A mutual fund allows you to participate in the stock market without your direct involvement in the process. The majority of the equity of US corporations comes from mutual funds. Typically, people participating in mutual funds are either institutions or retail traders.

Mutual fund investing presents its own sets of challenges compared to when you directly invest in individual assets yourself. Among the benefits are:

- Diversified portfolio

- Cost-effectiveness

- Professional managers

- High liquidity

However, you cannot avail of these advantages for free. They come at a particular cost, which you will learn later.

Pros and cons of mutual fund investing

As an investor, you must be aware that all types of investments carry certain risks. There are pros and cons to consider. We can say the same thing about mutual funds.

Mutual funds pros

- A mutual fund holds multiple assets, which reduces investment risk.

- Liquidity is superb. Mutual funds can redeem your shares in a matter of seven days, but redemption is quicker in actual practice.

- Open-end funds and closed-end funds hire professional traders to manage the investments.

- Small-time investors can partake in opportunities generally enjoyed by more significant investors only.

- Mutual funds can provide you multiple services for your convenience.

Mutual funds cons

- You will handle multiple charges and expenses.

- Your income is less predictable.

- You cannot customize your portfolio.

Mutual fund types

As you will find out later, there are three primary forms of mutual funds. However, another type can fall into one of the three types in the list but is unique in its own right. That is the exchange-traded fund (ETF). What makes it different is that it is listed in an exchange.

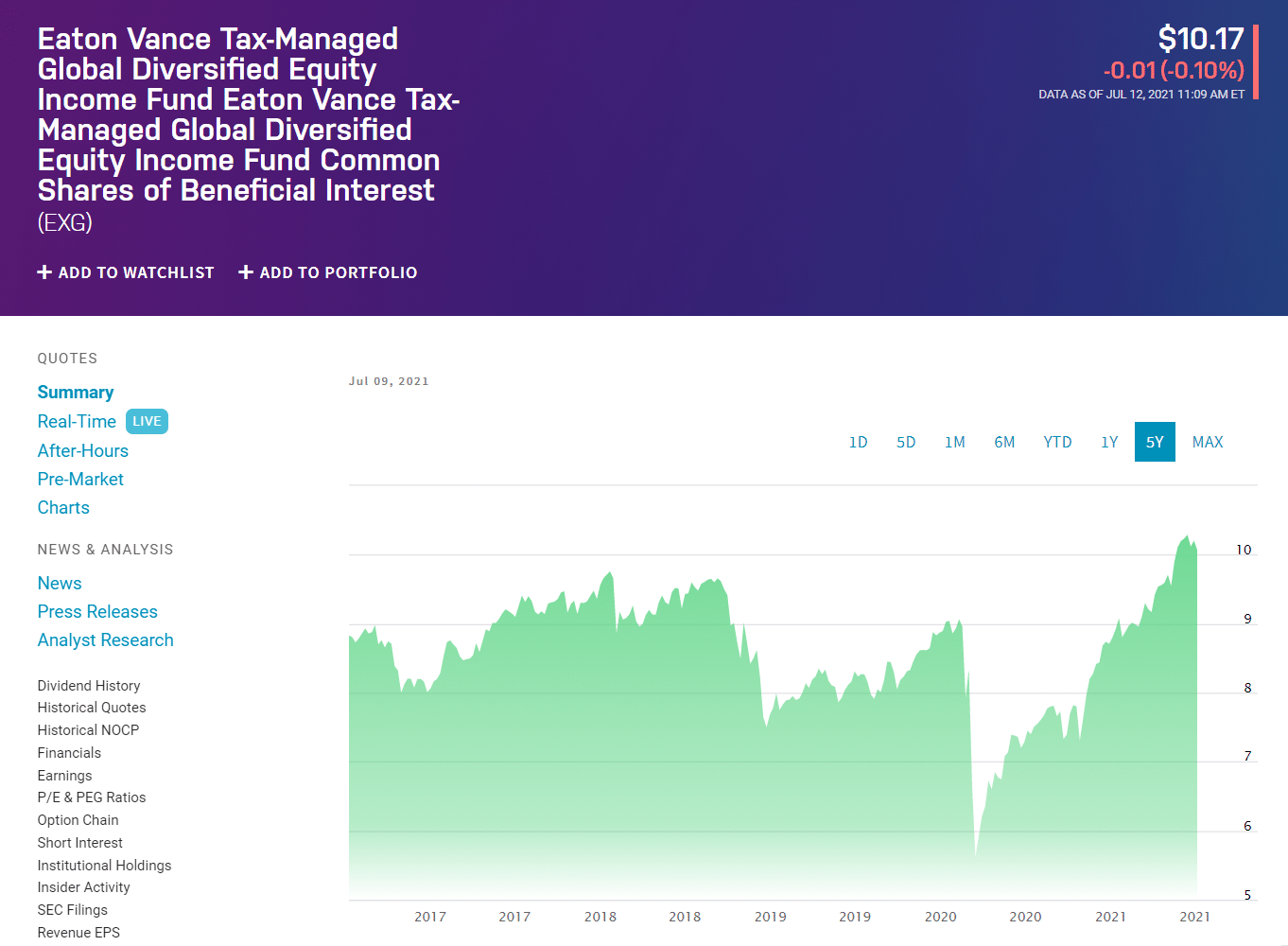

Closed-ended funds

A closed-ended fund allows you to own shares at one time only, that is, at the time of a fund created through an initial public offering. After this, the company managing the fund lists the shares of investors at a particular stock exchange.

If you want to liquidate your shares, you cannot return them to the fund as you please. To do so, you must get some other investors to buy your shares at the stock market. One of the most considerable funds in this category is Eaton Vance. See the above image.

Unit investment trusts

A unit investment trust (UIT) allows you to get shares for yourself at the time of fund creation only. Generally, these funds have a predetermined life span, which is predefined at creation time. Unlike closed-ended funds, you can return your shares to the fund anytime.

At your disposal, you may wait for the fund to reach its termination period, after which you can return the shares to the fund and realize returns. You can opt to put your shares in the stock market on rare occasions to consider other investors.

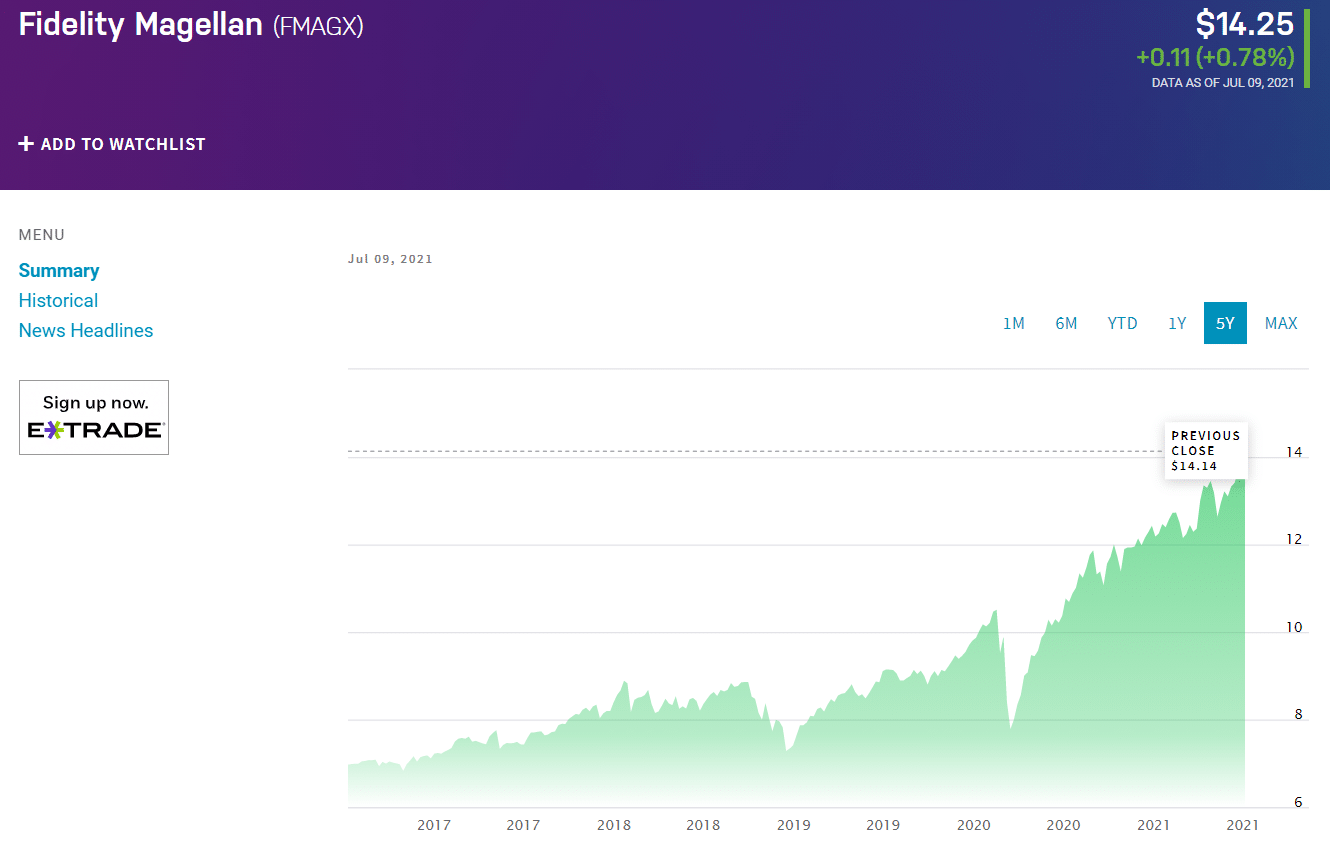

Open-ended funds

An open-ended fund must fulfill its obligation to redeem your shares when the business day ends at the net asset value. This practice is a requirement particularly true in the US. One of the oldest open-end funds is Magellan. Refer to the above image.

Exchange-traded funds

An exchange-traded fund combines the attributes of the three major types. However, the ETF structure is either UIT or an open-end fund. You can buy or sell ETFs at an exchange, which uses a mechanism to keep the price quote as close as possible to the NAV of the ETF assets.

Mutual funds based on primary investment

Another way of grouping mutual funds is according to the primary investment. The fund’s brochure defines this investment focus. In addition, the prospectus specifies the securities permitted, investment style, and investment goals.

Money markets

Money market funds focus their investments on extremely liquid and short-period assets. You might consider putting your money in this type of fund as an alternative to bank deposit accounts. This is even though the government insures bank deposit accounts as opposed to money market funds.

Bond funds

Investments in bond funds typically go to debt assets or fixed-income securities. These funds can be subdivided further into:

- Types of bonds owned (e.g., municipal bonds, government bonds, corporate bonds, junk bonds, etc.)

- Bond maturity (i.e., short-term, medium-term, or long-term)

- The country is issuing the bond (e.g., US, international, etc.)

- Whether the bond is taxable or not

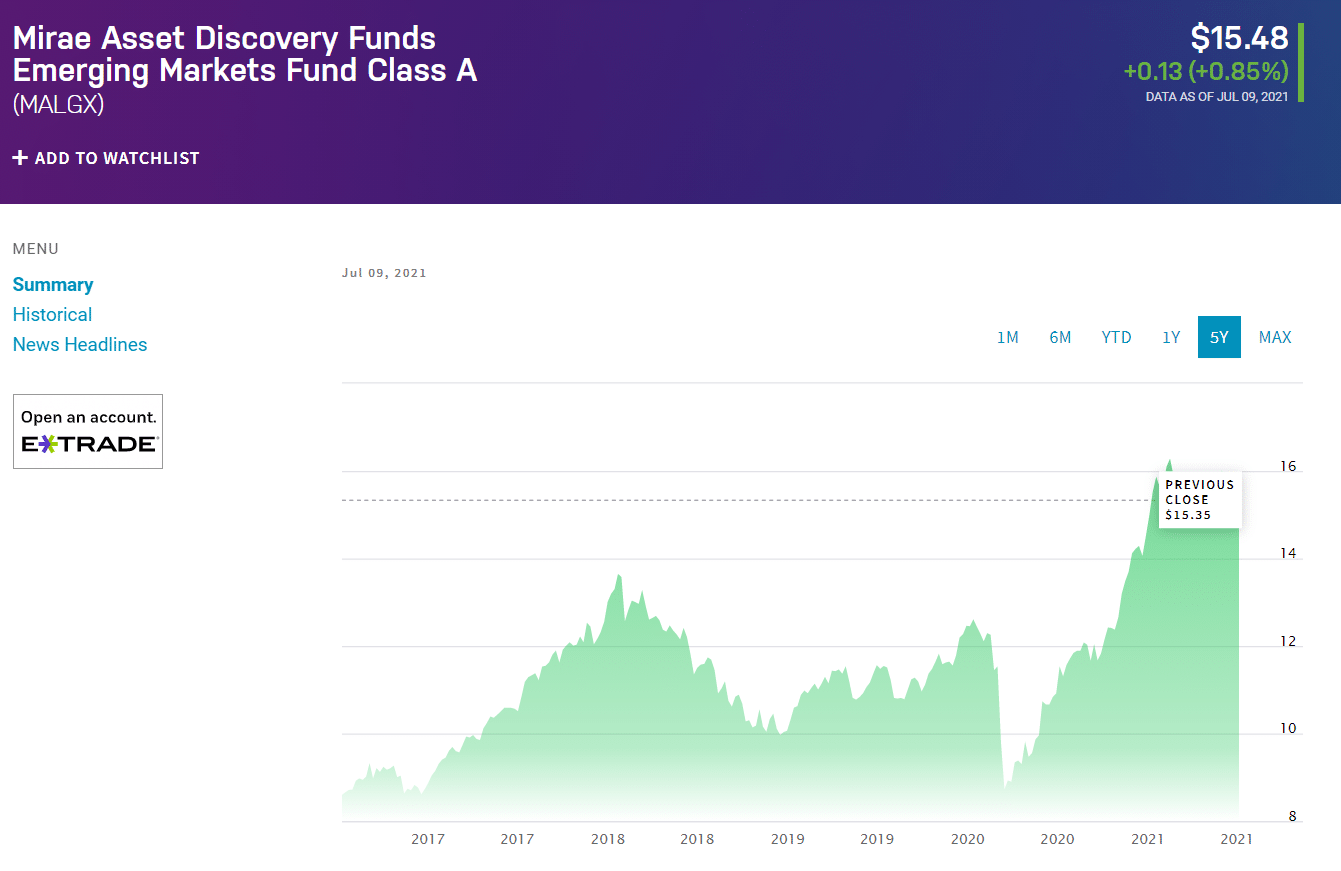

Stock funds

They are also known as equity funds, which buy common stocks. Managers handling these portfolios may consider getting stocks with specific attributes, such as:

- Stocks in a given region or country

- Stocks operating within a particular industry

- Promising stocks in the estimation of fund managers

- Highly performing stocks

- Stocks within a specific market cap bracket

- High-dividend stocks

One of the highest-performing stock funds recently is Mirae Asset Discovery Fund. Refer to the above chart.

Hybrid funds

Hybrid funds invest in an assortment of securities such as equities, bonds, or even convertible assets. Examples of hybrid funds are the following:

- Lifestyle funds

- Convertible bonds

- Blend funds

- Target-date funds

- Balanced funds

Mutual fund expenses

Along with other investors, you will cover the costs involved in running your mutual fund portfolio. As a result, you might see deductions from your account. Alternatively, the fund may pay other expenses upfront, but the investors will still handle the costs at the end of the year.

Management fee

The mutual fund pays a management fee to the company that creates and manages the fund and offers consultative and administrative services. The board of the fund evaluates the management fee yearly.

Distribution cost

Distribution costs cover the expenses for disposition of the shares, marketing campaigns, and provision of other types of services to investors. These charges differ from one share type to another.

Securities processing fees

Investors bear the cost associated with owning and liquidating assets within the portfolio. This cost includes commissions from brokers.

Fund services cost

A mutual fund may cover the cost of services such as audit and legal fees from professional organizations, expenses, and fees for the board of directors, and other extra fees.

Expense ratio

It results from dividing the total cost incurred by the fund within the year by the mean value of all assets in the fund. Typically, fund service costs and management fees go into this computation. For transparency, regulators demand fund companies apply the same formula when computing the expense ratio and then make the results publicly available.

Final thoughts

It is always a good idea to do your research when you plan to engage in something that involves a vast amount of money. This concept applies when you look to buy a high-ticket item or embark on an investing journey.

Reading this article and coming to the bottom indicate that you are serious about this type of investing. Now it is time to find mutual funds to put your investment dollars and transform your life for the better.