The vendor claims that the FXPro Dragon is based on an algorithm that allows you to make consistent profits without getting big drawdowns. In addition, the EA does not make spur-of-the-moment decisions. Rather, it compiles facts and figures without letting any fear and stress get in the way. So, you are told that it is the robot that you need to have. We disagree. Read our review to find out why.

FXPro Dragon trading strategy

When it comes to the trading strategy, the team just says that the EA does not open orders all the time and mainly awaits the best moment to enter the market. This description does not give us a clear insight regarding how the system really works. You will be interested to know that we later discovered that the grid method is part of the algorithm.

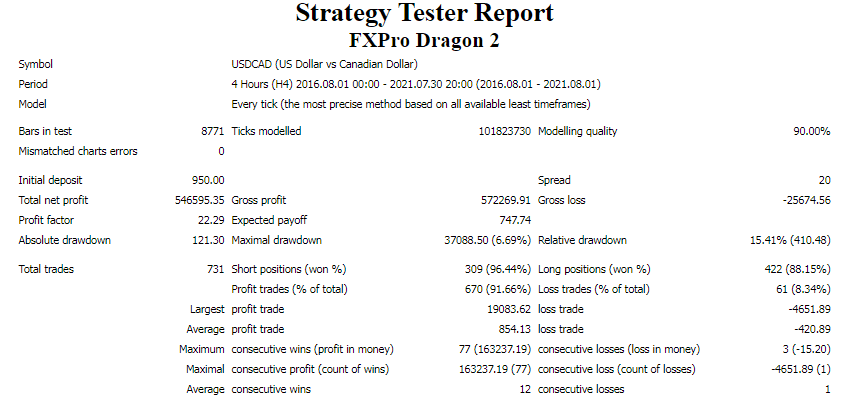

FXPro Dragon backtesting report

This is the backtest report for the USDCAD pair. On that note, the efficiency of the robot’s trading algorithm was tested from August 2016 to July 2021 using the H4 timeframe. With an initial deposit of $950, the EA completed 731 trades, winning 91.66% of them. As a result, a total net profit of $546,595.35 was realized.

Most of the short (96.44%) and long (88.15%) positions were successful. The profit factor of 22.29 also demonstrated the bot’s high return rate. The drawdown level (6.69%) was low.

FXPro Dragon live results

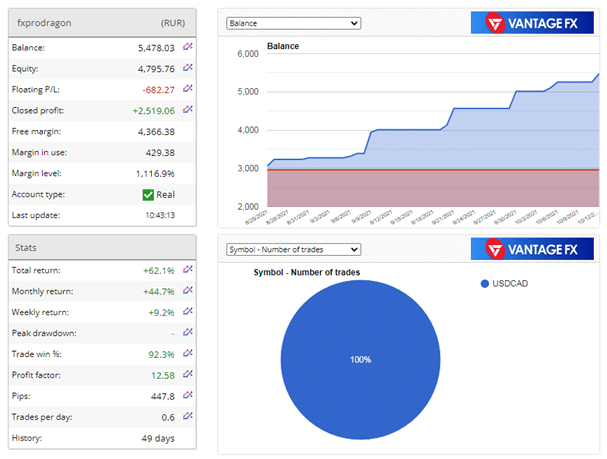

Let’s see if the above results can be replicated in real market conditions.

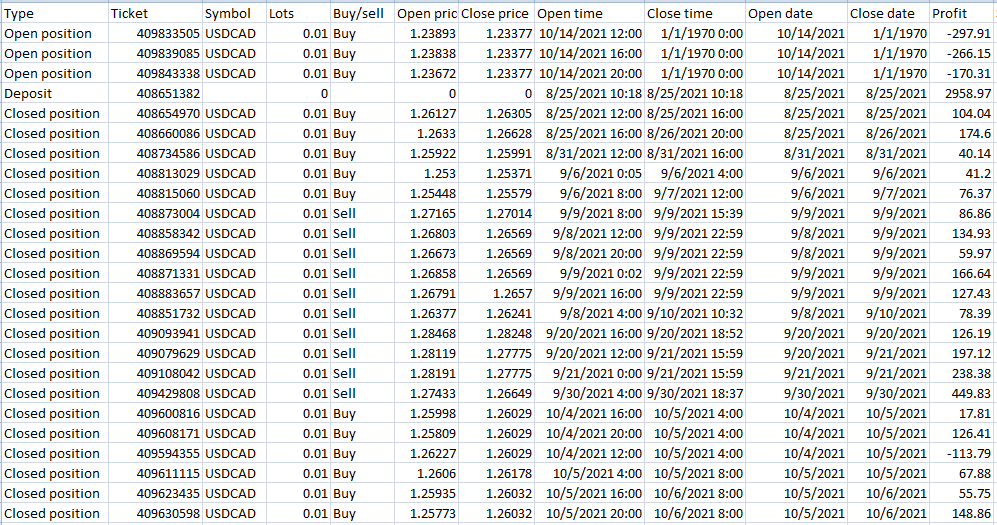

This account was opened just recently, on August 25, 2021, and deposited at $2,958.97. In less than two months, the bot has generated a profit of $2,519.06, increasing the balance to $5,478.03.However, a loss of $-682.27 has been made. The free margin is $4,366.38.

The EA has traded for 49 days, and so far, the total return is 62.1%. The profit factor (12.58) is lesser than the one we saw in the backtest report. It shows that the system generates lower returns in the live market. We have weekly and monthly return rates of 9.2% and 44.7%, respectively.

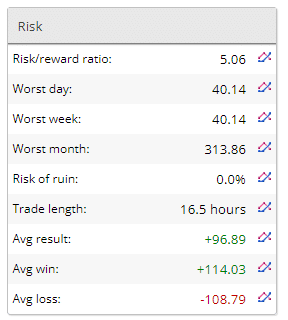

The average trade length is 16.5 hours. The risk/reward ratio of 5.06 means that the robot takes many risks and receives lesser returns in the process. Fortunately, the account is not at risk of being ruined. An average win is $114.03 when an average loss is -$108.79.

This data highlights the grid approach pesent. Furthermore, fixed lot sizes —0.01 are used. We could not help but note that the losses suffered were quite big.

Some features of FXPro Dragon

| Total return | 62.1% |

| Maximal drawdown | N/A |

| Average monthly gain | 44.7% |

| Developer | N/A |

| Created, year | N/A |

| Price | $129, $169 |

| Type | Grid |

| Timeframe | H4 |

| Lot size | 0.01 |

| Leverage | N/A |

| Min. deposit | N/A |

| Recommended deposit | N/A |

| Recommended brokers | 4 digit brokers |

| Currency pairs | GBPUSD, USDCAD, EURUSD, USDJPY, and USDCHF |

| ECN | N/A |

The vendor also says that the robot:

- Runs on the MT4 trading platform

- Is operation 24/5

- Has easy to use installer

- Has a responsive support team

- Provides free updates.

Main things that make FXPro Dragon an unreliable EA

- Zero vendor transparency

The team behind FXPro Dragon is unknown since its background data is not featured in the presentation. So, it would be risky to enlist the services of these professionals because their skills and competencies cannot be determined. They can easily scam you and get away with it.

- Grid strategy

As earlier stated, the devs have not elaborated the strategy their tool uses, but we have learned that the grid system is incorporated. This approach is very dangerous and is famed for blowing up accounts. Therefore, investing in the EA will make your account prone to losses and eventually crash.

Pricing details

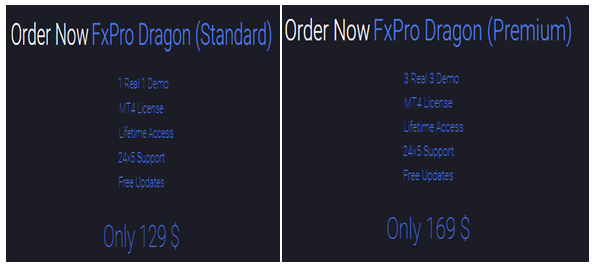

This robot comes with two different offers — the Standard and Premium packages, which cost $129 and $169 respectively. The former plan features 1 real and 1demo account, while the latter includes 3 real and 3 demo accounts. A money-back guarantee is missing, though.

Other notes

FXPro Dragon opened a page on FPA on June 10, 2021, but no customers have given their reviews since then. This shows that the robot is still unpopular among Forex traders.