These days, dealing in Forex pairs has become much easier thanks to Forex robots. These are software programs that work on the basis of a predefined logic. Each of them has a specified set of rules and can identify the opening and closing prices based on trading signals. While trading manually, a trader may be influenced by emotions and biases, but a robot can help in logical decision-making while also expediting the trade execution process.

Today, we shall discuss some of the top Forex robots in the industry and highlight the advantages and disadvantages of each. Some general information related to Forex robots will be covered as well.

What’s the difference between a Forex robot and an EA?

An EA or expert advisor is a piece of software that generates trade signals and sends you notifications whenever there is a lucrative trading occasion. Trading with these systems requires some manual intervention on your part where you need to confirm the order.

On the other hand, Forex robots trade automatically without manual input. It is better to use a Forex robot if you want your trading schemes not to require manual interventions.

Top 10 Forex Trading Robots

Here is a list of the best Forex robots to try in 2022. We have discussed 9 of the most trusted automated systems in the market while analyzing the key performance factors based on live statistics. Scroll down to read our reviews for each of these EAs:

1. TechBerry

TechBerry is making its name among the best social trading platform. Since its inception in 2015, it has been offering an 11.2% gain to subscribers each month. With a simple $10000, it is possible to generate $500 with little to no risk. This is made possible by executing a quality trading strategy formulated by collecting data from over 100K trading accounts. For additional tips and tutorials, be sure to watch Techberry on YouTube.

TechBerry supports 50 regulated brokers that keep your funds safe and secure. Furthermore, it takes the insurance of FIDC banks, adding reliability. The pricing starts at $19 for the Green plan. The range of services and features increases with the initial deposit. With the Infinite plan, subscribers get a 100% reimbursement in case of any loss and only have to pay a 15% service fee.

Subscribers can also try out the platform for $5000 with no annual subscription costs.

| Pros | Cons |

| A high win rate of 99% | Hard to apply for professional trader account |

| Access to a personal manager | |

| Over 10% gain each month | |

| Variety of membership plans for individual investors |

2. Trade Explorer

Trade Explorer is a multi-currency MT 4 compliant trading robot with verified records. The developer offers a 30-day money-back guarantee on the yearly and lifetime memberships. Superb customer support, free updates, and the best set files are available with each purchase.

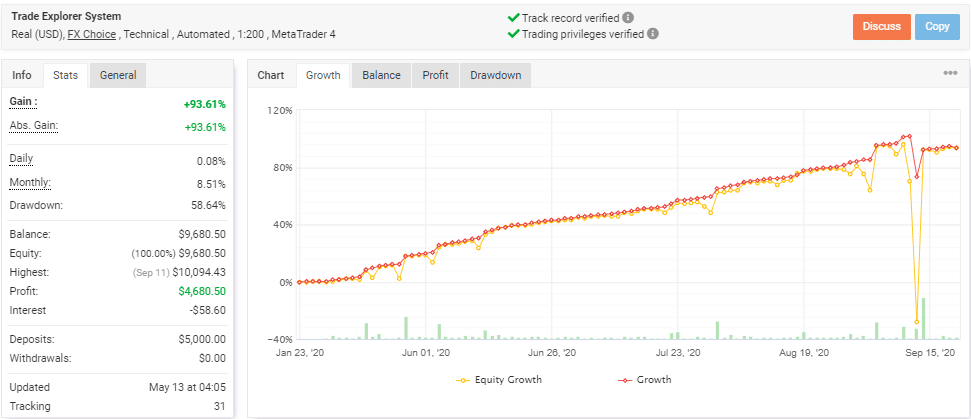

The live records on Myfxbook show us a performance from January 23, 2020, till September 15, 2020. The algorithm has produced an overall gain of 92.61% during this period, with a drawdown value of 58.64%. High leverage of 1:200 is used for the account, and there are sharp falls in the equity curve.

The algorithm uses averaging and martingale techniques which is obvious while observing the trading history. Multiple trades with different lot sizes are closed simultaneously.

| Pros | Cons |

| Multiple live records | High drawdown |

| 30-day money-back guarantee | Uses grid and martingale |

| It comes with a pre-optimized set file |

3. Happy Forex

Happy Forex offers multiple trading algorithms available for €299 and €499. The company updates its systems frequently and is keen to provide quality customer support. The robots install easily with the help of a .exe file where traders can select their choice of MT 4 platforms. Live and backtesting records are available for most EAs.

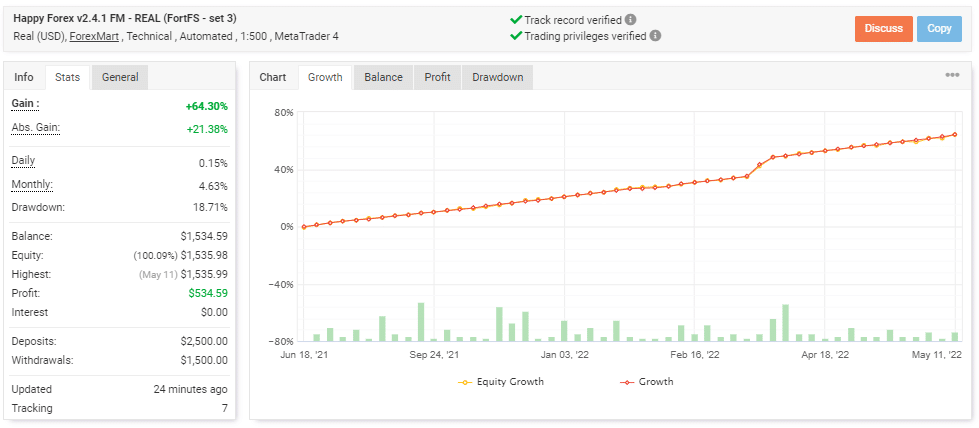

Happy Forex trading robot maintains a decent gain with a drawdown value of 18.71% while trading on AUDUSD and EURCHF. The algorithm uses an averaging strategy to trade without implementing a bi-directional mode. With a mean trade duration of 8 days we can say that it is a swing trader.

Traders can modify the spread value, stop loss and take profit within the settings of the EA.

| Pros | Cons |

| A decent drawdown | Uses grid trading |

| Subjected to regular updates | No vendor transparency |

| 10 robots with a single purchase |

4. GPS Forex Robot

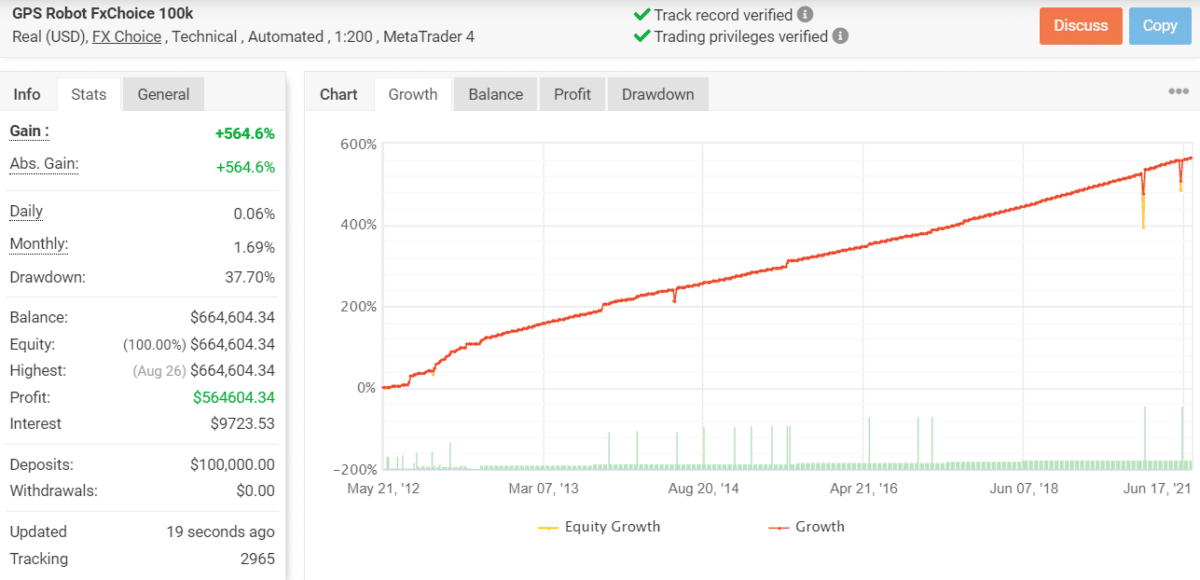

GPS Forex robot is the best MT4 expert advisor in terms of price. It is sold at an affordable price of $149 and the vendor also offers a 60-day money-back guarantee. There are several user reviews for this system on Trustpilot and Forexpeacearmy, but the vendor has not shared any contact information on the website.

This live account was launched on May 21, 2012, so it has been trading in the live market for a long time. The win rate for this account is highly impressive at 94%, but the drawdown is slightly high at 37.70%. The high drawdown tells us that the robot trades with high risk. Nevertheless, its performance has been quite impressive so far.

GPS Forex Robot often places reverse trades to make up for losses, which can be a bit risky. Unfortunately, the vendor has not explained the trading approach in detail.

| Pros | Cons |

| Long trading history | High drawdown |

| 60-day money-back guarantee | Lack of strategy insight |

| High win rate |

5. Forex Fury

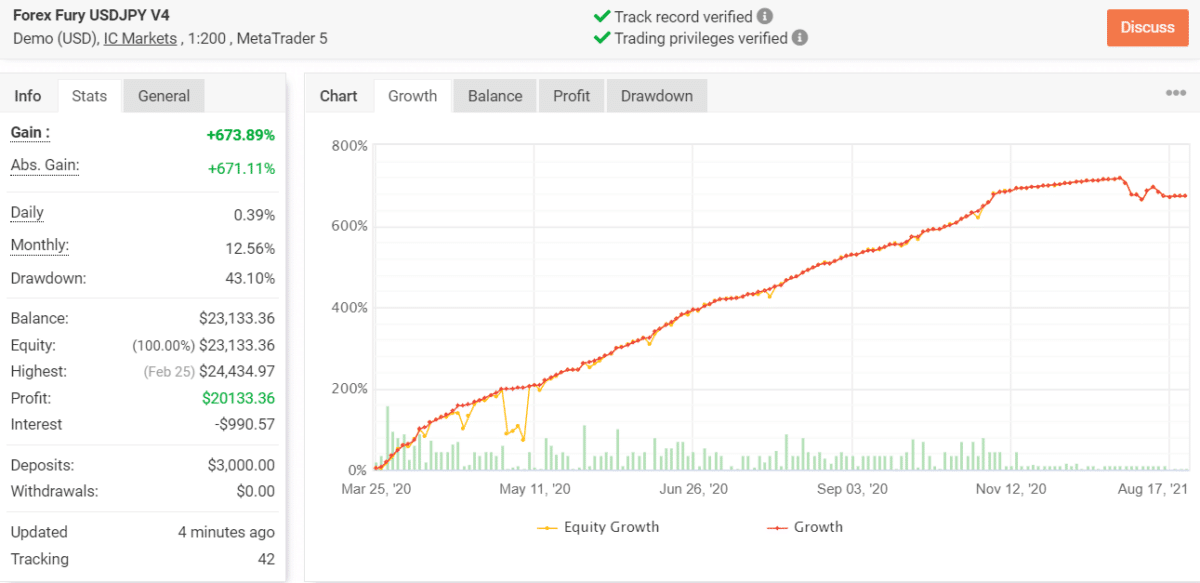

Forex Fury is a FIFO-compatible EA that works on both MT4 and MT5 platforms. It has low, medium, and high-risk strategies and has two plans that cost $229.99 and $439.99. This robot can be termed the best Forex EA since it has a rating of 4.5 on Trustpilot. The vendor has shared the details of the team members, which is a sign of transparency.

The first thing to mention about this live trading account is the high profitability of 96%. However, the system has suffered some losses recently, which is why it has a high drawdown of 43.10%. Still, it has a monthly gain of 12.56%, which is much higher compared to other robots.

Forex Fury is a range trading robot that uses filters to place trades based on fixed conditions. The trader can modify the settings to suit their trading style.

| Pros | Cons |

| Profitability of 96% | High drawdown |

| Customizable EA settings | Recent losses |

| Positive user reviews |

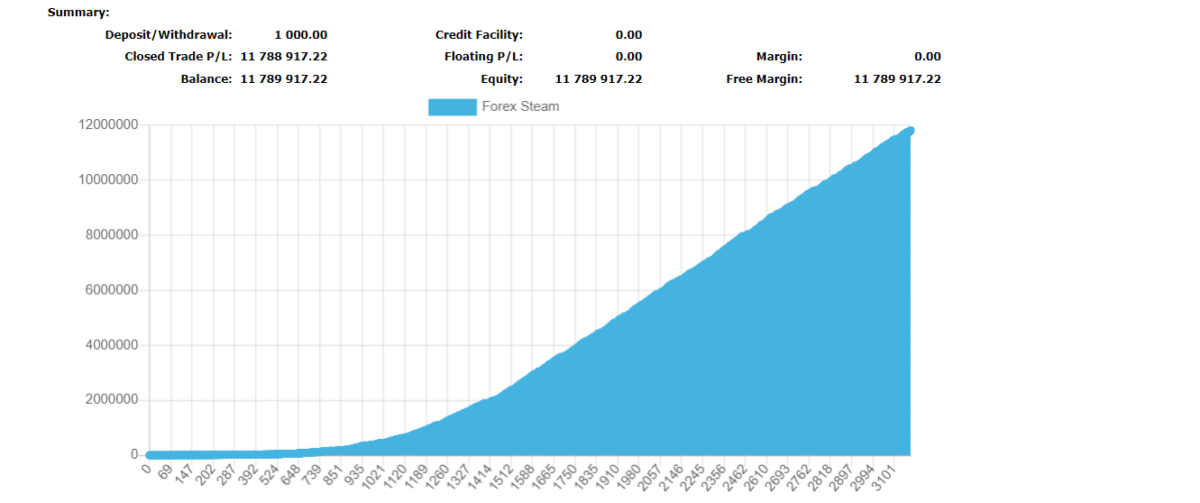

6. Forex Steam

Forex Steam is a make money robot that is available at just $117.99. However, the vendor does not offer a money-back guarantee, which could be a deal-breaker for some traders. You can run the software on 4 accounts simultaneously and the vendor provides a video guide and free updates for lifetime.

The vendor shares the live trading results on the official website, but these are not verified by third-party websites like Myfxbook, FXStat, or FXBlue. Therefore, we cannot see the drawdown for the account or the win rate.

Forex Steam has decent ratings on both Trustpilot and Forexpeacearmy, so clearly many traders trust the system. The details of the team members are shared on the website, along with the official address of the headquarters and the email address.

| Pros | Cons |

| Available at an affordable price | Unverified trading results |

| 4 software licenses provided | No money-back guarantee |

| Positive user reviews |

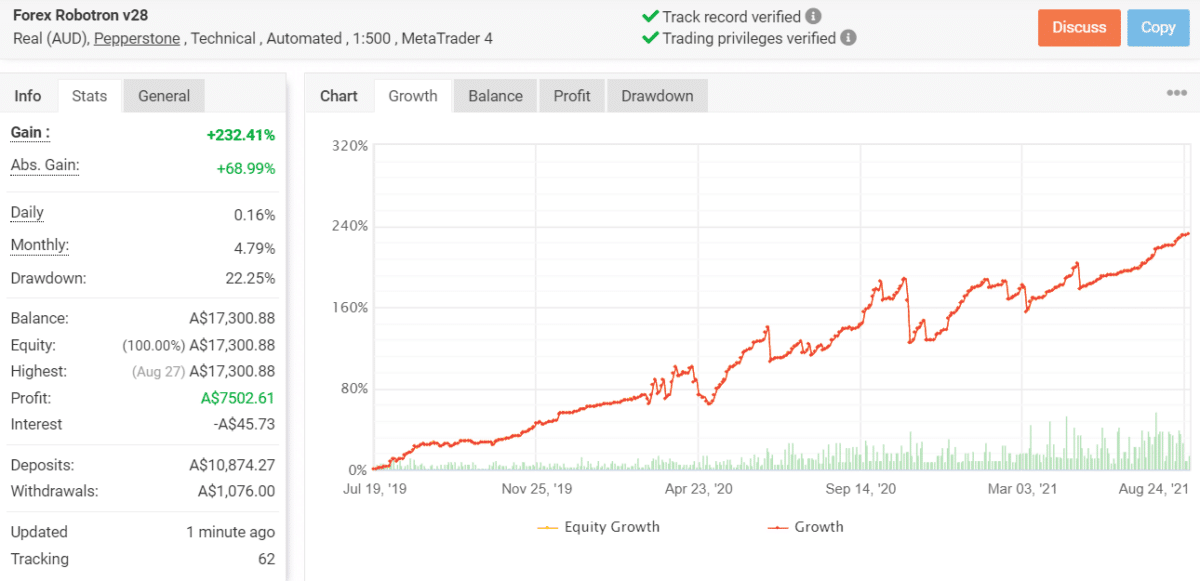

7. Forex Robotron

If you are looking for the best expert advisor for MT4, then Forex Robotron is a pretty decent choice. It trades in currency pairs like EUR/USD, EUR/GBP, EUR/CHF, EUR/CAD, and EUR/AUD for the M5 timeframe. It is supported by 15 years of high-quality backtesting data.

Active since 2019, this verified trading account on Myfxbook has a win rate of 82%. The robot has managed to close most of the recent trades in profits, which tells us it’s a reliable system. It has daily and monthly profits of 0.16% and 4.79%, respectively, and a drawdown of 22.25%. While the drawdown is a little bit high, it shouldn’t be a problem because of the high win rate.

There are not many user reviews for this Forex robot and the vendor does not offer a money-back guarantee. It has an aggressive mode that trades with high risk to generate more profits.

| Pros | Cons |

| Trades in multiple pairs | Not enough user reviews |

| Works with US brokers | No money-back guarantee |

| Unlimited licenses |

8. Forex Gump

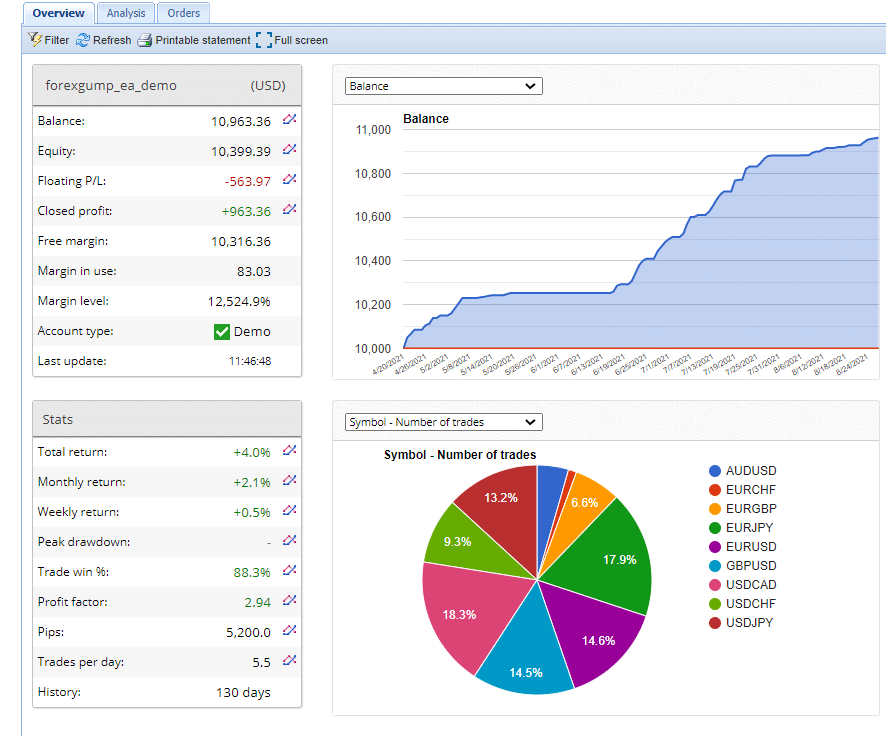

Forex Gump is a versatile robot that trades in 9 currency pairs. It lets you use a cent account, so you can get started with as little as $40. This makes it suitable for beginners. Both the pricing plans are quite affordable and the vendor also provides a 30-day money-back guarantee.

This trading account on FXBlue has been active for 130 days, during which it has conducted 698 trades. It has won 616 out of them, which means it has a profitability of 88.25%. Now, it has a high risk/reward ratio of 12.03, which indicates a high-risk trading approach. The vendor has not shared the details of the trading strategy, so we don’t exactly know what kind of market it is suitable for.

| Pros | Cons |

| Trades in 9 pairs | Lack of strategy insight |

| Cent account available | High risk/reward ratio |

| High win rate | |

| Money-back guarantee |

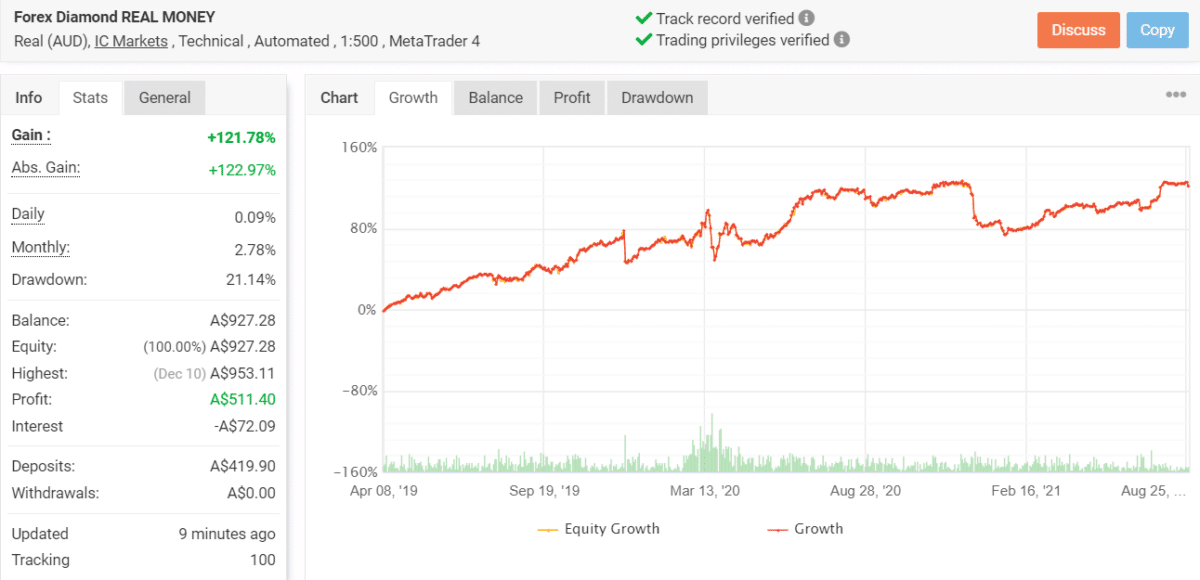

9. Forex Diamond

Forex Diamond is among the top 10 robots for Forex trading. You can purchase it for just $227 and the vendor offers a 60-day money-back guarantee. It follows a high-frequency trading approach and conducts more than 1200 trades every year. This robot has optimal money management and slippage protection features.

The win rate for this live trading account is 71% and to date, a total profit of A$511.40 has been generated through it. It follows a scalping strategy, extracting small gains from each trade. This is a short-term strategy that may not be suitable for all. The drawdown is marginally high at 21.14%.

There are no user reviews for this robot on third-party websites. However, the company has been manufacturing EAs for more than 15 years and has several other trading systems in their kitty.

| Pros | Cons |

| Slippage protection | Lack of user reviews |

| Affordable pricing plan | Short-term scalping strategy |

| 60-day Money-back guarantee |

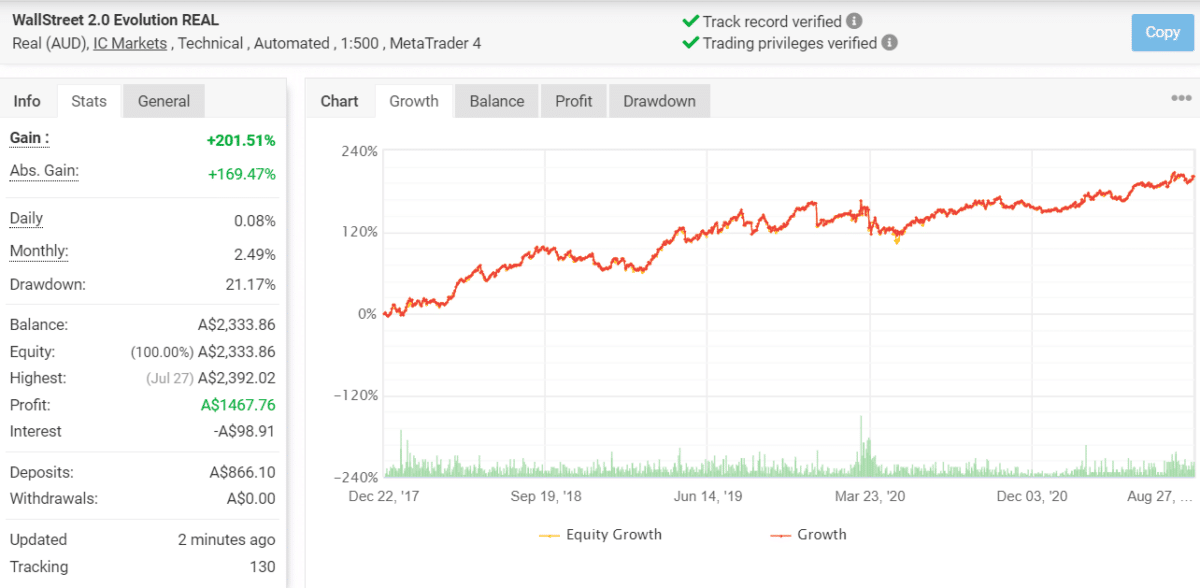

10. WallStreet Forex Robot

This is a product from the highly experienced FXautomater team. It trades in multiple pairs and lets you get started with small deposits of $100 to $500. It has a broker spy module that prevents dishonest brokers from cheating you with high spreads and high negative slippage.

This trading account has been active for more than 3 years, so you know the robot has a long track record of generating profits in the live market. It has placed 3238 trades through this account, generating a profit of A$1467.76 while maintaining a win rate of 79%.

The monthly profit for this account is 2.49%, which is not as high as the other top EAs. Since the vendor has not shared any strategy insight, we don’t know much about the trading approach.

| Pros | Cons |

| Long trading history | Lack of strategy insight |

| Broker spy module | Low monthly gain |

| 60-day Money-back guarantee |

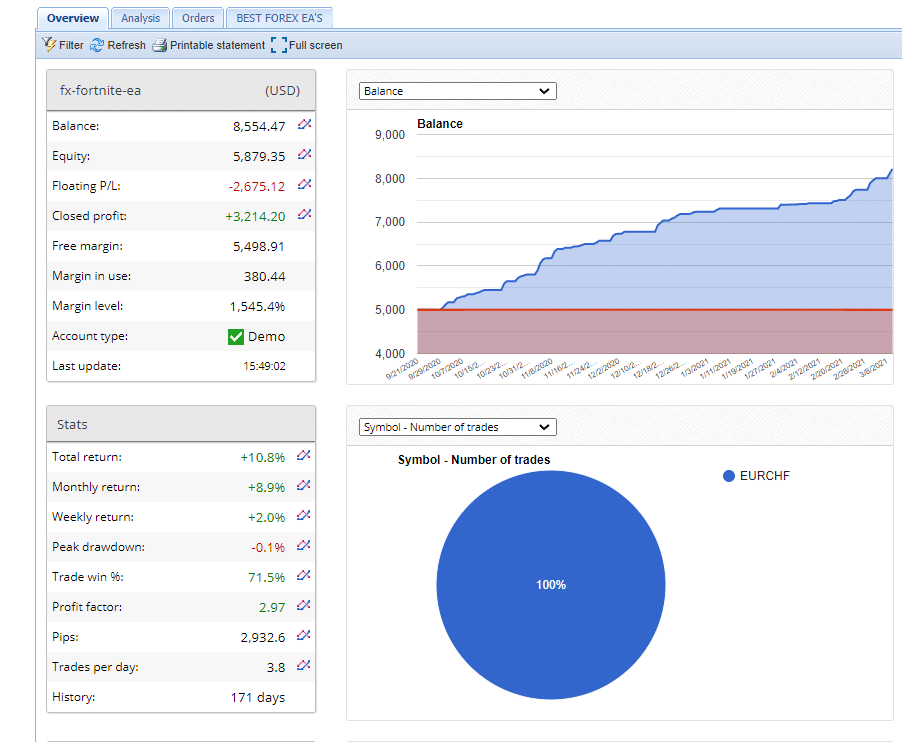

11. FX Fortnite EA

This is easily the best Forex robot for trading in the EUR/CHF pair. It supports cent accounts and has three risk settings. The pricing plans for this robot are quite affordable with the bronze, gold, platinum packages priced at $149, $199, and $249, respectively.

This trading account on FXBlue has been around for 171 days and it has a high win rate of 71.5%. The risk/reward ratio is decent at 8.61 and the peak drawdown is -0.1%. Currently, the total profit generated through this account is $539.08.

FX Fortnite EA follows Trend and Hedge strategies. It is quite odd, however, that there are no user reviews for the robot on third-party websites.

| Pros | Cons |

| Low drawdown | Lack of user reviews |

| Cent account supported | Lack of vendor transparency |

| Multiple strategies |

What is Forex trading?

You might be wondering what is Forex trading and how does it works. In simple words, it describes the activity of purchasing and selling currency pairs. Every day, around $5 trillion is traded in the Forex market.

Here, traders try to take advantage of the price differentials between pairs. It requires careful monitoring of the price charts and being aware of the factors that affect the prices. There are more than 80 pairs to trade in the Forex market.

Are Forex robots legal?

Yes, it is legal to trade with an automated Forex trading robot, but there are certain things you should keep in mind. There are a few brokerage firms out there that do not encourage trading with robots and regulations in place to prevent the same. However, the majority of brokers have no such restrictions.

How do Forex robots work?

Novice traders often ask the question – How do Forex robots work? The developer first creates some mathematical rules for the system. They also include some technical analysis functionalities for the robots to gauge the nature of the market.

Expert developers use archival data to test their strategies. After this, the system starts placing trades on its own. Although they offer a great degree of convenience, you cannot expect them to guarantee consistent gains.

How to avoid scam Forex EAs?

Here are a few tips for avoiding scam EAs:

Look out for a low drawdown rate

When a trading robot exhibits a high drawdown for a live trading account, it means there is a high risk of losing money while trading with it. The drawdown rate represents the percentage of capital lost while trading, so you should always look for a system that has a low drawdown rate.

Robots with low drawdown rates employ effective risk-management measures that prevent the system from trading further after it has lost a specified sum of money.

Make sure the Forex bot was well-tested before release

There are many unscrupulous vendors selling scam EAs that haven’t been adequately tested. It is vital for every developer to test their systems using archival data as well as live market data before releasing it to the public.

When a robot performs well on these tests, you know they are durable and can deal with different market conditions. You need to make sure it has a decent win rate and low drawdown.

Check out customer reviews on verified sources

Customer reviews are vital for any product these days and the same is true for Forex robots. Some vendors share customer testimonials on their official websites, but these cannot be considered authentic.

You should always look for systems that are reviewed by many traders on websites like Trustpilot, Forexpeacearmy, Quora, Myfxbook, etc. The reviews on these websites are monitored so you can be sure of their authenticity.

How long is this Forex tool on the market

As you know, the Forex market is highly volatile and unpredictable. Hence, it is wise to invest in a robot that has spent a lot of time trading in the live market. This way, you know it has been exposed to different market conditions and has dealt with them successfully. Robots with long track records are more likely to win you profits on a consistent basis.

Try it on a demo account

Before you use an automated system for live trading, it is always wise to test it using a demo account. These accounts let you trade using virtual money, so you can check the performance of the robot without taking any risk whatsoever. This allows you to learn how the system functions and also check whether it suits your trading style. Novice traders in particular should always test a robot on a demo account first.

Start small

If you are a novice trader or someone who doesn’t know what Forex trading is, you should always start with a small deposit. This is also true for experienced traders testing a brand new strategy. Trading in currencies is a risky affair and you should never invest more than you are prepared to lose. Some EA vendors let you use cent and micro accounts that work with very small deposits.

All robots require some supervision

EA vendors often claim that their robots can generate profits without any manual intervention on your part, but this is not entirely true. You often need to check that the trades are going as planned and that the robot is not generating any errors.

Final thoughts

The market is currently flooded with Forex robots that claim to generate profits on autopilot. Some of them offer a high degree of control where you can modify the EA settings to build your own unique trading style.

While investing in a robot, it’s not enough to consider the win rate. You must determine how risky the strategy is by studying the trading results and looking at the drawdown percentage. It is advisable that you decide on a strategy before purchasing a robot. There is no one strategy that is suitable for all, so you should select one based on your profit objective.