For more than a decade now, electric vehicles have gained favor among the general population and investors. One reason is that the clean energy revolution gained a significant amount of traction in the past years.

Another push for the field was the change in the Oval office. With the coming of the Biden administration, the White House took an unexpectedly more complex stand against fossil fuels and traditional branches of industry. It was more good news for the electric vehicle makers.

The optimism regarding the electric vehicle industry helped the EV stocks outrun the S&P 500 benchmark’s returns by more than 100%. Today, we will look at some of the most exciting options you have if you decide to jump on the bandwagon and become an EV investor yourself.

Top five electric vehicle ETFs

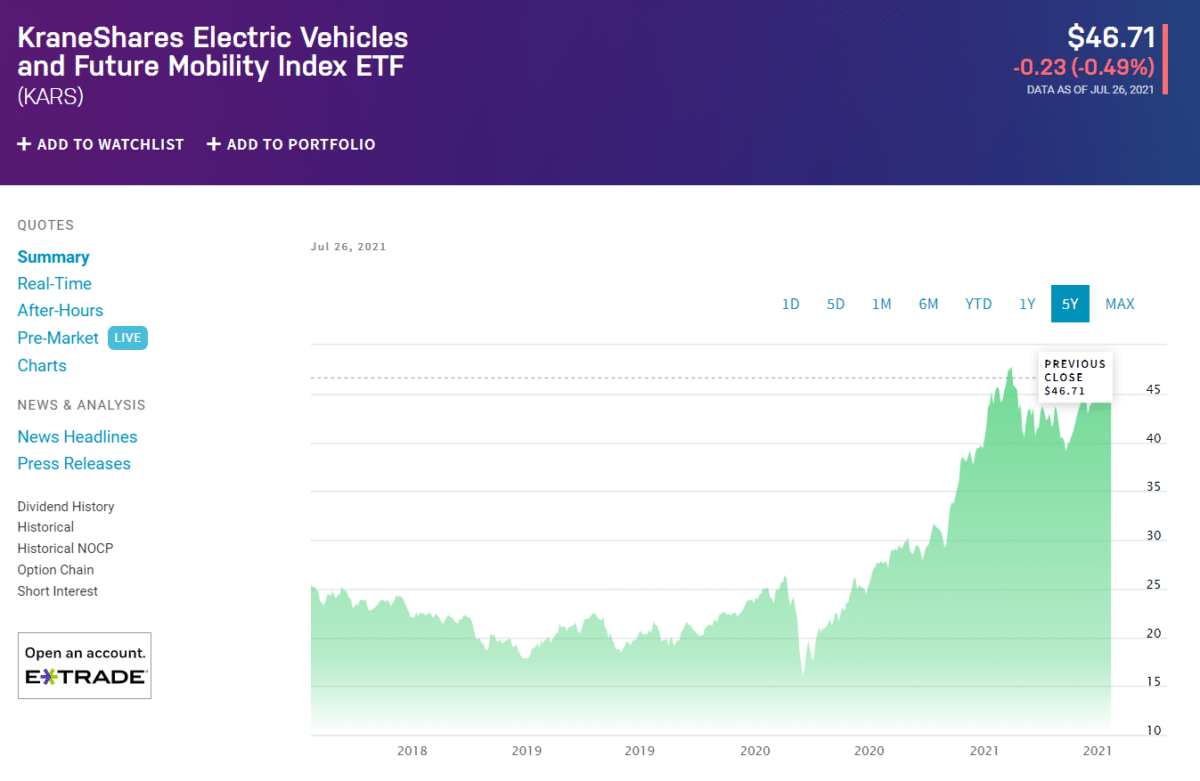

№ 1. KraneShares Electric Vehicles & Future Mobility ETF (KARS)

KARS ETF was made in 2018 to track the performance of the Bloomberg Electric Vehicles Index. Unlike some other funds on the list, which are a bit more broadly oriented, KARS mainly includes companies focused on electric vehicle production.

Among its 60 holdings, NIO and Tesla are among the top ten, with the Chinese automaker holding a modest upper hand over Elon Musk’s giant. As you can see from the chart, the yearly returns of the fund came in relatively high, at 66.8%.

Another exciting thing about the KARS index is that it offers exposure to holdings worldwide. While 43% of the holdings are in the United States, many of the fund’s units have headquarters in Germany, China, United Kingdom, Japan, and even France and Australia.

The ETF has a solid 5.52/10 MSCI ESG rating and is in the ninth percentile by MarketWatch.

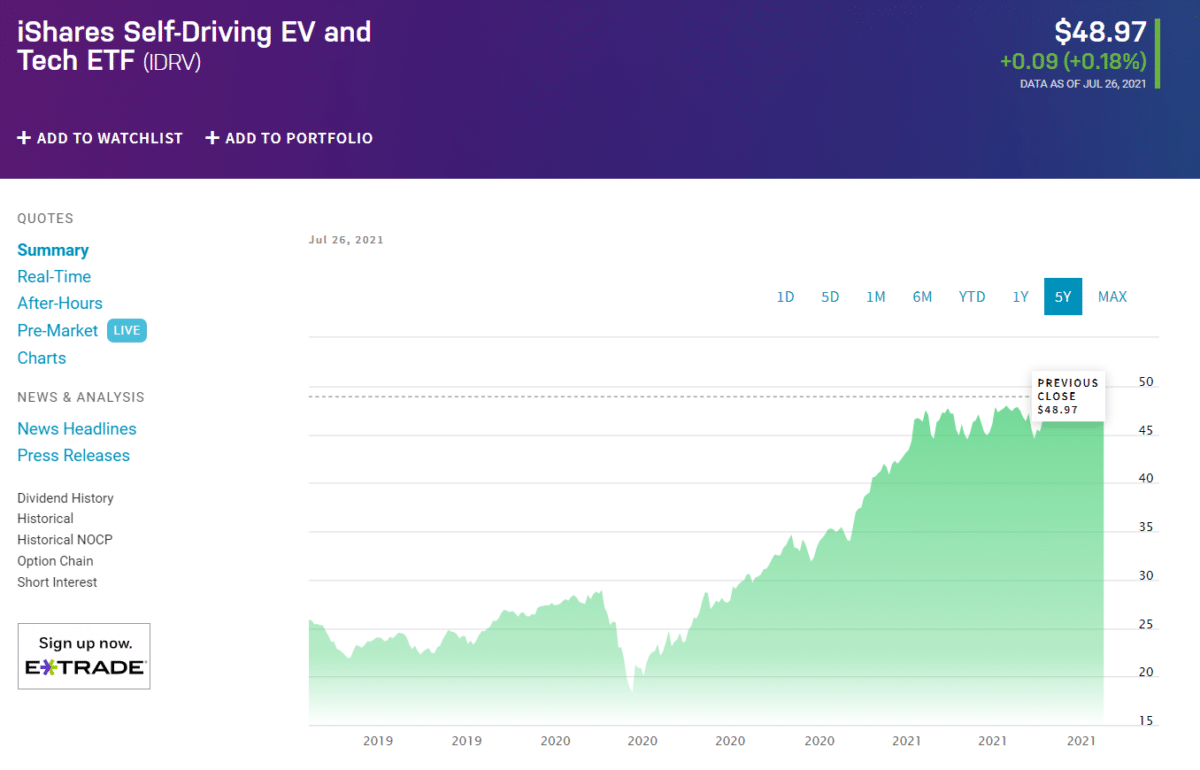

№ 2. iShares Self-Driving EV and Tech ETF (IDRV)

With more than 100 holdings, the IDRV ETF offers broader exposure to the electric vehicle niche. Apart from the leading players in the field, IDRV also includes other carmakers, like General Motors and Toyota, that still manufacture classic cars and have branches dedicated to electric vehicles.

It was given a fair 5.55/10 MSCI ESG rating and placed in the 47% percentile among its peers. The fund’s yearly returns amounted to 61.22%, which is an admirable result, and in line with the industry’s standards and trends.

The sheer number of holdings may be viewed as a downside by investors looking to get a hold of the future top players in the industry. On the other hand, if you are looking for a one-stop shop in terms of electric vehicles and green mobility, the IDRV could be the thing you were looking for.

The last quarterly dividend amounted to $0.2, at an expense ratio of 0.47% per share.

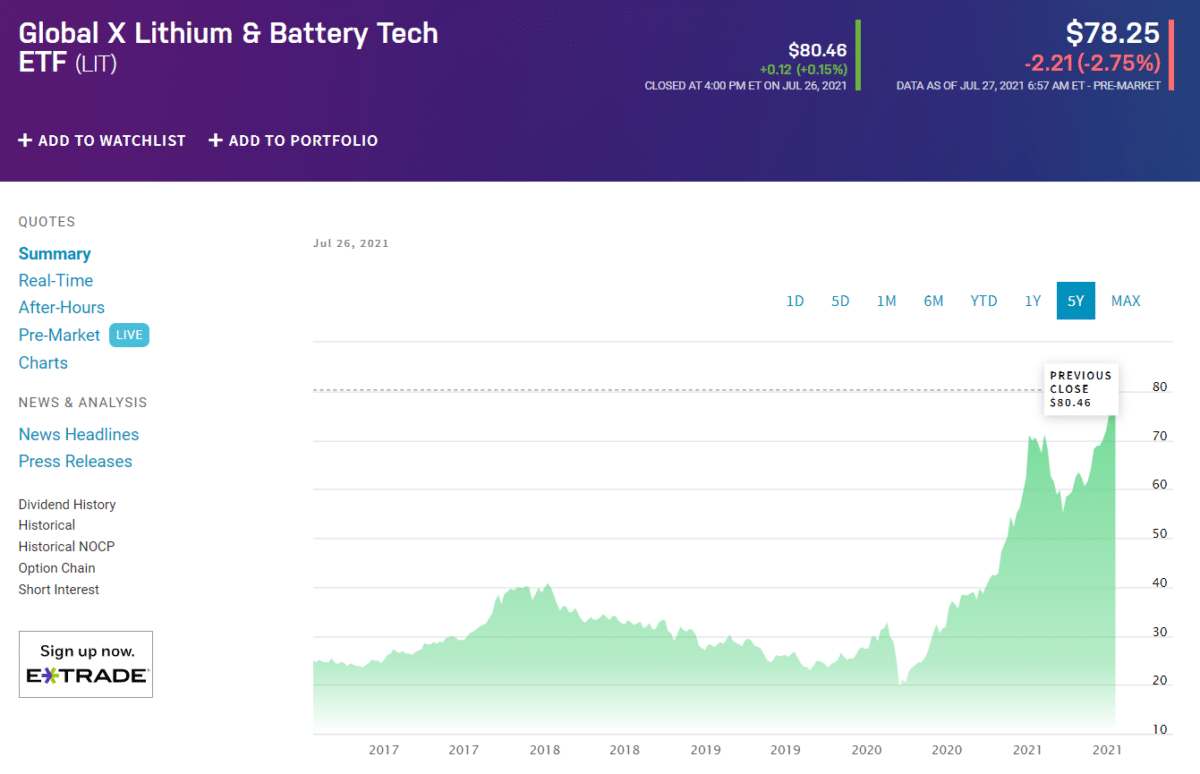

№ 3.Global X Lithium & Battery Tech ETF (LIT)

The Global X Lithium & Battery Tech ETF is the largest on this list, considering the assets under management. It was founded in July 2010 and boasted a dividend of $0.04 at an expense ratio of 0.75%. After the latest rebalance, the figure came in at $4.07 billion.

The special appeal of the fund comes from the fact that it offers a unique exposure to lithium, which is not only a desirable commodity at the moment but also can skyrocket in demand in the coming years.

One potential downside is that LIT will sometimes behave as a leveraged fund on lithium itself, resulting in higher returns. Still, it can also mean an increase in volatility, too high for most investors to weather.

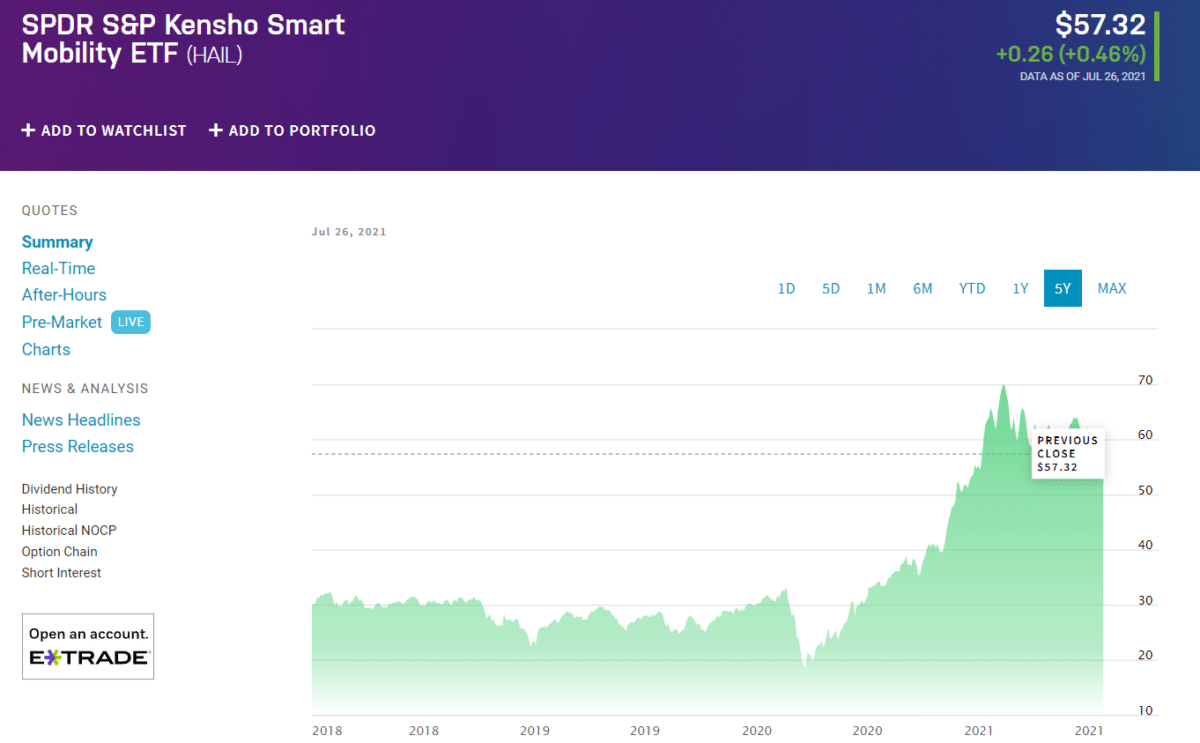

№ 4.SPDR S&P Kensho Smart Mobility ETF (HAIL)

The SPDR S&P Kensho Smart Mobility ETF is on a smaller side when it comes to assets under management, but it takes the “one-stop-shop” game to the next level. The fund comprises holdings ranging from electric car makers to companies specialized in automated agricultural tractors and drones.

That all-encompassing approach may seem a bit too much for some, but the fund gets rebalanced quite frequently. That way, all stocks get approximately the same weight in the fund, and none of the companies will ever be a make-it-or-break-it unit.

Its expense ratio is 0.45%, while its dividend came in at $0.15. It has a 5.88/10 MSCI ESG rating and has made a 66.5% return on an annual level. As you can see, this is pretty much in line with the other funds on the list.

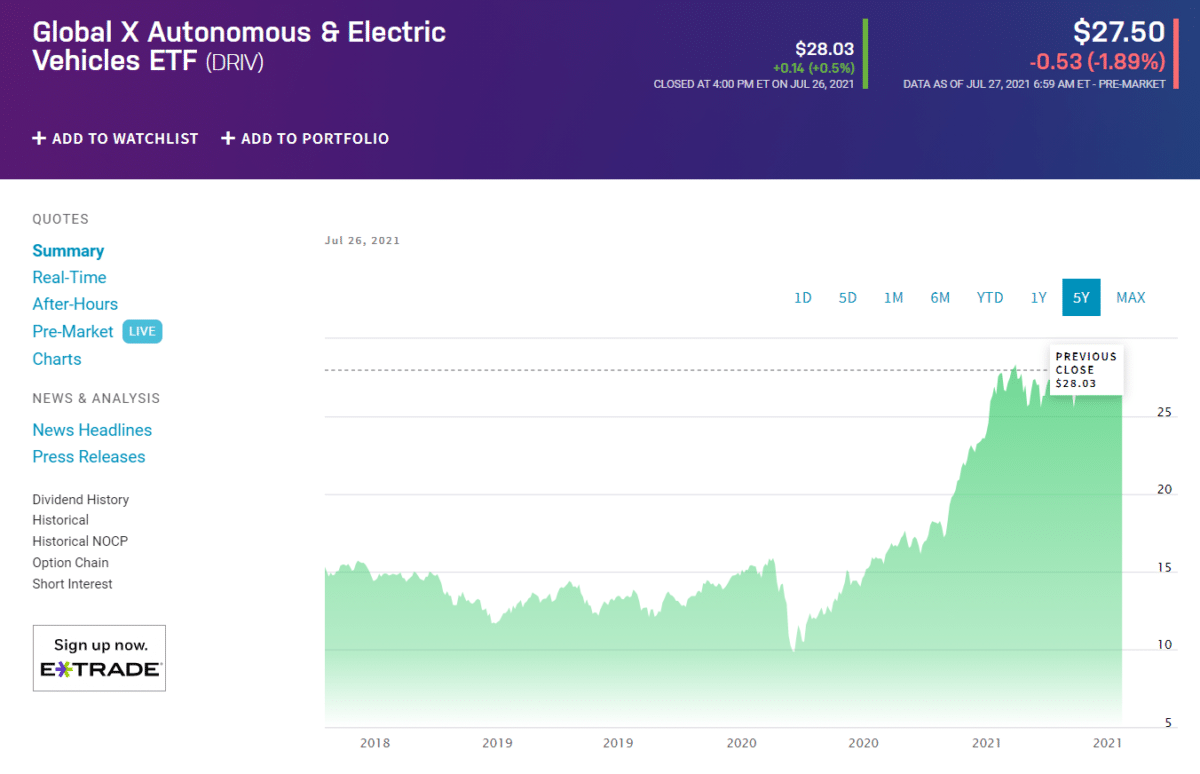

№ 5.Global X Autonomous & Electric Vehicles ETF (DRIV)

The list mentioned here is in no particular order, but we did save the DRIV ETF for last for a specific reason. Of course, the electric vehicle companies are represented in the fund, but not to the same extent as some other less direct participants in the green mobility industry.

The DRIV fund has holdings such as Alphabet, Nvidia, Microsoft, and Apple, which are not the first thing that springs to mind regarding electric cars. However, the companies mentioned do dabble in mobility solutions that accompany the industry of the next generation of vehicles.

More than two-thirds of the fund’s holdings are based in the United States, while the rest are in Japan, Germany, China, Australia, Korea, Hong Kong, Canada, and Italy.

The most impressive thing about the fund is its return over the past 12 months. While the fund’s dividend, expense ratio, and MSCI ESG rating don’t differ much from the rest of the ETFs on this list, the DRIV’s annual return came in at 82.92%, outperforming every other fund the list.

Final thoughts

With more and more people becoming aware of how harmful for the environment the traditional vehicles are, more and more investors are turning to alternatives.

Investing in electric vehicle exchange-traded funds can be a reliable way to play a role in the growing field of clean energy and green mobility. If you desire to make a specific bet on a particular company or subsector of the industry, you can do that.

If you can’t be bothered with researching each company or every possible aspect of the EV niche, there are choices for you as well, as was made evident by some of the funds listed.

The electric vehicle industry is growing and is to expand even more in the future. That’s why it might not be a bad idea to start thinking about jumping on the bandwagon, especially if lithium batteries power it.