Forex Flex EA is an MT4/MT5 compatible trading tool that offers full trading automation. It uses optimized settings and regular updates to ensure you get high returns and minimal losses. As per the vendor, this is the best MT4 tool since 2012. The main approach used by this FX EA involves virtual trades which help identify the right opportunity for the EA to open and manage trades.

Forex Flex EA trading strategy

As per the vendor, this FX EA uses 12 different approaches but there is no mention of what they are. The EA opens virtual trades using which it monitors the market and looks for profitable opportunities. When the perfect entry points are detected, the EA will open trades and manage them. The vendor states that the system is constantly updated to keep up with the current market scenario. We find the explanation is vague and does not reveal the approach used.

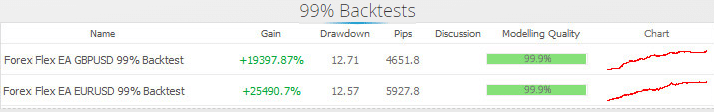

Forex Flex EA backtesting report

A couple of backtests are present on the official site. They are of 99.9% modeling quality and show a drawdown of 12 %. However, the vendor does not provide a detailed strategy tester report which makes it difficult to analyze the strategy and its efficacy. The insufficient details make us suspect this is not a reliable system.

Forex Flex EA live results

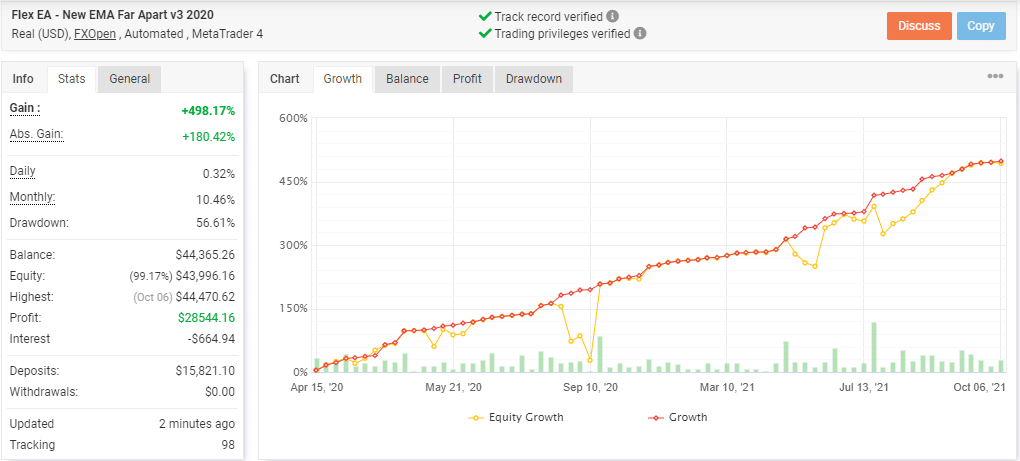

The vendor provides a few live trading results for this ATS. Here is a real USD account using the FXOpen broker on the MT4 platform verified by the myfxbook site.

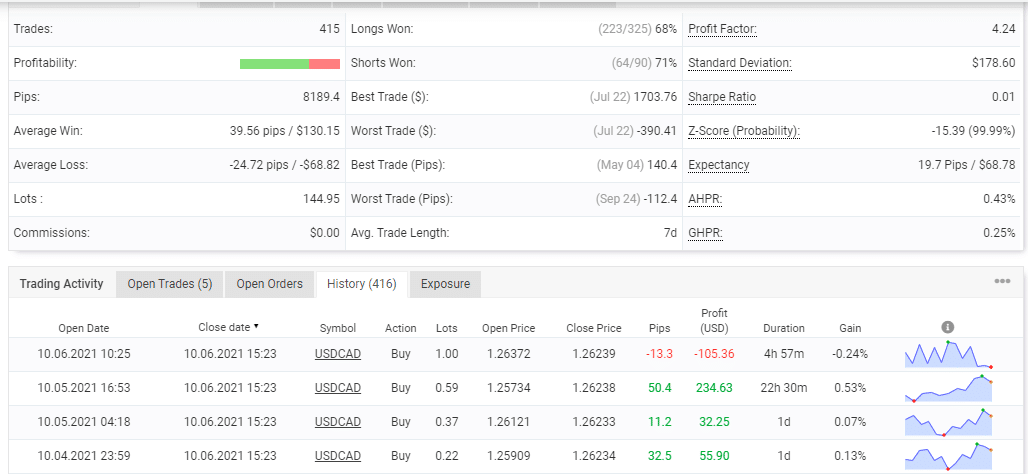

From the above stats, we can see a total profit of 498.17% and an absolute profit of 180.42% are present for a deposit of $15,821. The big difference between the total and absolute profit values indicates a risky approach. Further, the dangerous strategy is confirmed by the high drawdown value of 56.61%. The varying lot sizes found in the trading history also confirm that this EA uses a dangerous approach.

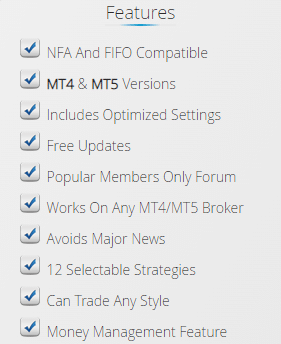

Some features of Forex Flex EA

As per the vendor info, this EA uses a money management feature and works on all currency pairs.A minimum balance of $1000 is recommended for the standard account, $100 for a micro or cent account, and $10 for a nano account. There is no info on the leverage and timeframe to use. The vendor recommends HotForex and FXOpen brokers though this system works with any MT4/MT5 compatible broker.

| Total return | 498.17% |

| Maximal drawdown | 56.61% |

| Average monthly gain | 10.46% |

| Developer | FlexEA |

| Created, year | 2012 |

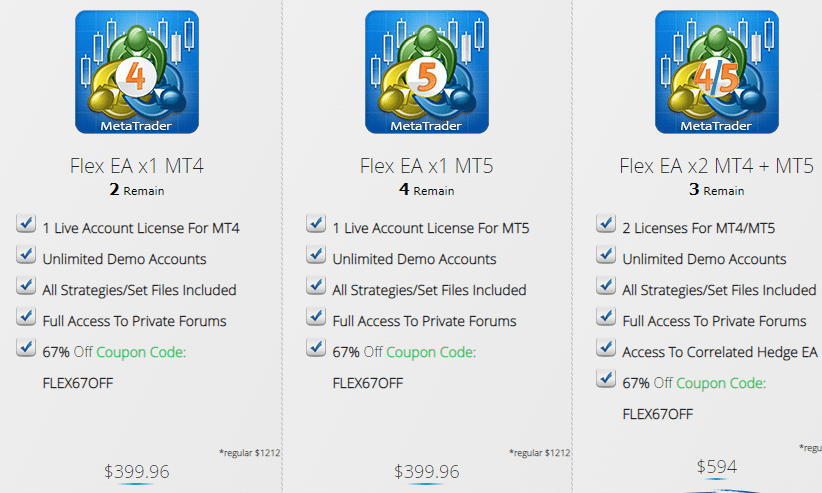

| Price | $399.96 – $594 |

| Type | Precision entry point |

| Timeframe | N/A |

| Lot size | Not less than 1000 units per 0.1 of a standard lot |

| Leverage | N/A |

| Min.deposit | N/A |

| Recommended deposit | $1000 |

| Recommended brokers | HotForex, FXOpen |

| Currency pairs | All currency pairs |

| ECN | N/A |

Main things that make Forex Flex EA unreliable

Here are a few major factors that make this FX EA unreliable.

1) High drawdown

A drawdown of more than 50% indicates that the EA can wipe out more than half of your capital with its risky approach. While the vendor claims that the system is safe and trustworthy, the results are contrary.

2) Zero vendor transparency

We cannot find info on the vendor, their founding year, location details, phone number, etc. The lack of transparency raises a red flag for this FX robot.

3) Undisclosed trading approach

Although the vendor mentions 12 strategies are used, they are not named and there is no explanation for them. The lack of info on the approach further confirms our doubts regarding the trustworthiness of this EA.

Pricing details

To buy this FX EA, you need to choose from the three packages offered namely, the MT4 version, MT5 version, and a combined package. While the MT4 and MT5 cost $399.96 each, the combination package with two licenses costs $594. The vendor offers a 30-day money-back guarantee. Compared to the price of other similar products, we find the price of this ATS is exorbitant and not worth it.

Other notes

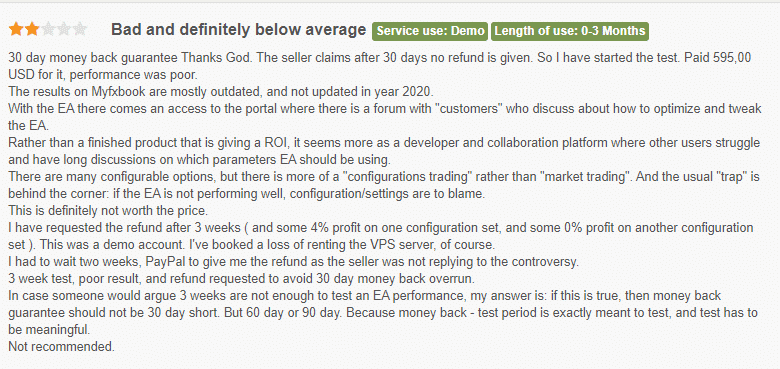

We found 79 reviews for this FX EA on the Forexpeacearmy site with a rating of 4/5. Here is a review from a customer:

From the above feedback, we can see the product is not worth the price as it shows poor performance.