System 17 with ATR strategy for MT4 is a momentum-based trading strategy using market volatility. The primary indicator in this strategy is the Average True Range (ATR) used in this strategy to measure the price volatility.

This strategy is very profitable while following a trend, and it can provide modest gains from a trending market. This trading method mainly focuses on following the market’s primary bias in any time frame to get the same price momentum.

Besides, we will use multiple MT4 trading indicators like RSI, system 17 arrow set-up to increase the trading probabilities.

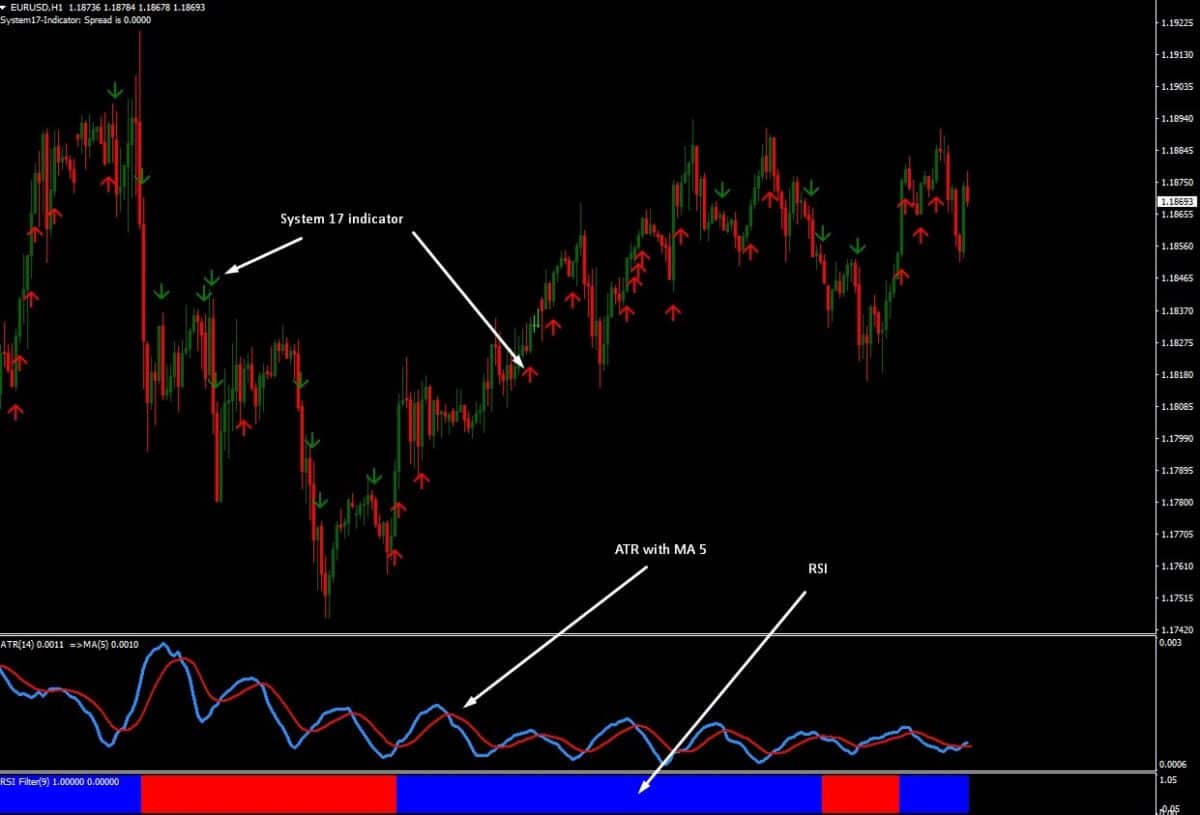

System 17 with ATR strategy for MT4

However, the currency market is full of disbelief; that is why the only way to hold down in the market is to build a higher accuracy trading system using various indicators. This trading strategy will use multiple trading indicators to identify the price momentum with higher accuracy. Moreover, these indicators are viral and dependable as many professional traders use them for their day-to-day market analysis.

Let’s have a look at trading indicators for system 17 with ATR strategy for MT4:

- System 17 indicator

- RSI filter nine period

- ATR 14 periods with moving average (MA) smoothed five periods

System 17 indicator

It is a trend following indicator, showing the signal as a buy and sell arrow.

- The red arrow indicates a buy signal

- The green arrow means to sell

Moreover, this indicator uses the concept of MA, period 12, to identify the average price momentum.

RSI (relative strength index)

RSI measures the ongoing price changes to assess overbought or oversold situations in a selected FX pair price. This indicator is developed by J.Welles Wilder Jr., who introduced it in the book “New Concepts in Technical Systems” in 1978.

Any RSI values below 30 or underneath show an oversold market condition. On the other hand, RSI readings above 70 indicate that the security is turning out to be an overbought position and might be prepared for a trend inversion or corrective pullback in price. It alludes to routine evaluation and utilization of the RSI.

ATR (average true range)

ATR is a volatility indicator developed by J. Welles Wilder Jr. The indicator’s founder has designed it with commodity and daily price movements in mind, like his other creations. Moreover, Wilder has created this indicator to identify the missing market volatility.

However, ATR works in the FX market very impressively and provides accurate entry and exit points. In addition, ATR indicators fluctuate up and down as the currency pairs become larger or lesser. It is significant to note that ATR only provides market volatility, not a market trend.

Let’s have a look at the visual illustration of these components.

Bullish trading strategy

System 17 with ATR strategy for MT4 is appropriate on all the timeframes from five minutes to daily, where one hour and the four hours provide the ideal outcomes as its essence the short term dominance of the fundamental news.

You can choose any currency pairs to apply this trading strategy, but we suggest:

- EUR/USD

- USD/CAD

- USD/JPY

- AUD/USD

- GBP/USD

- GBP/JPY

- EUR/JPY

Bullish trading conditions

- Arrow buy of system 17 providing the primary bullish indication in the price

- ATR is above MA smoothed five periods confirming the bullish trend

- RSI blue bar

Entry

After all trading conditions are confirmed, you should wait for the candle to close and execute the trade as soon as the candle closes.

Stop loss

As it follows strategy, the current bias is expected to continue as long as the price is trading over the most recent swing low. Therefore, place your stop loss below the recent swing low with a ten to 15 pips buffer.

Take profit

The ideal “take profit” level for this trading strategy is the next critical level from where the price can reverse. However, you can trail your stop loss level to breakeven when the price makes a new higher high. Otherwise, you can wait for the green sell arrow to close your running position.

Bearish trading strategy

This strategy is also applicable to all time frames from five minutes to daily, where one hour and four hours provide the ideal outcomes. It extracts the short-term dominance of the fundamental news.

You can choose any currency pairs to apply this trading strategy, but we suggest:

- EUR/USD

- USD/CAD

- USD/JPY

- AUD/USD

- GBP/USD

- GBP/JPY

- EUR/JPY

Bearish trading conditions

- Arrow sell of system 17

- ATR is above MA smoothed five periods

- RSI red bar

Entry

After all trading conditions are confirmed, you should wait for the candle to close and execute the trade as soon as the candle closes.

Stop loss

As it is a trend-following strategy, the current bias is expected to continue as long as the price is trading below the most recent swing high. Therefore, place your stop loss above the recent swing high with a ten to 15 pips buffer.

Take profit

The ideal “take profit” level for this trading strategy is the next critical level from where the price can reverse. However, you can trail your stop loss level to breakeven when the price makes a new lower low. Otherwise, you can wait for the red buy arrow to close your running position.

Final thoughts

System 17 with the ATR strategy for MT4 is the most profitable trading strategy because it depends on highly accurate indicators. Therefore, you can get better trading results at the end of the month. However, there is no 100% guaranteed profit in every trade, so you should follow multiple trades to determine its accuracy.

In this manner, system 17 with an ATR strategy for MT4 is very profitable in any time frame. Furthermore, to get better results from this trading strategy, you should use the proper money management system and have better mindsets.