The copper industry has seen considerable growth. In addition, demand for this metal is expected to skyrocket due to the shift from oil to renewable energy. Should you invest in copper exchange-traded funds?

Commodity copper may be utilized in many different ways. We have it in our houses, phones, and cars. Yet, this metal is typically overlooked in favor of more valuable metals like gold. In May 2021, copper reached an all-time high of $4.90 per pound. Investors see copper as a haven against inflation as well as a dependable means of storing capital.

Three things to know before starting:

- Copper ETFs follow the price of copper ore. It’s an industrial metal utilized in various industries, including manufacturing and electronics.

- Prices of copper fluctuate in lockstep with the state of the economy, rising when the economy is not going well and falling while the economy is going well.

- Many investors utilize commodities such as copper and gold to diversify their portfolios because of their widespread usage. However, its price grows with inflation, copper hedge against increasing inflationary expectations.

Demand is expected to grow in the long run. Decarbonization initiatives, according to experts, are expected to increase copper use in the following years. According to JP Morgan, global copper consumption is expected to rise by about 40% next year. The ETFs mentioned below concentrate on copper futures contracts and mining. As a consequence, these ETFs provide a once-in-a-lifetime chance as demand increases.

What is a copper ETF?

When it comes to home heating and cooling systems and steam boilers, copper is the go-to material because of its reddish-gold coloration and pliable nature. In addition, copper is an excellent investment because of its many uses as a commodity and a financial asset. Investments in copper may be made in several ways, including purchasing physical copper bars and coins and futures contracts, mutual funds, equities, and exchange-traded funds.

What to check before choosing a copper ETF?

Undoubtedly, the copper ETFs offer lucrative ROI. However, there are specific parameters to check while choosing an ETF.

- Check the 52-week price range of the fund and buy when prices are near the lower range.

- Look for the annual yield history of the ETF. If the yield has a positive trend, go for it.

- If the yield is stable, you can invest the money in the ETF. However, the option is viable for conservative investors.

Best copper ETFs for 2022

The following are three of the top copper ETFs to invest in right now.

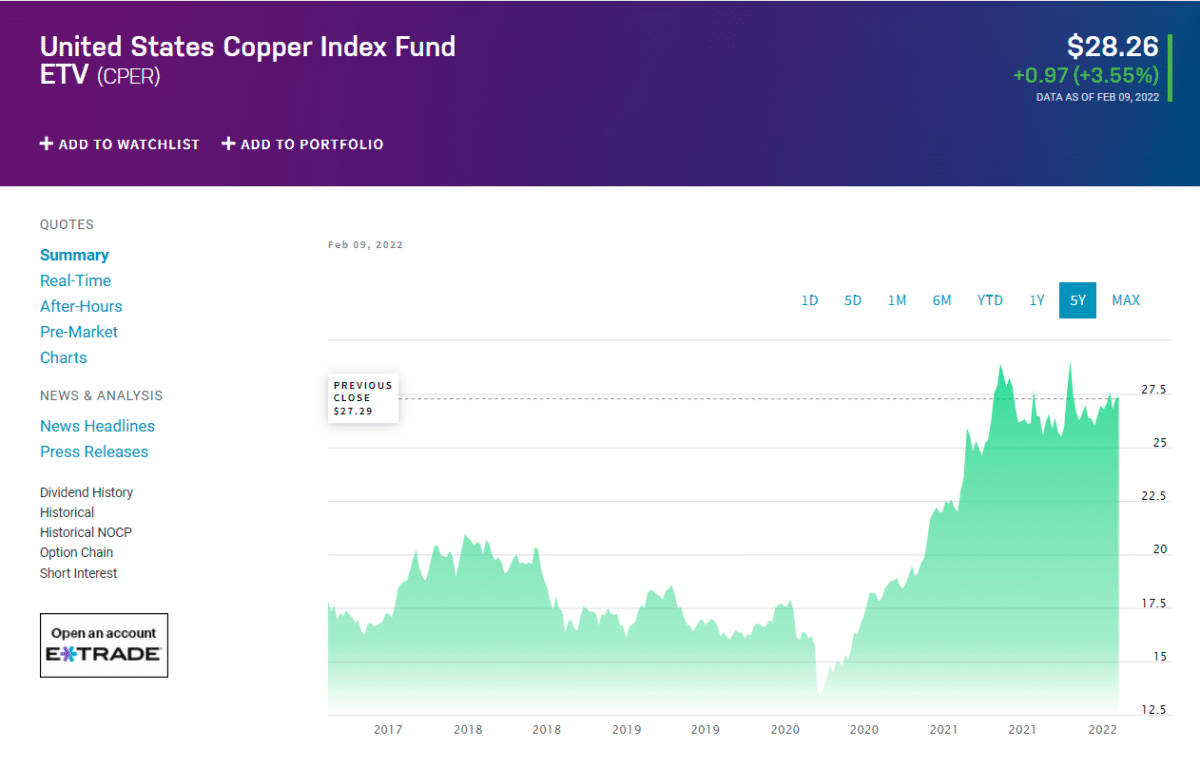

1. United States Copper Index Fund, LP (CPER)

Price: $28.26

Expense ratio: 0.8%

Almost ten assets are included in the United States Copper Index Fund, a commodity pool. The Goldman Sachs Financial Square Government Fund and the US Government Money Market Fund are the primary cash holdings of CPER. A significant cash weighting is due to this.

Trading takes place on the COMEX index, a commodity-specific index. The copper index is made up of a few copper futures contracts. A rule-based system devised by Summer Haven Indexing is used to choose acceptable contracts every month. As a result, the copper futures contracts used to calculate the index prices are copper. The fund’s goal is to mirror the SummerHaven Copper Index’s total return.

Investing in commodities and futures may be a challenge. However, you don’t have to be concerned about trading copper ETFs. Fund providers will take care of the rest if you make a simple investment.

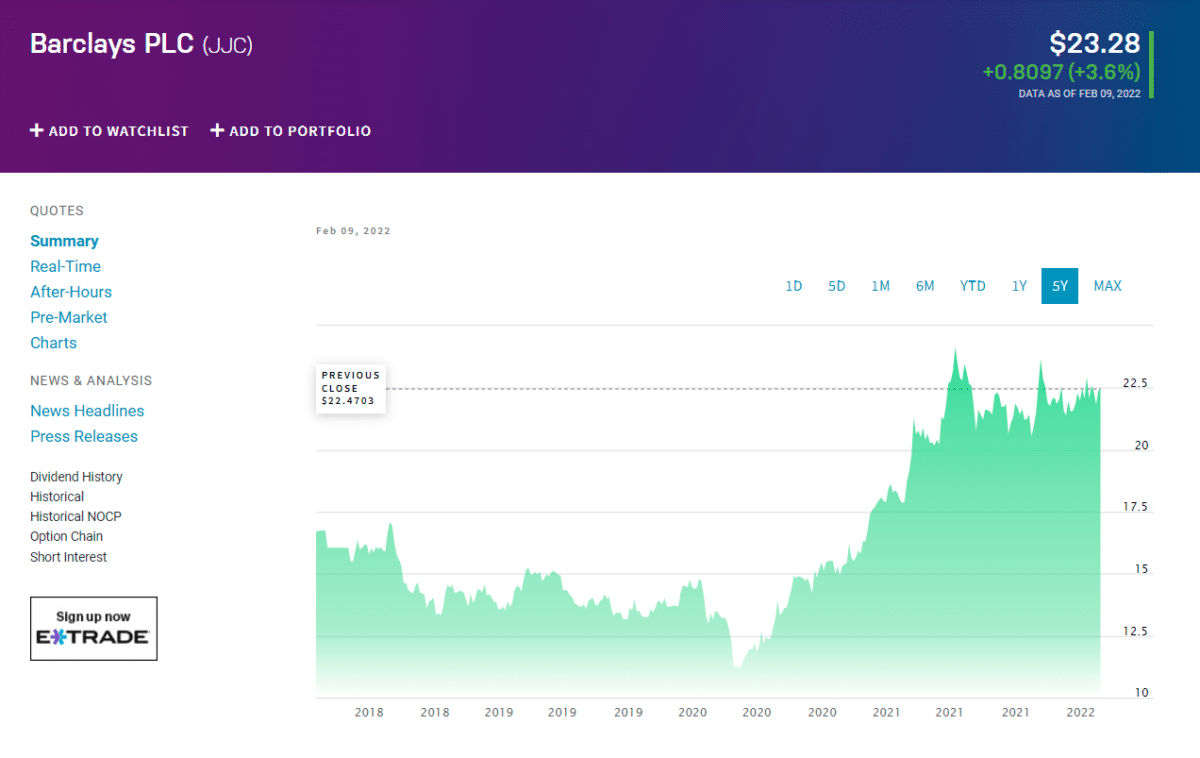

2. iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC)

Price: $23.28

Expense ratio: 0.45%

The JJC, the smallest fund on the list, follows the Bloomberg Copper Subindex Total Return, exposing you to copper futures contracts. When it comes to Barclays’ JJN, it’s an ETN or exchange-traded Note, a kind of debt issued by a bank. In contrast to an ETF, an ETN does not hold any underlying equities. The underlying futures contract is guaranteed to be paid back by the Note’s sponsor, in this case, Barclays. There may be no tracking issues with the ETN since it does not hold any equities. If Barclays goes bankrupt, investors may not get their money returned since the ETN has its own credit risk, which appears improbable.

As one of the world’s leading industrial metals, copper might be a helpful inflation hedge for JJC investors. However, investing in futures-based methods should raise red flags for investors because of the risk of loss due to contango. One alternative for investors who wish to get exposure to the metal other than via a mining firm is JJC, the sole pure-play option.

As said, index components consist of commodity futures contracts, representing the projected returns on an unleveraged investment in those contracts and the interest rate gained on cash collateral held in Treasury Bills. The Bloomberg Copper Subindex Total ReturnSM acts as a benchmark for this investment. For investors, commodity futures contracts are used instead of actual commodities in the ETNs.

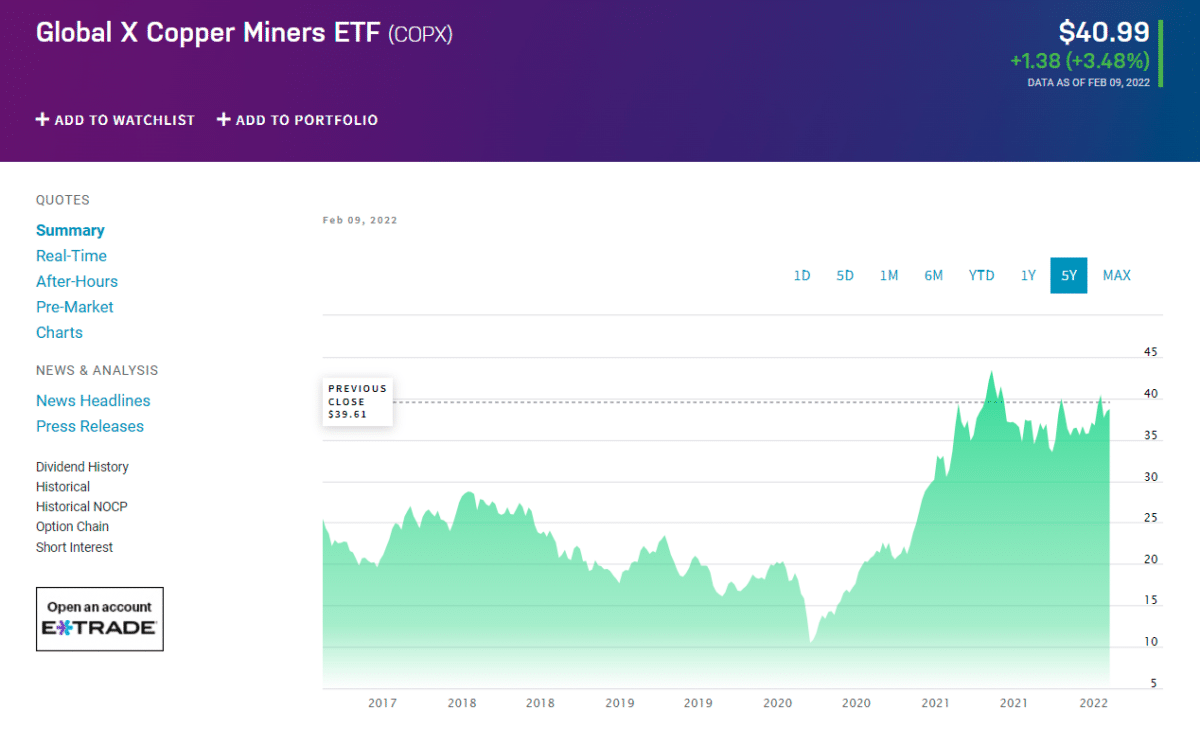

3. Global X Copper Miners ETF (COPX)

Price: $40.99

Expense ratio: 0.65%

The Solactive Global Copper Miners Total Return Index is used to assess the Global X Copper Miners ETF performance. Global copper mining and processing firms, particularly those in the US, focus on this fund.

There are more than 40 holdings in this fund. OZ Minerals in Australia and Freeport-McMoRan in the United States are significant market capitalization. These businesses are focused on long-term mining operations using low-cost and efficient techniques.

Before charges, the Solactive Global Copper Miners Total Return Index’s price and yield performance is expected to be equivalent to that of the investment. All of the fund’s assets are invested in the underlying index’s stocks and derivatives (ADRs and GDRs) based on those stocks, at least 80% of the time. Copper mining companies across the globe are the focus of the underlying index. As a result, there isn’t much variety in this fund.

With this ETF, investors don’t have to worry about the complexity of futures trading to obtain exposure to copper. If you’re looking for a way to bet on the expanding demand for a commodity that can be used in several ways, consider COPX. COPX is often traded as a leveraged gamble on the underlying natural resources, making it a risky investment and an excellent tool for profiting from increased commodity prices.

Pros and cons

| Worth to invest | Worth to getaway |

| Copper ETFs may have an advantage over gold and other precious metals because of their many industrial uses. | Copper’s industrial use might suffer when the economy is sluggish, which lowers the metal’s demand. |

| They help you diversify your portfolio. | Some mutual funds and exchange-traded funds may limit their exposure to copper in a broader portfolio. |

| They are worth investment because of their trading flexibility and also due to their easy risk management. | In addition to the metal itself, you may have to pay for things like storage, insurance, and so on. |

Final thoughts

Investing in the copper market offers a wide variety of opportunities. Record-breaking results in the year 2021 have investors paying attention to the sector. To make an informed decision, it is vital to consider both an investment’s positive and negative aspects to make an informed decision.

Consider doing your research before choosing whether or not to invest in copper ETFs. Additional ways to invest in copper may be discovered by looking at these ETFs with long-term growth potential.