The Head and Shoulders is one of the most used patterns to predict downtrends in the FX market. Market participants can take short positions on pairs before the downtrend begins with the help of this pattern.

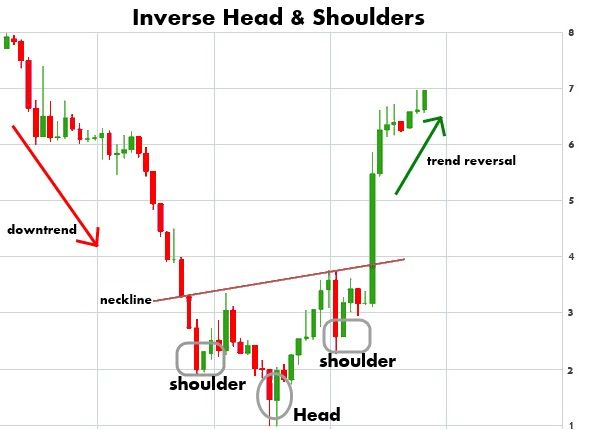

What is interesting is that there is an opposite version of the pattern to detect an uptrend. This version is called inverse Head and Shoulders (H&S). It follows the same principle as the regular one and reflects the struggle between the bullish and bearish forces to establish the asset’s price.

Using this technique, you can anticipate the price movement and ride the up-trend to benefit from it. Keep reading to learn how to use this pattern like a professional.

What is the inverse Head and Shoulders pattern?

It is a price action strategy that allows traders to anticipate an up-trend in the pair’s price. The name of the pattern is very illustrative of the way the price behaved during this period.

The inverse H&S can be seen after both an uptrend or a downtrend. Thus, what happened before the formation of the pattern is not relevant.

The pattern consists of one first low price level that then goes up to a certain point that will become the resistance level of the period. So that’s the left shoulder.

Secondly, after the price reaches the resistance level, the pair price goes down again to a new low that is even lower than the first one, rising again to the resistance level where the second phase starts. That’s the head.

Finally, the price goes down a third time to meet a low similar to the first one in the left shoulder. This low could be higher or lower than the left shoulder’s low but never lower than the low of the head. Finally, the price goes up again to the resistance level. That’s the right shoulder, and there you have our inverse H&S pattern.

All three elements of the pattern reached the same resistance level, that level is also called the neckline, and it is key to perform a good trade with this pattern.

How to trade with the Head and Shoulders trading strategy?

The way we trade this pattern is very straightforward. After the price forms the pattern on the chart, the trader waits for the breakout to enter the trade. As you should know, the patterns and strategies we see in reality are not as straightforward as shown to us in drawing courses.

You need to have the capacity to adapt the principles of the technique to what you see on the chart. Let’s see how we can apply this strategy in a bullish and a bearish trade with two examples.

Bullish trade setup

The inverse H&S pattern is always for a bullish trade setup, meaning that after the pattern is on the chart, you want to take a long position to make a profit.

What we are going to do here is to make the distinction between how we should face the trade according to the slope of the neckline.

So, for this case, we will refer to a bullish trade setup for those inverse H&S patterns with neutral or bullish resistance levels.

Entry

You only enter the trade after the breakout occurs. There are always traders who like to risk more to get greater profits, but the recommendation is to wait for the breakout to happen to ensure that the pattern is correct. You say that the breakout happens once the price is over the neckline. That is your entry point.

Take profit

Contrary to other patterns, the inverse H&S pattern has in it a target price. You set the take profit level according to the magnitude of the retracement after the price reached the low level of the head.

For instance, in our example, the head’s low is 113.236, and then, the price went up to 113.580. The magnitude of the retracement was (113.580- 113.236 = 0.344). That is 34,4 pips since we are talking of the USD/JPY pair.

That is the size our position should be.

Bearish trade setup

We will call a bearish setup to those inverse H&S patterns with necklines forming a negative slope. That is when the pattern gets lower highs during its formation.

Entry

Here, since the resistance level is not constant, you need to adapt your entry point. What you do here is to adapt your entry point to the slope of the resistance level. Then, once the price breaks out, you enter a long position to ride the uptrend.

Take profit

Again, the take profit level recommended depends on the magnitude of the retracement from the head’s low. However, we wanted to put this example to understand that these “rules” are not always right. In the example, the magnitude of the retracement from the head’s low to the resistance level is twice the magnitude of the uptrend.

How to manage risks?

The way we manage the risk in this and all the strategies can be the difference between being profitable and losing money like 90% of traders do.

The most basic and perhaps more effective risk management tool is the stop-loss order.

For the inverse H&S strategy, the stop-loss orders depend on the personality of the trader. Some traders are more risk-tolerant than others. Here we present two different options to put the stop-loss levels.

The first is to set the stop-loss order below the lowest point of the right shoulder. That way, if the price retraces a little, you don’t get out of the position immediately.

The second way is to put the stop-loss immediately below the breakout. The risk here is much lower, but there is no room for the price to retrace, so you can be out of the position before the uptrend takes off.

Final thoughts

The inverse H&S strategy is one of those patterns with simple rules that every trader can follow. Like most techniques, the time frame is essential to make the signal stronger. Also, you can confirm the pattern by using the volume indicator. In this case, you want the volume to increase when the price starts rising after the second shoulder.

Learning how to trade the pattern will be another vital tool in your trading arsenal.