A tax-free account does not have any federal or state tax outstanding on the interred earned in the account, both when the interest is earned, distributed, and withdrawn.

Taxes take a big chunk of anyone’s hard-earned money. But you don’t need to worry as you have such an account that can help you increase your funds without any tension of future taxation, even while withdrawing the funds you will spend.

We all want our money to be safe when we retire. Jump into the article and read it through to know everything about these retirement accounts.

Three things to know before starting:

- Investors get an opportunity to earn tax-free incomes on the capital amount.

- The Roth IRA and the Roth 401 (k) are the plans involved in these accounts.

- The Roth 401 (k) plan has a significantly larger participation limit than the Roth IRA plan, and taxpayers over 49 can add additional contributions.

Defining a tax-free retirement account

It is a long-term investment that an individual makes to accumulate money for their retirement age. The interest you will earn on this account will be tax-free. Federal or state tax does not apply to the distribution or while you are withdrawing your income from such an account.

Usually, you will be required to approach a financial institution that will set up an individual retirement account (IRA) for this account.

People think and understand the regular IRAs as tax-free accounts. Yes, it is wrong to think so. People believe the funds they invest in a traditional IRA increase without taxes, but in reality, it is a tax-deferred account and what that means is it is not tax-free but delayed. Also, there is an income tax when you withdraw the amount from a regular IRA.

Examples of tax-free accounts

The two types exist in the USA: IRA and 401 k. It has a determining annual income, withdrawal dictates, and participation limits. The funds invested in both are authorized to increase without taxes on them when you are without them in retirement.

- Roth IRA

It is a retirement plan that the US government created to assist working individuals to save for their retirement. As mentioned, the limits on these accounts are $6,000 for 2021.

- Roth 401(k)

Traditional 401(k) plans allow employees to contribute with their wages being taxed already. Therefore, the contributions to these plans are not taxable income.

Furthermore, the rules state that your contributions will be growing tax-free until you retire or withdraw the amount.

However, should you withdraw before 591/2 years, you will be required to pay taxes and other penalties. But if you make withdrawals at retirement age, you will receive tax gains.

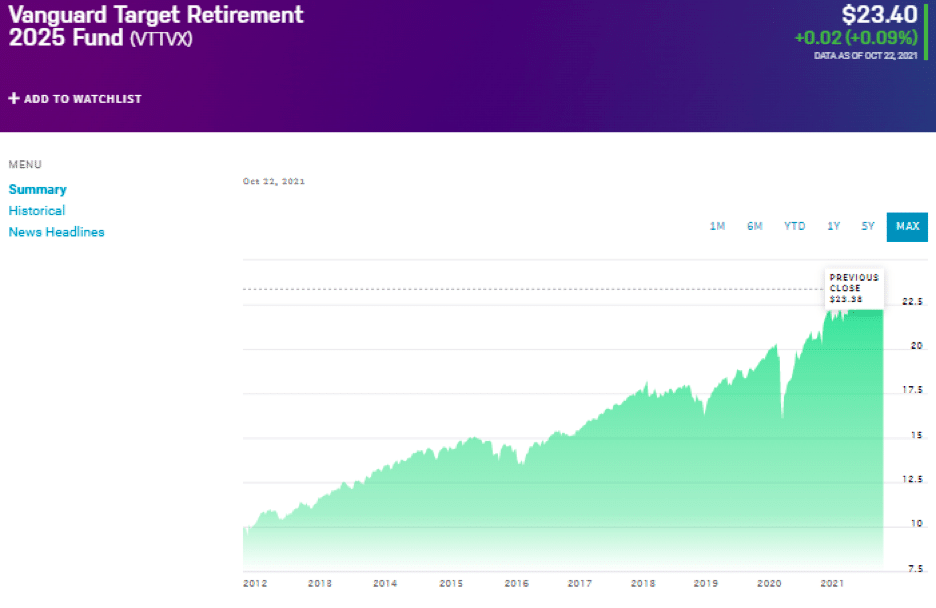

The VTTVX fund is an example of a retirement investment plan which matures in 2025.

- Municipal bonds and funds

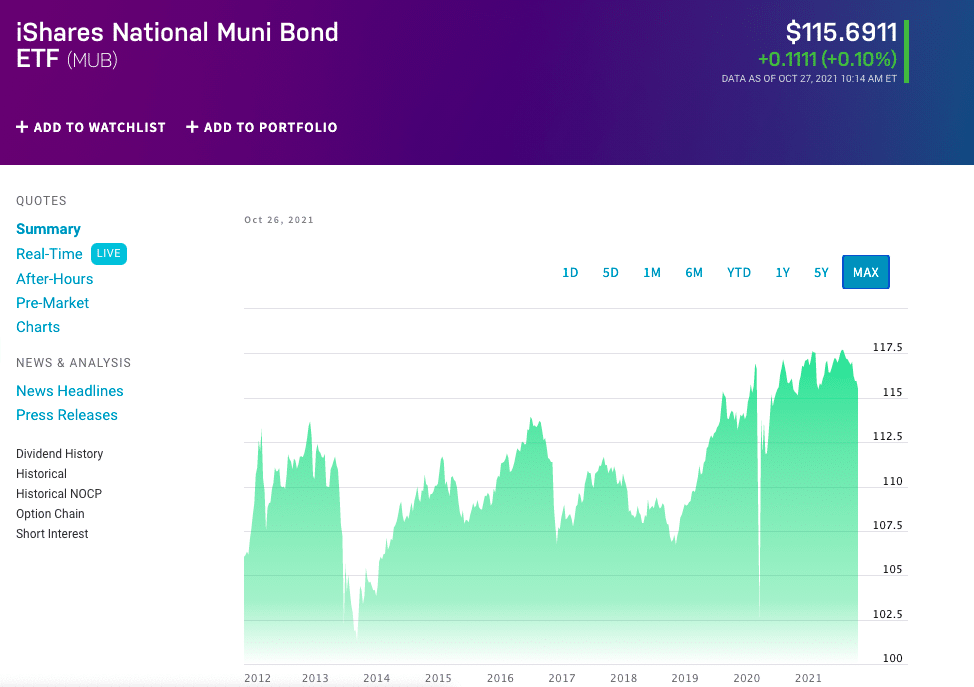

The most investment-specific examples of tax-free incomes are municipal bonds. What you need to do is analyze and decide if these bonds meet your investment needs. The best part of the investment here is that the income generated from these bonds does not have federal taxes, depending on where you live. Nevertheless, they still might be submissive to state income taxes.

When you do not pay taxes on your income indirectly, you will be given comparatively less interest than taxable bonds on the invested money.

MUB ETF is an excellent example of low-cost municipal bonds, and you do not have to pay federal taxes on the interest earned on them.

How much can I put in such an account?

Contributions to your tax-free retirement account are dependent on the type that you choose.

For example, the limit for Roth IRA for the 2021 tax year is $6,000 per person, with an additional $1,000 for taxpayers older than 49 years.

On the other hand, the Roth 401(k) contribution limits are significantly higher. An individual can invest up to $19,500 with an additional $6,500 for taxpayers over 49.

Pros & cons

Investing for retirement is supposed to be a proactive approach to secure your income when you can no longer work. However, just like any other type of investment, retirement plans pose risks as well. So, it is better to look at the pros and cons before getting involved in it.

| Worth to invest | Worth to getaway |

| •Excellent benefit You will be exempt from paying taxes on your earnings at retirement. | •Early withdrawal penalties If you withdraw from your fund before your retirement age, the bank will subject you to fees and penalties. |

| •Legal protection Workplace 401(k) plans are protected by Federal law, safeguarding the employees and their beneficiaries’ interests. | •High fees The fees charged on retirement funds can be high, and investors have little control over these fees. |

| •High contribution limit Retirement plans allow you to contribute a significant amount annually which is favorable for those looking to increase their contributions every year. | •Pre-tax on contributions Although Roth IRA plans are considered tax-free, this is only true for gains and not contributions. You already would have paid the tax for the funds you will be investing in. |

Final thoughts

After understanding how it all works, you now appreciate these accounts and how they differ from regular IRAs. One more thing to understand here is that indirectly you pay tax on Roth IRA, meaning once you make money, you pay taxes on them, and then you invest your money in the Roth. Once kept in Roth, you do not pay more taxes, and your investment grows, giving you interest.