The real estate zone is the investment of choice for millions of investors due to its relatively safe nature, steady cash flows, tax advantages, and adequate price enhancement over the years. In addition, investors divert their attention to real estate for diversifying their portfolios as this sector is an excellent hedge against stock markets.

According to the US Census Bureau, the average prices of US houses showed a consistent increase from 1965 to 2019, excluding some years of the global recession. Moreover, by the end of 2020, prices of single-family homes in the US rose by 9.5% than the previous year, as reported by S&P CoreLogic NSA Index.

As the historical data reiterates the positive performance of the real estate industry, individuals are investing in this sector through physical properties and real estate funds.

In this article, we have reviewed the performance and characteristics of Tulsa Real Estate Fund, titled in the memory of the Black Wall Street incident, Tulsa, Oklahoma.

Three things to know before starting:

- TREF is a Tier 2 crowdfund that aims to reanimate distressed urban communities and invest in geographically diversified real estate assets.

- TREF has documented an 8% preferred ROI for its shareholders.

- The minimum possible amount for investing in this fund is $500.

What is Tulsa Real Estate Fund?

Tulsa Real Estate Fund is an African-American-owned Regulation A+, Tier 2 real estate investing crowdfund. This economic platform provides investors an opportunity to hold shares in the real estate industry and counter gentrification.

In June 2018, Tulsa Real Estate Fund officially launched its operations and accommodated both accredited and unaccredited investors. The company’s stated objective is to buy commercial, single-family, and multifamily properties or lands in urban areas and sell or lease them at higher prices.

The organization has a target to reach a $50 million market cap, and it raised the capital above $6 in the first week of its inception. In addition, according to the Jumpstart Our Business Startups Act (JOBS), the TREF, LLC holds the spot of an “emerging growth company.” As a result, its projects and operations are free from any legal or financial audits and disclosures.

Moreover, the investors’ shares do not work like stocks with no listing on stock exchange markets. Instead, these shares indicate ownership of assets under the Tulsa Real estate Fund.

What are the types of investments under TREF?

Individual investors can own shares by opening and funding their accounts by the ACH payment system, wire transfers, or physical checks. The minimum investment amount is $500 with a $25.50 investment processing fee. However, the account minimums and fees are liable to change for overseas investors.

TREF also offers “Transactional Funding” loans to facilitate the selling parties closing their deals in profits. Interested individuals can submit a deal stating their requirements and conditions to initiate the process. The company has designated a $3 million/day to this one-day-bridge loan business, though some agreements can exceed this mark.

Moreover, TREF considers strategic partnerships with emerging sponsors on joint syndications. Its preferred deals expect $200,000 to $1 million equity, focusing on redevelopment and land projects, apartments, and niche real estate.

How does TREF operate?

TREF begins its investment process by searching for a suitable property. The company endeavors to invest in a diversified portfolio of real estate assets in central business districts and urban communities of the United States.

Moreover, they target properties with good locations and reliable construction that can grab the interests of buyers and tenants. Fund managers also consider investments in distressed areas and urban revitalization programs that can deliver attractive returns.

After identifying the subject property, the manager strictly evaluates the construction budgets, resulting in loans to value ratio, market feasibility or analysis, and project valuations.

Once the project underwriting and contractual permits are in place, then construction starts. Finally, the company initiates the selling and renting of properties after or before completing a project, keeping the profit targets and other market factors in view.

Financial conditions and portfolio highlights of TREF

More than 15,000 investors from 22 countries have become part of the TREF community, according to the latest data. The fund’s total estimated capital accumulation stands at $12 million, and the value of assets under management is approximately $13.7 million.

Moreover, TREF distributes 8% cumulative dividends among its investors annually based on the financial data. In February 2021, the company delivered dividend payouts of $1.76 per membership interest totaling $391,428.

The fund charges a management fee of 5.5% on your investments. For the six months ended in June 2020 and 2019, the incurred management charges were $243,083, and $201,843, respectively.

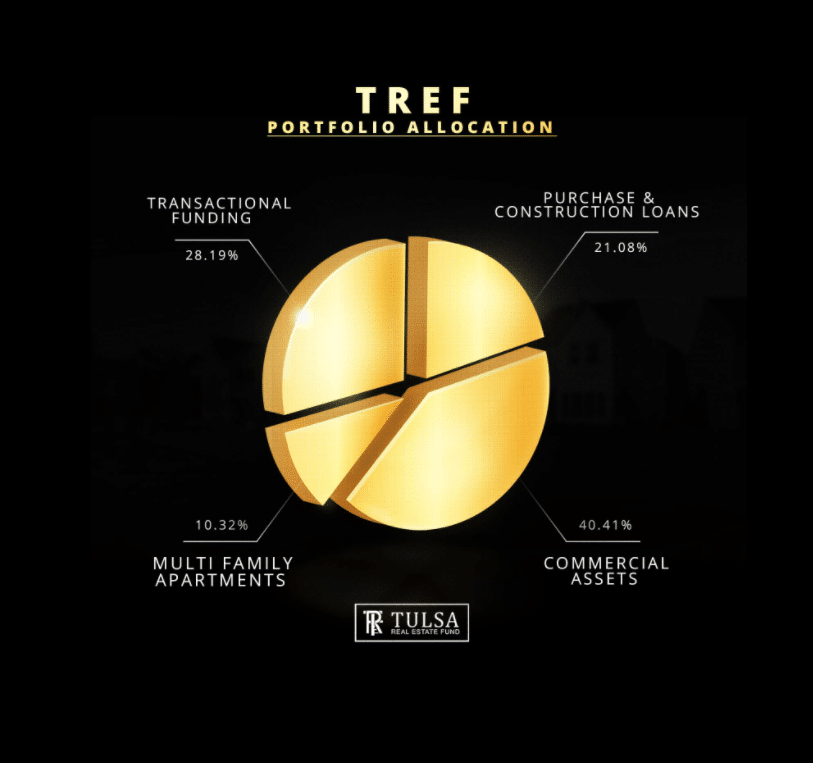

The asset division under the TREF portfolio is as follows:

- Transactional funding: (28.19%)

- Purchase and construction loans: (21.08%)

- Multifamily apartments: (10.32%)

- Commercial assets: (40.41%)

Reasons to invest in TREF

In 2019 and 2020, TREF, LLC invested in nine and six properties respectively by joint venture projects, acquirement of ownership, or as a mortgagee.

TREF allows the investors to own shares in commercial and residential properties with a low investment amount (500$) compared to the required capital for direct investments.

Furthermore, the company accommodates accredited and non-accredited investors and distributes annual dividends to maintain an income flow. In addition, the organization dispenses 50% of the total profits to its shareholders.

According to Jay Morrison, the CEO, and founder of Tulsa Real Estate Fund, the fund aims to generate investment results along with combatting gentrification and make real estate investments accessible to all social classes.

TREF claims to maintain financial transparency, internal controls, check and balances, and accountability. Moreover, the fund’s shareholders receive quarterly or annual financial reports and monthly newsletters.

Risks associated with TREF

Investors should consider some risk factors related to the fund. Some of them are as follows:

- The company locks your money for 12 months after collecting the investment amount. It means you cannot get your capital out within this duration.

- According to the official circular, the company had 0$ in cash with above $15,000 liabilities before the IPO offering. It indicates a precarious situation as the owners do not have any reserves and assets in this project.

- There is unclear and limited information regarding the profit-making procedures and specifics of an investment.

Final thoughts

TREF imparts a positive social impact by allowing low-income families to participate in real estate investments. Moreover, shareholders do not need real estate knowledge or management expertise as the TREF management oversees all the investment aspects.

However, real estate investments like TREF are long-term ventures that require a substantial period before they can generate profits. Therefore, this fund is suitable for investors who fully understand the intricacies associated risks of investments.