The most common precious metals in the investment world are gold and silver, with savvy investors expanding this list to include platinum and palladium.

The majority of the investors are not at fault for not being aware that uranium is a precious metal with immense opportunities to make money in the current world of decarbonization. It is a metal used as fuel for nuclear reactors and applications in space exploration and medicine.

In the last two years, the uranium market has been a beehive of activity as the developed economies push for zero greenhouse gas emissions to protect the environment for future generations. Experts confirm that nuclear energy is safe, scalable, cost-efficient, the best alternative clean energy option.

Thus, forecasts show this energy niche will grow from $34.6 billion in 2021 to over $49 billion by 2025. With such an explosion, the uranium market is up for grabs, and the ETFs below are in pole position to benefit if played right.

What is the composition of uranium ETFs?

Exchange-traded funds comprise a pool of assets sharing common economic characteristics. Therefore, uranium funds include organizations that deal with uranium in its exploration and mining, refinement, uranium utilization in equipment manufacture, and all uranium-related ancillary services.

As such, all organizations in the uranium value chain qualify as holdings as long as they have either invested a significant amount of their total assets in uranium-related activities or derive substantial revenues from uranium-related activities.

With uranium mining concentrated in a few countries and organizations, fundamentals and other indicators create high volatilities for individual stocks, necessitating the need for risk mitigation when investing in uranium. As such, uranium ETFs present the relatively safer investment option.

Top 5 uranium ETFs to buy now and hold in 2022

With inflation comes an inflow of investment into hard assets, with metals leading the way. Despite a bullish run for all things commodities since the pandemic, uranium has been making the biggest waves.

As the world grapples with its dependence on fossil fuels to the detriment of the environment and climate, nuclear energy has emerged as the safest, scalable, and most economical zero-emission energy option. With this realization, the following logical action will be a race for safe nuclear reactors, spiking the demand for uranium and continuing a bullish run that started gradually five years ago.

Here, we explore five uranium ETFs providing exposure to this commodity and energy niche with the potential to skyrocket investor returns.

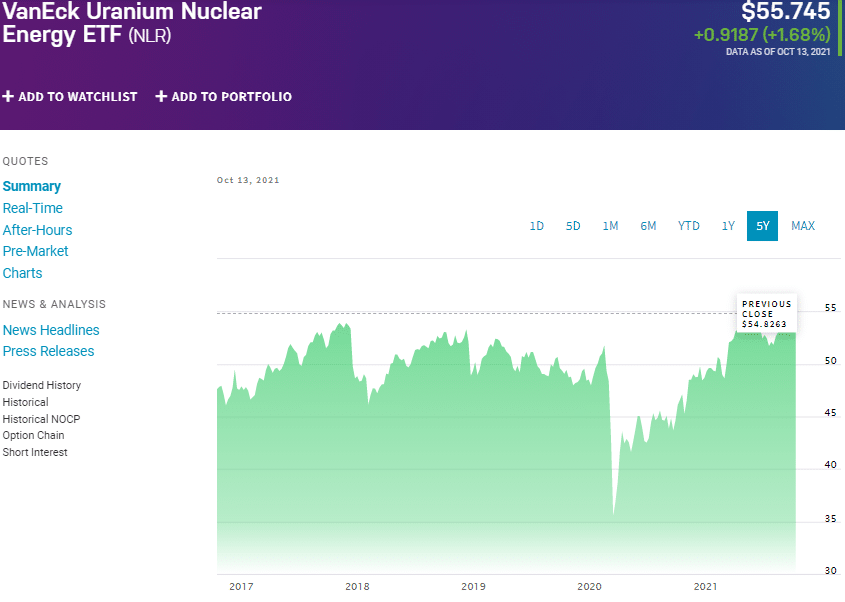

№ 1. VanEck Uranium Nuclear Energy ETF (NLR)

Price: $55.745

Expense ratio: 0.60%

Dividend yield: 2.01%

The VanEck Uranium Nuclear Energy ETF tracks the MVIS® Global Uranium & Nuclear Energy Index, exposing investors to the entire nuclear energy supply chain. It invests at least 80% of its total assets in the assets making up its benchmark index, in addition to equity securities and depository receipts of organizations involved in the uranium and nuclear energy market.

The top three holdings of this ETF as of now are:

- Duke Energy Corporation — 7.72%

- Dominion Energy Inc. — 7.56%

- Exelon Corporation — 6.74%

NLR ETF has $30.02 million in assets under management, with an expense ratio of 0.6%. Despite the meager assets it manages, historical performance shows that investing in this ETF has borne investors consistent returns.

Thus, 5-year returns of 40.43%, 3-year returns of 17.65%, and pandemic year returns of 22.52%. Given a dividend yield of 2.01%, current year-to-date returns of 13.32%, and the fact that the NLR is yet to hit top gear when compared to the historical category average returns, it is worth looking into right now to buy and hold.

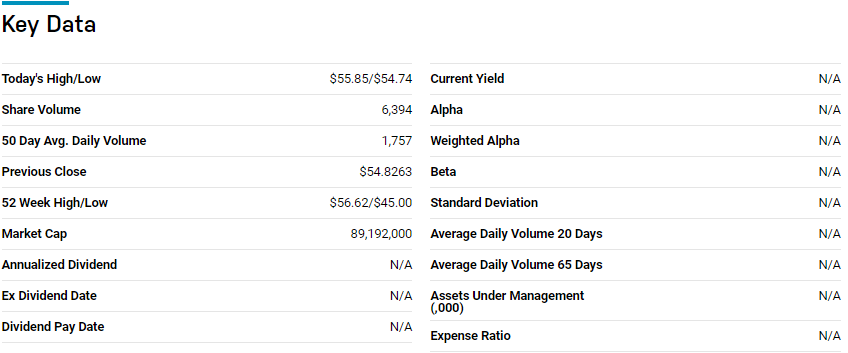

№ 2. Global X Uranium ETF (URA)

Price: $28.76

Expense ratio: 0.69%

Dividend yield: 0.49%

The Global X Uranium ETF tracks the Solactive Global Uranium & Nuclear Components Total Return Index, exposing investors to the entire global uranium value chain. It invests at least 80% of its total assets in the assets making up its benchmark index, in addition to GDRs and ADRs of the composite index holdings.

US News evaluated 36 Natural Resource ETFs for long-term investing, and URA ETF came at rank 20.

The top three holdings of this ETF as of now are:

- Cameco Corporation — 22.77%

- National Atomic Company Kazatomprom JSC Sponsored GDR RegS — 10.34%

- NextGen Energy Ltd. — 8.05%

URA ETF boasts $1.13 billion in assets under management, with an expense ratio of 0.69%. Since the start of the uranium and nuclear energy niche bullish run five years ago, this ETF has proven to attract phenomenal returns warranting consideration now to hold come 2022.

Thus, 5-year returns of 161.16%, 3-year returns of 134.64%, pandemic year returns of 166.61%, and year to date returns of 87.79%. In this period, it has outperformed both the category and segment industry averages.

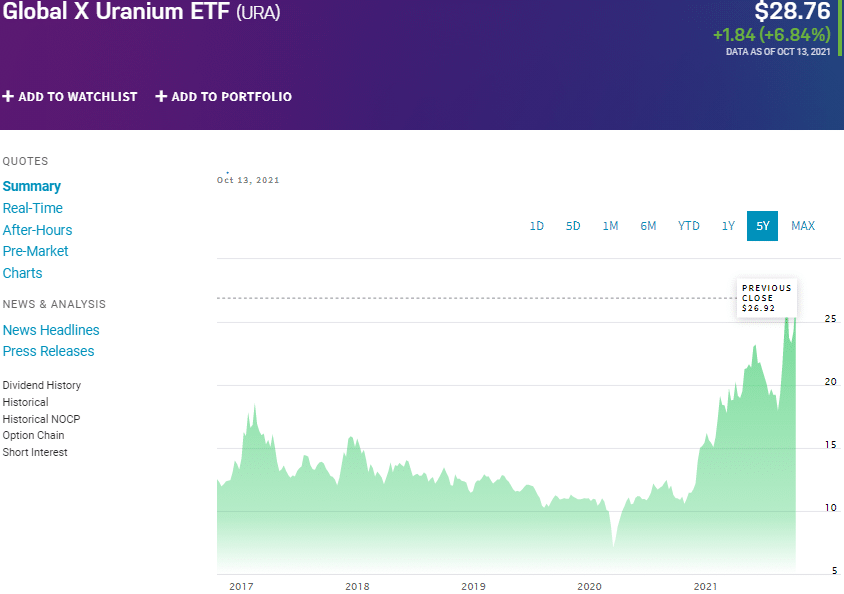

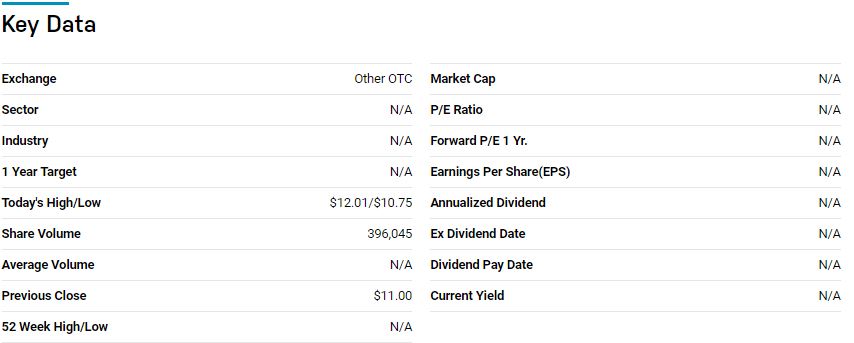

№ 3. Sprott Physical Uranium Trust (SRUUF)

Price: $11.7283

Expense ratio: 0.35%

Dividend yield: N/A

The Sprott Physical Uranium Trust Fund is a commodity ETF that seeks to reflect the physical price of uranium. It buys physical uranium and stores it in billions.

At present, it has these stocks of uranium:

- U3O8 with 30,614,382 kilograms

- UF6 with 300,000 kgs

SRUUF ETF has $1.6 billion in assets under management, with investors parting with $35 annually as the management fee for a $10000 investment. This ETF is the largest contributor to the soaring prices of uranium and uranium-related equities through its aggressive buying and stocking of uranium in readiness for the nuclear energy niche explosion.

Historical performance shows that the SRUUF might be a sound investment for the conscious investor.

Thus, 5-price change of +92.90%, a 1-year price change of +91.15%, and a current year-to-date price change +51.53%.

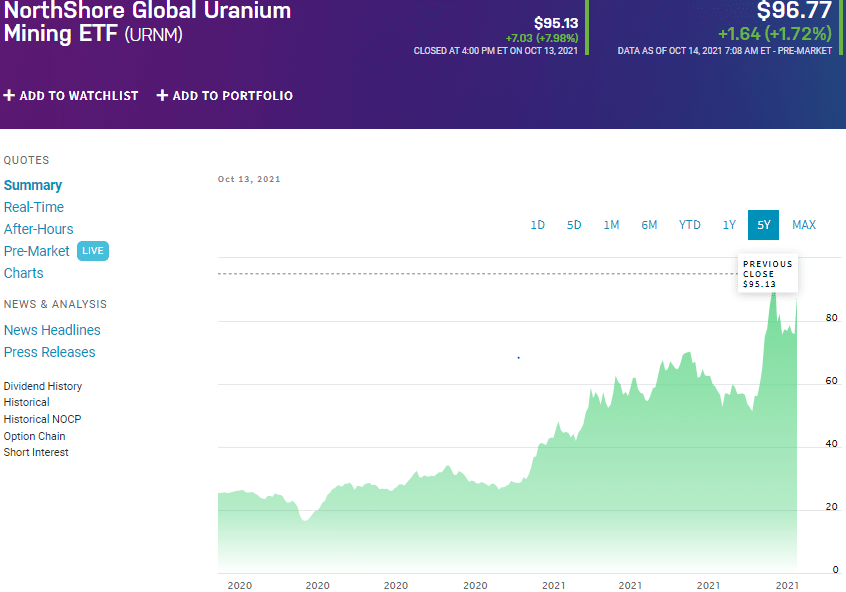

№ 4. North Shore Uranium Mining ETF (URNM)

Price: $96.77

Expense ratio: 0.85%

Dividend yield: 1.16%

The North Shore Uranium Mining ETF tracks the North Shore Global Uranium Mining Index, exposing investors to the entire uranium market. It invests at least 80% of its total assets in the assets making up its composite index. The tracked index categorizes uranium equities as those belonging to organizations that:

- Devote a minimum of 50% of their total assets in uranium exploration, mining, development, and production.

- Derive at least 50% of their total revenue from holding physical uranium, owning uranium royalties, or providing ancillary services to the uranium industry.

The top three holdings of this ETF as of now are:

- National Atomic Company Kazatomprom JSC Sponsored GDR RegS — 16.95%

- Cameco Corporation — 26.48%

- Sprott Physical Silver Trust — 8.05%

URNM ETF, despite having been launched at the close of 2019, already boasts $3775.68 million in assets under management. It costs investors $85 annually to own $10000 worth of URNM shares.

Despite the coronavirus pandemic ravaging the world not long after its launch, this ETF still managed pandemic year returns of 245.53%, making it one of the best performing ETFs of 2020.

Having already amassed current year-to-date returns of 121.75%, the launch of this ETF looks like a stroke of genius, and not getting a piece of it is quite the mistake if considering uranium investing.

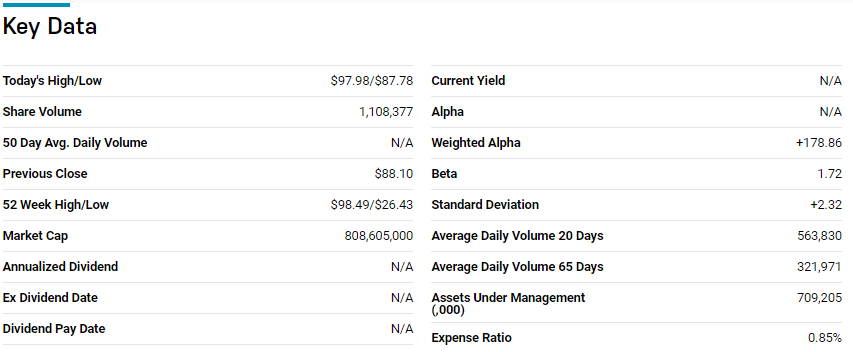

№ 5. Horizons Global Uranium ETF (HURA)

Price: $27.33

Expense ratio: 0.85%

Dividend yield: N/A

The Horizons Global X Uranium ETF is listed with the Toronto Exchange and Solactive Global Uranium Pure-Play Index, exposing investors to the uranium market of developed economies.

The tracked index categorizes uranium equities as those belonging to organizations that:

- Those whose primary activity is uranium exploration and mining.

- Organizations are directly investing and participating in the uranium market.

The top three holdings of this ETF as of now are:

- National Atomic Company Kazatomprom JSC Sponsored GDR RegS — 21.39%

- Cameco Corporation — 19.63%

- Yellow Cake PLC Ordinary Shares — 17.49%

HURA ETF has not fared at URA, amassing only $41.5 million in assets under management in the year it has been in operation, coupled to a 085% expense ratio.

It has also not been able to match the returns of URA, but it holds its own compared to other ETFs in the category, putting in a strong case for investment consideration; pandemic year returns of 65.67%, followed by a current year to date returns of 66.05%.

Final thoughts

Technology and science have evolved enough for the world to avoid another Fukushima disaster to the extent that compared to other natural resources, uranium radiation exposure is only 1% in comparison to 80% from other naturally occurring events.

In addition to this, nuclear energy is proving to be the only scalable green technology to power humanity’s next phase of evolution. As such, the uranium ETFs above are in pole position to take advantage of opportunities in both the uranium commodity segment and the nuclear energy niche, as they both attain critical mass.