FxQuasar EA trades using grid and martingale strategies and comes with high-quality technical support working on AUDUSD with a loss risking system in place. The developer does not declare their names or experience in the markets. To better understand the robot, we will go through all the live records and see if we can get profits from it.

FxQuasar trading strategy

The developer states that the robot does a smart analysis of the market and has a special loss limiting system in place. It has six different sessions built within where the three are responsible for buying, and the others use sell positions. Each of these works independently from the other.

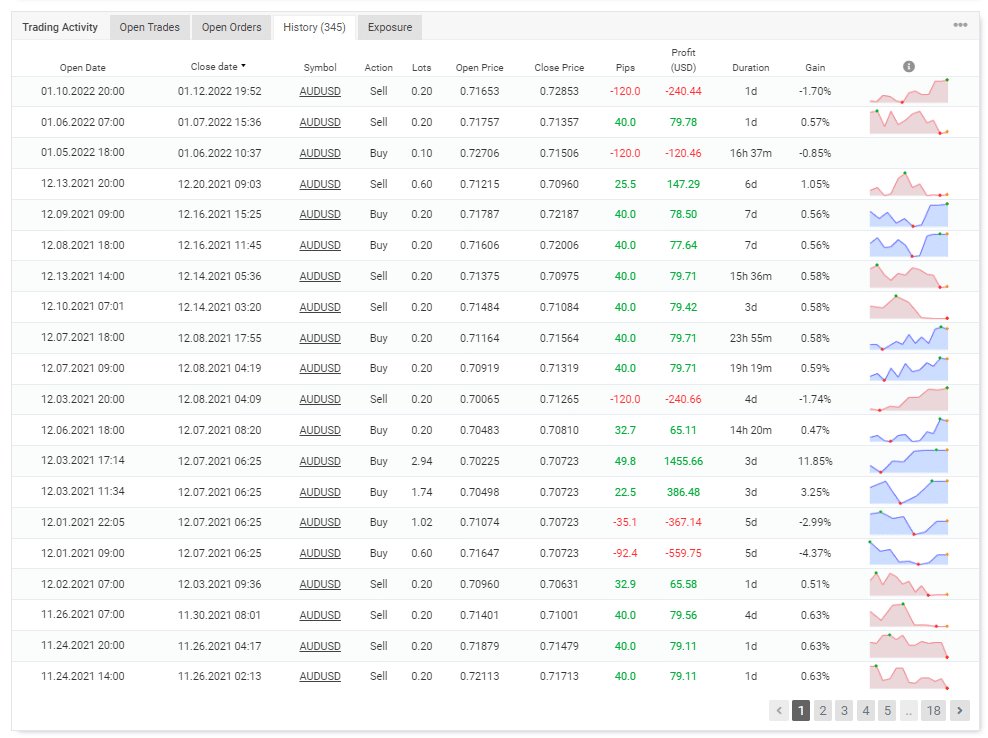

To better understand the topic, we head over to the live records on Myfxbook and analyze the history. We came to know that it uses grid and martingale strategy with trades on AUDUSD and has an average holding duration of 3 days.

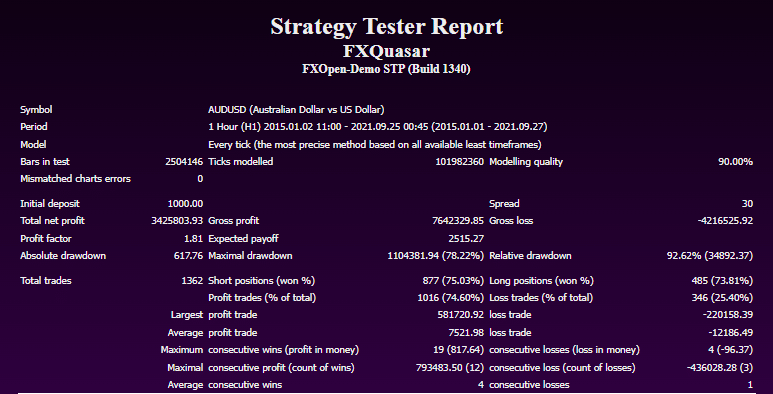

FxQuasar backtesting report

Backtesting results are available for AUDUSD, where the relative drawdown was around 92.62%. The winning rate was 74.6%, with a profit factor of about 1.81. All the tests were done on the 60 minutes chart with a starting balance of $1000. The robot tanked an average profit of $3425803.93 during this period. There were 1362 trades in total in which the best trade was $581720.92, while the worst one was -$220158.39.

FxQuasar live results

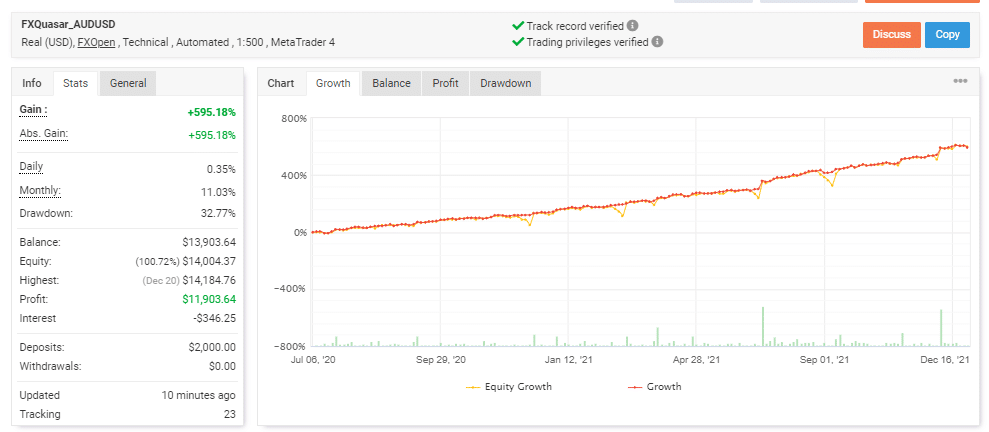

Verified trading records are present on Myfxbook. We have a performance from July 06, 2020, till the current date. The system made an average monthly gain of 11.03%, with a drawdown of 32.77%. The stated drawdown gives us a poor risk-reward ratio to match it with the monthly output.

The winning rate stood at 74%, with a profit factor of 1.81. The best trade was $1455.66, while the worst was -$559.75 in a total of 344 executions. There were $2000 in deposits and $0 in cashouts.

Some features of FxQuasar

FxQuasar has the following features:

- It has a risk management system in place

- There are detailed backtesting records

- Six different sessions trade the markets

- Smart analysis of the currency pair

| Total return | 595.18% |

| Maximal drawdown | 32.77% |

| Average monthly gain | 11.03% |

| Developer | N/A |

| Created, year | 2020 |

| Price | $279 |

| Type | Grid and Martingale |

| Timeframe | H1 |

| Lot size | N/A |

| Leverage | N/A |

| Min.deposit | N/A |

| Recommended deposit | N/A |

| Recommended brokers | N/A |

| Currency pairs | AUDUSD |

| ECN | No |

Main things to consider if you invest with FxQuasar

Let us go over several things that make the company unfit for use.

Grid and martingale

The use of averaging and martingale strategies makes the robot risky for live accounts. With the game plan, it is possible that it can cause a margin call on the portfolio if the market trends in one direction.

Developer transparency

The developer does not provide us with details on their trading experience and whereabouts. This causes us to raise concerns about the proper functioning of the robot. We do not know if it is properly developed or not.

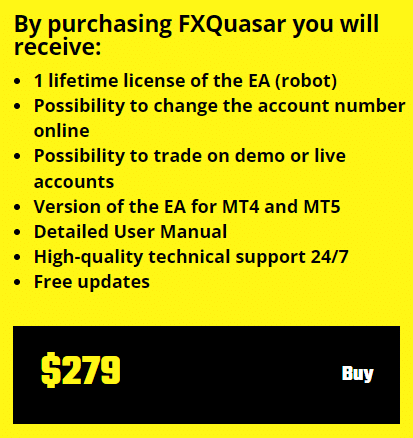

Pricing details

The robot comes with an asking price of $279. There is no money back guarantee offered from the developer. The cost is average if we compare it with other grid systems in the market.

Other notes

FxQuasar does not have any comments from customers on popular platforms such as Forex Peace Army. We do not know the general viewpoint of traders without any proper feedback.