Nickel is a silvery-white lustrous metal found in its pure form in the earth’s crust. However, nickel is also a compound in iron and cobalt.

Nickel is considered a stable metal and therefore environmentally friendly. The metal’s temperature stability makes it ideal for use in electric vehicles. However, most nickel is used in stainless steel production, almost 70%. Only 7-8% of nickel goes to producing electric vehicle batteries.

With the electric vehicle market growing tremendously, the demand for nickel has increased, and therefore the metal’s price has soared.

The price increase also brings about high volatility, which presents opportunities for investors to jump on the bull run. Read this article further to discover the top nickel ETFs for 2022.

Three things to know before starting:

- Nickel’s use in the manufacturing of electric car batteries has recently caused a surge in price.

- Supply and demand factors are the main drivers behind the price of nickel.

- Nickel’s spot price increased by 22% from April 2021, and inventory has been lowering by over 50%.

Nickel ETF: how does it work?

An ETF is an exchange-traded fund that invests its assets in a basket of stocks, specializing in a particular market sector.

Nickel ETFs invests its assets in companies specializing in mining, processing, and producing of nickel. The assets are divided across a group of companies worldwide.

The fund issuers will pick the firms with the best long-term performance and rebalance the portfolio as the company’s performance change over time.

When investors choose to buy an ETF, they don’t own the stock of the companies it invests in, but they own stock of the fund itself. The ETF’s value would increase or decrease depending on the index that it tracks and the performance of its significant assets.

What to check before choosing ETFs with nickel?

Before investing in nickel ETFs, there are a few things to consider.

- The price volatility of nickel

Investors should be mindful of the volatility of the nickel market sector. Since the price is also susceptible to fundamentals, it can rise or decrease rapidly. Therefore, you need to consider the risk involved.

- Nickel’s use in EVs

The use of nickel in electric vehicle batteries, although in a small amount, impacted the metal price. The EV industry is rapidly evolving and expanding; it’s become a growing market. Therefore, the demand for nickel will increase in the future.

Best ETFs with nickel to buy in 2022

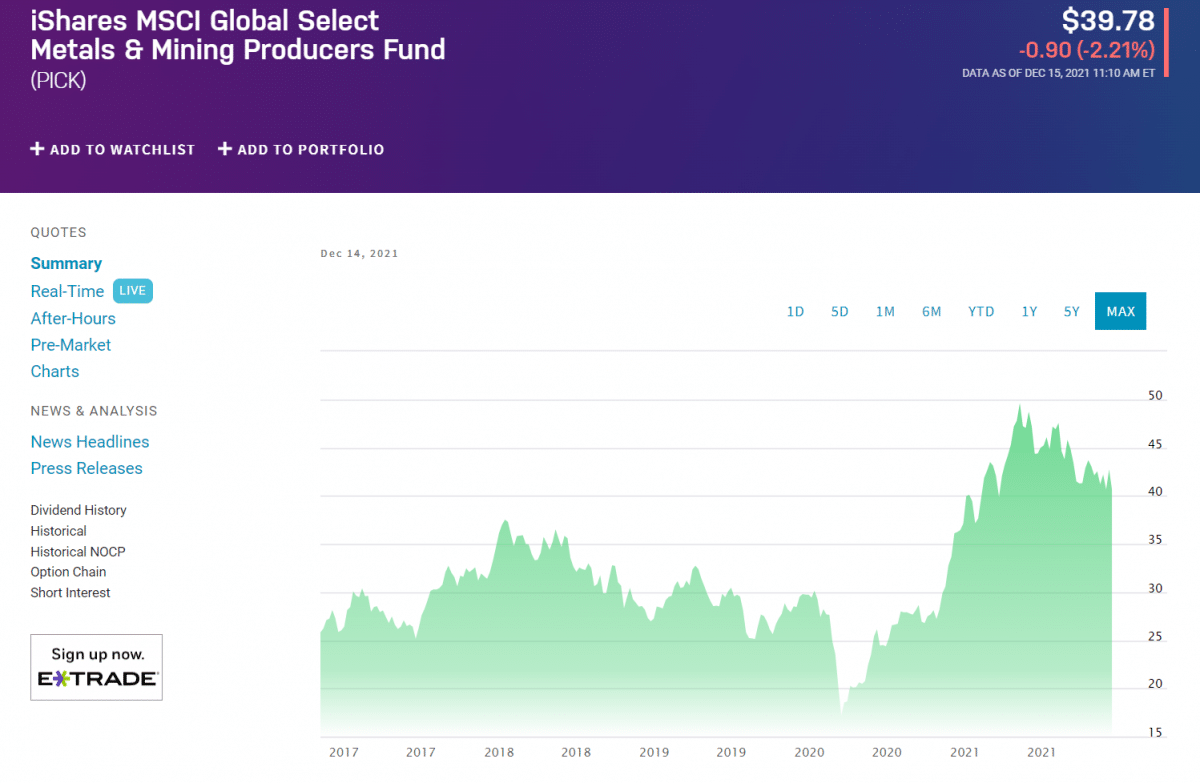

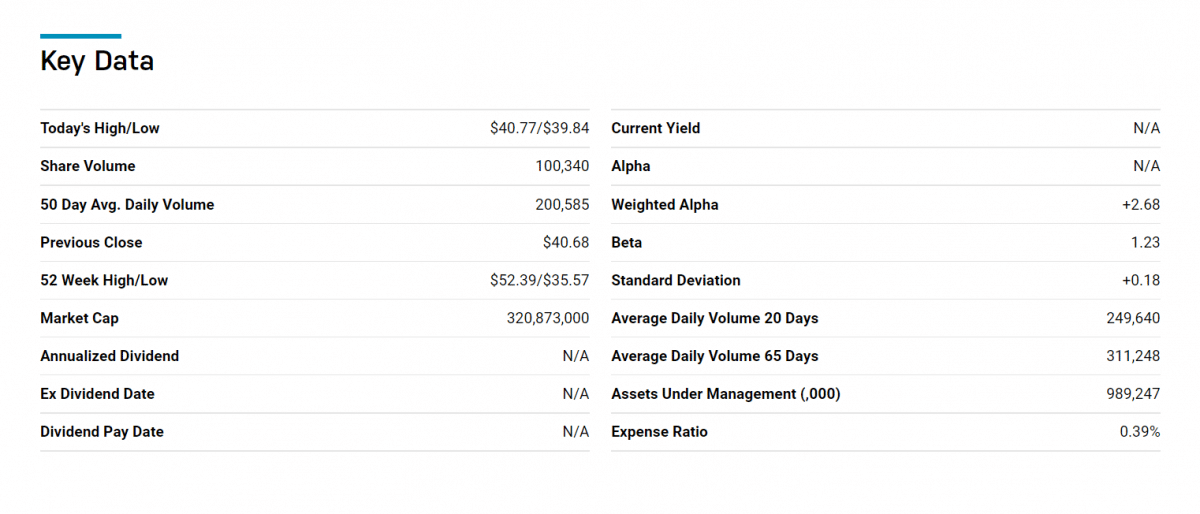

1. iShares MSCI Global Metals & Mining Producers ETF (PICK)

Price: $39.78

Expense ratio: 0.39%

The PICK ETF had its inception on 31 January 2012 and is managed by BlackRock. The ETF allows access to the mining industry, which includes a group of companies that extract and produce metals, which contain nickel. The PICK ETF has $1.01 billion assets under management.

PICK is a good fit for investors looking to venture into short-term mining stocks.

The fund has 220 holdings, and it allocates 7.7% of its equities to the BHP group. Furthermore, the ETF tracks the MSCI ACWI Select Metals & Mining Producers Ex Gold & Silver IMI, excluding gold and silver mining companies.

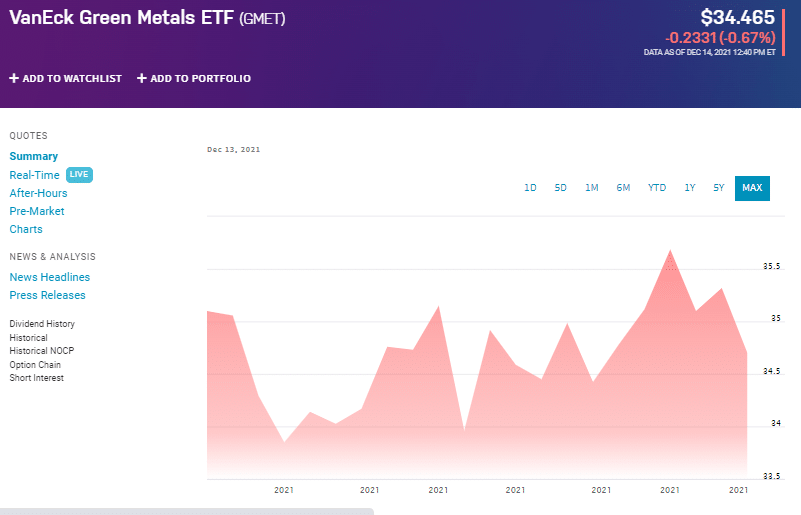

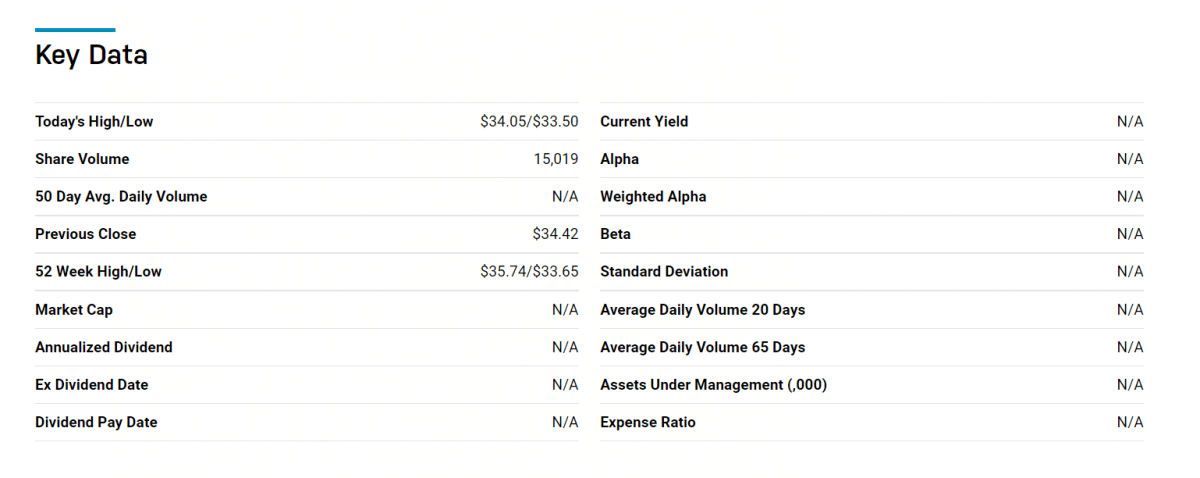

2. VanEck Green Metals ETF (GMT)

Price: $34.46

Expense ratio: N/A

The VanEck Green Metals ETF is the newest on our list, having debuted on the New York Stock Exchange Arca on 9 November 2021.

VanEck issued the fund, focusing on the global metals and mining equities market. GMET tracks a market-cap-weighted index of global companies involved in mining, refining, and recycling metals and rare earth elements used in technologies contributing to clean energy transition.

The fund has $10.6 million assets under management, and it has 300,000 shares outstanding.

The fund has 45 holdings and invests 8.98% of its assets in the Freeport-McMoran Inc. company.

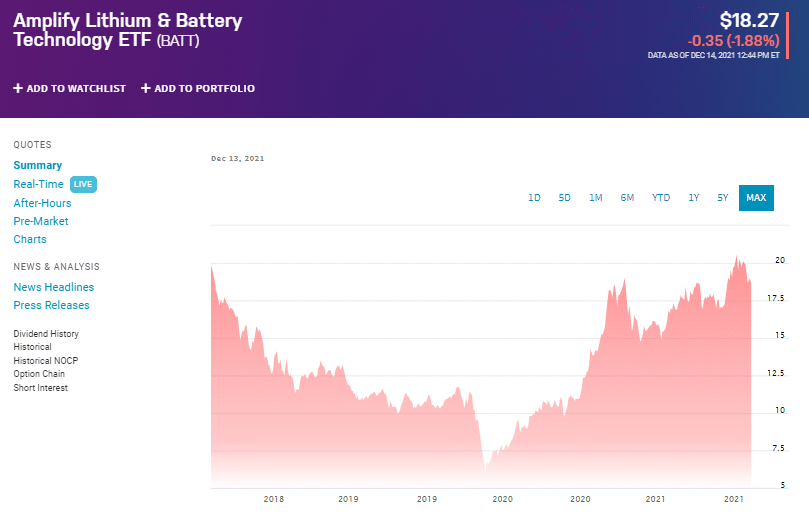

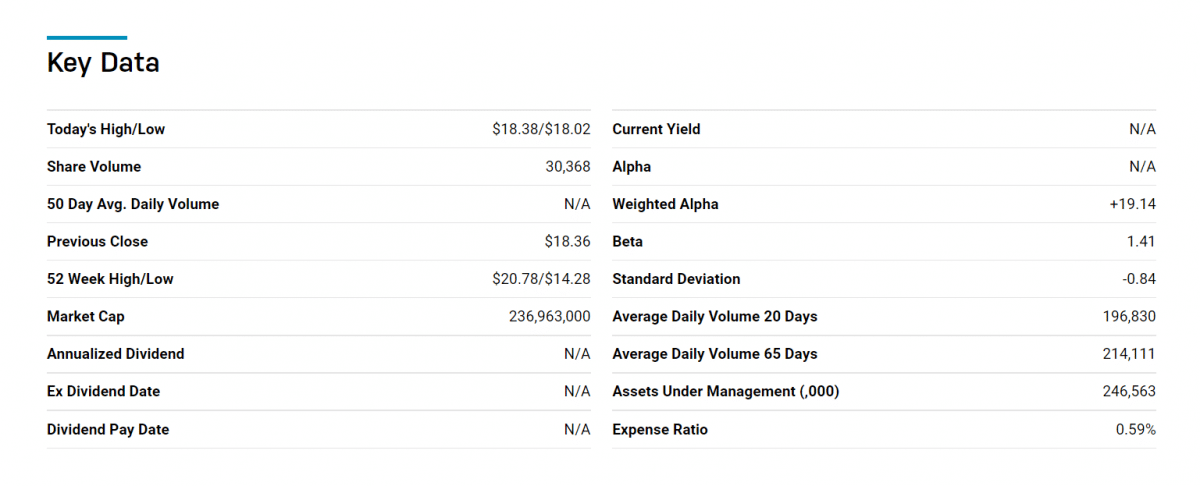

3. Amplify Advanced Battery Metals and Materials ETF (BATT)

Price: $18.27

Expense ratio: 0.59%

Amplify is the issuer of the BATT ETF and started trading on the New York Stock Exchange Arca on 6 June 2018.

BATT tracks a market-cap-weighted index that invests in global advanced battery material companies such as those that mine or produce lithium, cobalt, nickel, manganese, and graphite. The fund has $248.80 million assets under management and a weighted market cap of $92.29 billion.

The fund has 73 holdings and invests in companies with 50% of its revenue sourced from mining exploration, production, development, processing, or recycling of lithium, cobalt, nickel, manganese, or graphite.

Furthermore, BATT tracks the EQM Lithium & Battery Technology Index. The fund has 86 holdings, with the largest weighting allocated to Contemporary Amperex Technology and BHP Group.

BATT has paid out dividends of $0.03 annually, and the subsequent dividends are due December 2021.

Pros and cons

There are some pros and cons that you must look into before investing in nickel ETFs.

| Worth to use | Worth to getaway |

| Green metal Nickel’s appeal as a green metal has attracted investors keen to fund sustainable investments. | Price volatility The price is volatile and sensitive to supply and demand fundamentals, and investors should consider this risk. |

| Diversification & inflation hedge Nickel allow diversification into mining, but it is also an excellent investment to hedge against inflation. | Few ETFs for nickel only Only a few ETFs invest in nickel, not giving investors many options. |

| Electric vehicle market The growing electric vehicle market will increase the demand for nickel since there is a need for electric car batteries. | Nickel mining requires significant capital Mining nickel requires extensive capital investment. This limits the companies that the ETF can invest assets in. |

Final thoughts

After considering all the facts, investing in nickel seems to be a good option for investors looking to diversify their funds. However, it comes with its own set of risks which investors should weigh carefully before deciding on the correct fund.

The upside is that the mining companies the funds invest in are historically good performers and the world’s leading exploration and mineral processing companies. This should give investors peace of mind before venturing down this road.