Bank stocks and other financial equities are back in the spotlight again with the dawn of another earnings season. And any wind in their sails is sure to be felt by bank ETFs. As measured by the S&P 500 Banks Select Industry Index, the banking sector has outperformed the broader market over the past 12 months, with a total return of 32.3% compared with the S&P 500’s total return of 18.6%, as of Feb. 3, 2022.

Bank ETFs offer a way for investors to share in these profits by investing in a basket of banks and other financial services companies.

How does it work?

ETFs can be a simple way if you’re wondering how to invest in the financial sector. Funds that focus on the financial sector invest in companies involved in different areas of finance, such as banking, insurance, real estate, and investment management. You can choose a broad financial ETF that invests in all these areas or invest more narrowly in one of the sub-sectors.

Top three things to know before starting:

- The banking sector outperformed the broader market over the past year.

- ETFs provide a simple option if you’re looking for an easy way to invest in the financial sector.

- A broadly diversified fund based on indexes such as the S&P 500 might be a better fit if you’re just starting.

Best regional bank ETFs to buy in 2022

Though the regional bank sector may seem homogenous, several different businesses fall within the financial label. You can invest in a bank ETF or choose to focus on one of its sub-sectors.

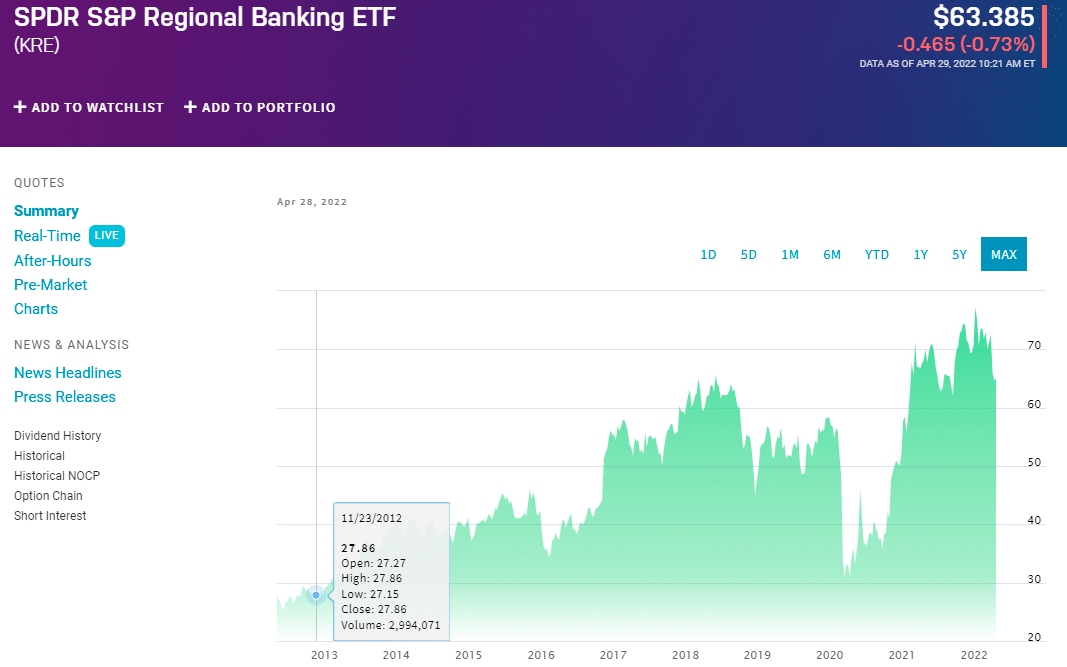

1. SPDR S&P Regional Banking ETF (KRE)

KRE was designed to track the S&P Regional Banks Select Industry Index. The fund tracks this equal-weighted index, and investors gain highly diversified exposure to regional banks in the US, including small-, mid-, and large-cap regional bank stocks.

Dividend yield

The fund’s dividend has been overwhelmingly strong, with trailing 12-month yields at 2.00%. This ETF focuses on investments in a diversified group of US regional banks.

Expense ratio

Its expense ratio is below average compared to funds in the financial category. The fund has an expense ratio of 0.35%, which is 56% lower than its category.

Returns (annualized)

The fund has returned 6.2% over the past year and 13.4% annually over the past three years, 7.3% per year over the past five years, and 11.5% per year over the past decade. Recently, in March 2022, KRE returned -6.8%. It has an R-squared of 51%, a beta of 1.32, and a standard deviation of 31.9%. It has a high total risk rating.

ESG rating

IAT ETF has an MSCI ESG fund rating of A based on a score of 6.73 out of 10.

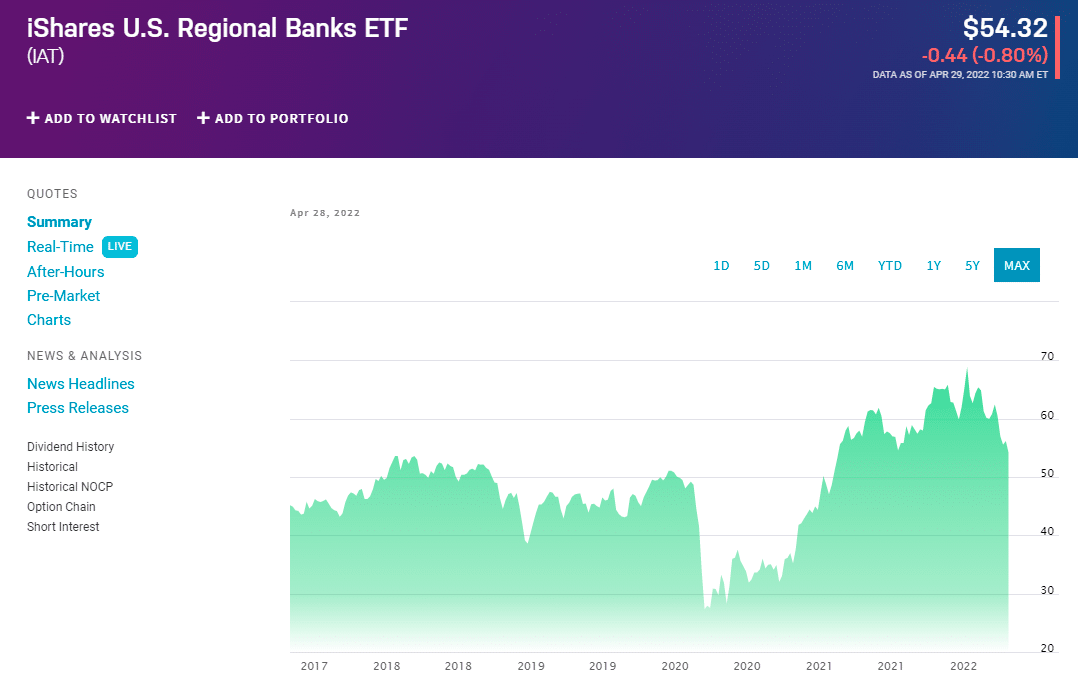

2. iShares US Regional Banks ETF (IAT)

Founded in 2000, IAT is the youngest fund manager on this list. While the company is relatively young, it hit Wall Street with a splash, quickly becoming one of the most trusted managers on the market. The fund is designed to track the performance of an index essentially made up of mid-sized US banks.

Dividend yield

Investors in the fund will pay fees of 0.42% on an annual basis. That’s about the industry average and aligns with what ETF investors expect to see. While price appreciation has been impressive, the dividend yield associated with the fund is the lowest on the list at 1.83%. Nonetheless, that yield means investors can still expect to see reasonable dividend payments.

Expense ratio

Its expense ratio is average compared to funds in the Financial category. IAT has an expense ratio of 0.41%, which is 49% lower than its category.

Returns (annualized)

The fund has returned 6.1% over the past year and 13.8% annually over the past three years, 8.3% per year over the past five years, and 11.4% per year over the past decade. Recently, in March 2022, IAT returned -7.7%. The fund has an R-squared of 53%, a beta of 1.29, and a standard deviation of 30.5%. It has a high total risk rating.

ESG rating

IAT ETF has an MSCI ESG fund rating of A based on a score of 6.73 out of 10.

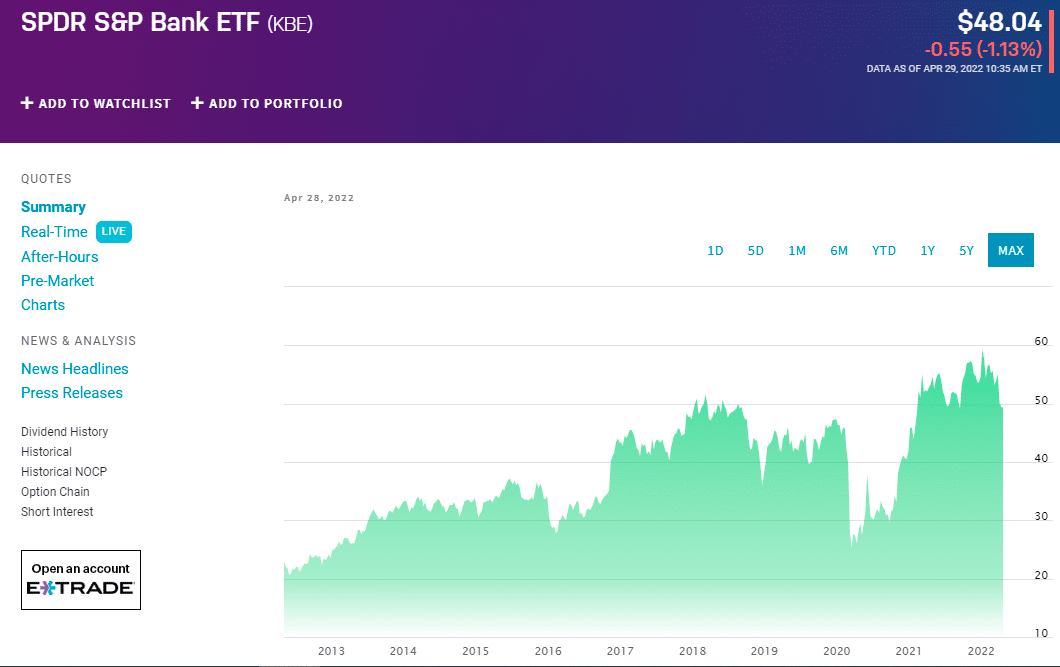

3. SPDR S&P Bank ETF (KBE)

Investors have trusted the fund with more than $3.37 billion so far. It has a strong history of solid performance with costs below the industry average. With such a large amount of assets in the fund, it’s clear it is a popular option.

Dividend yield

The fund paid a dividend yield of 1.87% in the past 12 months; the forward-looking yield is 2.03%.

Expense ratio

Its expense ratio is below average compared to funds in the financial category. KBE has an expense ratio of 0.35%, which is 56% lower than its category. The fund has returned 3.2% over the past year and 10.8% annually over the past three years, 6.5% per year over the past five years, and 10.4% per year over the past decade.

Returns (annualized)

Recently, in March 2022, KBE returned -7.0%. It has an R-squared of 56%, a beta of 1.33, and a standard deviation of 30.5%. It has a high total risk rating.

ESG rating

KBE has an MSCI ESG fund rating of BBB based on a score of 5.52 out of 10.

Pros and cons

| Worth to invest | Worth to getaway |

| ETFs are a great way to invest in a specific industry without cornering the market on all the stocks in that sector. | Depending on where you trade, the cost to trade an ETF can be far more than the savings from management fees and tax efficiency. |

| If you are interested in a sector like the banking industry, a bank ETF may be the way to go. | One disadvantage of investing in regional bank exchange-traded portfolios is the added layer of complexity that comes with the products. |

| The way these assets are taxed as opposed to other investment choices. | Keep in mind that leveraged and inverse ETFs are not for the faint of heart, they are more for advanced traders with complex investing strategies, not beginner investors. |

Final thoughts

Once you fully understand these bank ETFs, you can consider adding either or all of them to your portfolio. And good luck with all of your trades.