With the recent Bitcoin and other major coin crashes, the buzz about the beginning of a cold crypto phase has begun morphing into reality. The ‘crypto winter’ notion instills a more significant fear among investors and traders than the regular bearish market. This long-term market collapse can generate a major panic among investors due to the uncertain future.

The crypto market has witnessed long phases of crypto winters; for example, the violent price plunge of more than 50% during August 2012 and a drop of more than 80% in 2013 and 2018.

Various factors can cause a crypto winter; the past crashes were not the last ones, and the market is possibly bracing to enter a new winter slump. So, do you want to know the implications and impacts of such winter phases?

Read this article to know about the probability of a new crypto winter and what it can mean for you as an investor.

Three things to know before starting:

- ‘Crypto winter’ terminology points to a long duration of crypto market collapse and dormancy where bulls are nearly non-existent.

- Bitcoin has witnessed a decline of 32% in 3-4 weeks from November-December 2021, stipulating a discussion about the inception of crypto winter.

- The current sell-off presents an excellent opportunity to buyers who can now invest in digital assets at lower prices.

What is crypto winter?

Crypto winter refers to a phase of the crypto market when digital currencies’ prices, mainly BTC, keep crashing drastically and remain in a downtrend for a long duration, possibly one to three years. The historical records show that these periods occur in cyclical rotation after the market reaches the pinnacle of optimism and frenzy (crypto spring) till the next price pump.

In addition, cryptocurrencies have a highly volatile nature compared to traditional currencies and stocks. As a result, the crypto market crash can be disastrous, stoking apprehension and fright among investors and traders.

The past crypto winters: 2014-2020

Bitcoin and other digital assets have regularly received significant public attention due to the positive expectations surrounding their blockchain technology and decentralization concept. Some investors just wanted to ride the ‘crypto’ wave with everyone.

Whatever the reason, these buoyant bubbles had to burst at some point due to various factors such as massive hacks, exchange shutdowns, fraudulent schemes, government regulations, or simple liquidity of accounts.

Although Bitcoin faced numerous crash periods in the past, here are two of the most prominent past crypto winters

December 2013 — January 2016

Decline: -86.9%

BTC crash (2014)

Bitcoin formed an all-time high of $1150 in December 2013; however, the ban on cryptocurrencies by China at the end of 2013 caused the prices to plunge more than 50% overnight.

Moreover, Mt. Gox, the biggest cryptocurrency exchange, faced regulatory troubles, and hackers targeted the platform during 2013- 2014. The exchange reported a loss of more than 850,000 Bitcoins ($450m) and eventually went entirely bankrupt.

The Mt. Gox catastrophe severely impacted the crypto space, pushing it into a prolonged crypto winter phase till the recovery started in 2016.

December 2017 — December 2018

Decline: -83.6%

The famous 2017 crypto boom caused an enormous Bitcoin price surge to about $20,000 from an $800-$900 level at the start of 2017. In December 2017, the price came crashing as the investors cashed out their gains from the over-valued Bitcoin bubble.

The crypto winter continued during 2018, dragging the prices to below $2000 by December 2018. The primary cause of this collapse was the $530 million hack of Japan’s largest OTC crypto exchange, Coincheck.

Is the crypto winter 2021 coming?

There is no clear and defined boundary of a crypto winter; however, speculations about an upcoming crypto winter are in full swing due to ongoing major price dips of various digital assets.

Bitcoin formed an all-time high of approx. $69,000 just last month (November 2021), but the currency is now entering its fifth week of a consecutive bearish trend. Currently, the price is hovering around the $46k to $47k mark, indicating a fall of more than 30% in just a few weeks.

Correspondingly, other major crypto coins like Ethereum, Cardano, Solana, and Polkadot have been trading in red for several weeks.

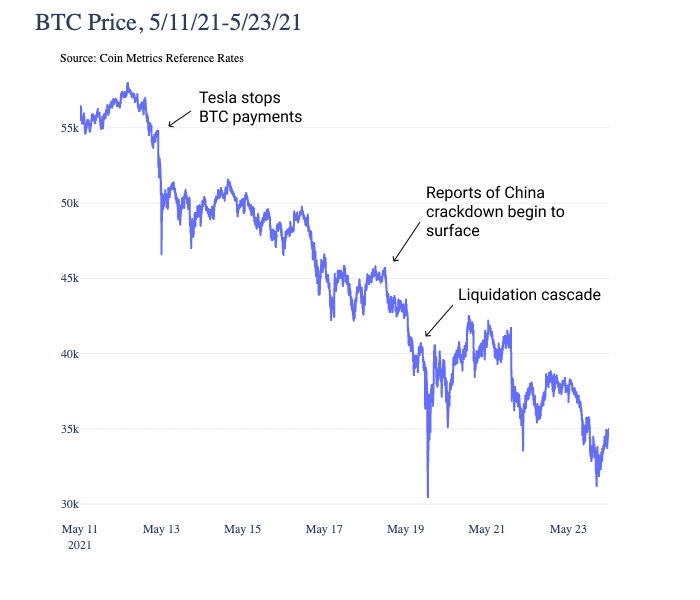

Moreover, the Bitcoin price dropped hard a few months back, during April-May 2021, by 51.1%, spawning debate among investors about the start of potential crypto winter.

What is causing the massive sell-offs?

The May 2021 price decline was primarily due to Elon Musk’s announcement about the rejection of Bitcoin as a payment medium for Tesla’s transactions. In addition, a strengthening dollar and economic recovery also propelled some people to let go of their digital assets.

The current (December 2021) price downswing after the $69k peak is the result of various possible reasons:

- The introduction of the US infrastructure bill

- The harsh crackdown of Chinese authorities on crypto miners and investors

- Margin accounts liquidation

President Joe Biden’s $1 trillion bill about strict regulations on crypto tax reporting and verification of $10,000 above transactions has become a significant barricade to the crypto enthusiasts’ financial liberty and decentralization nature of digital coins.

Moreover, China’s National Development and Reform Commission has recently announced harsh actions against Bitcoin miners due to massive power consumption and declining local currency value. In addition, margin calls due to the crypto depreciation have resulted in the liquidation of billions of assets on several exchanges.

Should you sell or buy crypto during crypto winter?

The answer to this question varies with the type of trader you are. Panic sellers undergo a frenzy on the slight price breakdown, whereas others with patience hold their assets and prefer buying the dips.

Currently, Bitcoin is nowhere near the 80% decline rate of past crypto winters, blurring the possibility of true crypto winter. However, investors need to know that Bitcoin has always recoiled after a price slump, though it may take a significant amount of time.

The fixed 21 million supply of Bitcoin and every four-year halving events are the major components that maintain the currency’s demand. Moreover, the tax regulations on crypto have further enhanced its legitimacy and can push the price to record new highs.

The best strategy can be to stack the relevant digital assets before the start of the next crypto spring, which can occur following the next halving event in 2024. Investors can use averaging techniques like fixed-amount regular investing to gain significant profits when the crypto bleeding ends.

Final thoughts

The current crypto winter hype can be temporary or short-term, making it the best time to invest in major coins at the lowest possible rates. Moreover, the long-term outlook of the crypto sphere is still optimistic with the introduction of many new crypto and metaverse projects.

However, as indicated by historical price movements, this domain requires a substantial risk tolerance and consistency to achieve worthy gains. The spring would always come after the winter, though it can take considerable time. Nonetheless, there is no denying that uncertainty and fear come in parallel to the crypto winter fuss and long-term bearish waves.