Money may not be the most crucial thing in the world, but it can do you a lot of good once you have retired. Healthcare costs can add up quite quickly, and your rent and other expenses, and that’s only scratching the surface of it.

Growing old should be a lovely experience during which you have the time to do all of the things you wanted to but somehow never got around to it. One of the approaches that people take to secure enough money for living, traveling, and enjoying financial security into old age is 401k plans. So what are the 401ks, and how do they work?

Overview on 401k plans

Let’s start with the absolute basics. So the name 401k stems from its namesake section of the Internal Revenue Services Code, which regulates this type of accounts.

The idea is that the United States government benefits companies and employees, primarily via tax reductions and exemptions, to encourage people to save for retirement. That way, more people remain financially independent, and it is also better for the economy. It’s a win-win.

How do 401k plans work?

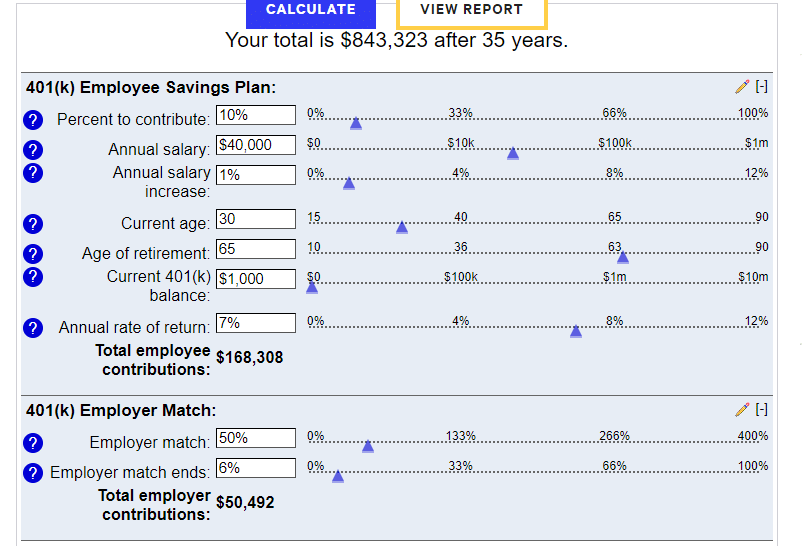

When you decide to sign up for a 401k, you usually determine either a fixed amount or a percentage you are willing to contribute to your retirement fund. The figure is then deducted from your taxable income. The money you set aside is not taxed before you decide to withdraw it, which allows it to compound more freely.

Another kind of 401k plan that is quite common is Roth 401k. The main difference between Roth 401k and its traditional counterpart is the timing of the taxation. With Roth 401k, you pay the tax when you deposit the money and withdraw it tax-free once you retire.

In addition, some employers offer a so-call match option. In simple terms, it means that your company will contribute a certain amount to your 401k, usually expressed in percentages of the figure you set for your retirement plan.

Before deciding to get “free money” from your company, check if the firm has set some limitations in terms of amount, contribution time window, or the time you need to spend at the company to be eligible for withdrawal.

The benefits of 401k plans

- Federal-level protection

Workplace retirement plans are under the protection of the Employee Retirement Income Security Act of 1974, or ERISA for short. Among other things, this means higher transparency of the plan’s features.

It also means that you have a right to sue for benefits if the plan is mismanaged, while at the same time it ensures that you get certain benefits even in the case of a job loss or if the plan gets canceled for another reason.

- Getting investing advice

Making portfolio-related decisions can be tricky. Choosing the right option for your situation and investment goals can be too much for people who want to live in comfort once they retire.

This is where the 401k plan comes in handy. Since most of the plan providers are large brokerages, you will have a bunch of resources at your disposal, usually for free. There is no reason you shouldn’t take advantage of a chance to have a professional tailor an investment plan to your circumstances, aims, and risk tolerance.

- Matching funds

As we already mentioned, some employers offer to match the amount you decide to carve out from your income and direct it towards your savings fund. This can be even more useful when we consider that 401k plans sometimes come with an upper limit on how much money you can invest on an annual basis.

The good news is that the money your company spends to match your investment doesn’t enter the count, hypothetically making your invested figure even double in size.

Let’s take it as an example that your average yearly salary is $40,000, adjusted for inflation. If you start saving at 30, you will have earned more than $843,000 on just over $168,000 invested over 35 years, thanks to compounding.

The drawbacks of 401k plans

- Limited investing options

The 401k plans can seem a bit bland regarding the number of options in which you can invest. While the individual retirement account (IRA) offers various opportunities, with a 401k, you are usually limited to shares, bonds, mutual funds, etc.

On the other hand, having fewer tried and tested options can make things significantly easier for you. Let’s not forget, not only investing enthusiasts seek 401ks. Some people want to live comfortably once the job income stops, and for them, the simplicity comes as a godsend.

- Higher fees

Another potential downside is that the 401k plans can bear higher fees. To make things worse, you, as a plan participant, have very little say in the matter of how high the fees bestowed upon you will be.

The one thing you can do to minimize the charges is to choose securities such as exchange-traded funds that come at a lower cost, to begin with.

- Early withdrawal penalties

401ks are known as retirement plans for a reason. Of course, you can access the funds you deposited ahead of time, but you will then get slapped with an early withdrawal fee. To sidestep that land mine and withdraw without drawbacks, you usually must prove you have a qualifying hardship.

Like with the previous one, what appears as a downside can also be a positive thing. If you are smart and only part with the money you can do without your daily living; you will end up with a rather hefty sum by the time the checkout time comes.

Final thoughts

In the end, the question remains: are 401k plans still worth it today when the investment options are almost countless? The answer is: it depends, but probably yes. Let us explain. Suppose you have an investor who desires to create a portfolio and invest enough money to have a chance at a peaceful and enjoyable retirement, more power to them. That individual does not need to reach for 401ks to achieve their investment goals.

On the other hand, it is terrific for all the other people, who don’t know much about investing, to have an easy, simple way to reach a carefree old age, at least when money is concerned.

Yes, the fees may be higher, and the early withdrawal fees can be a pain in the neck, but at the end of the day, they gain financial support to prevent themselves from being left high and dry once they retire.