Irrespective of any work you do, you must be looking for an extra income in your pocket. There are tons of ways and trips to make this income. One of these possible ways is the use of investment apps.

Such a simplified mobile application allows users to invest and earn passive income on their invested capital. According to a popular investment app called Acorns, their users seem to make between $5 and $25 a month in bonus investments from everyday purchases.

Do you want to learn more about the Acorn Investment app? We have listed everything you need to know and why it is one of the best apps to use.

Three things to know before starting:

- The app provides users with the opportunity to invest and earn rewards.

- It has wide popularity and uses robo-advisors to suggest the best investment portfolio according to your profile.

- It promotes early investment and offers an IRA as part of their family plan.

What is the Acorns investment app?

It is the app founded by Walter and Jeff Cruttenden, and it launched on August 26, 2014. Their mission was to make investing accessible to everyone.

Therefore, they created the app to allow working-class individuals to benefit from investing.

Acorns have a client base of over nine million users. It offers investment, banking, and reward earnings all from one platform.

Who should choose Acorns investment income app?

Acorns use a robo-advisor feature that rounds payments to allow you to save. If you purchase an item, it rounds up the cost to the nearest dollar, and the balance goes to your investment account.

The app is, therefore, perfect for those who are clinical about saving every cent. Furthermore, some applications provide the same service at a lower cost; however, Acorns might appeal to anyone who feels that the app will generate even more savings.

How does Acorns investment work?

It offers five products that work on robo-advisor technology; therefore, there are no human advisory services.

- Invest for your future

Acorns offer an investment account that provides access to ETFs, representing a wide range of stocks, and they benchmark against stock indices. The ‘round ups’ and ‘dollar-cost averaging funds the investment account. Funding from the investment comes from your ‘spare change, which is links to your account.

‘Round-ups’ is generated from the spare change of your card purchases. Once your everyday expenditures total up to $5, Acorns automatically transfers this to your investment account.

- Later start today

This feature is a retirement investment that Acorns sets up by suggesting the best IRA (Individual retirement account) for you. You can set up recurring contributions, which Acorns will add to your IRA automatically. And you can even invest extra cash from as little as $5.

- Earn extra money

With Acorns, you can earn extra money simply by shopping from affiliated brands and stores. It offers over 350 top brands for clients to earn extra money like Macy’s, Nike, Nordstrom, and many more.

Furthermore, you can also earn when you find a job, whether part- or full-time. Clients can also make referral bonuses via the ‘Invite a friend’ feature, and Acorns pays $5 to you and your friend.

- Early investors

This feature provides an investment account for kids. The aim is to allow kids to start investing from early. You can add multiple kids per family, and investment in a UTMA/UGMA account starts at $5 per day, week, or month. Acorns also give access to their financial wellness system and educational resources provided by Acorns and CNBC.

- Bank smarter

Through the ‘Bank smarter’ feature, clients can obtain an Acorns checking account. The account is digital, allowing direct deposit, check sending, mobile check deposit, and more.

The account is also FDIC-insured to a maximum of $250,000; in addition, clients receive fraud protection and an all-digital card lock.

How does the Acorns app advance your money?

Against signing up for your new account, Acorns has to assess the best ETF for your criteria. Therefore, you have to answer questions relating to your net income, age, and net worth. This is to determine your investment goals and risk tolerance.

Acorns will evaluate the profile and put together an investment portfolio assigned to different asset types. For example, your portfolio could be conservative, moderately conservative, moderate, moderately aggressive, and aggressive. And each type of portfolio is adapted to offer investment assets associated with the goals and risk.

They also provide portfolio rebalancing, and this is all automated, therefore taking the worry out of your mind.

Fees and costs

Features

Acorns offer two pricing plans, a personal and family plan.

- The personal plan is an all-in-one investment, retirement, and checking, plus a metal debit card, bonus investments, and money advice.

- The family plan offers investment accounts for kids, personal investment, retirement, checking accounts, and exclusive offers and content.

Pricing

The personal plan is available for $3 a month and a family plan for $5 per month.

How to start?

Acorns are available to US citizens only. Therefore, you can join by signing up via their website. Once you choose the appropriate pricing plan, you can set up your investment account within the app. Furthermore, users can download the app, which is iOS and Android compatible.

How much could I get for one month using the Acorns?

Your investment portfolio and your contributions determine your monthly returns. Customers have reported monthly earnings of $5 to $25, paid out from the bonus earnings received from the ‘Earn extra money feature’.

With regards to investments, it is not easy to predict since you have to consider that earnings are tax-deductible as well. It depends on how much ‘spare change’ you generate and how the asset class is performing.

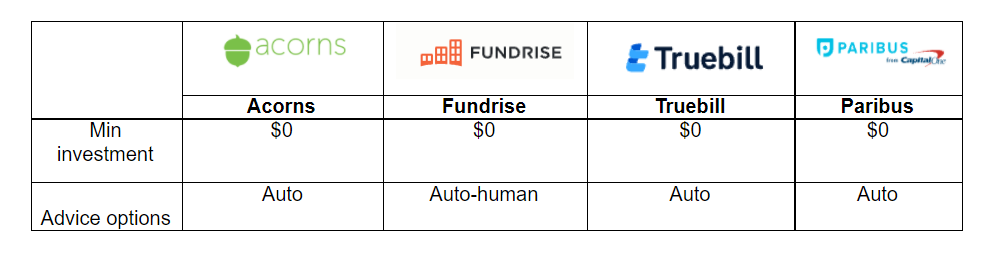

How does Acorns’ investment compare?

The app uses the robo-advisor to automate investments. However, there are similar apps that can compare with Acorns.

Pros & cons

Let’s look into the pros and cons of the Acorns app.

| Worth to use | Worth to getaway |

| Affordable investments • It requires a $0 minimum investment, therefore making it affordable to everyone. | No human expertise • Due to its robo-advisor functionality, users do not have access to consulting with a human concerning investment options. |

| Low monthly fee • Acorn’s personal plan costs only $3 a month and is low compared to similar plans with fewer features. | Management fee • The monthly fee seems small, but it doesn’t make financial sense for individuals holding an investment account with a low balance. Your investment might take a while to grow if you have $5 remaining, and $3 goes for management fees. |

| User-friendly interface • The Acorns app has a user-friendly interface that is easy to navigate, and most features are automated, therefore offering convenience to the user. | Limited account options • Aside from the IRA investment, which is long-term, the app offers ETFs only, which limits your options to diversify across different investment types. |

Final thoughts

Acorn is a great investment app to use, especially if you are a beginner and follow the “set it and forget it” strategy for saving and investing.

The main draw is the automatic round-up feature. You can find the convenience pleasant. However, if you are looking from a perspective and become a more sophisticated investor, the best suggestion would be to dig and opt for a different broker.