Many options traders have come across vertical spreads recently, and we want to dwell on the pros and cons of vertical spreads. Is this a good strategy, or is it just another trading approach Jim from the block told you about?

Let’s get started.

Defining vertical spreads

To understand the merits and demerits of vertical spreads, you need first to familiarize yourself with its definition.

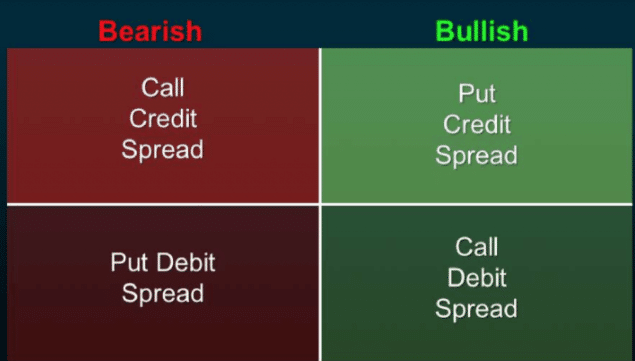

In options trading, it is a strategy that allows you to attain or sell an option with a similar expiration but with a different strike price. Like other options strategies, the vertical spread has its divisions.

Bull call & bear put are debit spreads, while bull put & bear call are credit spreads. Like a difference between the debit/credit cards, with debit, you have to pay to open a position. On the other hand, with credit spreads, you receive money for opening the position.

Let’s look at the example.

Assume that Apple hit a one-year high at 139.50 on April 28 after climbing $4 compared to the previous day. Apple released its earnings report, and the company is generating profits. Apple is sitting comfortably at the top with the possibility of continuation of an uptrend.

However, the market is in an uncertain state. You don’t know if Apple will continue the trend or take a dip. If you believe that Apple will trade sideways to up 5% while the upward move is under pressure.

If you are willing to risk $1 in return for a potential profit of $2 per share, then with the help of vertical spread’s bull call, you can buy the Apple stock with the higher break-even.

Your maximum risk is $1, including the commissions. However, if the Apple stock climbs above $139.50, then the bull call spread will get you a gain of $2.

It’s important to note that this profit doesn’t include commissions. If the Apple stock dips below the 139.50-mark, and you hold the position till the expiration, then you’ll suffer a loss.

This is an example of a bull call spread. You can also apply this for the bull put spread. With other types, vertical spreads follow the same pattern with an opposite position.

Now that you have understood the concept of vertical spreads, let’s move to the question, “Is vertical trading spread hot or not”? To answer this question, we have to separate the good and bad.

First, let’s talk about the benefits of spread trading.

Pros of vertical spread trading

- Cost savings with debit spreads

As we mentioned earlier, bull call & bear put are debit options. So if you take your trading positions using any one of them, you save the cost of opening positions.

This is because they are debit options. With debit spreads, you buy one option and sell the other simultaneously with the varying strike price. It allows you to have a net debit for your trading account. It sells all your options lower than the amount you acquire it for. That’s how you save the cost for putting up your position.

- Risk reduction with credit spreads

Credit spreads consist of bull put & bear call. With credit spreads, you have one option and sell the other one with a changed strike price. When you open a position with vertical credit spreads, you have a premium. It is an amount you receive when you sell an options contract. The credit spread gives you a higher premium when you sell an option in comparison to the premium you receive for buying an option.

So, you’ll generate an amount when your position takes up on the platform.

- Higher ROI with debit options

We are all in this for the money. As an options trader, you have to do the math on how much you will earn and how much you will lose. But many traders forget about that. Instead, they think it’s like solving algebraic equations. However, it isn’t that puzzling.

To calculate your ROI, you only need to know:

- How vast is the strike price?

- Is the option a debit or credit spread?

- How much do you pay for debit or receive for credit spread?

Here’s an exciting thing about vertical spreads. With the debit spread option, your ROI is higher because of the lower cost for opening debit positions. Your possible profit is the difference between the spread width and the transaction cost.

As the transaction cost is lower, you have a more significant ROI. Okay, the pros were excellent, but vertical spreads have their flaws as with other trading strategies.

Cons of vertical spread trading

- Lower profits with credit options

The credit options do let you receive money for opening the positions; however, there is a catch. The possible gain for credit spreads is the amount you receive minus transaction costs.

The quantity you receive is less as compared to what you pay to open the debit option. Therefore, this way, credit spreads eat up your profits — the need to hold positions till the expiry. Like we mentioned earlier, you can trade options in the opposite direction with the same expiry.

But here’s where vertical spreads lag. If you are facing a loss, your losses pile up until the expiration date. You don’t have any choice of leaving the position earlier. Till the contract expiration date, you are in this.

This is why many traders use vertical spreads when their saving cost is higher than the commission cost.

Final thoughts

Bullish and bearish vertical spreads offer the trader strategies with limited profit potential but also limited risk. The essential advantage of vertical spreads is that they do not require strong directional price movement. They are beneficial in that they allow you to make a profit if the price moves in the corridor, freeing the investor from predicting the market’s direction.