About the ISHG ETF

The ISHG fund’s inception as a component of the Nasdaq Arca was on 21 January 2009. BlackRock issued the fund, and they have been its managers since its inception. The iShares 1-3 Year International Treasury Bond ETF benchmarks the FTSE World Government Bond Index-Dev Markets 1-3 Years Capped Select Index.

The purpose of the ISHG ETF is to track a market-value-weighted index of a developed market, non-US government-issued debts maturing between one to three years. Therefore, the fund invests in bonds of developed countries. Rebalancing of the fund occurs monthly.

ISHG Fact-set analytics insight

ISHG has assets under management of $75.13 million and a total of 950,000 (as of 10/12/21) shares outstanding. The fund’s weighted market cap value is not available. The ISHG ETF has an expense ratio of 0.35%.

ISHG performance analysis

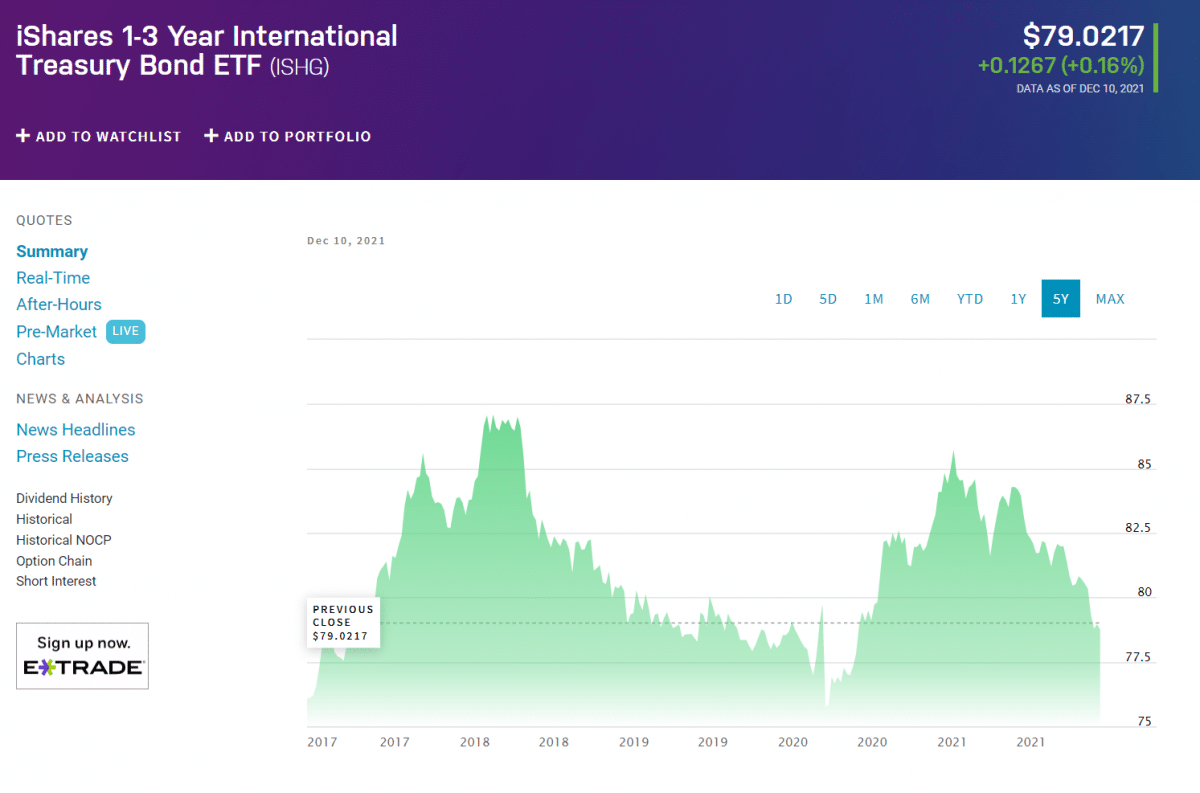

ISHG had an annual return of -6.46% and a year-to-date return of -7.22%. The fund has been lagging behind its benchmark index for the last decade. Dividend payments occur monthly, and the latest dividend rate was $1.43.

ISHG key holdings

The ISHG ETF has 141 holdings, spread across developed countries. The fund will invest at least 90% of its assets in the index’s component securities and may invest up to 10% of its assets in certain futures, options and swap contracts, cash, and cash equivalents.

The top ten holdings by country are listed below.

| Holding name | % of assets |

| Sweden (1.5% 13 November 2023) | 2.19% |

| Treasury Issues (Long-term) | 1.98% |

| Government of Ireland (3.4% 18 March 2024) | 1.92% |

| Japan (0.1% 20 December 2022) | 1.88% |

| Australia (0.25% 21 November 2024) | 1.82% |

| Norway (2.0% 24 May 2023) | 1.76% |

| Australia (5.5% 21 April 2023) | 1.69% |

| Ireland (3.9% 20 March 2023) | 1.56% |

| Denmark (1.5% 15 November 2023) | 1.55% |

| Norway (3.0% 14 March 2024) | 1.55% |

Industry outlook

The ISHG fund invests only in developed markets bonds, with one to three years. The fund has been behind its benchmark index for the last decade, and its annual returns are -6.46. However, the fund has been paying dividends monthly to investors.

Investing in foreign bonds can be risky. However, the iShares 1-3 Year International Treasury Bonds ETF is a short-term investment portfolio. Furthermore, rebalancing of the fund occurs monthly. Investors choose such funds to diversify their funds, and it’s an attractive option if the US Treasury yields are lower.