There are various concerns in the mind of an investor when it comes to selecting a fund manager who could generate consistent profit on their invested capital. Hence, prompting the latter to increasingly consider passively managed funds, including index funds.

Investing in index funds is specifically aimed at individuals who want to grow their capital but prefer to diversify across a basket of assets. The Russell 2500 Index of SMID caps has beaten small caps by an average of 0.7% on three-year rolling monthly returns and outperformed 60% of the time.

Do you wish to know more about this fund and increase your invested capital?

If yes, read this article as we have done a detailed review of the Russell 2500 Index Fund and its performance.

Three things to know before starting:

- The fund is a market-cap-weighted stock index whose components consist of 2500 small-cap and mid-cap stocks.

- The stocks are the smallest by market cap of the Russell 3000 index.

- All the stocks are US companies comprising financial services, producer durables, and consumer discretionary sectors.

About the Russell 2500 Index Fund

The Russell 3000 consists of 3000 US stocks, and it is a broad-based index. The Russell 2500 makes up the smallest stocks within the Russell 3000 by market cap. Companies listed on the Russell 2500 Index are small to mid-cap, and they go up to the $10 billion market cap range.

The Index launched on 1 July 1995 and trades on the NYSE ARCA stock exchange under the ticker symbol R25I. The sectors that make up the 2500 companies are from financial services, consumer discretionary, and producer durables industries.

The fund has net assets of $734.60 million under its portfolio. Its major market sectors consist of:

- Technology (17.18%)

- Industrials (15.28%)

- Healthcare (15.18%)

- Financial services (13.77%)

- Consumer cyclical (12.73%)

- Real estate (9.16%)

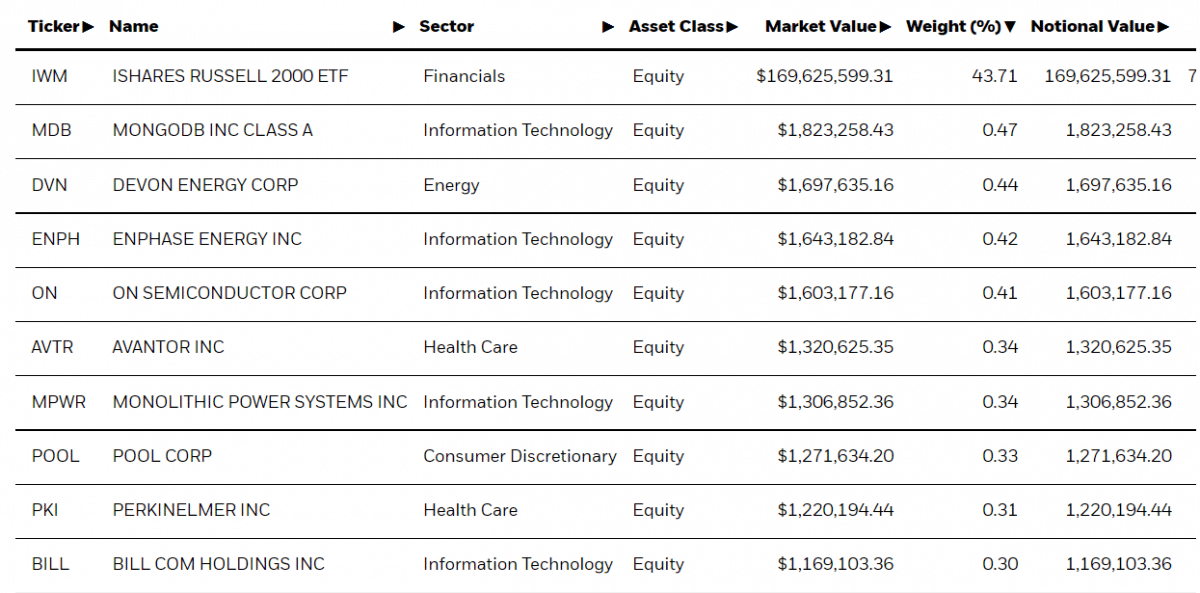

The below list makes up the top ten holdings for the fund.

Role in portfolio

Investment in the Russell 2500 Index fund is possible by investing in the iShares Russell Small/Mid-Cap Index Fund, which tracks the Russell 2500 Index performance.

Management

The fund has been under management by the BlackRock Institutional Trust company since 30 January 2013.

Risk

The securities of smaller, less well-known companies can be more volatile than those of larger companies. Furthermore, value and growth stocks can perform differently from other types of stocks; in addition, growth stocks can be more volatile. Value stocks can continue to be undervalued by the market for long periods.

Performance

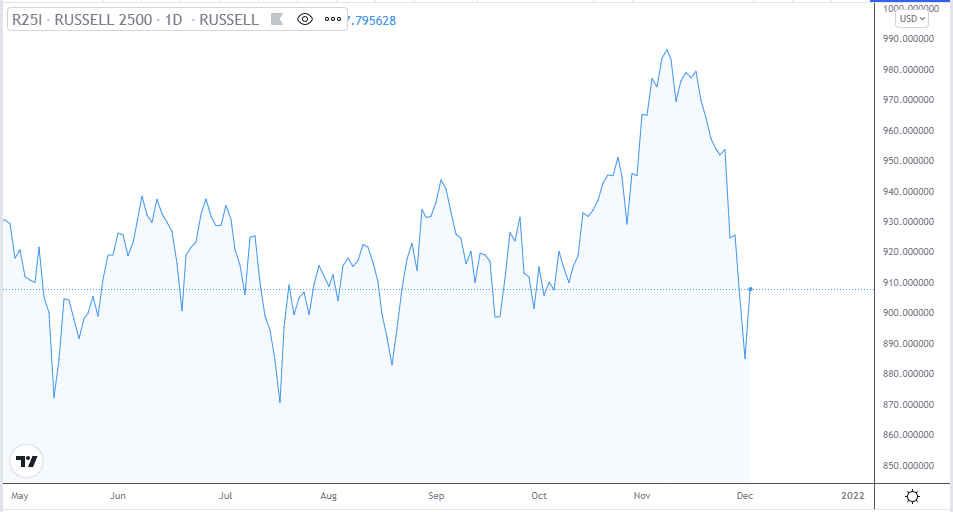

The Russell 2500 Index fund had a year-to-date change of 11.76% and an annual increase of 18.16%. The fund’s 3-year returns are 16.03%, five years, 13.49%, and ten years 13.90%.

Fees

No other fees are available for the fund.

Net expense ratio

The Russell 2500 Index fund has an expense ratio of 0.04%.

Category average

The Russell 2500 Index fund has returned lower versus other Small blend funds in the category. The Small Blend fund has returned 18.92% for 2021 versus the Russell 2500 fund, which had a 14.46% total return for the calendar year.

Volatility measurement

The Russell 2500 Index fund risk statistics over the last three years are as follows:

- Alpha: -0.02

- Beta: 1.00

- R-Squared: 99.99

- Sharpe ratio: 0.55

Pros and cons

We see the Index fund overall has a good marking, but you must consider a few of its downsides when investing into it.

| Worth to use | Worth to getaway |

| Diversification The fund allows investors to diversify in small-cap stocks. | Growth stocks are volatile The fund invests in many growth stocks, which are usually highly volatile and add additional risk to the portfolio. |

| Good long-term returns The Russell index fund had positive annual returns for the last ten years. | Performance vs. category The fund has been performing slightly lower than other funds in its category. |

| Low expense ratio The fund has a low expense ratio of 0.04%, significantly lower than other funds in the category. | Value stocks undervalued The long-term undervaluation of value stocks can mean investors need to hold their funds for more extended periods to observe significant gains. |

Final thoughts

Index funds have been known to be in existence since the 1970s. The popularity and demand of passive investing and lower fees have powered them to skyrocket in the 2010s. Lower fees here caps less than 0.20% in comparison with active funds that charge fees over 0.80% to 1.00%

Better performance comes from lowered expenses leading to the passive funds successfully outperforming most actively managed mutual funds.

Investors seeking to invest in the overall performance of the Russell 2500 Index may wish to invest in the Russell Small/Mid-Cap Index Fund, which seeks to track the performance of the Russell 2500 Index.