There’s a lot of info out there for crypto trading, with everyone jumping into the pool. Many people find crypto robots the holy grail of trading.

However, the question is can you rely on crypto bots for a more extended period. Can you set and forget a crypto robot for profitability? Well, let’s try to find out.

What’s a crypto robot anyway?

For those who don’t know, crypto bots are software programs that interact with crypto exchanges to analyze trading data and then use this information to place buy or sell orders on your behalf. The robots act on a predetermined and encoded set of rules to monitor activity in the markets.

Crypto bots may come with pre-installed trading strategies, but you may also configure the bot to your liking. You may use free bot services that help you with your cryptocurrency trading. On the other side, many bots charge a user fee, which can be high in some cases.

Traders typically look for the bot that will be most useful to them and then download the script from a developer. You can also set a robot to place a buy order at a specific price and leave the trade when the price hits a particular level, just like the example mentioned below.

Remember that each bot includes different requirements in terms of software and hardware.

Can you set and forget about crypto bots?

Now that you know what a crypto robot is, let’s move to the burning question: can crypto robots be profitable for the long term? The answer to this question depends on several factors. So, let’s explain each one of them.

1. Security

The security of your crypto trades should always be your top priority. Therefore, you should only use software that does not require you to deposit your cryptocurrency on the platform.

Hackers prey on trading bots and exchanges; therefore, it’s necessary to make your robot as secure as possible. Imagine forgetting about a crypto robot without checking for security.

2. Consistency

Usually, crypto robots make a higher risk-adjusted profit than if you had purchased the same coins and held them for a more extended period. Risk-adjusted signifies that your positive benefits outweigh your negative gains.

Consider two scenarios:

- Daily returns of 1% every day with zero negative days, with a total return across the year of 15%.

- Returns of 5% for the first month, -2% for the second month, +3% for the third month, and so on with the annual return of 20%.

Which one would you pick? Hopefully, you choose the first option. The first example is a good illustration. When something is constant, it becomes far less risky.

Even if the second one ended out at 100 percent over the year, you should still favor the first one’s stable returns. The idea here is that if you choose between consistent returns and higher returns in the future, you should always select the consistent one.

That’s how you know you are in this for the long run.

3. Cost

Some crypto bots are available for free, while others come with a significant price tag. You see, when you are setting and forgetting a robot, you’ll have to pay monthly or an annual subscription fee. Ask yourself, “Should I spend money on this robot”?

The only way you can save the cost is to know to code. If you don’t know, then you have to rely on crypto robot providers. So, it’s essential to keep costs in mind.

4. Back-testing

It is the most important phase when implementing a trading plan. The trading bot software executes your strategy based on previous data and gives you relevant information. If a robot cannot back-test, how can you set and forget it? Remember, a back-tested robot is a profitable robot.

5. Minimum drawdown

In trading, a minimum drawdown is a decrease in your trading capital. The entire purpose of your trade is to keep your account from losing money. Or, at the very least, your winners outnumber your losers.

If a robot has a low drawdown, it will generate good revenue because more winners will be generated. Some robots, on the other hand, maximize profitable trading but have a maximum drawdown. Even if they make six figures per year, they have more losers than winners. As a result, they will not work for you.

6. Recovery setup

There are forex robots that can recoup losses by opening a position in the other direction. This is hedging. The cryptocurrency markets can be volatile, and even a robot can’t prevent it. It can, however, help to balance the trade.

A crypto robot will open a long and a short position through hedging. Then, it will provide you with a short-term hedge against your losses. The goal is for there to be more winners than losers.

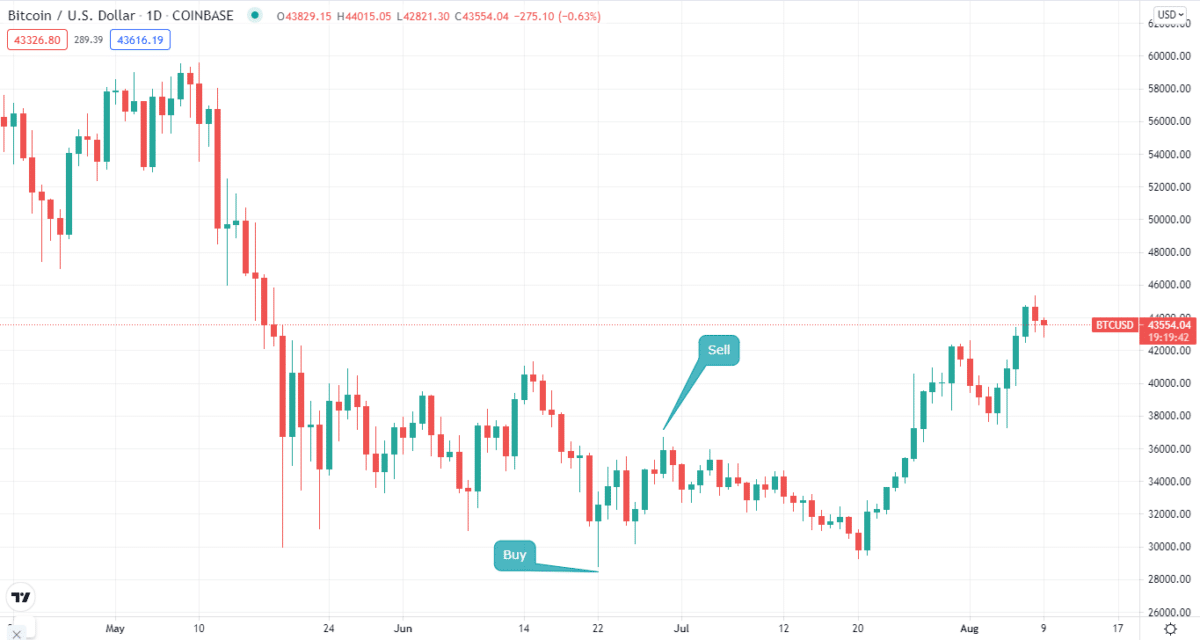

For instance, let’s take a look at the chart. As you can see, there is a fantastic buying opportunity. However, after a while, the price began to drift.

A crypto robot will open a sell position at this point as well. As a result, it will operate as a barrier, shielding you from negative price movements. Considering all the above factors, yes, you can set and forget a crypto robot. They run round the clock and execute orders on your behalf.

If you set and forget a crypto robot for six months, chances are you’ll end up profitable. However, we all know how a crypto market can behave. It is the most volatile market of them all. Volatility act as a two-edged sword, on the one hand, it is profitable, and on the other, it comes with high risk. So, keep that in your mind.

Final thoughts

Many people are making money from crypto robots, and you can make it too if you consider all the factors mentioned above. Remember that while setting and forgetting a crypto robot, consider the overall structure of the crypto market. They can be profitable for some but unprofitable for many.