The Gold Eagle is a gold trading expert advisor that uses the Trendline Pro indicator and grid approach. The developer Evgenii Aksenov claims that the grid method helps in optimized trading resulting in consistent profits. As per the developer, this is an MT5 supported FX EA that is designed to trade on gold and bring profits regardless of the time and manner in which a trade was entered.

GOLD Eagle trading strategy

According to the info provided on the MQL5 site, this FX EA uses the grid approach. The vendor claims that in this technique, the trades are optimized by opening new orders with average profits. The dev tries to convince us that a series of such orders are closed consistently after gaining profits. Let’s check how good the system is in trading.

GOLD Eagle backtesting report

Aksenov does not provide backtesting reports for this FX robot. Although the performance in backtests does not predict a similar result in real trading, traders use backtests for understanding the strategy and assessing its effectiveness. The absence of backtests raises suspicion about the reliability of this EA.

GOLD Eagle live results

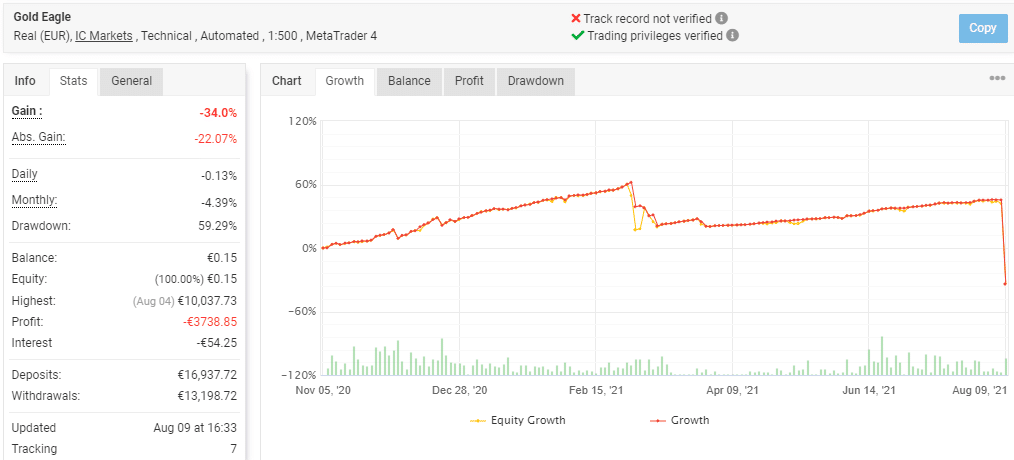

A real EUR account using the ICMarkets broker and automated trading with the leverage of 1:500 on the MT4 platform is present on the Myfxbook site. The account has verified trading privileges but its track record is not verified.

From the trading stats, we find that the account is operating at a total loss of 34% and the absolute loss value is 22.07%. The daily and monthly losses are 0.13% and 4.39% respectively and the drawdown for the account is 59.29%. For this account started in November 2020 up to August 9, 2021, a total of 1298 trades have been executed.

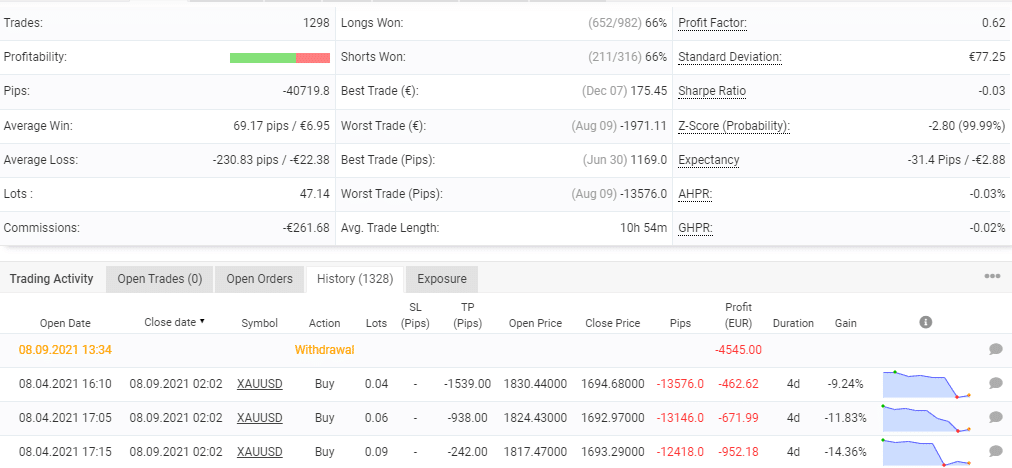

Profitability is 66% and the profit factor value is 0.62. From the trading history, we can see varying lot sizes are used from 0.04 up to 0.21. The high drawdown, losses sustained, and the big lot size indicates that the strategy used is very risky and unreliable.

Some features of GOLD Eagle

This FX EA works mainly on the XAUUSD pair. The developer does not provide info on the recommended timeframe, leverage, and deposit. We could find very minimal info on the expert advisor. A mobile trading panel is present which has auto-trading and manual trading options. For the manual trades, the orders are closed with a profit by using the DD reduce function feature. A news filter and conservative and aggressive trading styles are other features that are found in this FX robot.

| Total return | -34.0% |

| Maximal drawdown | 59.29% |

| Average monthly gain | -4.39% |

| Developer | Evgenii Aksenov |

| Created year | 2020 |

| Price | $149 |

| Type | Grid |

| Timeframe | N/A |

| Lot size | N/A |

| Leverage | 1:500 |

| Min.deposit | N/A |

| Recommended deposit | N/A |

| Recommended brokers | N/A |

| Currency pairs | XAUUSD |

| ECN | Yes |

Main things that make GOLD Eagle an unreliable EA

- High drawdown

From the trading results, the EA shows a big drawdown. A drawdown above 50% is not something that traders will be comfortable with. It indicates the risky approach and unreliability of the FX robot.

- Poor performance

From the real trading results of this FX EA, we find big losses that indicate the approach is ineffective. The small profit factor shows that the losses are more than the profits. These factors confirm that this is a poorly performing EA.

Pricing details

To buy this FX robot, you need to pay $149. The developer does not provide info on the features included with the package other than the offer of a free demo account. He provides an email address for customer support. While the price is not expensive, there is no money-back guarantee present, which shows this is not a reliable expert advisor.

Other notes

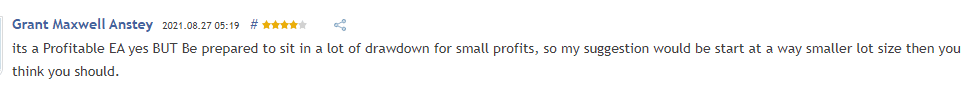

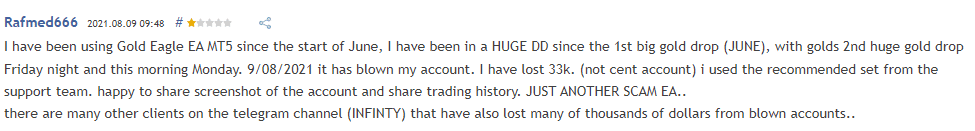

We found a few customer reviews for this FX EA. Here are a few of the feedback from users.

From the above testimonials, it is clear that the EA has plenty of drawdowns with low profits. This aligns with our analysis of the real trading results. The high drawdown and loss of profits show this is not a trustworthy system.