An essential commodity in the global economy, natural gas consumption and supply may be susceptible to economic, climatic, industrial, and geopolitical changes, resulting in considerable short-term price variations.

As a result, investors may earn returns based on the actual performance of natural gas via ETPs such as ETFs and ETNs, although fund-specific differences can be significant.

Three things about natural gas ETFs to know before starting:

- Investors may get exposure to natural gas prices by investing in these funds.

- Their futures contracts are used as their holdings in these commodity pools.

- Their prices have begun to rise after 2020 when they fell to their lowest levels in 30 years due to lifted supply constraints and the release of lockout restrictions.

Natural gas is a crucial commodity globally to create energy, heat homes and buildings, power consumer and commercial appliances, and act as a feedstock for various chemicals.

As a commodity, the price of natural gas varies in response to changes in demand and supply. Natural gas prices are affected by economic growth, weather, excessive/insufficient gas production, government policies related to natural resource exploitation and transportation, and substitution (new applications for natural gas and new alternatives replacing natural gas), among other things.

What are natural gas ETFs?

An exchange-traded fund that tracks the performance of the natural gas market is known as a “natural gas ETF.” Commodities ETFs include the natural gas ETF, which is a subcategory. In theory, commodity funds should be easy to set up. It’s not correct to say this, however. One of the last things any asset management organization wants to do is stockpile truckloads of natural gas in one’s backyard.

How do natural gas ETFs work?

As an asset management business, you may obtain exposure to natural gas by taking a long position in the natural gas futures market. However, if you’re an ordinary retail investor, you have no means of getting exposure to a hazardous asset class like natural gas without setting up a futures account.

Investors who purchase futures contracts face the uncomfortable requirement of daily mark-to-market margins and the danger of a margin call, even if they do not intend to use them. In a natural gas ETF, a retail investor may have access to a complex derivative while keeping the structure of an essential vanilla commodity. Consequently, it opens up a wide range of investments to broader investors, enabling them to spread their risk and diversify their rewards.

What to check before choosing ETFs?

- It’s a great moment to buy when the fund’s 52-week price range is at its lowest point.

- Take a look at the ETF’s historical dividend yields. If the yield seems to be increasing, consider investing.

- The ETF is a good option if the result is constant. But, on the other hand, conservative investors may want to think about it.

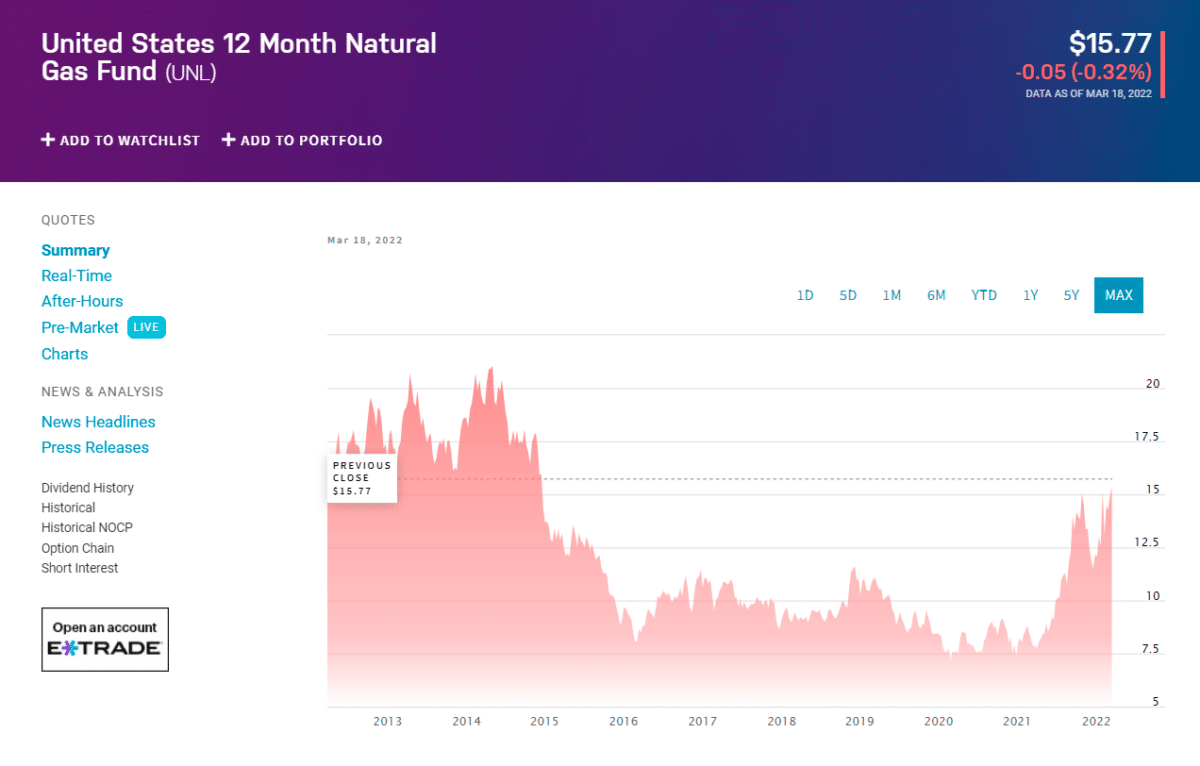

The United States 12 Month Natural Gas Fund (UNL)

As a commodity pool, UNL pools its investors’ money and trades commodities on their behalf in the form of futures and options. It owns natural gas futures contracts and diversifies its positions over different maturities to prevent the negative impact of contango, which is a rise in natural gas prices.

There is also the option of UNL participating in forward and swap deals. There are 12 months of futures contracts for UNL to compare its performance against, including the near-month contract that is about to expire and the next 11 months. As an inflation hedge, investors may be interested in UNL.

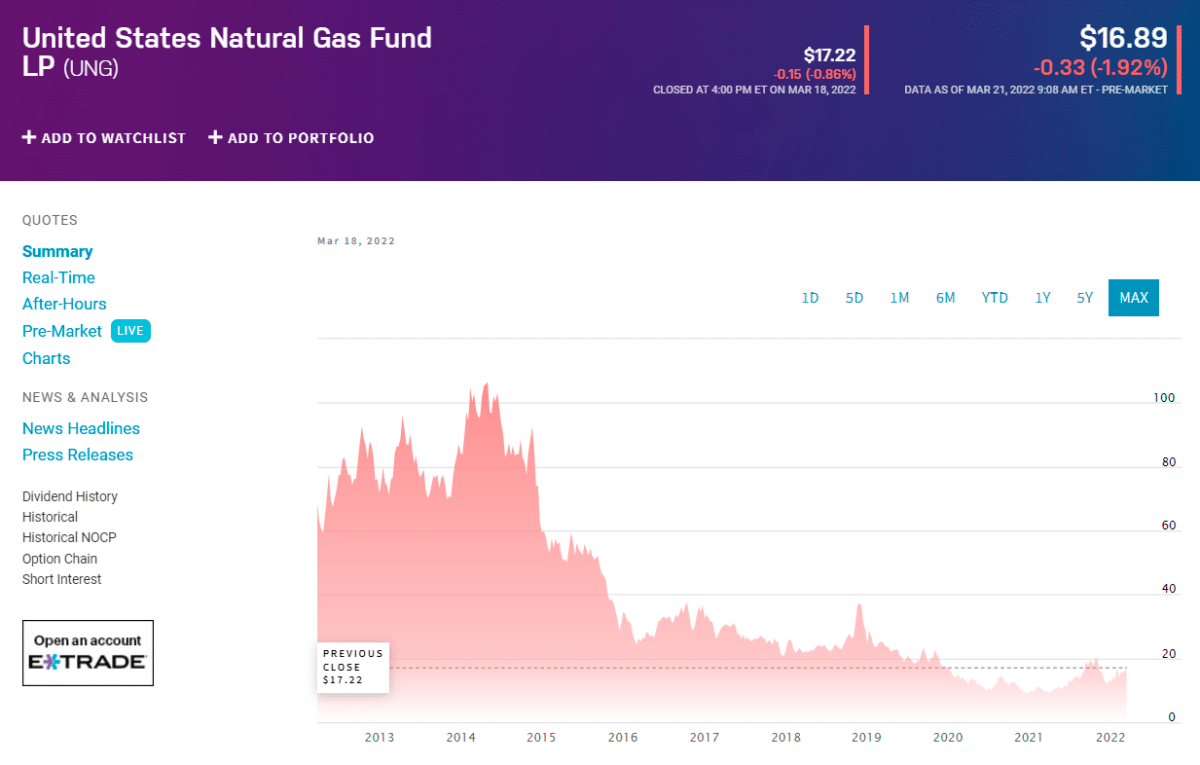

The United States Natural Gas Fund (UNG)

(UNG), which, like UNL, is a commodities pool that aims to provide investors exposure to the price of natural gas. UNG is a futures contract for natural gas traded on the New York Mercantile Exchange that represents daily fluctuations in the benchmark futures contract (NYMEX).

On the other hand, UNG invests primarily in short-term futures contracts, which expire within the month after the current one. 6 Contango may have a detrimental impact on a fund’s performance. Thus short-term traders should take caution while investing in it. It might also serve as a kind of inflation insurance.

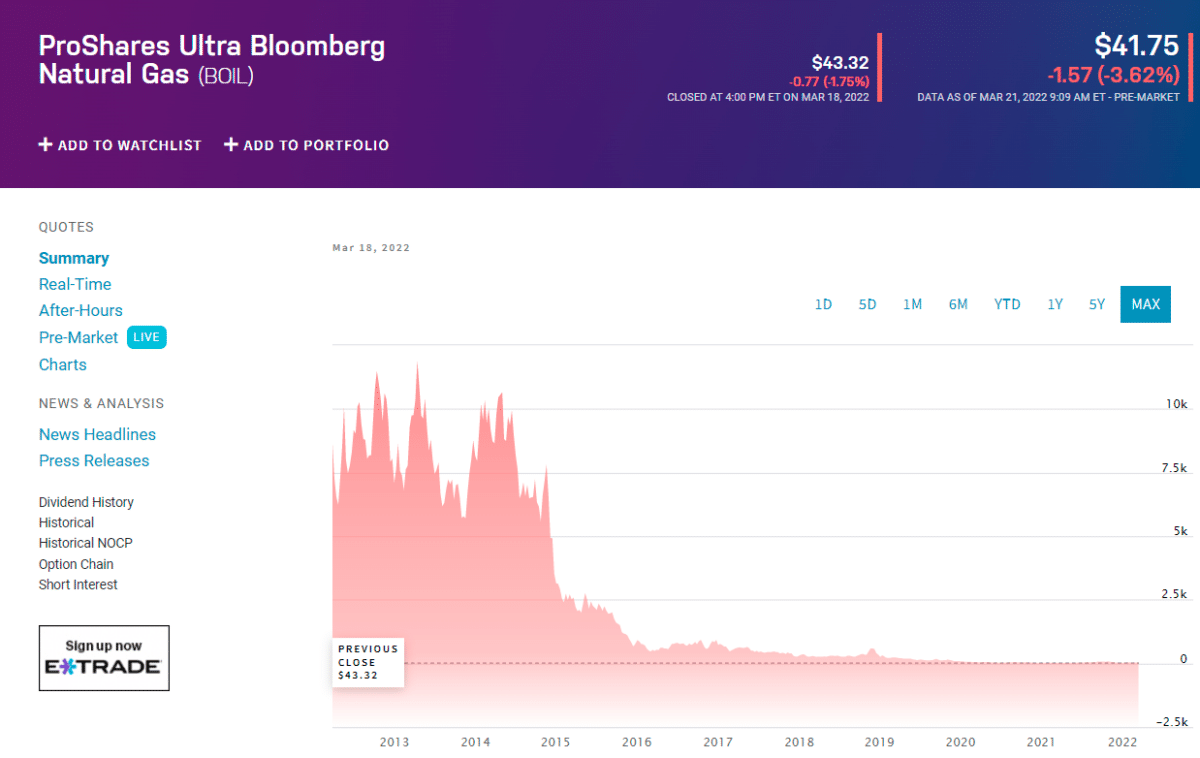

ProShares Ultra Bloomberg Natural Gas (BOIL)

This ETF offers 2x daily leveraged exposure to natural gas, an asset class that may suffer substantial price fluctuations in a short period. BOIL is only intended for experienced, active investors because of the fund’s high level of volatility and its use of explicit leverage.

It’s important to remember that BOIL intends to provide leveraged returns based on natural gas futures contracts index rather than on-the-spot natural gas prices. Therefore, a fund’s returns from futures-based investments may differ from a spot investment, depending on the futures curve’s slope. For obvious reasons, an investment in spot natural gas is not realistic for most investors. Also worth mentioning is that BOIL offers a daily reset option, which means that if this position is left open for an extended period, it should be monitored regularly.

Pros and cons

| Worth to invest | Worth to getaway |

| Energy equities are projected to provide investors with higher profits. | Despite their wide range of investments, ETFs may be volatile, depending on their stocks. It is possible to estimate the fund’s volatility by gauging its spread. |

| Investing in ETFs is best done over a lengthy period. | Investing in ETFs outside of the United States requires careful consideration of the country’s economic stability. |

| If you want to diversify your portfolio, you may utilize energy ETFs. | The last point to consider is that foreign governments may not always be on your side in establishing laws that impact your assets. |

Final thoughts

Natural gas exchange-traded products may give investors easy exposure to natural gas price swings. Still, there are some significant issues to bear in mind, such as yearly management fees, fund expenditures linked to transaction costs, performance drag from negative roll yield, and possibly poor liquidity for the instruments themselves. Moreover, as seen by the numbers, no one of these tools is especially good at predicting natural gas spot prices over lengthy periods.