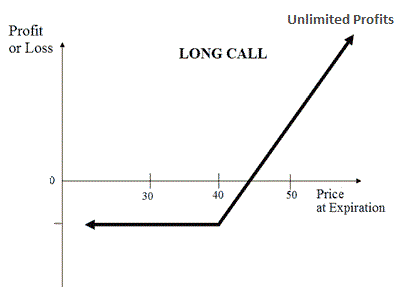

Many market participants like to trade options because they are simple to understand, and traders can manage the risk. For example, if you think that a currency pair will go up, you buy a call option when buying options. If you feel that it will go down, you buy a put option.

In any case, if your predictions are wrong, the only thing you would lose is the premium paid. That gives you the right to buy or sell the traded option at the strike price. This way, when buying options, you can manage your risk and potentially have an unlimited reward.

On the other hand, when selling options, risks are unlimited, and the premium defines the maximum reward. For this reason, buying options are preferred for new traders.

Forex trading option

We can say that a trading option is an operation in which someone sells another trader the right to buy or sell a pair. The trader who buys the option will execute its right depending on whether his prediction was right or not.

Reward/risk ratio for long and short options

The reward/risk ratio relates to the amount of money the trader could lose and the amount of money he could win. This relation varies from trade to trade, but we can distinguish between long and short option trading scenarios in general terms.

- When buying an option, because you are paying, the risk is limited, but the reward could be unlimited.

- You are getting paid for taking the risk when selling options, so this could be unlimited, and the max reward is equal to the premium received.

This way, when a trader buys an option, he is looking for volatility, while when a trader sells an option, he is looking for the currency to remain stable.

When choosing a long or short option, we select the trade with the highest reward with the minimum risk if we play by the book. However, it’s not always that simple.

Traders sometimes forget to put the probabilities into the equation. Only the reward/risk ratio combined with possibilities can make a trader profitable in the long run. Remember that to be a successful trader, you must think about being good in the long term.

Using probabilities to optimize the reward/risk ratio

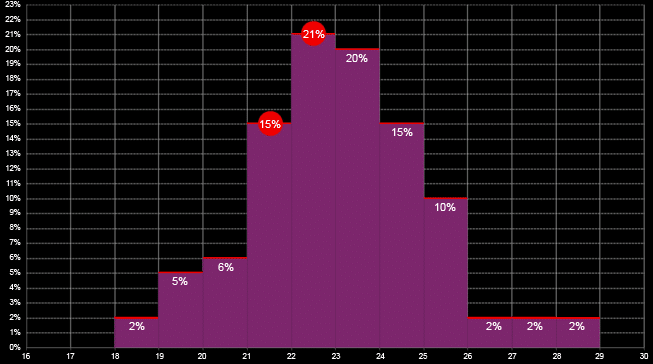

It is necessary to know the chances of trade are successful and determine if your reward/risk is worth it.

Let’s use the following example to explain how probabilities determine if a trade makes sense.

Imagine a trade in which the reward/risk ratio is 3:1. For every unit invested, the trader will receive three. This looks like an acceptable trade. Now, we must consider the possibility of that trade being successful.

For example, if the probability is 20%, we would only receive the reward one out of five times. So we may get lucky the first time and win three times the money invested, but in the long run, if we keep making similar trades, we will lose money, as the following table shows.

| 1st trade | 2nd trade | 3rd trade | 4th trade | 5th trade | ||

| Money invested | $100 | $100 | $100 | $100 | $100 | Total |

| Result | +$300 | -$100 | -$100 | -$100 | -$100 | -$100 |

Of course, what we see above is a simplification of a trade. It doesn’t consider premiums or partial losses and profits. But it is a straightforward way of explaining how taking into account the probabilities can help you make better choices about the trade you make.

However, the combination of probabilities and the reward/risk ratio helps us choose better trades but not improve the trade itself. Some techniques use a variety of different trades to reduce risks.

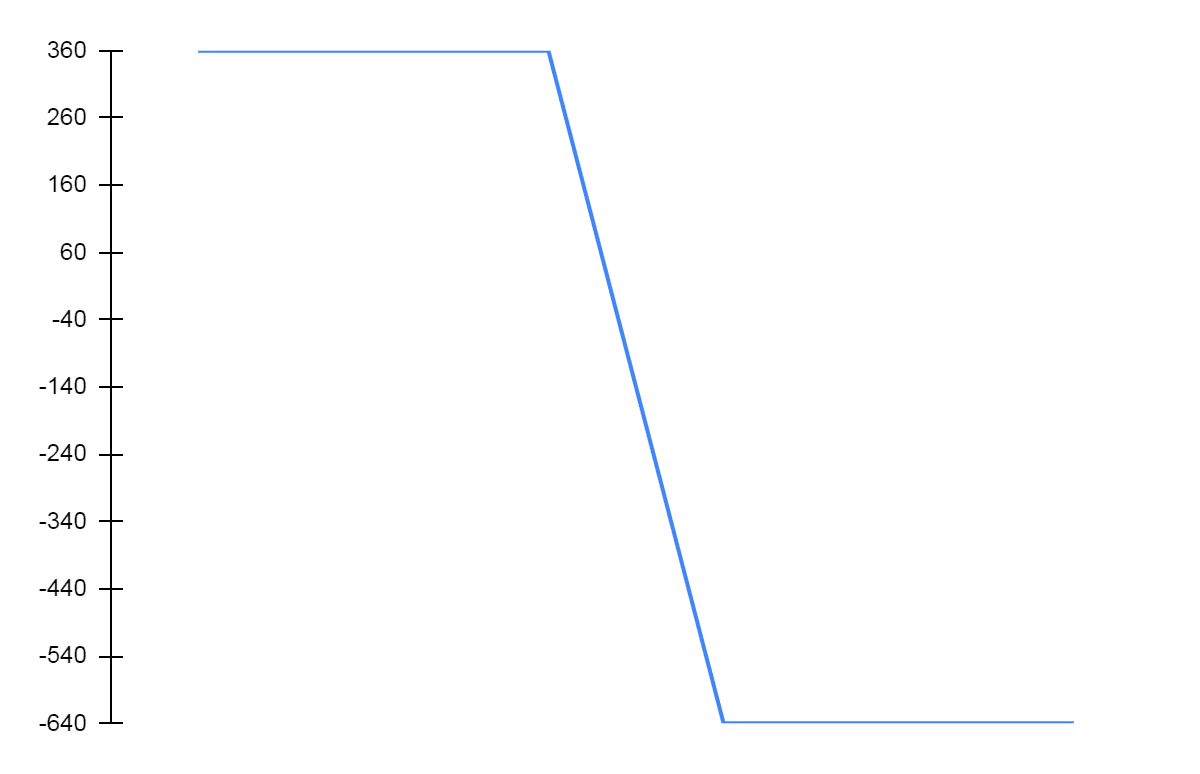

Vertical spread to optimize reward/risk ratio

A vertical spread combines long and short options at different strike prices but with the same expiration date. The vertical spread technique is focused on reducing the risk of the trade. It consists of trading two options at once. The idea is that in case our option goes wrong, a compensatory option makes us earn money and limits our losses.

Let’s see an example.

Imagine a pair whose price is 1.86. We then sell a 10,000 units contract call option at 2.00 for a premium of 0.06. If, at the end of the period, the option stays below 2.00, the trader would have made 600.

0.06 x 10,000 = 600

However, if the trade goes wrong for the seller and the price goes up to 2.6, his loss would be:

(2.6 – 2 – 0.06) x 10,000 = 5.400

And the more the price goes up, the more he would lose.

We have talked about how selling options can have unlimited risk. The good news is that there is a way to limit that risk.

Let’s put some numbers to this to understand if the trader decides to buy a call option for the same pair at a higher strike price and the same expiration period. When the price goes up above the second strike price, he’ll be making money that will be used to cover his losses.

The same trader decides to buy a 10,000 units contract for a call option at 2.10 for a premium of 0.024. If the price stays below 2.00, we established that he would earn 600 because of the premium collected when selling the call option. But now, because he bought a call option for 0.024, he’ll be losing 240. In total the profit well be:

600 – 240 = 360

So our reward is now more minor, but the risk is also less. If the price goes as high as 2.6, the second trade will make a profit.

(2.6 – 2.10-0.024) x 1000 = 4760

This way, at the end of the trade, the net loss would be:

5,400 – 4,760 = 640

And that would be the maximum loss for any case. So, the maximum reward is determined by the difference between the premiums. The maximum loss is always the difference between the amount lost and earned with both options. In the middle is what happens if the price stays between the two strike prices.

Final thoughts

As in any other type of forex trade, the reward/risk ratio is fundamental to decide whether a trade is worth it or not. Options trading is a popular way of trading that allows you to manage risk, especially when buying options. However, reward/ratio can’t be considered alone, and other tools and strategies can help traders make better choices.

Many traders fail to make the correct decision when entering a trade by ignoring the probabilities for that trade. That is why, although sometimes the reward/risk ratio is desirable, they end up losing money in the long run. Having a high ratio with low probabilities is like aiming too high and failing repeatedly. In the forex option, there are some techniques to manage more efficiently the reward/risk ratio. The vertical spread is probably the most basic one and is the key to understanding all other methods. Its main advantage is to cap the risk of the trade-in case that the price moves widely.