AVIA is a firm that provides signal services from its accounts where the system works with various risks. The presentation has a middle level of informativeness. There’s no main claim provided.

AVIA trading strategy

- The developers decided not to share details about the main strategy.

- We don’t know details about the time frame.

- The advisor works with all possible symbols on the terminal. So, there can be price action or something like this.

AVIA backtesting report

The system doesn’t have backtest reports revealed. We’re sure that it was tested strictly before being placed on accounts with over £100,000 on the deposit. It’s a con that we can’t check the past trading results of the system.

AVIA live results

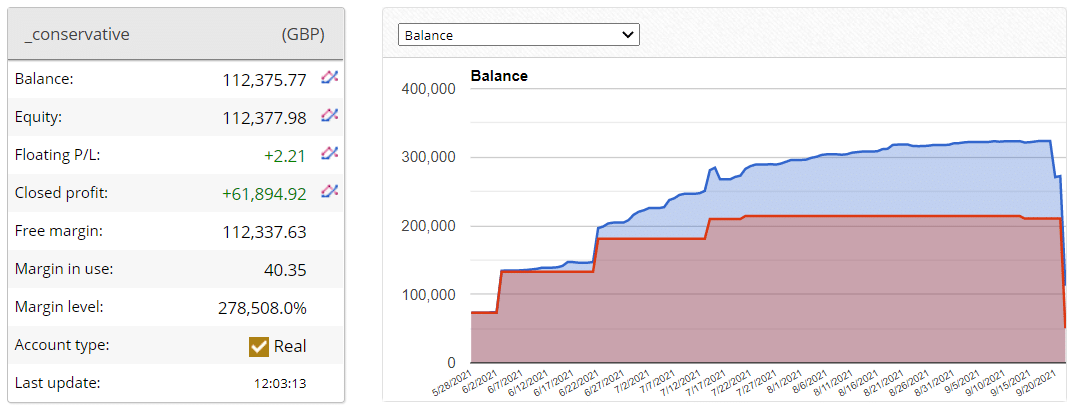

Trading results is one of the most important parts of trading activities. We should check how the system works under real market conditions. The chart shows that it handles the market and it’s profitable. The robot has been running a conservative account with £112,375 on balance. The floating profit is £2.21 when the floating loss was £53,900 several weeks ago. The closed profit is £61,894. The margin level is high and stable.

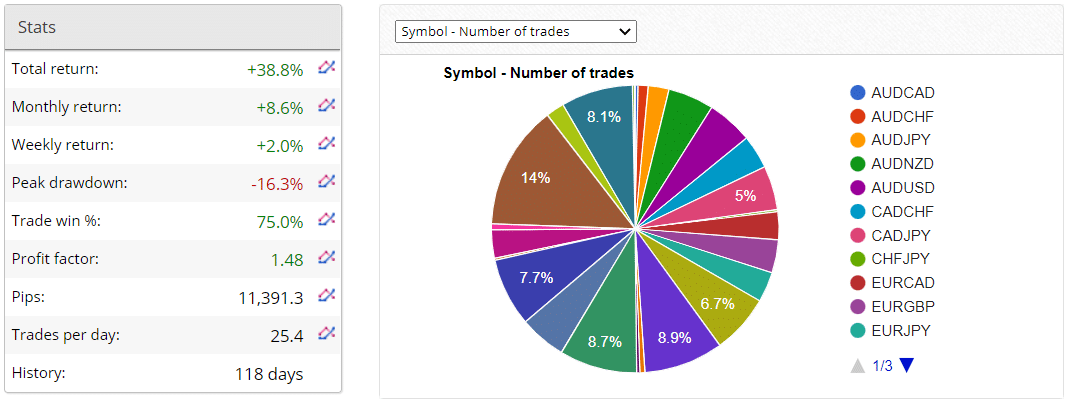

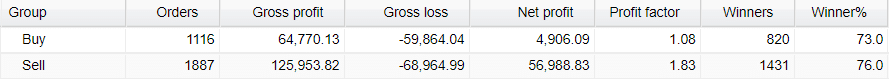

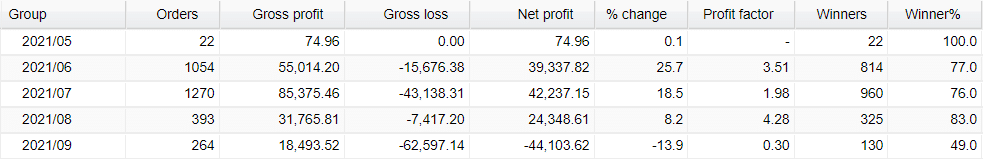

The total return is 38.8%. An average monthly gain is 8.6%. The maximum drawdown is 16.3%. It’s a high number. The accuracy rate is 75.0%. The profit factor is 1.48. The robot has been working for 118 days. An average trade frequency is 25.4 orders daily.

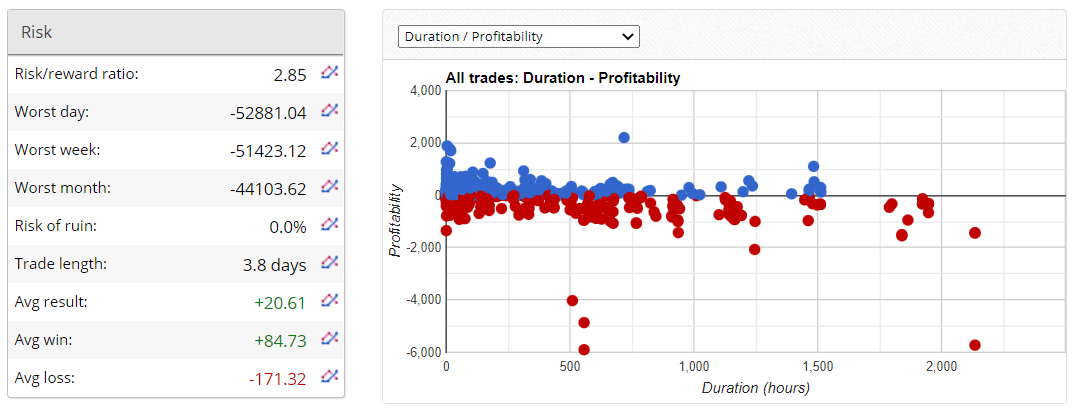

The system tardes with an average trade length of 3 days and 8 hours. The risk of ruin is 0.0%. An average trade result is $20.61. An average win is $84.73 when an average loss is -$171.32.

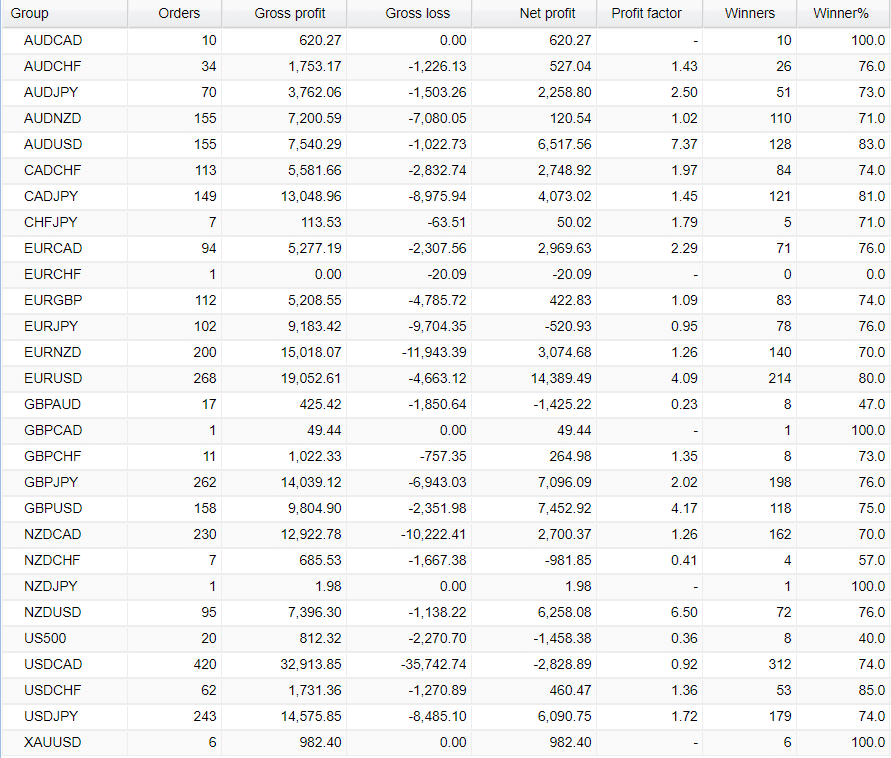

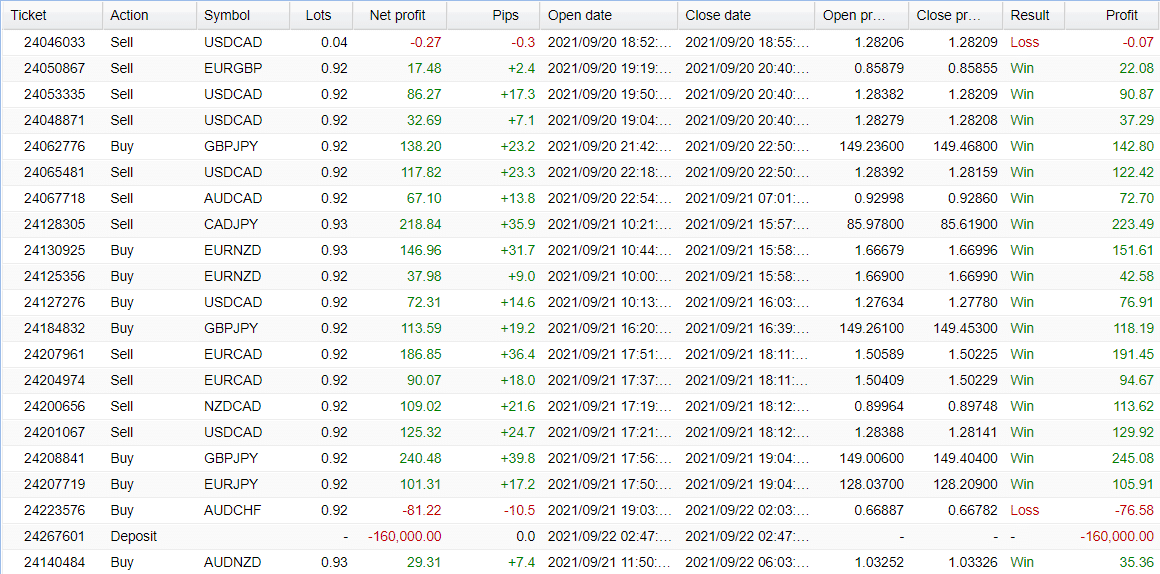

The system works with all available pairs. USDCAD is the only symbol where there were closed 420 orders.

Most profits were made only in the sell direction–£56,968.

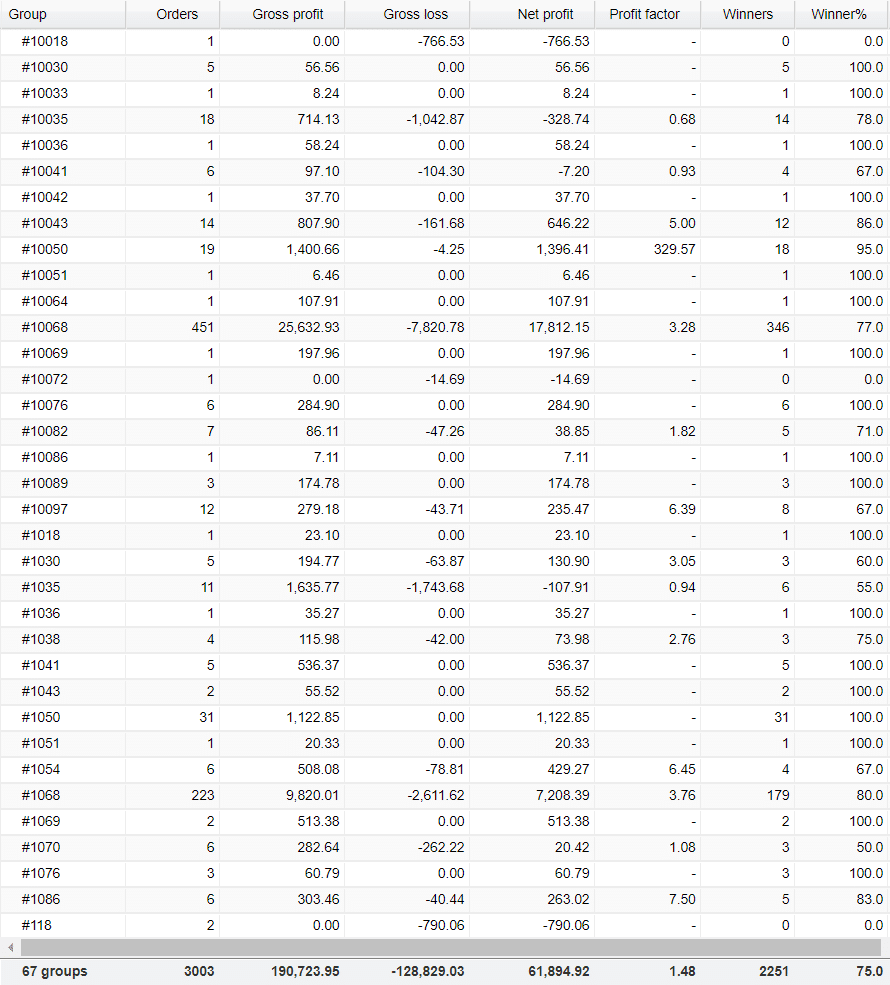

We may note that there are 67 magic numbers. The devs added two more because there were 65 of them.

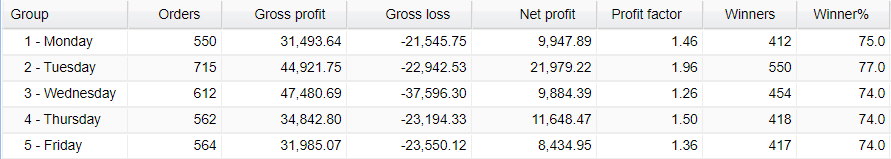

Tuesday is the most active day, with 715 orders and £21,979.

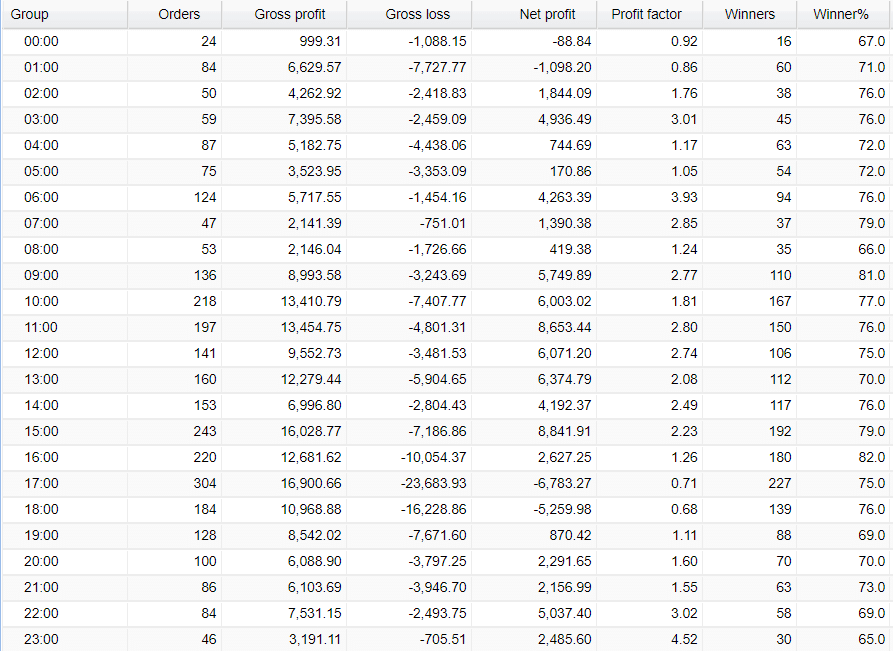

The European session is the most traded among others.

The advisor lost £44,103 in September 2021.

The system uses different lot sizes in trading.

Some features of AVIA

Let’s talk about the features and other details of the service:

- The advisor executes orders on many accounts with various risk settings.

- The company provides MAM services.

- The advisor executes orders on all major cross pairs.

- There’s a detailed trading plan provided.

- The system skips trading high-impact news hours.

- The system unites the trading experience of its developers.

- We can choose what risks we are okay to work with.

- There’s an option of “Levels of Risk Tolerance.”

- We can copy these signals automatically using the proper software.

- We can customize the drawdowns that we can handle.

- We are free to work with any broker house.

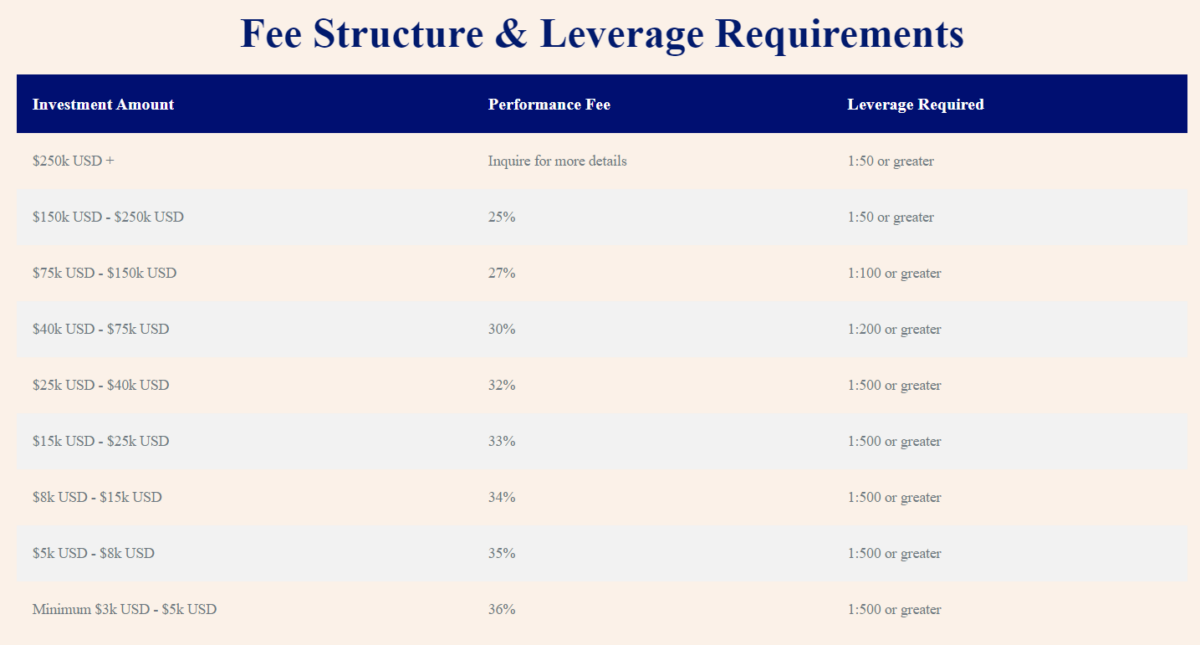

- If an account is less than 40K, the leverage should be 1:500.

- The account has to support hedging.

- We can work with default lot sizes.

- There are only 30 days of support provided.

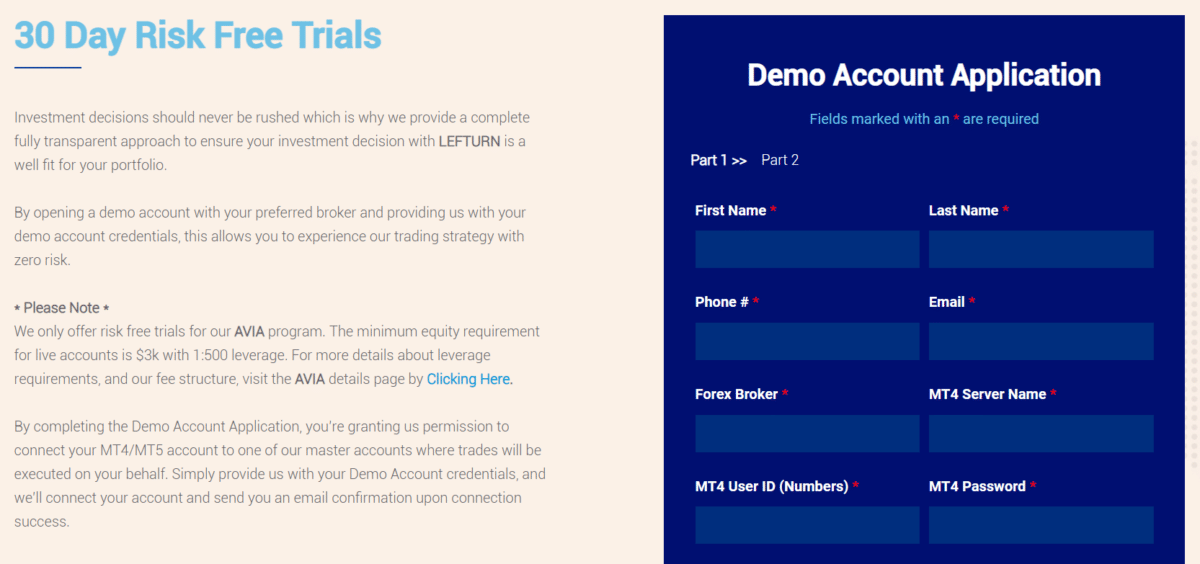

- We can start using it on a demo account.

- “With conservative risks, we can make 12% monthly with 7-10% drawdowns. The minimum investments are $3,000.”

- “With moderate risks, we can make 18% monthly with 9-12% drawdowns. The minimum investments are $3,000.”

- “With aggressive risks, we can make 25% monthly with 13-17% drawdowns. The minimum investments are $3,000.”

- “With very aggressive risks, we can make 34% monthly with 15-20% drawdowns. The minimum investments are $3,000.”

| Total return | 38.8% |

| Maximal drawdown | 17.3% |

| Average monthly gain | 8.6% |

| Developer | AVIA |

| Created, year | N/A |

| Price | from 25% to 36% commissions |

| Type | N/A |

| Timeframe | N/A |

| Lot size | N/A |

| Leverage | N/A |

| Min. deposit | $3000 |

| Recommended deposit | N/A |

| Recommended brokers | N/A |

| Currency pairs | All available on the terminal |

| ECN | Yes |

Main things that make AVIA doubtful system

- The developers withdrew one account in a big way.

- September 2021 has brought many losses.

Pricing details

The company charges a commission that depends on the size of our account. The minimum balance of $3,000 will be charged 36%. The account with $150,000 has a 25% commission.

There’s a 30-day trial. We can copy signals to the MT 4 and MT 5 accounts.

Other notes

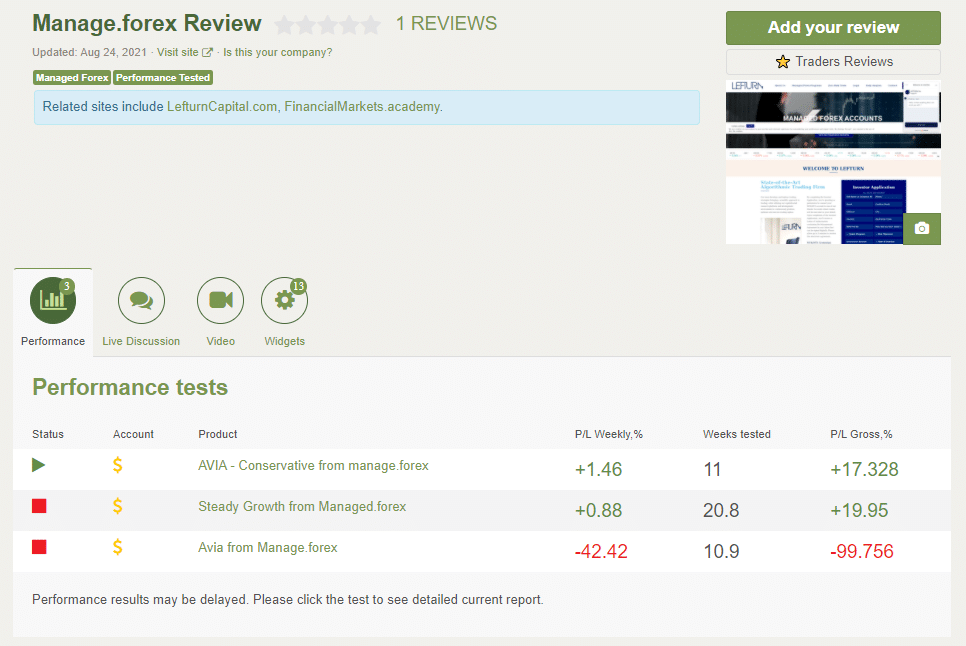

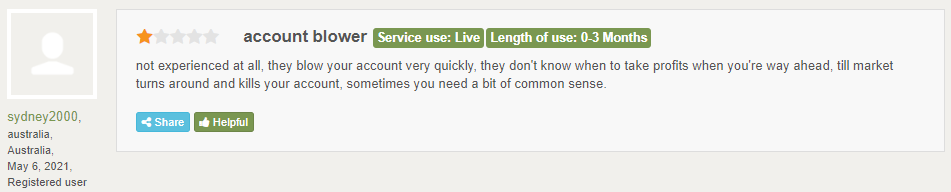

There’s a page of AVIA on Forex Peace Army. We have a single review written.

The negative user feedback informs us that we cannot be profitable with this service.

AVIA or ALPHI?

Whois.domaintools.com research has shown that the devs have made some changes on September 27, 2021. Firstly, they changed the URL to their website. Secondly, they rebranded their service and now it is called Alphi. Thirdly, the website content was also rewritten. They added a live trading account (launched the fxblue site on October 5) to demonstrate the trading performance of their trading service. After a detailed analysis, we have found that this is just a miserable attempt to attract new traders.