CFD trading has been gaining popularity as an investment technique lately, and this demand is expected to keep growing in the coming years. The reason behind this increased interest is the benefits one reaps from a successful CFD trading business.

The internet has been flooding with stories of wild riches and sustainable incomes that traders have derived from CFD. Most experienced traders have been making handsome returns on their accounts.

One of the main benefits of CFD trading is that you can speculate on price movements in either direction, with the profit or loss you make depends on the extent to which your forecast is correct.

Before you start contemplating the profits, keep in mind these figures are for seasoned and expert traders.

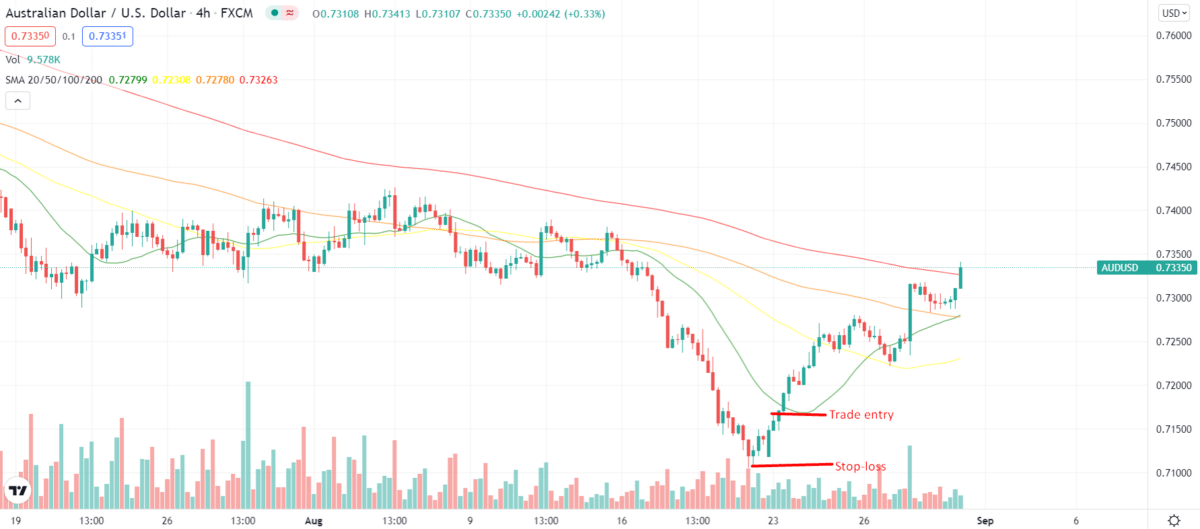

Make use of stop-loss orders

Stop-loss order is a function in forex to limit the losses when the market is volatile, i.e., moving in a direction opposite your position. These are placed to limit the risk in a trade or protect the profits in a trading position.

The FX market is pretty unpredictable. A slight spike in the market prices is significant enough to send shockwaves through the CFD market.

The risk in this business is inevitable; however, you can minimize it by trading and using your stops.

Set a limit for yourself and once you hit the target, exit the trade. This will help you stay in check, and you won’t get carried away.

For example, a trader in California is opening a trade in the Asian session, expecting that the volatility during the US or European sessions will affect their trades. Now, they want enough space for their trades to work, so they set a stop-loss of 50 pips on every position that they initiate. This will provide for a minimum one-to-one risk-to-reward ratio.

However, avoid being over-cautious with it. You must not set a stop-loss way below the market price, or else the trades will close automatically after the margin call, and you won’t be able to make a decent profit.

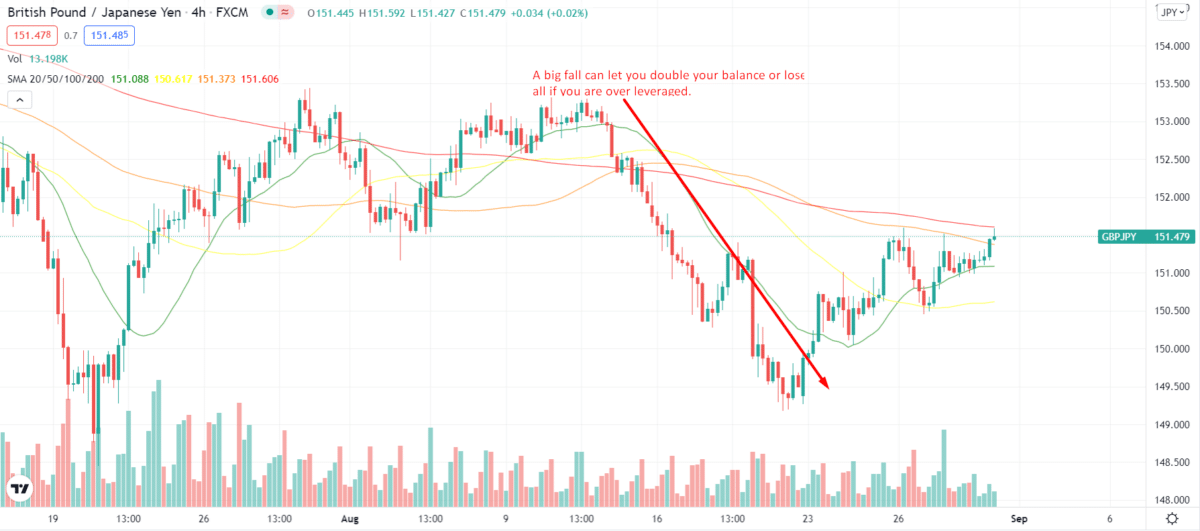

Manage your leverage smartly

Leverage is a significant part of trading CFD. For example, in FX, the use of leverage refers to borrowing funds to increase a trader’s buying power beyond what one could obtain from his or her cash balance alone.

As enticing as it sounds, you need to be careful with it. It is okay to use leverage but look at it this way, in most conditions, it is impossible for the prices to instantly move in the desired direction once you have opened a position.

If you keep the leverage too high, you might be forced to close the position over even a tiny move (0.1%) in the wrong direction. This way, you won’t profit if they shift back and start moving in the right direction.

The greater your leverage is, the more exposed you are to a trading disaster. Thus in Europe, regulators have set a maximum leverage of 30:1 for major currency pairs. So, whenever you find yourself in doubt, keep your positions small.

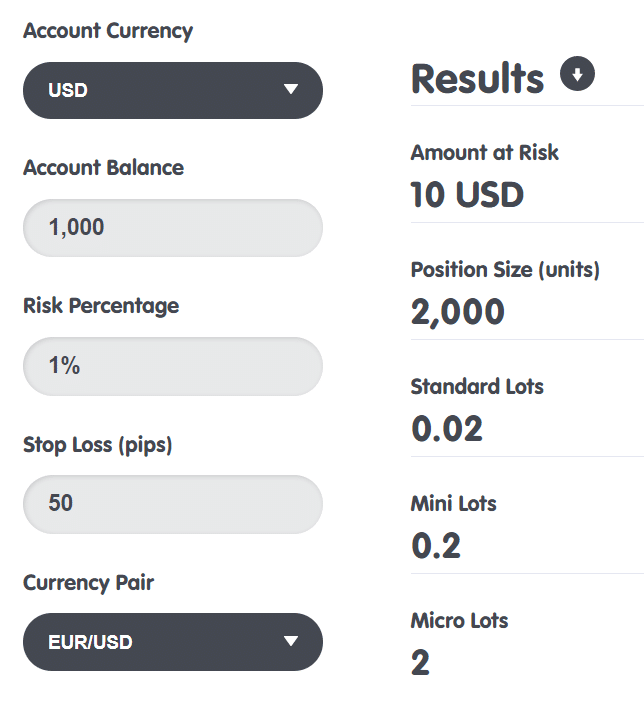

Avoid chasing your losses

We have mentioned this before. Unfortunately, losses are inevitable in CFD trading. You cannot avoid them; however, you can learn not to chase them.

When things don’t go your way, remember to stick to your initial strategy. The biggest mistake a CFD trader can make is letting emotions take over.

Understandably, investing time and money in the market only to see things going south can be a bit overwhelming, but traders who keep funding apparent losses in an attempt to win back their capital invite doom upon themselves.

Set your rules and follow them religiously. For example, if you plan to set your stop-loss 1% below the buying price, then don’t abandon this decision just because you are fond of a specific currency pair, assuming it will do well. Instead, use risk calculators to acquire the right volume and price to exit.

For good portfolio management, you need to cut out losses as quickly as possible. The quicker you do it, the greater chance you have of making a profit.

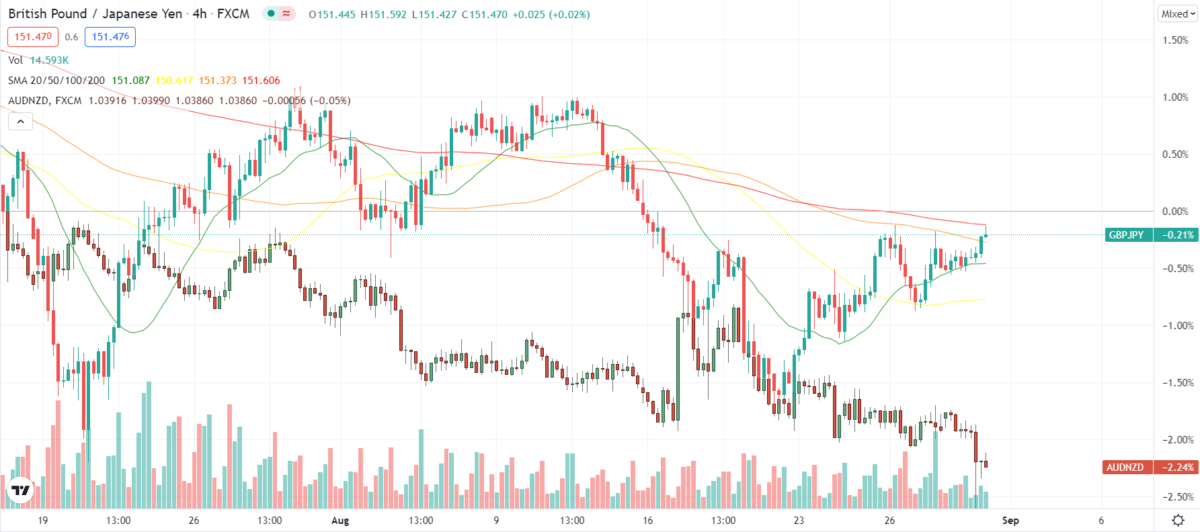

Diversify your trades

Putting all of your eggs in the same basket was never a good idea. The all or none mindset is not feasible in CFD trading.

One of CFD trading’s many benefits is that it provides you access to a wide range of assets and markets. So, there are multiple options to diversify your trades.

Be careful not to tie up all of your capital in a particular market or even a country. For example, if you expect the oil stocks to increase shortly, don’t invest heavily in Shell, Exxon, and BP plus crude oil simultaneously.

If your assumption turns out wrong, you will be in deep trouble because all these assets are connected and likely move in the same direction.

So, use your options. Diversify your trades to split the risk over multiple markets and instruments. Remember, you can never rely too much on one market.

You have to avail multiple options so that even in a worst-case scenario, your capital is intact. This is the ultimate goal.

Invest time in homework

Make sure you understand your craft well. You can’t be successful in any business until you equip yourself with the required knowledge.

Investing when you don’t know the difference between a USD/GBP and a GBP/USD quote is dumb. Know your platform. Learn the terms and their functions.

Invest in learning

Once you decide to step into CFD trading, constant research and reading should be a part of your daily routine. Research regularly about the markets you invest in, current affairs, global crises, political matters, etc.

Read CFD expert authors to have an insight from the best. Remember, the more you know, the easier it will be to make good decisions.

There is no substitute for experience, but theoretical knowledge combined with practical training will lead you to the top of your game.

Final thoughts

You cannot become better at CFD trading overnight. It requires time, patience, and consistent effort. You must brace yourself for setbacks and difficulties along the road. However, with a clear head and significant knowledge, you will be able to overcome all the obstacles.