial for lower-carbon energy. Meanwhile, precious metals like gold and silver have industrial uses and are essential for investors. These demand drivers should help boost metals prices in the future.

Investors have several metal-related investment opportunities that could help them profit from rising metals demand and prices. Of those options, ETFs offer an easy way to invest in the metals sector broadly. Here’s a closer look at some of the leading metals-focused funds.

How does it work?

An ETF, or exchange-traded fund, owns different stocks and trades on a public stock market. The value of the shares fluctuates in response to the value of the companies it owns. A steel ETF owns shares in any company involved in the steel lifecycle. That could be a company that produces it, manufactures steel products, transports them to retailers, or sells them.

Steel ETFs offer an alternative to buying individual stocks by providing you with a selection of the top-performing companies in the industry. Our experts pick out the top steel ETFs for this year and explain where to get them in this guide.

Top three things to know before starting:

- Steel is a crucial component in many modern technologies.

- Steel production uses a lot of energy and releases a lot of carbon dioxide. Hence, most companies need to invest significant amounts of money into making their processes more environmentally friendly.

- Investors who genuinely believe in the overall performance of the steel sector should invest in steel sector ETFs.

Best steel ETFs to buy in 2022

Let’s take a look at the best ETFs to invest in.

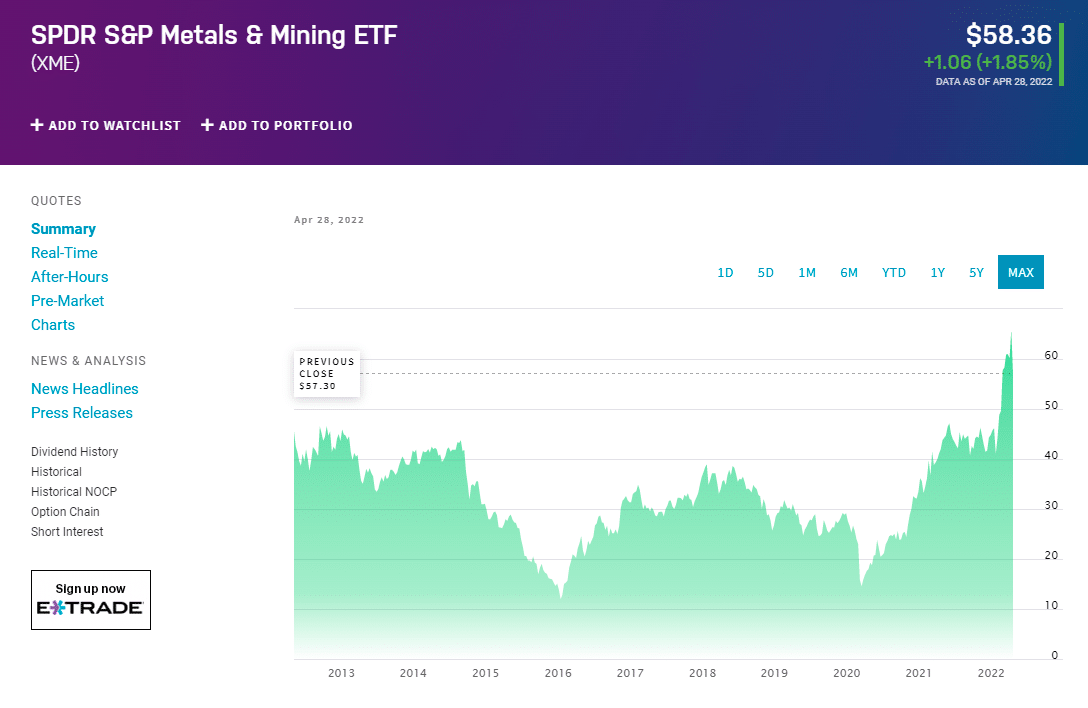

1. SPDR S&P Metals & Mining ETF (XME)

The SPDR S&P Metals & Mining ETF seeks to expose investors to metals and mining stocks in the S&P Total Market Index. It holds shares of mining companies in the following subsectors of the metals and mining sector: aluminum, coal, and consumable fuels, copper, diversified metals and mining, gold, precious metals and minerals, silver, and steel. The ETF had 32 holdings as of early 2022, led by the following five:

The ETF is ideal for people seeking an investment focused on the US metals sector. The ETF uses an equal weight strategy, which provides investors with targeted exposure to the entire US metals and mining sectors, including precious metals. It charges a relatively low ETF expense ratio of 0.35%.

The fund has returned 54.8% over the past year and 29.2% annually over the past three years, 16.9% per year over the past five years, and 3.8% per year over the past decade. Recently, in March 2022, XME returned 16.5%. It has an R-squared of 55%, a beta of 1.67, and a standard deviation of 39.1%. It has a high total risk rating.

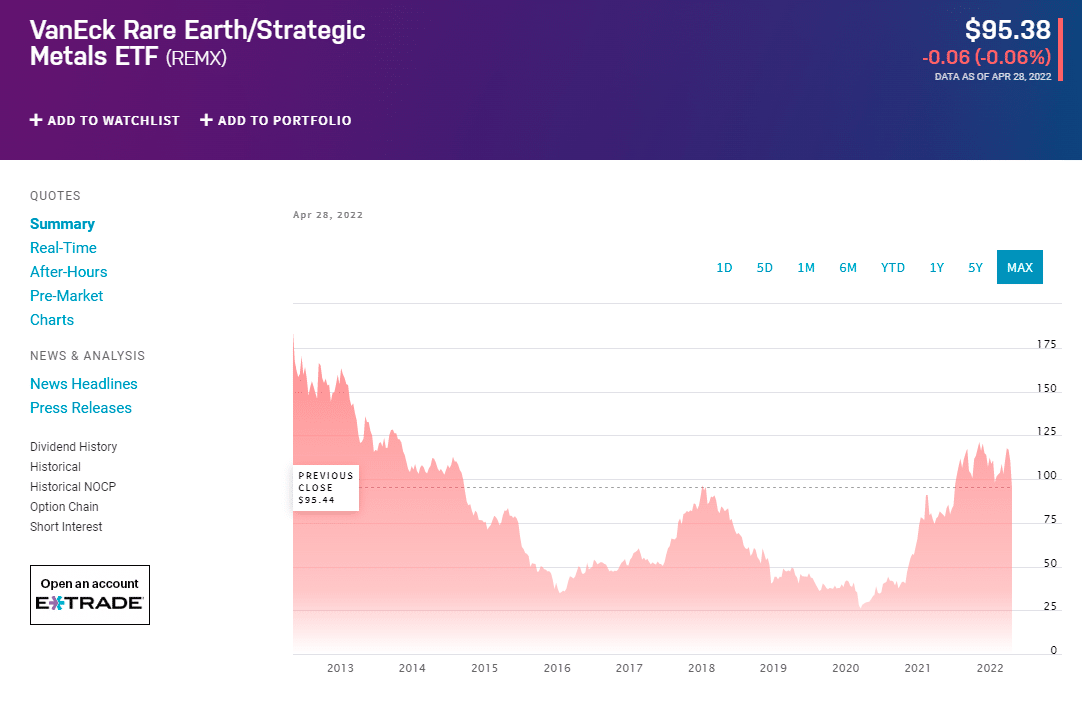

2. VanEck Rare Earth/Strategic Metals ETF (REMX)

The VanEck Rare Earth/Strategic Metals ETF gives investors targeted exposure to companies focused on producing, refining, and recycling rare earth and strategic metals and minerals. The ETF held shares of 20 rare earth and strategic metals companies as of early 2022.

The ETF allows investors to own a basket of companies focused on important mining materials for the technology and green energy sectors. It charges a modest fee of 0.59% for access to these emerging metals.

The fund has returned 66.6% over the past year and 39.7% annually over the past three years, 22.3% per year over the past five years, and -2.3% per year over the past decade. Recently, in March 2022, REMX returned 7.5%. It has an R-squared of 39%, a beta of 1.40, and a standard deviation of 38.9%. It has a high total risk rating.

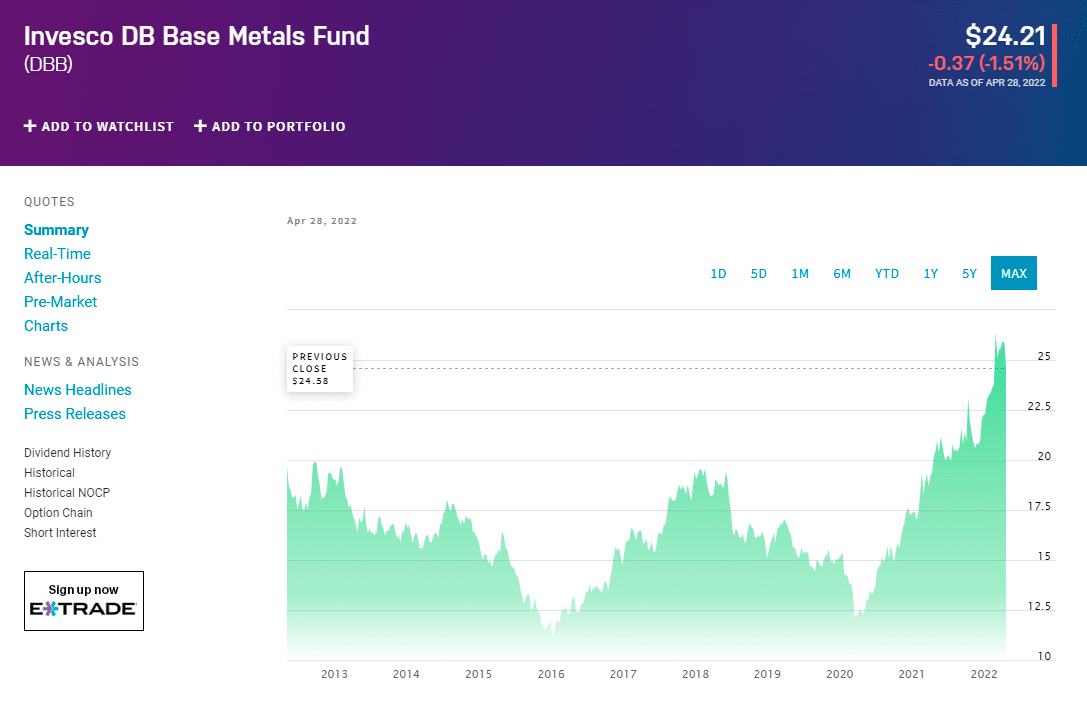

3. Invesco DB Base Metals Fund (DBB)

The Invesco DB Base Metals Fund enables investors to conveniently and cost-effectively invest in commodity futures. The fund focuses on some of the most liquid and widely used base metals, such as aluminum, zinc, and copper.

The ETF uses leverage and collateralizes futures contracts with US Treasury bills and other Invesco products built around government debt.

The ETF is best for sophisticated investors who want to make a short-term trade on the thesis that base metals prices will rise sharply in the near term. The fund is somewhat speculative since futures contracts can be very volatile. It charges investors a modest expense ratio of 0.77%.

The fund has returned 38.8% over the past year and 15.7% annually over the past three years, 10.4% per year over the past five years, and 2.9% per year over the past decade. Recently, in March 2022, DBB returned 7.2%. It has an R-squared of 60%, a beta of 0.79, and a standard deviation of 16.9%.

Pros and cons

| Worth to invest | Worth to getaway |

| Rising demand for metals tends to drive up prices, providing investors with the opportunity to make money on the metals market. | The returns from steel ETFs are also a mixed average of all the constituent stocks that are held by the ETF. |

| One broad way to invest in the thesis that metals prices will rise is through metals ETFs, an essential tool for bullish investors on the metals market. | They are sector-focused, rather than diversified. |

| Investors tend to like companies that make an effort to go ‘green’. |

Final thoughts

Steel has been among the top metals as an investment choice due to its popularity and high demand. Steel has now gained the status of the leading basic building block of modern-day infrastructure. Steel ETFs are available to investors for making a pooled investment in steel-based companies.