Under-trading can affect your trading performance primarily. So as much as you are worried about not over-trade your balance, you should keep checking to not get yourself in a situation where you are under-trading. In this article, we will be discussing the best five tips to overcome under-trading.

What is under trading in forex?

Under trading is the situation where traders miss opportunities because of excessive caution. For example, if you don’t open trades for days out of fear of losing, that means you are under trading.

Now, this will prevent you from losses, but you will see a drastic drop in your profit potential as well. Therefore, it leaves an adverse effect on your profit margins and performance.

Two symptoms of under trading are:

- The high current ratio and liquid ratio

- Lower turnover ratio

Tip 1. Find causes that lead to under trading

There can be several reasons that make an investor not trade. Knowing the cause will guide you to find a suitable solution.

Why does it happen?

Traders mostly fall victim to under-trading when they are going through recency bias. For example: Let’s suppose someone underwent heavy losses in a week. Now he will expect to face a similar situation again, which makes him reluctant to invest.

How to avoid the mistake?

If you have suffered a loss recently, it’s better to reduce your trading volume for the time being rather than stop trading. Dig in to find the reason for your loss and adjust your strategy accordingly. It would help if you defined your risk and rewards so that your losses may not exceed the unaffordable range.

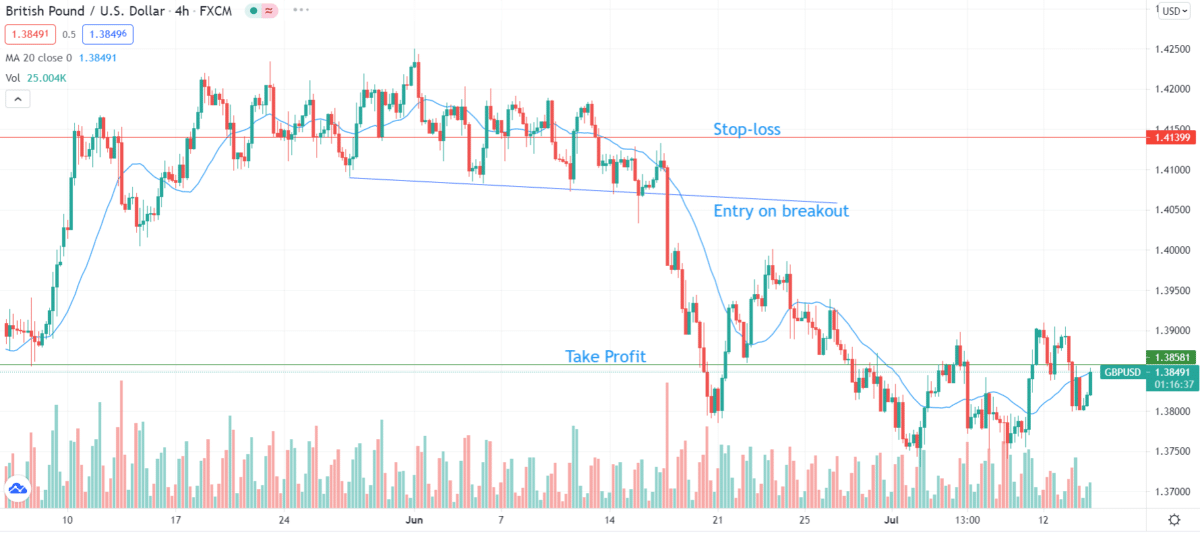

For example, if you use trendline in trading; then, never miss a trading opportunity if the reward is at least 1.5 times the risk. The below chart shows an opportunity with a risk of 73 pips and a reward of 212 pips.

Tip 2. Control your fear if you want to succeed

Fear is a constant companion in trading. You can’t help feeling it but what you can do is control it. Once you let fear control you, it’s downhill from thereon.

Many investors fall prey to it.

Why does it happen?

After one heavy loss, beginners start speculating more losses in the future. Naturally, this instills a sense of fear in them, and they start panicking. Resultantly, they shy away from trading.

How to avoid the mistake?

First of all, tell yourself that losses are inevitable. They are a part of the game. You can never entirely avoid them. Once this realization dawns, you will be able to keep your nerves in check.

Secondly, instead of panic buying/selling at the nick of time, plan strategically. Only deposit the amount you can afford to lose. Stop following your instincts blindly and follow strict money management rules.

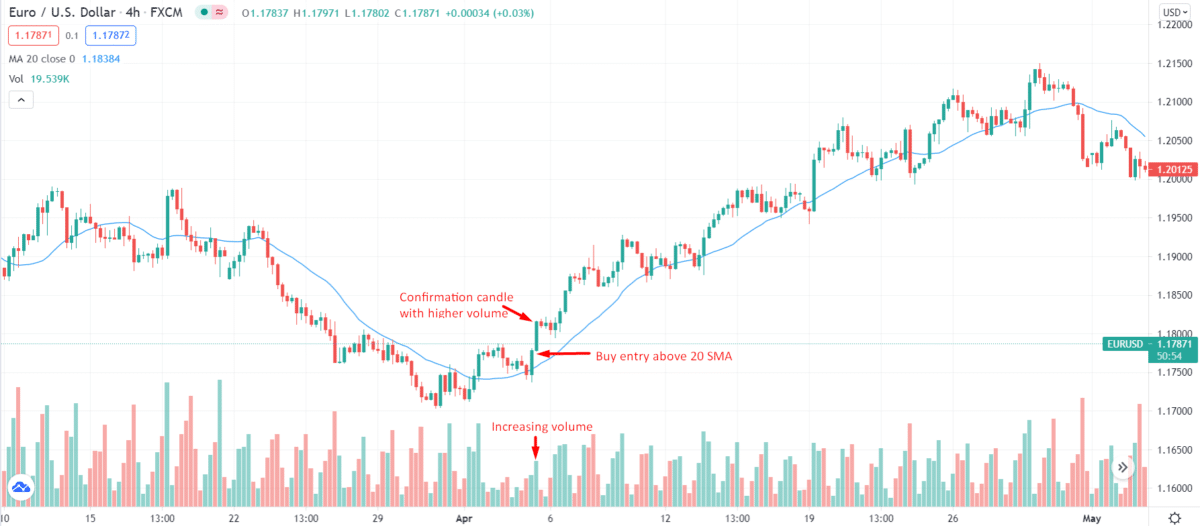

You can overcome your fear if you have a definite trading plan. You can use another confirmatory indicator to add more confidence to your trading. Check the example below.

Tip 3. Create rules to instill discipline

It is easy to get carried away with emotions when you are working in such a high-pressure environment. This is why you need to set some rules for yourself.

These rules will prevent you from getting overwhelmed or making impromptu decisions. Most traders bear opportunity costs when they don’t follow the guideline and fall prey to under-trading.

Why does it happen?

Without rules, your trade is random. It’s like taking a shot in space. You will have different results from each trade and won’t be able to evaluate them properly.

Investors that do not set rules end up in a limbo of losses.

How to avoid the mistake?

Set definite rules using your experience. The same rules give different results to everyone. This happens because there are so many factors that are taken into account while trading.

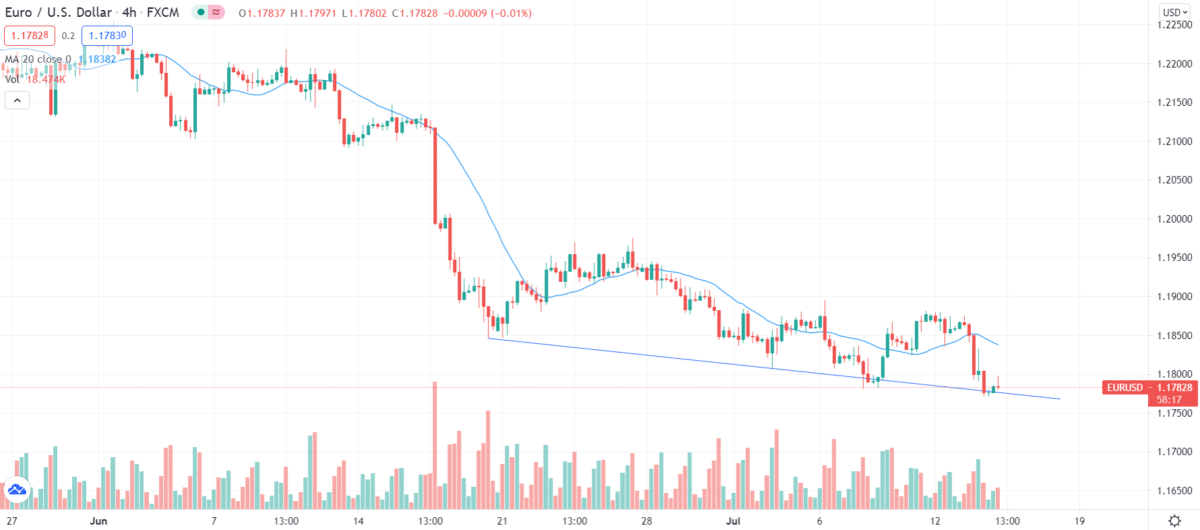

Create the set of rules that best suit you. Define a stop/loss for yourself. Decide a time frame that you will be following. Learn when to withdraw. Specify the markets you will be investing in. Look at the example below.

The above chart tells you that the EUR/USD is on the verge of a trendline breakout. Your instinct may call you a sell-off right now, but you never know what happens next. So, never follow instinct. Instead, follow the trading rules. Trade only when the trendline breaks.

Taking these steps will make you in charge of your situation, and you will make rational decisions.

Tip 4. Trade with discipline

This is somewhat related to the previous point. Discipline is the key ingredient in determining your success as a trader. All the rules mentioned above are of no use if you don’t stick to them. So this is where discipline is essential.

Have a trading plan, find out your weak points, work on them regularly, and take responsibility for the situation.

Traders who do not teach discipline in their professional life are bound to fail.

Why does it happen?

Forex is a fast business where the market changes overnight. As a result, undisciplined trading will bear unexpected results with heavy drawdowns and unexpected losses.

For example, you opened a trade in the New York session and found a sudden rise or fall in a particular instrument because of some news. If you haven’t been disciplined throughout, you won’t make a smart move in such an environment.

How to avoid the mistake?

Define your risks and rewards. You can decide to risk a certain percentage of your capital, say 1% percent, and then stick to it. You can also opt to invest in major pairs, that too in the New York session only.

For example, you have a strategy based on moving averages, but you get a trading signal from RSI. Now discipline demands that you follow your strategy.

The lower you lose, the greater are your chances of overcoming under trading.

Tip 5. Avoid weak/fake setups

To overcome under-trading, you need to avoid weak/fake setups. For example, if there are four requirements and only three are met, we call the setup weak.

Investors usually fall into the trap.

Why does it happen?

Investors can be impatient while opening or closing the trade, so they don’t wait for the requirements to fulfill.

How to avoid the mistake?

Wait for the ideal situation. Let’s study this with an example of moving averages. Say you are using 20-period simple moving averages. If the price of a specific currency pair like the EUR/USD is rising on the 1-hour chart, then it is a buying signal.

Now, this is where you have to be patient. Tally the price on the 4-hour chart as well. If the price is on consolidation, then it is a weak setup, and you shall not open the trade.

If the charts align, then it will be a robust setup, and you may proceed.

Final thoughts

It is natural to have setbacks while trading. It would help if you made careful moves to overcome the loss. All the tips mentioned above will help you in this regard, and you will invest with more confidence.