There are many reasons why traders and investors like forex, but time flexibility and volatility are most important.

Even a beginner trader with a good trading strategy and risk can easily make 8-12% a month. Talking about a professional trader can make an average $$20,000 if they are taking the risk of $1000.

For instance, let’s talk about someone who has $100 and wants to start forex trading. Well, the first question that arises is, is it even possible?

Well, jump into this article, and we will share everything you need to know about starting FX trading with just $100 and winning trades most of the time.

Three things to know before starting:

- FX trading is risky, and entering into the market with a small amount needs you to be disciplined.

- A well-tested and working trading strategy is needed to achieve the required target profit.

- Risk: reward ratio is the most crucial part of following in order to make a consistent profit.

Is it possible to make $1000 from $100 on forex trading?

Well, $100 shouldn’t be worth too much these days when the value of the dollar is not on the moon due to the rise and hype around cryptocurrencies, but yes, if you want to trade the forex market, $100 can get you started and could even generate a new source of income from home.

Technically speaking, it is possible to make $1000 from $100 by trading forex; you need to develop and implement a successful trading plan and manage your risk.

How to trade?

Whether a beginner or an experienced trader, you will need a trading strategy to trade forex. Here is a trading strategy in which we will be using 20 and 50 moving average crossover. This here is the most simple strategy you will ever get.

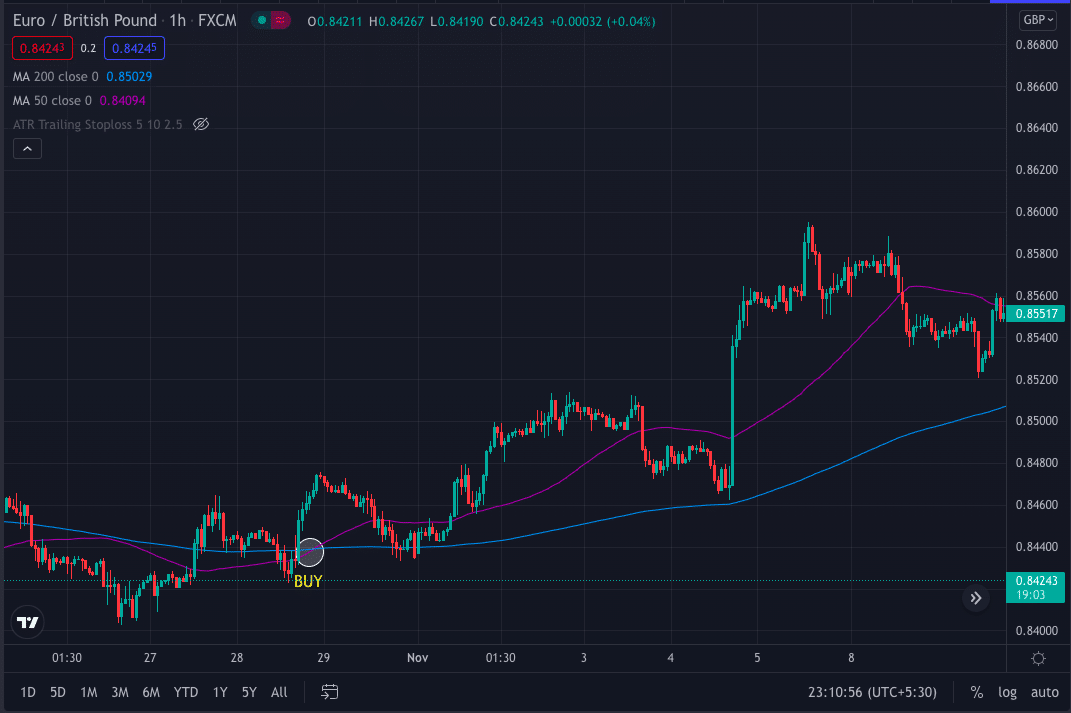

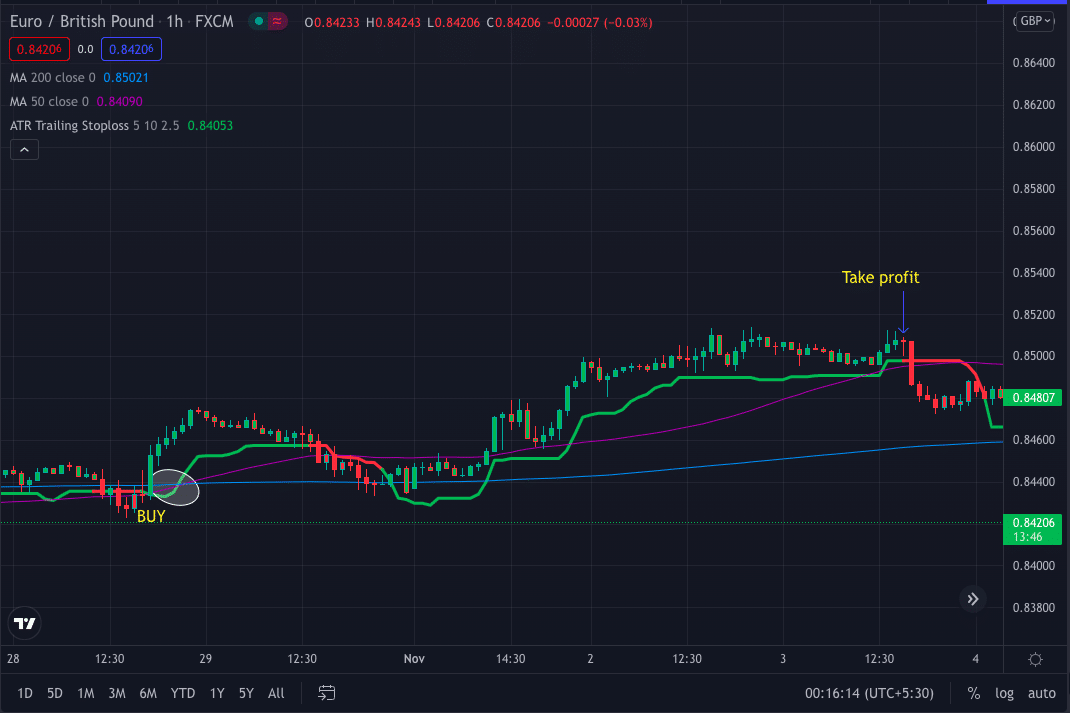

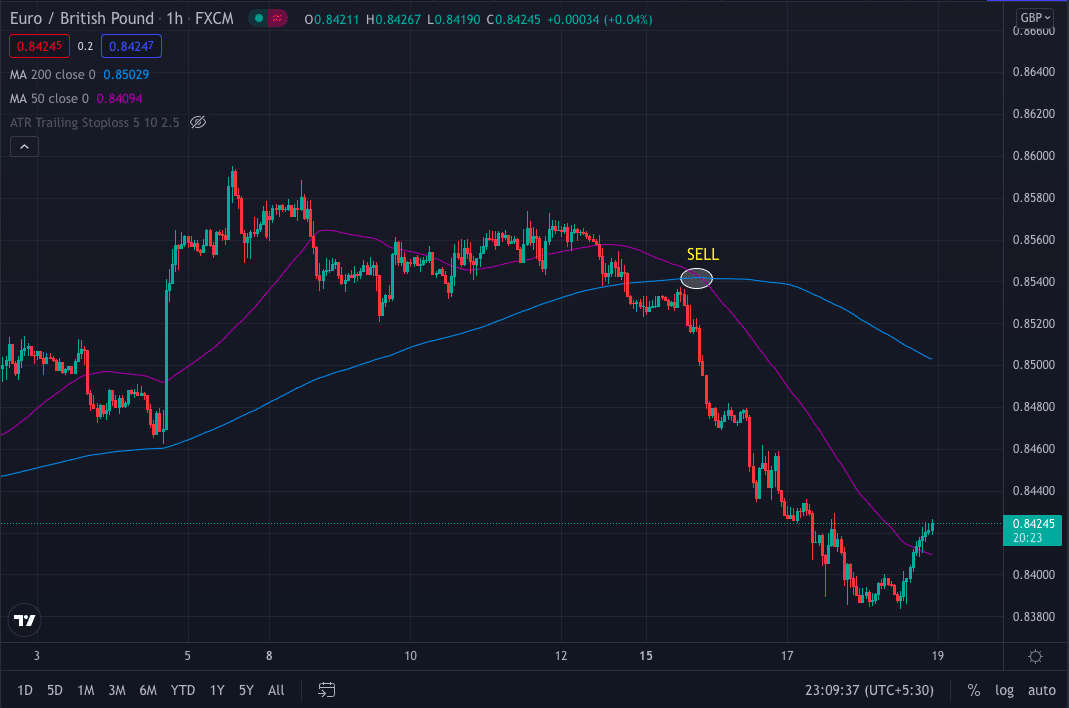

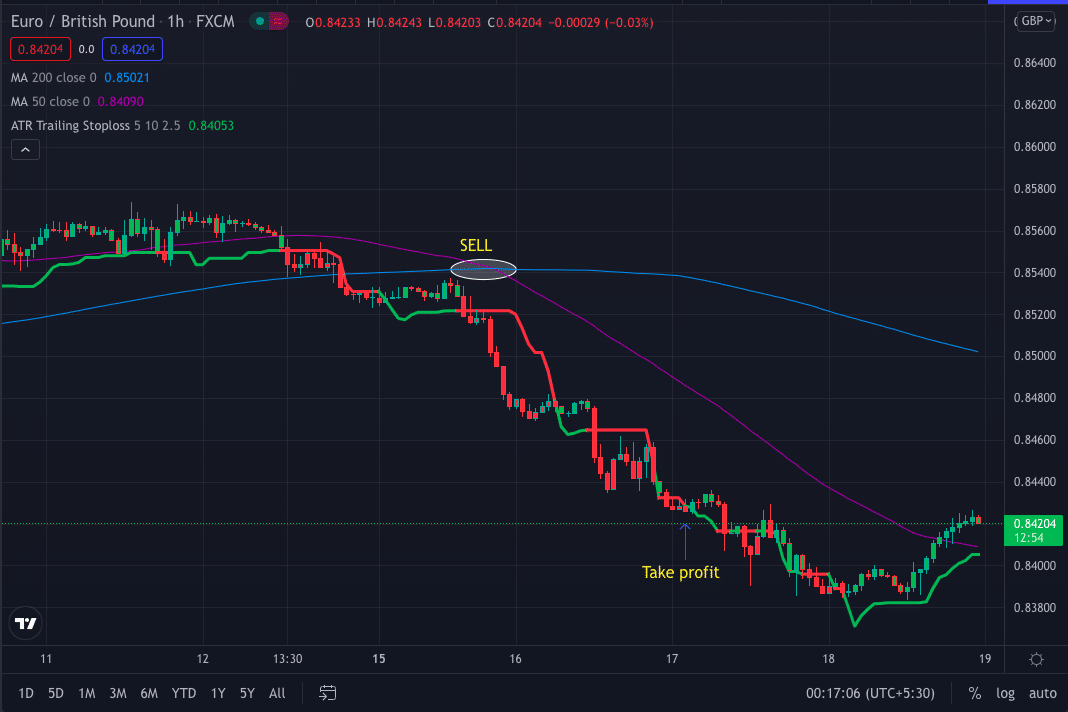

Apply 20-moving average and make it blue color then apply 50-moving average and make it purple. We will be using EUR/GBP pair on 1hr time-frame for the setup.

Note: Always choose the pairs that show reactions when there is a crossover of moving averages.

Bullish trade setup

- Take the buy trade when the 20-moving average crosses the 50-moving average from down moving up.

- Move to a lower time frame and look for the market reaction when the crossover happens.

- Take profit using ATR trailing stop loss.

In the above EUR/GBP 1hr chart, we can see the market is reacting when there is a crossover of the moving averages. The 20-MA is crossing the 50-MA, moving up giving a buy signal.

Entry

Enter the trade when you see the 20-moving average crossing the 50-moving average. Look for extra confirmation like the break of the previous swing high on the lower time frame.

Stop loss

Place your stop-loss 20 pips away from your entry.

Take profit

For take profit use ATR Trailing stop loss, as soon as you see.

Bearish trade setup

- Take the sell trade when the 20-moving average crosses the 50-moving average from up moving down.

- Move to a lower time frame and look for the market reaction when the crossover happens.

- Take profit using ATR trailing stop loss.

In the above EUR/GBP 1hr chart, we can see the market is reacting when there is a crossover of the moving averages. The 20-MA is crossing the 50-MA, moving down, giving a sell signal.

Entry

Enter the trade when you see the 20-moving average crossing the 50-moving average. Look for extra confirmation like the break of the previous swing low on the lower time frame.

Stop loss

Place your stop-loss 20 pips away from your entry.

Take profit

For take profit use ATR Trailing stop loss, as soon as you see green signal.

How to manage the risks?

It is essential to use a proper risk: reward. Better to only enter the trade with 1:2 R: R also; try looking for extra confluence. If the signal is formed near a support or resistance, it will be more accurate. Do not take more than 2% on any trade; if you feel the trade is worth taking, you may increase the risk to 3-5% but keep in mind to let the trade run until 1:2 R: R.

| Worth to use | Worth to getaway |

| Low cost Forex trading has significantly less commission and fees. Forex brokers make money from the difference between ask and bid price called a spread. | High risk Forex is risky if you do not have the proper knowledge. The news here can influence the whole market, and this led to high fluctuation. |

| High liquidity Compared with any other financial market, the FX has the most significant number of market participants. This provides the highest level of liquidity. | High volatility The FX is the most volatile in the financial market. |

| Low capital requirement You can start trading with as minimum as $20. The leverage here provides the best help. | The strategy does not always work Any strategy in the forex market to work is not easy. Due to high volatility, sometimes the method does not work. |

Final thoughts

Forex is highly volatile, with a daily transaction worth 6.8 trillion dollars. A career as a forex trader can be lucrative, flexible, and highly engaging. Trading here with $100 is risky, but if done with the proper plan could ultimately change your life for the better.

Indicators in any trading give you late entry and exit, so it is better to learn price action and candlestick analysis. Keep in mind that the strategy mentioned above is not a full-proof strategy. It would help if you kept your risk low to be in the market for long.

You can use compounding in your trading to get more profits in the future.