Since the last few years, the cryptocurrency sphere has gathered massive public interest due to its unique blockchain technology and positive prospects. Despite the speculative nature of digital coins, investors and traders are pouring out their funds to capitalize on the expected boom of this industry.

The cryptocurrency trading volumes hit the $2.5 trillion mark in September 2021, indicating this domain’s magnitude of popularity. As of November 2021, BTC alone shows an average daily trading volume of $25 billion.

Due to this immense crypto enthusiasm, many firms and companies have long tried to mingle cryptocurrencies with traditional stock markets. Amid the crypto frenzy, the first Bitcoin ETF entered the stock market on October 19, 2021, marking the beginning of a new era.

In this article, we have discussed the characteristics of Bitcoin ETFs and details about the ProShares Bitcoin Strategy ETF (BITO).

What are Bitcoin ETFs?

They are the exchange-traded funds that trace BTC’s price. Investing in such funds is different from investing in the regular Bitcoin, as cryptocurrency exchanges have no involvement.

Bitcoin ETFs present diversification to the investors’ portfolios and trade like standard stocks on the stock exchanges. Investors can benefit from the cryptocurrency realm without directly exposing themselves to the crypto market by considering these ETFs.

The first-ever Bitcoin ETF (BITO) began its operations last month. In the past, SEC had rejected all the Bitcoin ETF proposals due to this digital coin’s decentralized capitalism and un-regulatory nature that raised many security concerns.

How do Bitcoin ETFs work?

They work similarly to the traditional ETFs that mimic the investment results of an index or basket of commodities or assets. The fund owners deal with the underlying assets by buying or trading them. Investors do not directly hold the tracked currencies or stocks and only own the shares of the exchange-traded fund.

A Bitcoin ETF imitates the price of BTC or its derivatives and gains or loses value with the corresponding fluctuations. Moreover, these ETFs exchange on traditional stock markets like NYSE and NASDAQ as regular stocks.

Cryptocurrency ETFs also provide the advantages of traditional ETFs, including financial transparency, flexibility, risk mitigation, and tax benefits.

Reasons to use for investors

A Bitcoin ETF is an ideal investment choice for investors who desire to avoid and bypass the security concerns linked with BTC and other cryptos.

Moreover, the investors can procure the benefits of the Bitcoin market without getting involved with the complex crypto exchanges. Instead, they can trade the digital coins ETF on a regular stock market in an uncomplicated and straightforward way.

In addition, most investors are more accustomed to and familiar with traditional stock markets’ methodology and working. Therefore, these ETFs open a way for investors to engage with the crypto realm without learning about these digital tokens’ detailed accounts and intricacies.

It is important to note that most official authorities and governments have banned cryptocurrencies as a legal medium of exchange. However, a Bitcoin ETF operates like a regular ETF without any security issues; hence approved as a legalized portfolio holding.

ProShares Bitcoin Strategy ETF (BITO)

This is the first US Bitcoin-linked ETF launched on October 19, 2021. It provides exposure to the BTC futures contracts:

- BTCX1

- BTCZ1

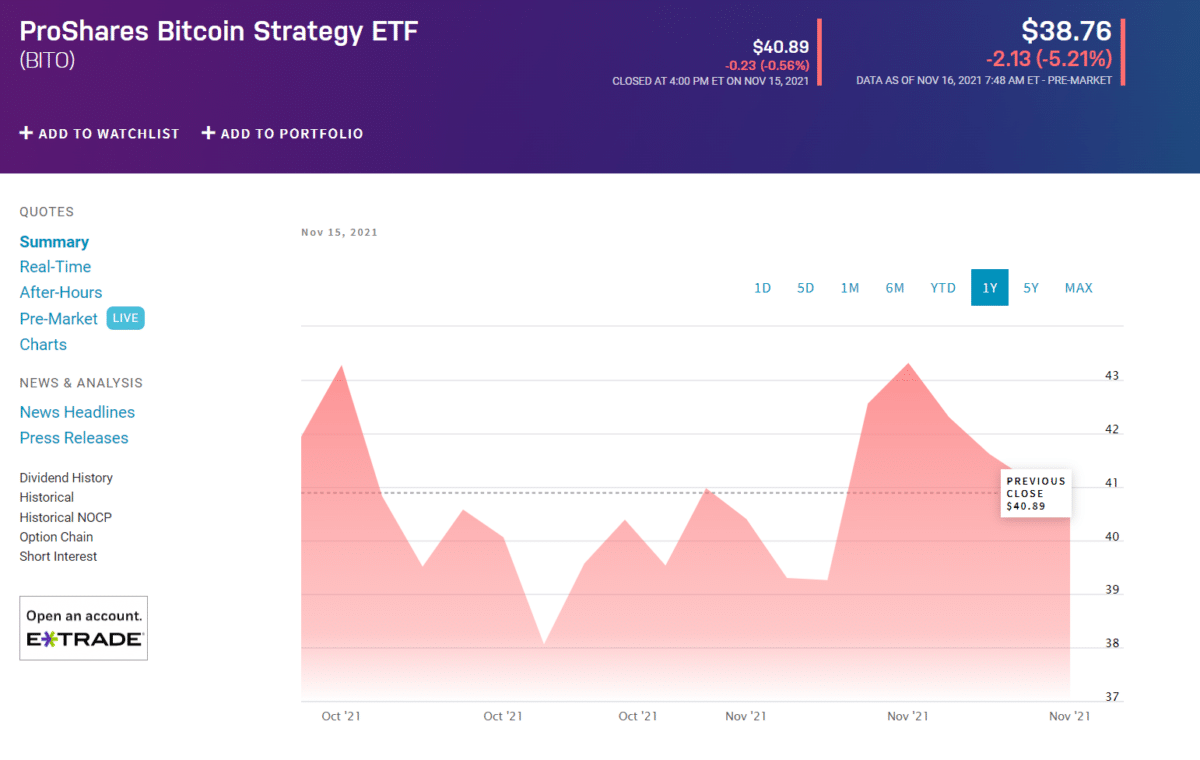

Within just two days of its trading on the NYSE, BITO hit over one billion USD in assets, becoming the quickest ETF to reach this mark.

It is essential to know that BITO does not invest in Bitcoin directly but instead in BTC futures. Bitcoin and BTC futures hold significant differences. Bitcoin futures involve future trade orders at a specified price and do not entail direct asset-buying BTC.

You can gain profits from the futures contracts by “trading at a premium,” which indicates a higher asset price at the time of trade execution than the initial contract price.

Though the intrinsic pilot of the Bitcoin futures is the “physical” digital token, it does not precisely follow the price movements of BTC. Future-based contracts do not faithfully replicate the underlying currency price due to some additional costs and tracking errors.

BITO futures contracts

Commodity Futures Trading Commission oversees and regulates the futures contracts of BITO. This Bitcoin ETF also utilizes leverage and invests in US Treasury Bills.

Bitcoin futures follow the Chicago Mercantile Exchange’s rules. Moreover, the CME group is also the direct exchange of these contracts.

Fees

As the Bitcoin ETFs have recently come into the picture, their fees are higher due to the involvement of many intermediary parties. The expense ratio of BITO is 0.95% that is significantly higher than the average.

It means that for every $100 of your investment, $9.5 will go to the fund’s management expenses.

Regulation

While the crypto exchange platforms have controversial security and insurance policies, a Bitcoin ETF grants the advantages of regular stocks and fund investments. Most brokerage accounts provide SIPC protection and financial securities insurance of up to $500,000.

Is a Bitcoin-linked ETF suitable for you?

Bitcoin is highly speculative and volatile. Though BITO is a BTC futures ETF, it still provides exposure to the Bitcoin price action. Its recent volatility example is that BTC price plummeted to $62,000 from the $68,000 mark in just one day.

Professionals suggest the portfolio allocation of less than 5% to risky assets like cryptocurrencies. It would be best to consider your risk appetite and investment goals before investing in a Bitcoin-linked ETF.

Pros & cons

Bitcoin ETFs have various advantages but several limitations as well. Here, we have discussed the basic pros and cons of these ETFs.

| Worth to use | Worth to getaway |

| Regular stock exchange The fund trades on regular stock exchanges that allow investors to circumvent the complexities of direct crypto exchanges. | Higher fees BITO has relatively higher management fees than the average range. |

| Short selling This fund provides the unique advantage of short selling in case of depreciating Bitcoin prices. | Limited market hours You can trade Bitcoin ETFs only during the stock market open hours. In contrast, regular crypto coins trade 24/7/365. |

| Security It has regulated security and insurance policies as opposed to the traditional cryptocurrency market. | Inaccurate tracking The ETFs do not precisely track the price variations of BTC. |

Final thoughts

BITO is a milestone in the ETF universe that has amalgamated the benefits of traditional and crypto investments. It is ideal for investors who prefer the convenience of conventional stock markets with no association with crypto wallets and exchanges.

In addition, investors are highly optimistic about the inauguration of the Bitcoin “spot” ETF soon, even though the SEC has recently rejected the VanEck spot Bitcoin ETF. Investors hope that the introduction of BITO and BTF can be a starting point for the introduction of many Bitcoin ETFs in the upcoming years.