The ProShares Short Euro is a currency ETF. Currency ETFs provide investors exposure to foreign exchange by pooling their funds. Investors essentially benefit from the change in the exchange rates between currencies. The ETF is available similar to a stock which you can purchase via a brokerage or investment management firm.

Investors prefer currency ETFs since the fund uses hedging strategies against inflation and foreign asset risk.

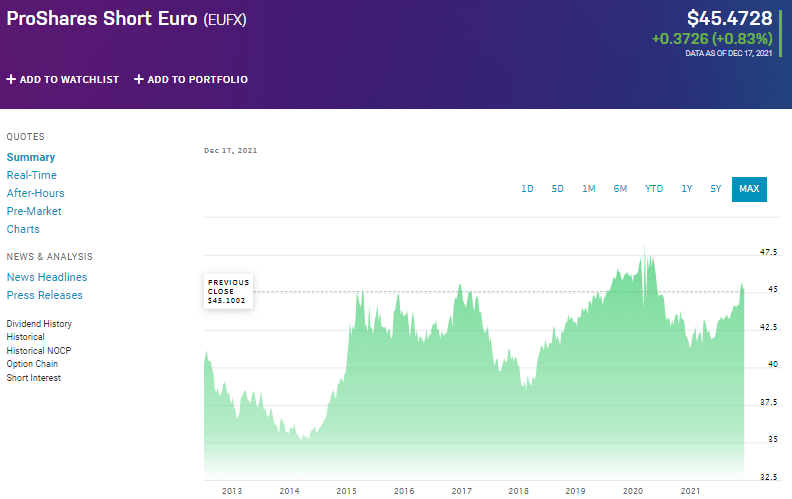

The EUFX ETF had excellent returns, especially in the last year, and it would be good for investors to take a closer look at the performance and the mechanisms behind this fund.

What is the ProShares Short Euro Fund?

The fund’s inception was on 26 June 2012, and the fund’s issuer is ProShares.

The ProShares Short Euro ETF tracks the spot price of the euro and uses the inverse (-1x) of the performance of the euro’s spot price daily. The fund’s index is the USD/EUR exchange rate, and it has no segment benchmark.

The fund invests in the currency sector and is a short-term ETF.

What are the types of investments under the EUFX?

The ProShares Short Euro ETF invests in the euro currency’s singular asset. The fund, therefore, has one holding. Moreover, the fund has a single asset weighting scheme.

How does EUFX operate?

The fund is not a long-term investment product. Furthermore, the fund rebalances its exposure back to -100% daily.

As a result, path dependency and compounding make long-term returns in the fund challenging to predict when compared with the EUR/USD spot rate changes.

Also, keep in mind that EUFX references the EUR/USD cross rate as reported by Bloomberg at 4 pm ET — something that can differ by a few pips compared with other reference rates.

Financial conditions and portfolio highlights of EUFX

The EUFX ETF has $2.26 million assets under management. Furthermore, it has an expense ratio of 0.97%. EUFX has an average spread of $0.09 and an average daily share volume of 338.

Reasons to invest in EUFX

The EUFX fund is a short-term investment and obtains exposure to its asset via futures contracts. Furthermore, the fund made annual returns of 7.21% and a year-to-date return of 9.07%.

The fund is suitable for short-term investing since it tracks the daily performance of the euro. It is ideal for investors who are not looking to keep their capital locked in an asset over a long period.

The ETF’s performance has been positive due to the decline in the euro currency. The US dollar has been stronger, and therefore this is good for the fund.

Another reason investors should choose this ETF is that it obtains returns on the euro’s inverse performance daily. Therefore, you can opt to trade it as a CFD, provided your broker offers the option.

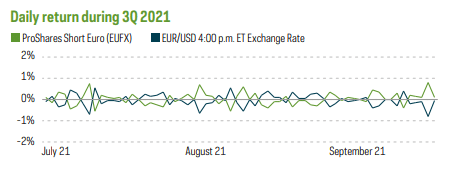

The chart above shows the daily returns of the fund compared to its benchmark, the EUR/USD exchange rate. Investors will note that the fund’s returns are opposite to the benchmark’s price since it tracks the inverse performance of the euro. Therefore, the ETF’s performance is good if the EUR/USD rate is down.

Risks associated with EUFX

In terms of risks, the fund has a high closure risk. This means that the issuer can close the fund due to regulatory or business reasons, and the probability of this happening is high.

Currency investments are risky since global factors influence them. The risk is that the euro can gain significant strength against the US dollar should the European economy strengthen. However, this will likely be a short-term risk as we can see the exchange rate of EUR/USD fluctuates up and down in a short period.

Although currency risk plays a part, the good thing about the EUFX fund is that it can mitigate your portfolio exposure to the performance of the euro.

Pros and cons

| Worth to use | Worth to getaway |

| Euro has been bearish The euro’s trend has been bearish since January 2021, which is suitable for the EUFX returns. | Currency risk Due to the exposure to a single currency, there is always a risk of the euro gaining against the US dollar and thus negatively affecting the ETF’s performance. |

| Hedging to mitigate risk EUFX is good to hedge your portfolio and minimize risk in other investments. | High expense ratio EUFX expense ratio is 0.95% which is relatively high. Therefore, investors should consider the costs involved when investing in these ETFs. |

| Benefit from short term returns The ETF is ideal for investors looking to gain from short-term returns. | Risk of closure The fund has a high risk of closure, resulting from regulatory or business reasons. |

Final thoughts

Considering all the facts, the EUFX is an excellent way to diversify into currencies and obtain a balanced long- and short-term holdings portfolio.

However, investors should note the risks involved in singular asset ETFs since the performance benchmarks the underlying asset. That said, with sound risk management and fund advisors, investors can make informed decisions and quantify the risk so that they are not overly exposing their capital to one particular asset class.