As you may know, ETFs are groups of securities bundled together that you can buy at an exchange. Much like stocks, their prices rise and fall, and you can earn money either from dividends or from a difference between buying and selling prices.

- How do those funds come to be?

- Who decides what stocks and bonds to include in an ETF and how many holdings to look for in the first place?

- Who calls the shots on whether the fund will be leveraged, and will it pay dividends or reinvest into its holdings?

There are many questions, and the answer is ETF issuers.

What are ETF issuers?

To use simple terms, exchange-traded funds issuers are the companies that make the ETFs happen. To be more precise, they are firms that specialize in creating, marketing, and selling ETFs.

That means they are in charge of choosing the right companies for each fund by their market cap, niche, industry, and similar aspects. They also need to find the right logistics-related firms to take care of the fund. That means looking for the proper custodian, the auditor that fits, the fund administrator, and similar entities.

ETF issuers can be stand-alone firms that do these kinds of tasks primarily. Still, they can also be a part of a more significant financial institution, like a lender or a financial conglomerate. They also cover the fees you pay related to your ETF trading, as they distribute the money down to different service providers and their staff.

Let’s find some good examples of respectable ETF issuers and learn from an example what are the boxes that a good ETF issuer should tick.

Criteria

There are various ways to compare the ETF issuers, but it’s always good to have criteria set in place to make the process as objective as possible. In our case, we will categorize the issuers by assets under management, the number of ETFs they offer, and revenue.

- Assets under management

Assets under management refer to the total market value of securities that an entity, in our case ETF issuer, holds. The relationship is seemingly simple. The more assets under management an issuer has, the better it looks.

And while there is, of course, more nuance to the topic, many investors do value assets under management comparisons when trying to determine the quality of a fund or its issuer, for that matter.

- Number of offered ETFs

Assets under management tell only one side of the story. Of course, a higher figure does instill more confidence. Still, the sheer size of the fund, or aggregate funds of an issuer, does not provide enough information for you to make an educated decision when choosing one.

The number of ETFs that an issuer offers says a lot about the versatility of the company. You always want to diversify and hedge against uncertainties in specific industries. If a provider offers a broad spectrum of different ETFs, it means that they have covered all the bases, and they can tolerate risk and maintain the fund you chose in the years to come.

- Revenue

Revenue is somewhere halfway between the previous two criteria. Revenue tells us how much money the issuer holds made in the past quarter, half of the year, or the entire year.

This parameter is important because it tells us how big of a cash flow the issuer deals with and hints at how successful the issuers’ bets were in the past. Assets under management only tell us how big the fund is, but the revenue reveals if most of the investments were home runs or swing-and-misses.

Examples of good ETF issuers

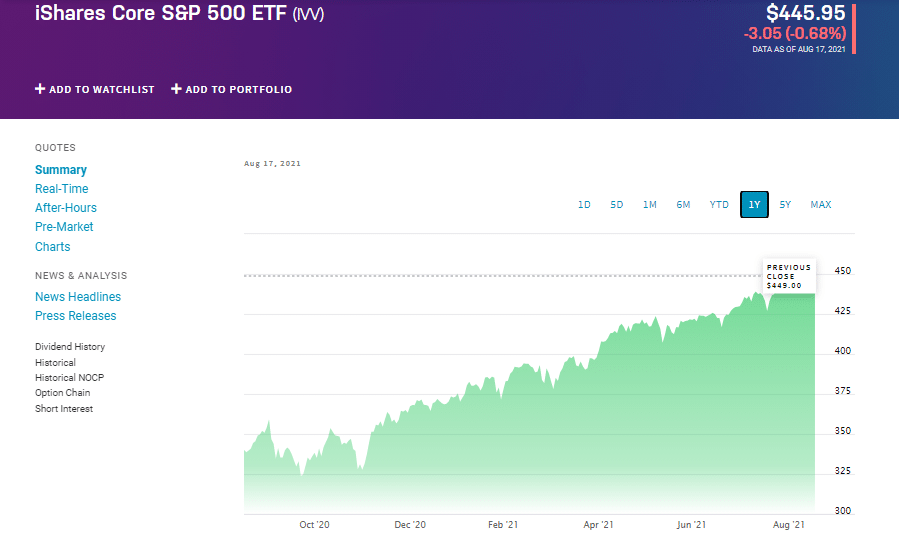

1. iShares Core S&P 500 ETF (IVV)

iShares made a list as an absolute champion of assets under management. The subsidiary of BlackRock Inc. has approximately $1.8 trillion of assets under management, while its revenue amounts to more than $3.5 billion.

Take just one look at the provider’s flagship S&P-based fund IVV, and it will be starkly clear what returns the fund yields.

Another ETF by iShares worth mentioning is iShare US Aggregate Bond ETF AGG, which offers a chance to enter the bond market, and has almost $79.4 billion in assets under management.

It should come as no surprise as BlackRock is a company that primarily deals in mutual funds and ETF management.

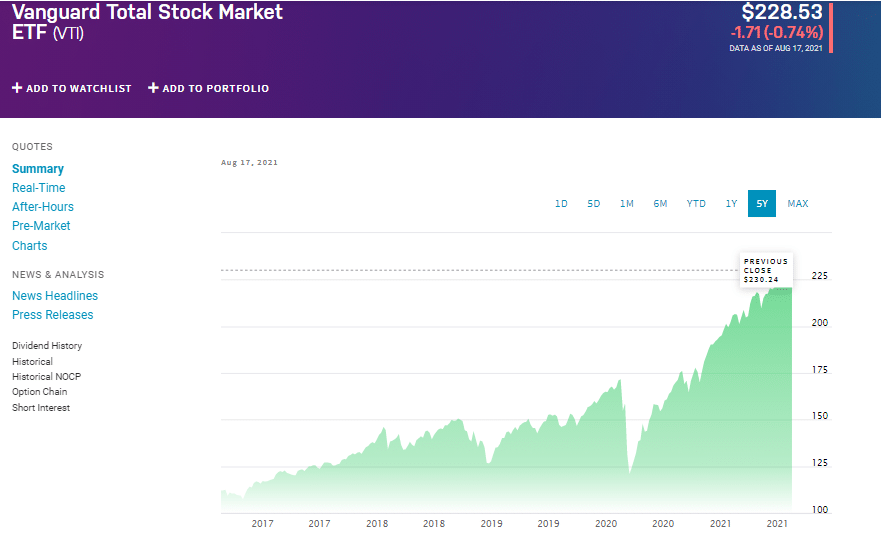

2. Vanguard Total Stock Market ETF (VTI)

Vanguard is similar to iShares in some aspects but couldn’t be further apart in others. For example, the issuer offers 80 different ETFs, which is four times fewer than iShares. On the other hand, its average expense ratio is three times lower than that of the BlackRock subsidiary.

Also, Vanguard is indirectly owned by its shareholders, and it also boasts a hefty amount of assets under management. While lower than iShares, it still came in at approximately $1.9 trillion. Its revenue amounts to over $769 million, and its average expense ratio is 0.06%.

This is Vanguard’s VTI ETF. With minor setbacks that the Covid-19 pandemic prompted, you can see that the returns from the fund continuously climbed over the past five years.

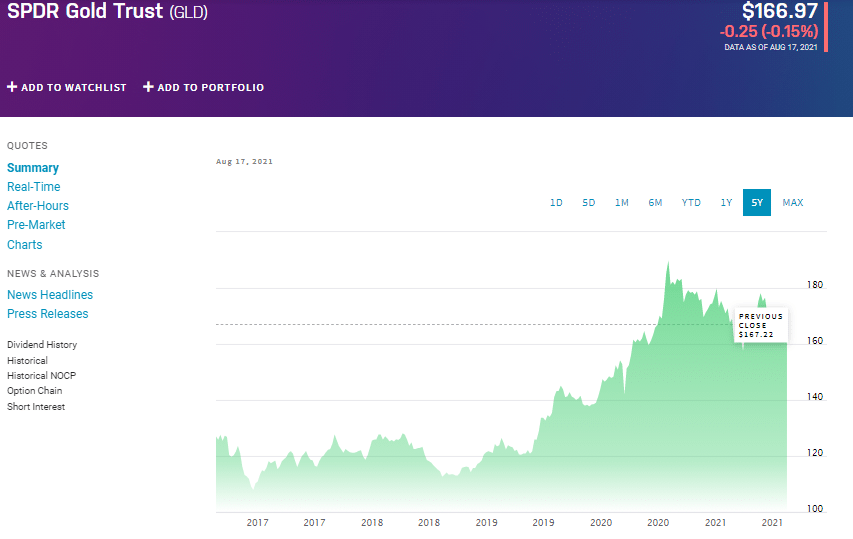

3. SPDR Gold Trust (GLD)

State Street SPDR is a publicly-traded company, and it comes in third behind iShares and Vanguard on most lists.

Its assets under management stood at over $770 billion, while it offers 139 exchange-traded funds. Its revenue stands reasonably high at $1.3 billion.

The most exciting thing about SDPR is its gold-based ETF SPDR Gold Trust GLD, which those looking to hedge against uncertainty by investing in bullion can use as a valuable tool.

Final thoughts

Choosing the right issuer can be tricky, mainly because they all have their merits. The good thing is, in this case, you don’t have to choose anything. There is no reason for limiting yourself when you can opt for ETFs issued by various providers.

The most important thing is to tailor your choices to your needs and preferences. The more options you have available, the better.