It can be hard to choose the right ETF for your portfolio because more than 1,800 of them already, and more than 150 new ones are added each year.

ETFs, or exchange-traded funds, are like mutual funds in that they combine the money of many individuals to invest. As with regular stocks, ETFs can be bought and sold on a stock market in the same way that stable stocks can be bought and sold.

An ETF can track the price of one product or many different items. For example, it tracks the basket of 34 businesses that manufacture at least 50% of their revenue from blockchain, NFT, and cryptocurrency operations. Structured ETFs can even look like some type of unique investment.

How does it work?

Blockchain ETFs can only be bought and sold through shares in companies that use or benefit from blockchain technology. There are a lot of investors that use blockchains because of their tricky and beneficial blocks of digital information.

To put it another way, many people may be afraid to invest in blockchain because the cryptocurrency market is so volatile. Investors in blockchain ETFs don’t invest directly in the cryptocurrency market but rather in the stock market of regulated companies.

What to check before choosing ETFs?

It’s important to many investors to know how much an exchange-traded fund cost, how much money it has, and who owns it. That’s the only thing that counts. However, the underlying index is the most important thing to look at when evaluating an ETF.

Do not only look at the stocks that an ETF owns but also how those stocks are scaled. Others take a more risky approach to try to outperform the market. Our Screener’s Fit page has all this information and the most recent feedback. You can find it there.

Best ETFs to buy in 2022

Following are the best ETFs to buy in 2022 to have more profit.

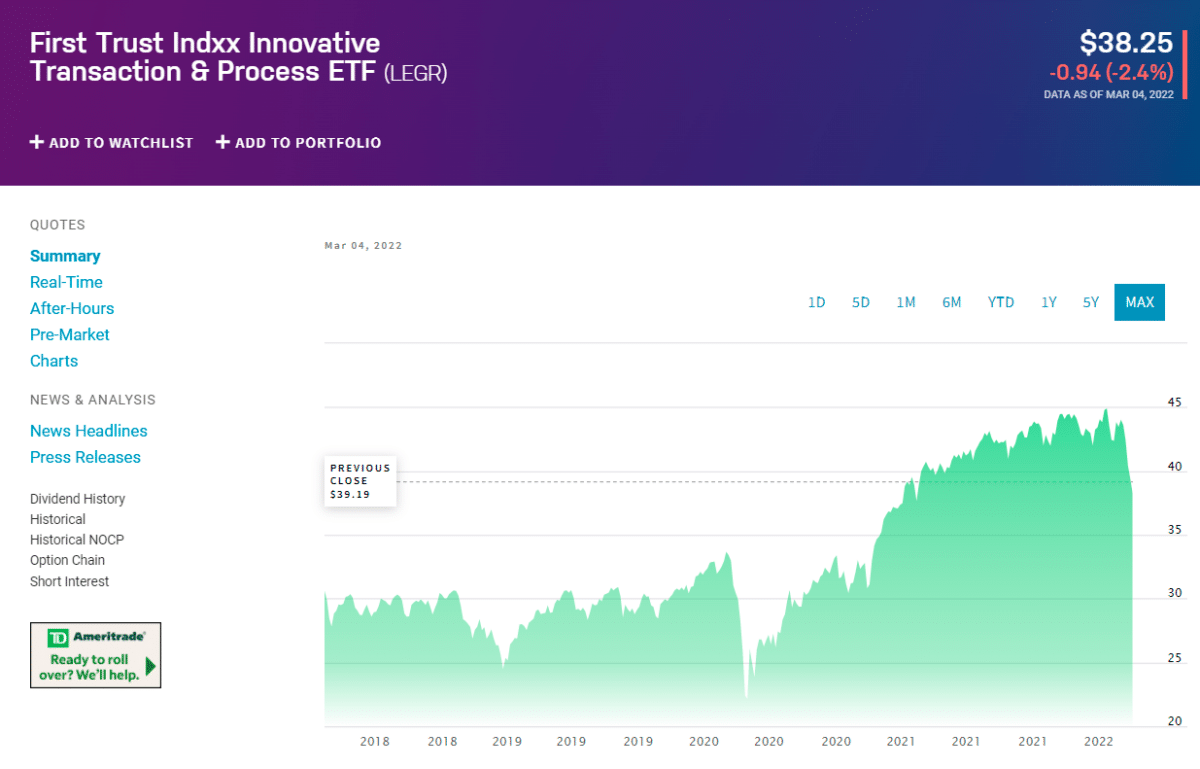

1. Innovative transaction and process (LEGR)

With the help of the Blockchain Index, LEGR can keep an eye on the performance of companies that are using blockchain technology or investing in, developing, or making blockchain-ready goods and services. A minimum of 90% of the ETF’s net assets are usually invested in the stocks that make up the index blockchain. A little more than 40% of the portfolio is made up of financial stocks, followed by IT and consumer discretionary stocks.

Here are the top holdings:

- Maersk A/S

- ENGIE SA

- MicroDevices (AMD)

These are shares of a shipping company, a French utility company, and a semiconductor manufacturer. The current trend has helped LEGR, which has gained a significant profit this year, even though the rest of the stock market has decreased.

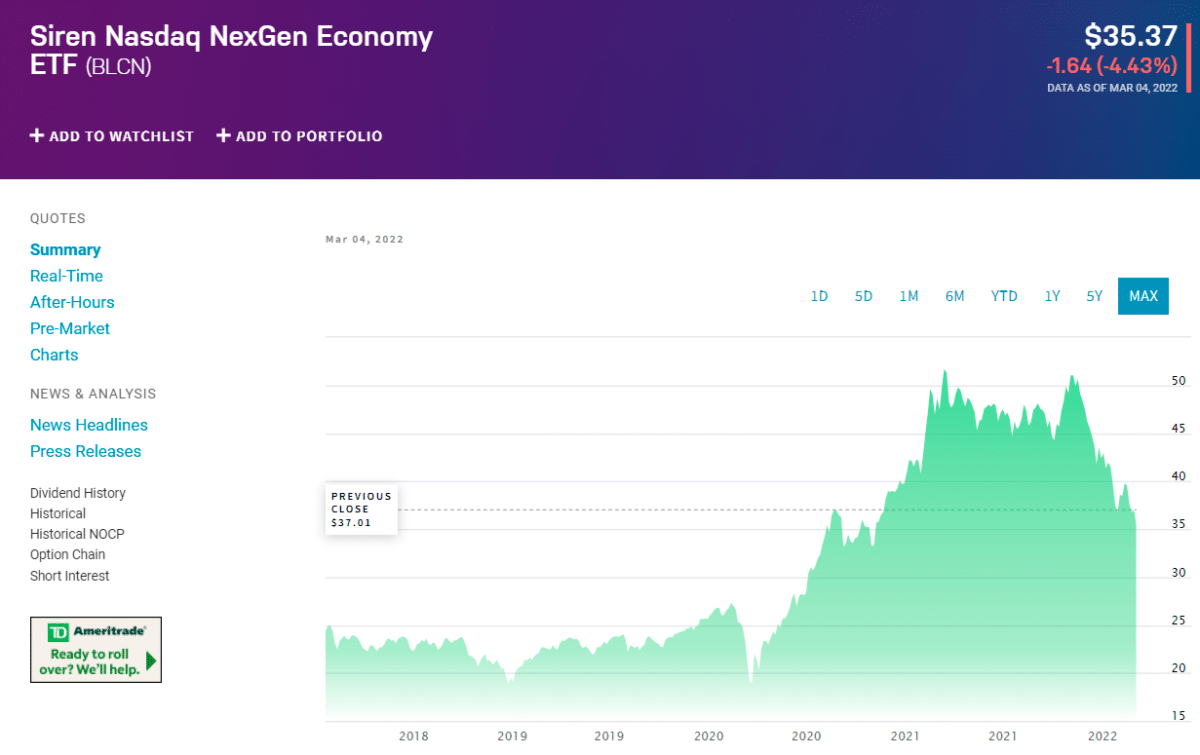

2. NexGen economy (BLCN)

To keep track of how blockchain-related businesses are doing, BLCN uses an index made by Nasdaq called the “Blockchain Economy Index.” This index shows how well these companies are doing.

Here are the major holdings of BLCN.

- Mastercard Inc.

- International business machines corp.

- Baidu Inc.

The ETF invests in growth and value stocks using a broad approach. Based on data from Covid, we can say that if demand starts to exceed supply in the first quarter of the year, energy prices might rise.

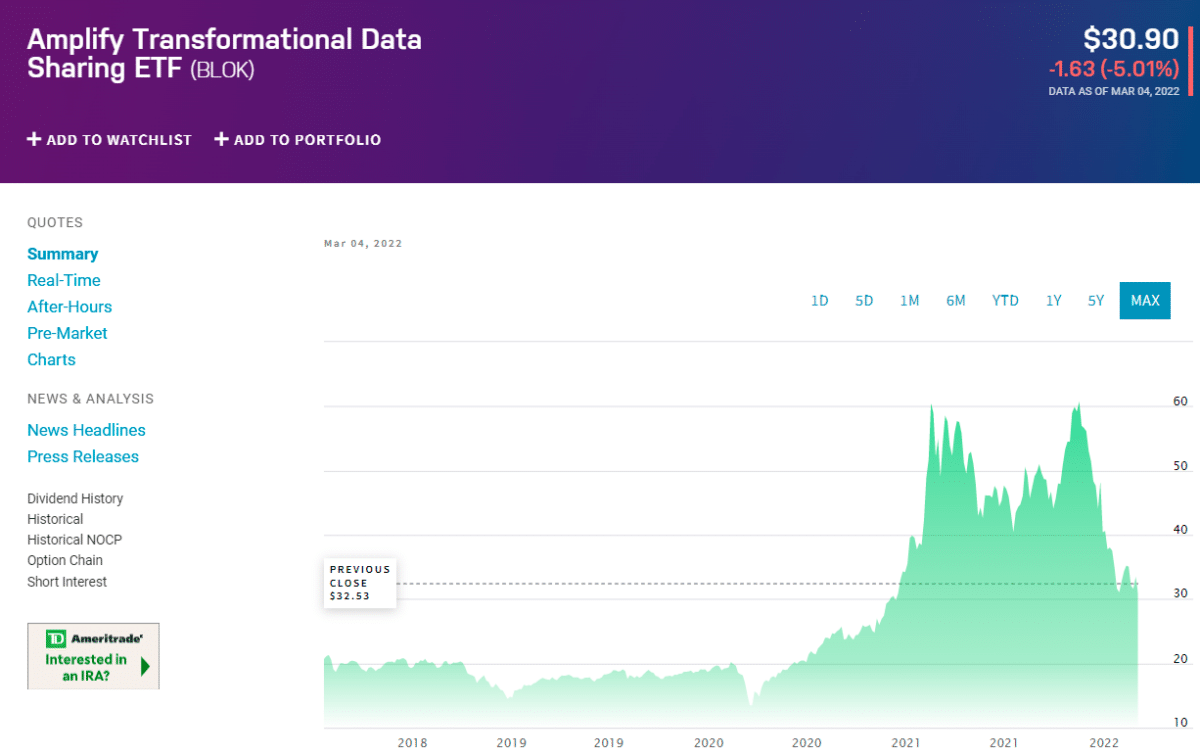

3. Amplify transformational data sharing ETF (BLOK)

At least 80% of its net worth is invested in the stocks of companies developing and using blockchain technology. This ETF is actively running in the NFT market. The fund wants to get indirect crypto exposure as part of its goals. Also, it invests in a wide range of different market capitalizations worldwide.

The bulk of its holdings is in software, financial markets, and information technology (IT) service companies. As a result, you can get into blockchain businesses and get a taste of crypto.

In such a fast-moving market, active management helps the ETF make quick decisions and figure out what could happen and what could go wrong. As a result, underlying ETFs are expected to outperform large-cap rivals in the long run.

This group of companies comprises independent technology drillers and service providers. As a result, firms in the BLOK benefit from a better pricing environment, which leads to better profits and cash flows, even if the price of technology devices changes each day.

Pros and cons

| Worth to use | Worth to getaway |

| As a result of NFT ETFs, a new market for building wealth has opened up with a lot of room for growth. | NFT ETFs are very risky to trade without demand and asset data. |

| NFT funds give a verifiable record of validity and ownership on the blockchain. | Their impact on the environment isn’t outstanding at all. But, over time, it could be bad for our environment if we keep making trades in NFT ETFs. |

| Small investors in NFT ETFs may have more options for their money portfolios in a post-pandemic environment. | Many scammers and fraudsters are in the market, so there is a risk. |

Final thoughts

A non-fungible token ETF was expected to engage a lot of excitement from investors. Based in New York, defiance ETFs became the first fund to provide exposure to the developing market last week. As a result, non-fungible tokens are now going to the ETF world.

NFT ETFs basket comprises companies that make at least half of their money from the systems like blockchain, cryptocurrencies, and NFT. For example, an ETF called “BLOK” makes revenue by investing in stocks of companies working on or using blockchain technology.

The Defiance Digital Revolution (DDR) ETF was added to the New York stock exchange on 2 December 2021. It focuses on both NFTs and the blockchain market. Using proper market knowledge, experience, and trends analysis, you can profit from NFT ETFs.