When you invest in forex, you are participating in the buying and selling of currency pairs. There are many ways to make money in this market. However, your trading style determines how you will be entering and exiting the markets.

Trading on daily or weekly time frames is an option that you can consider since it has proved to generate consistent profits for many professional traders.

Each strategy has its benefits and drawdowns, but you can master it and become successful with the proper knowledge.

Do you want to know the best FX investment strategy daily vs. weekly? We will explain the two strategies with examples to determine if it is suitable for you.

Day trading

In the FX trading niche, day trading focuses on price movements within a daily trading session. Day traders analyze price movements from one minute to daily time frames.

Once they identify an opportunity, they will enter a position and rarely hold it overnight. The aim is to exit the position within the daily trading session. Sometimes, depending on which pairs you trade, the volatility can be lower than usual.

Therefore, the price movement is slower. If this occurs, day traders would hold their trades overnight and wait for the direction to appear in their favor.

Another factor is that specific currency pairs have low liquidity, and therefore less momentum than, for example, pairs dominated by the dollar, pound, and euro.

The reason why day trading is so popular is that you stand to profit instantly. However, it has risks associated, especially if you lack the proper knowledge.

Day trading example

Let’s see by following an example of how day traders would analyze the trend to enter the market.

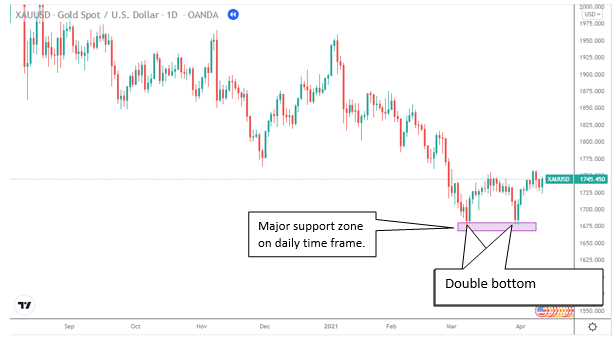

A day trader would identify the overall movement of the price. In this example, the pair has formed a double bottom on the daily time frame. This is a compelling indication that the price is about to reverse from the downtrend.

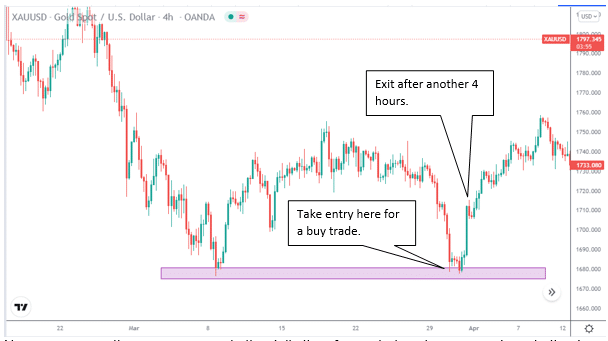

Now we can see the same zone as the daily time frame, but we have gone down to the 4H time frame. A day trader would enter a buy trade as indicated in the chart. The last time the price rejected this level numerous times, assuming it would move upwards.

Day traders will take advantage of the price movement and exit the trade within 4H in profit. In this case, you can also decide to hold it longer since there is good momentum.

Weekly trading

It is not an official FX trading style, but it is similar to swing trading. When you follow a weekly trading approach, you are analyzing time frames from weekly downwards.

Trades who prefer this type of trading are willing to hold their positions longer. However, they also have to wait longer for an opportunity in the market since the formation of price movements in the weekly timeframe takes longer.

The biggest lure to trade weekly time frames is maximizing profits by holding positions longer, taking advantage of the big price swings that a currency makes. For weekly traders, currency volatility is not a significant concern since they don’t need to exit the market quickly.

Technical indicators also work well with weekly trading techniques because they eliminate small movements during daily time frames. As a weekly trader, you don’t have to pay attention to the minor pullbacks in the market since your focus is on the more significant trend.

Let’s illustrate this in the following example.

Weekly trading example

We will use the same pair, XAU/USD, to illustrate how you can trade using the weekly time frame.

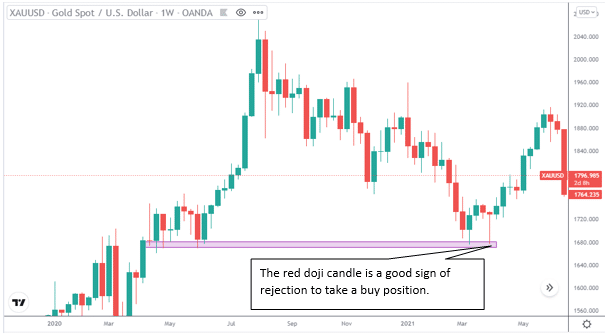

We have marked the support zone in the weekly time frame. Here we can see that the price has previously touched the zone but not broken it. As a weekly trader, you would find an opportunity to enter the market and hold the trade for a few days.

As shown in the chart, the Doji candle shows strong rejection. We have to remember that this candle is a weekly time frame. Therefore, it consists of many 4H candles.

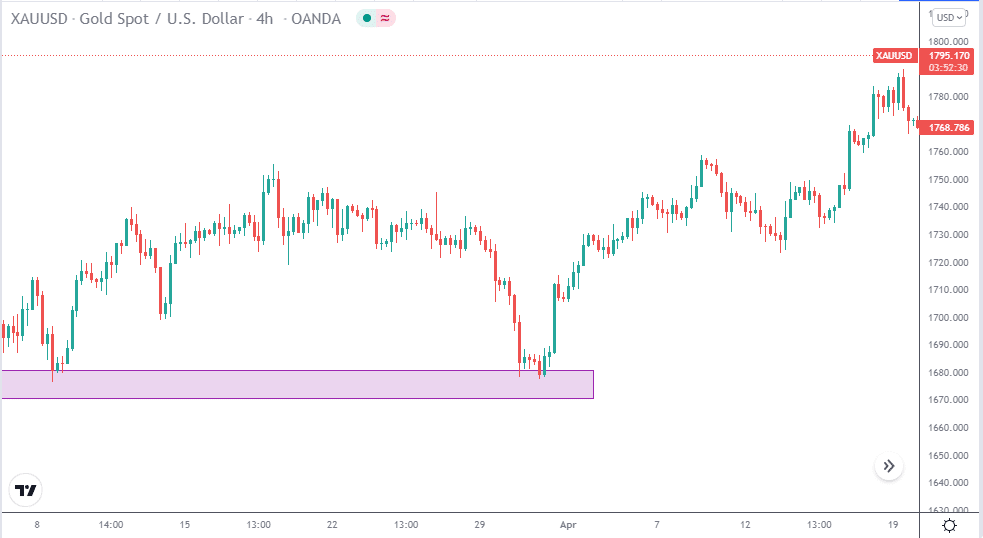

If we go down to the 4H time frame, you will see there are many rejections — a sure sign to enter the market with low risk.

Pros & cons: daily vs. weekly

Now that we explained the different trading styles, let’s consider the pros and cons of daily versus weekly trading.

Daily trading

| Pros | Cons |

| • Instant profits Day traders benefit from making profits quicker because the immediate market movement determines their entries. • More opportunities The price structures change quickly within the daily time frame. Therefore, you will find more opportunities to enter the market. • Avoid overnight risk You don’t have to hold traders overnight, and therefore avoid the risk of overnight fees and spreads. Furthermore, you don’t have to expose your trades to unpredictable overnight moves in the market. | • News can disrupt your position The risk of day trading is that significant news events can disrupt your positions. News can create a high level of volatility in the forex market and be detrimental to your trading positions. • Low liquidity If a currency pair has low liquidity, it can take hours before the price moves in a specific direction. And it can retest the same zone a few times. Such conditions might force you to hold overnight, which is not ideal for a day trader. |

Weekly trading

| Pros | Cons |

| • Maximum profit You maximize your profit because you take advantage of large swings in the price movement. • Less monitoring of charts Once you make your entries, you don’t have to monitor the charts constantly. • Ideal for part-time traders Weekly trading is ideal for people who trade part-time and have a full-time job since it is less time-intensive. | • Less trading opportunities Trading weekly time frames present fewer opportunities, and there can be times when the price has no clear direction. • Overnight fees Weekly trading requires holding overnight, and therefore you will have to pay swap fees for every position you hold. This can be significant if you trade large volumes. |

Final thoughts

As we have seen that both trading styles can be beneficial; however, they also have disadvantages which you should consider. When it comes to forex trading, you have to adopt a style that suits your personality and emotional maturity. In addition, you have to maintain a trading plan with clear goals. Your goals will ultimately determine which type is best suited for you.