Consumer staples contain merchandise like meals and drinks, family items, hygiene merchandise, and alcohol and tobacco. These items are thought-about fundamental requirements that buyers will purchase in good or dangerous financial instances. Investors trying for broad publicity to the patron staples sector could look to exchange-traded funds (ETFs) targeted in this space.

Consumer staples tend to be a good investment during periods of economic turmoil. Companies that produce essential goods like food, beverages, and consumer products come into favor when investors turn to value-oriented equities.

How does it work?

An industry or sector index consists of all the companies of a certain sector starting from a parent index. For example, the MSCI World Consumer Staples index tracks all companies from the consumer staples sector that are included in the MSCI World. A global consumer staples ETF thus gives you the opportunity to invest in the largest companies from the consumer staples sector worldwide.

The sector tracks companies whose primary businesses are based on food and beverages, hygiene products, household items, etc. – things people need every day. Demand for products in this sector remains relatively constant and is non-cyclical, and consumers are usually unable or unwilling to stop buying these products. Consequently, revenues for these companies are relatively steady even during market turmoil. As a result, this sector is typically more insulated than others during market downturns.

Top three things to know about the consumer staples sector before starting:

- Such companies give shoppers the chance to buy food, beverages, and personal care items, and demand for those goods is constant even when the overall economy sputters.

- The following three consumer funds have gathered the most assets and remain popular choices among investors.

- This is an attractive sector for those seeking steady growth, healthy dividends, and low volatility.

Best consumer staples ETFs to buy in 2022

Most of these funds have similar holdings, so consider expense ratio, spread, volume, and yield. Let’s take a look at the best three funds to invest in.

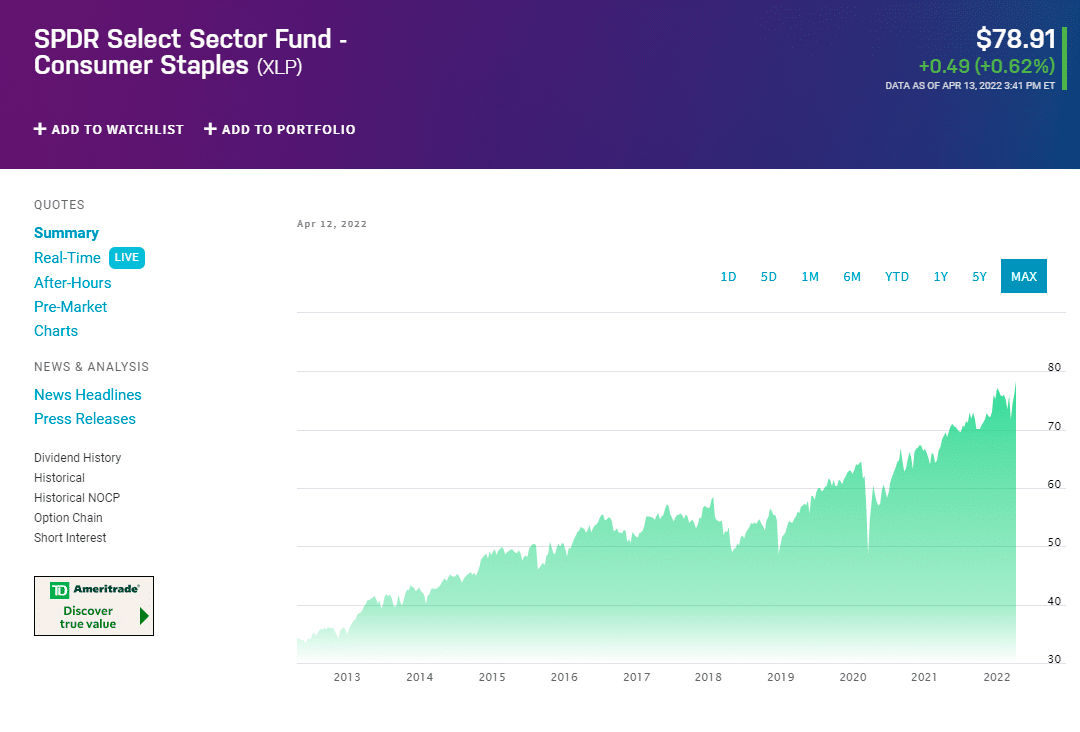

1. Consumer Staples Select Sector SPDR Fund (XLP)

The fund invests in companies engaged in developing and producing consumer products, including beverages, food, tobacco, drugs, and household and personal products. Focused on consumer staples companies, it provides investors with exposure to a segment of the US equity market that may perform well during an economic downturn.

It follows a blended strategy, investing in a mix of growth and value stocks of mostly large-cap companies. The fund’s top three holdings are Procter & Gamble Co., a multinational consumer goods company; PepsiCo Inc., an international food, snack, and beverage company; and Coca-Cola, a global beverage company.

It has accumulated over $15 billion in assets since its first launch in 1998, which is more than double the next largest fund in space.

The 33 companies in XLP conduct business in the food and staples retailing, beverage, food product, tobacco, household product, and personal product industries in the US. Also, the fund’s 2.48% dividend yield makes it the highest-yielding fund on our list.

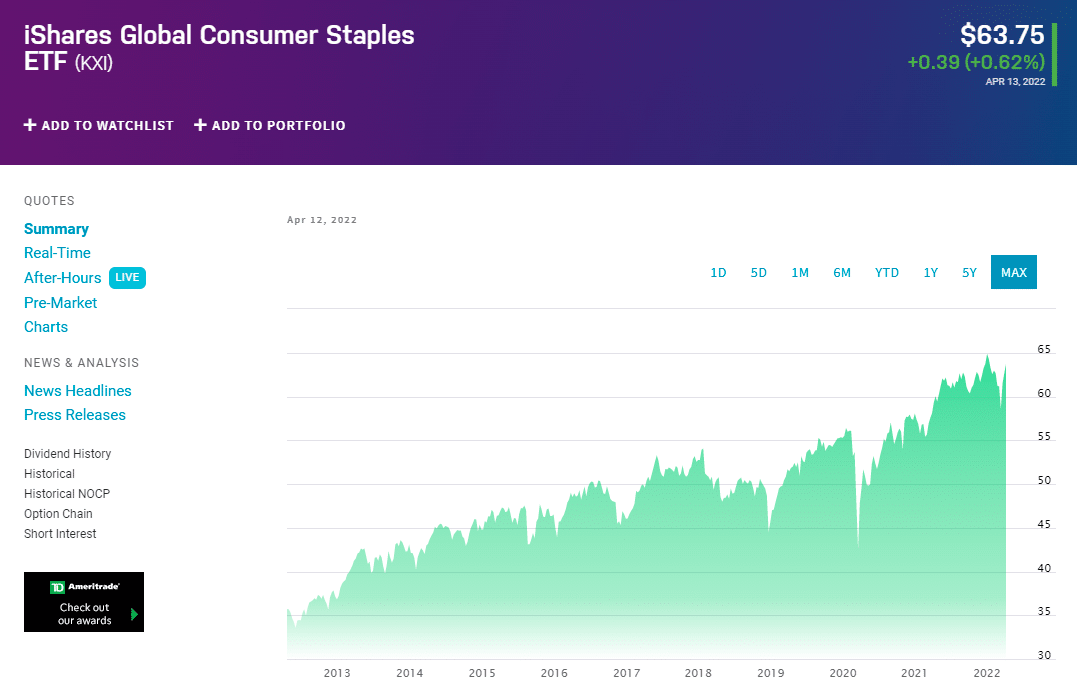

2. iShares Global Consumer Staples (KXI)

The fund, launched in September 2006, follows the S&P Global Consumer Staples Index, including the US and other nations’ consumer staples issues. The fund invests in global equities that produce essential products such as food, tobacco, and household items.

This fund is for you if you’re seeking exposure to consumer staples stocks worldwide. About half the fund is invested in the US, followed by the UK (13%), Switzerland (10%), Japan (6%), France (6%), and the remaining invested in Canada, Netherlands, Australia, Belgium, and Germany.

The fund generally invests at least 80% of its assets in the component securities of its underlying index and in investments that have economic characteristics that are substantially identical to the component securities of its underlying index and may invest up to 20% of its assets in certain futures, options and swap contracts, cash and cash equivalents.

The global exposure provided by KXI comes with a cost. Its 0.43% expense ratio is much higher than XLP. KXI has a dividend yield of 2.29% and paid $1.46 per share in the past year.

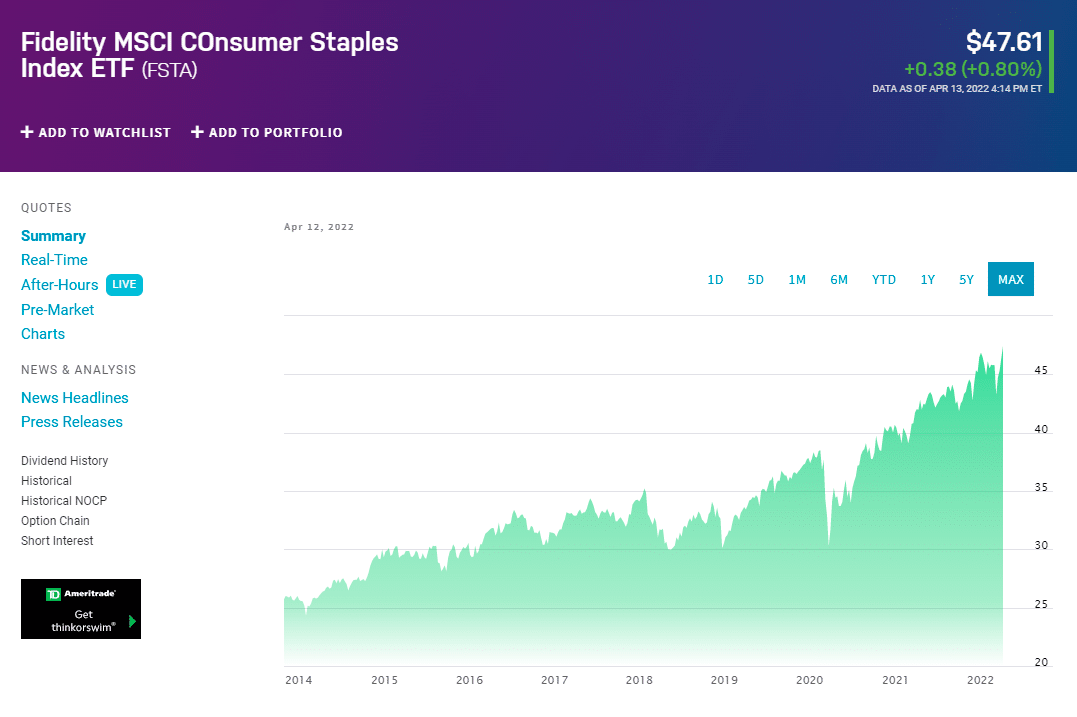

3. Fidelity MSCI Consumer Staples Index ETF (FSTA)

The fund seeks to track the MSCI USA IMI Consumer Staples Index, which gauges the performance of consumer staples stocks within the US equity market. The fund provides exposure to a broad range of consumer staples companies.

Its most extensive exposures are to companies within the following industries: food and staples retailing, beverages, food, and household products. It holds primarily large-cap value stocks, but it also includes some mid-caps and small and micro caps.

Since its debut, this fund has been one of the cheapest and most effective ways to get exposure to the sector. The company has nearly $618 million in assets, and over 120,000 shares are traded daily on average. The dividend yield comes in at 2.12%.

Pros and cons

| Worth to invest | Worth to getaway |

| If you want to add a little stability to your portfolio, consumer staples funds will give steady but unspectacular returns and a nice dividend. | Consumer staples companies aren’t flashy and won’t be the leaders during big stock market booms. |

| The sector may offer market participants diversified investment exposure to a range of companies likely to be leaders in their respective sectors. | US consumers are feeling the heat of continuously rising inflation levels. |

| Consumer staples tend to be a good investment during periods of economic turmoil. | In the past few months, demand for non-essential products worldwide has declined relative. |

Final thoughts

Such funds are a great addition to any portfolio. They can lower risk and provide great returns. If you don’t already own a few, you might want to consider adding some to your portfolio soon. The companies above are some of the most prominent players in their industries. They’re stable and keep returning value to their owners.