Buying real estate, especially for a new investor, can be an exhilarating experience. But investing in property can be a complex and tricky process, with red tape around every corner.

Like all investments, it comes with inherent risks, which you need to know. Since owning a property is a long-term investment, you would want to make one hundred percent sure that you make the right decisions every step of the way.

Top 10 things to know about real estate investing

Investing in REIT might sound simple and easy, but there are few things one should know before buying property. We will share ten essential tips you should know about real estate investing.

№ 1. Choose location

The most important thing to know when buying property is location. The best site offers convenience to the user. You have to consider your tenants’ needs when investing in commercial property, or if you intend to sell, your future buyer would also be needing certain things.

For example, if you invest in commercial property and plan to lease them, your tenants would want to be close to:

- Public transport

- Easy access to highways

- Warehouses, etc.

Moreover, the area’s status is a crucial factor as it also influences the property’s value. If the location has high crime statistics, chances are investors would not be keen to buy there.

№ 2. Take time to shop

Shop around by considering different options instead of buying the first property that meets your requirements. Buying a property requires a significant investment, and once the deal completes, you are stuck with it. Therefore it’s vital to shop around and conduct thorough research.

Don’t be fooled with the building’s outer appearance, and do your due diligence by checking electrical compliance, structure and plumbing integrity, the status of utility bills, and property taxes.

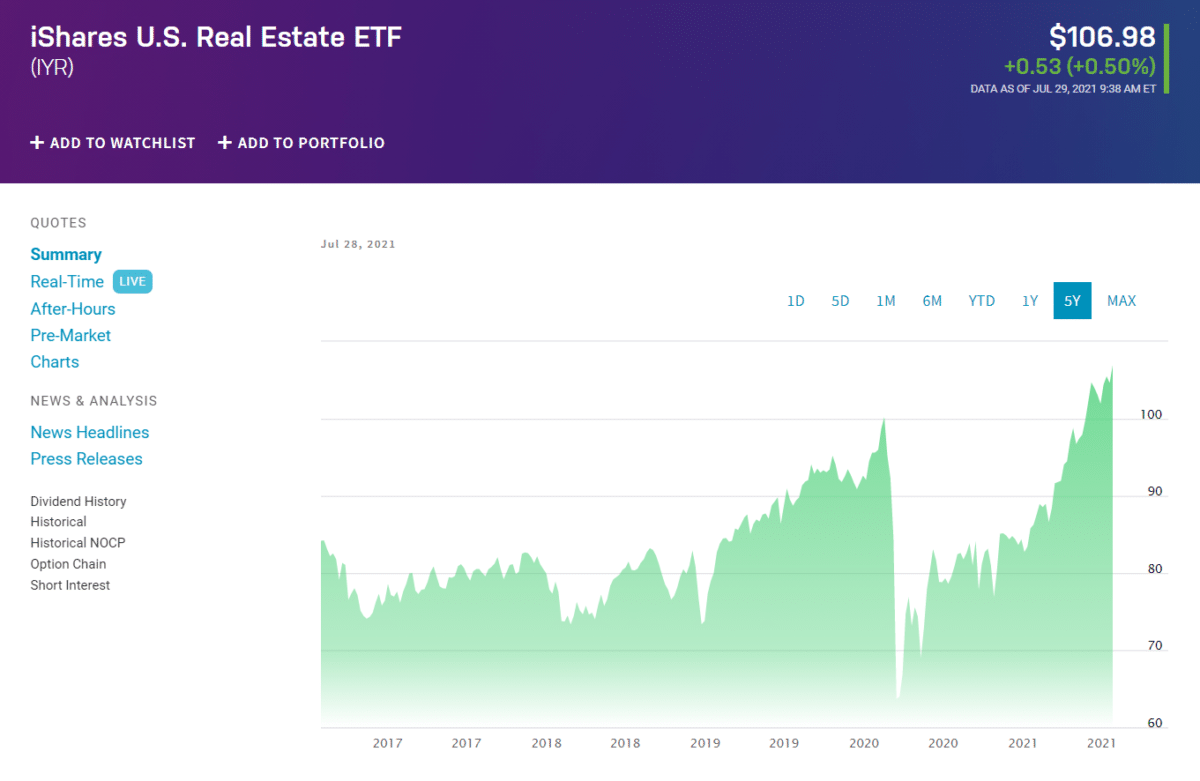

This ETF tracks the investment results of an index composed of US equities in the REIT sector.

№ 3. Consider the costs

Properties have lots of hidden costs that, to the novice investor, could be a nasty surprise later on. Costs like transfer fees, deposits, conveyance fees can all add up to a hefty sum, besides the bond costs.

№ 4. Put down a deposit

It’s very likely when you buy a property through financing, and you will have to put down some deposit or security. It depends on the property’s value, and putting a down payment will help reduce the capital amount.

№ 5. Budget for operating costs

Leasing out property can be very lucrative, but you have to factor in all the costs required for the upkeep of the property. You should factor in unforeseen repairs and maintenance to the property.

Other costs like building insurance and levies would be coming from your rental income. You should ensure that at least 50% of the rental income can cover these costs so that you don’t pay out of your pocket.

№ 6. Choose finance or cash purchase

Depending on your affordability and investment goals, you can opt for finance or cash payment. Buying property cash is a way to avoid paying interest on mortgage loans and other hidden costs. However, financing is another option, but you must plan your budget to afford the payments. You also need to make provisions if your tenant fails to pay the monthly rent to prevent defaulting on your loan.

№ 7. Avoid high-interest rates

A vital factor to note if you are financing your purchase is interest rates. The interest on home loans is considerably lower than investment property since it carries a lower risk.

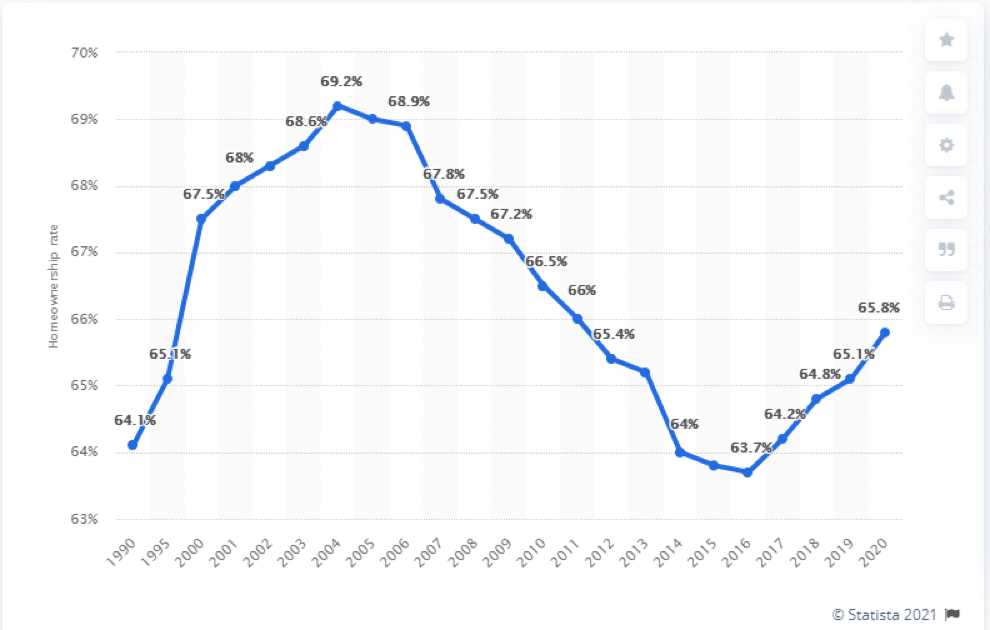

In 2020, the homeownership rate was 65.8%. This rate represents the number of property owners occupying the household.

№ 8. Note risks of investing in real estate

REIT investment can be rewarding, but like any investment, it carries some risk. And it would help if you considered the risks below.

Market uncertainty

One of the most significant risks is market uncertainty, as we are now experiencing a global pandemic. Inflation and interest rates can affect your investment significantly. An increase in inflation will result in higher bond repayments, which will eat away at your earnings.

Low liquidity

If there are too few buyers, the liquidity is low, and you will find it hard to sell your property. An upmarket location could attract many buyers regardless of the economic climate. However, a property located in a less favorable area would be hard to sell.

Credit risk

Credit risk is always prevalent; factors that can influence are tenants who fail to pay the rent, leading to you defaulting on your bond payments. Large corporations have fallen victim to this at a commercial level, even the ones who are creditworthy. Therefore it’s best to build in some leverage for this type of risk.

Vacant property

A common risk is a property that is vacant for too long. Since your income is dependent on the rent, the longer it’s empty, the less money you will be making, and the higher your expenses will be.

You can overcome this risk by finding a suitable property agent, targeting the needs of tenants, and using free ads to market your property creatively. The last resort would be to sell, but this can also result in a risk of losses and debt.

№ 9. Remember about the pros of REIT investing

- Appreciation

If you maintain your property well, the value will appreciate. In addition, any upgrades or renovations that you make will add to the value of the property.

- Tax benefit

In the USA, the government does not tax your rental income as they do for self-employment income. As a property investor, you benefit from taxes just like a regular business that has tax-deductible expenses.

- Continuous cash flow

One of the most excellent benefits is continuous cash flow, primarily if you can lease your property for the long term to reputable tenants.

№ 10. Don‘t forget about the cons of REIT investing

- Long term investment

Buying real estate means you are in it for the long haul. It is not an asset that you can quickly sell if you need funds urgently. Furthermore, there are also transactional fees associated with selling a property.

- Unreliable tenants

Tenants who are defaulting on their rent are another headache. In addition, if they vandalize your property, it could affect the value of the building, which leads to more expenses to fix untimely damages.

- Large investment

Buying property, irrespective of whether it’s residential or commercial, requires a lot of money. You either have to get financing, save up and pay cash, or find partners to invest with you. And the more significant the sum of money you need, the more risk is associated with it as you have no guarantee that you will get a good return in a reasonable time.

Final thoughts

If you are eager to invest in property, consider the points we have outlined in this article, as it aims to help you make an informed decision. Yes, it’s a scary process, but as long as you do your homework correctly and plan carefully, you can obtain a fruitful long-term investment.

Many people have succeeded in mastering the property market; some have failed and tried again. In the end, the decision comes back to you as the investor on how you would like to spend your money.