The technology sector is booming, and these stocks have performed exceptionally well, even during the pandemic. Most of the S&P 500 gains are due to the significant rise of technology companies’ revenue.

This has presented an excellent opportunity to invest in index funds that benchmark the S&P 500 index. Index funds shield investors from the high volatility of the greatest assets and allow diversification across numerous sectors.

As an investor, you would be relieved to discover that the Blackrock S&P 500 Index fund offers returns of over 10%. Furthermore, the historical returns of index funds are roughly 10% annually, which is higher than your average interest earned on a savings account. Therefore, read this article further to determine if this fund is the right fit for your portfolio.

Three things to know before starting:

- The Blackrock S&P 500 fund tracks the performance of the S&P 500 index.

- The fund has a net expense ratio of 0.10%.

- The Blackrock S&P 500 fund’s best quarterly return was 20.49% in June 2020.

What is the Blackrock S&P 500 Index fund?

The Blackrock S&P 500 index fund, renamed the iShares S&P 500 Index fund, seeks to provide investment results that correspond to the total return performance of publicly traded common stocks. The fund benchmarks the S&P 500 index.

The fund invests the same percentage of assets in a specific stock as the stock’s representation in the S&P 500 index. The fund’s objective is to invest at least 90% of the value of its assets in securities comprising the S&P 500.

The Blackrock S&P 500 index fund has 506 holdings, and the fund has an average market cap of $562,262.9 million. The top five holdings are:

- Apple Inc. (6.06%)

- Microsoft Corp. (5.78%)

- Alphabet Inc. (4.24%)

- Amazon.com Inc. (3.90%)

- Facebook Inc. (2.21%)

The Blackrock S&P 500 index fund’s top sectors are information technology, health care, consumer discretionary, financials, communications, industrials, consumer staples, energy, real estate, and materials in terms of exposure breakdown.

History of the Blackrock S&P 500 Index fund

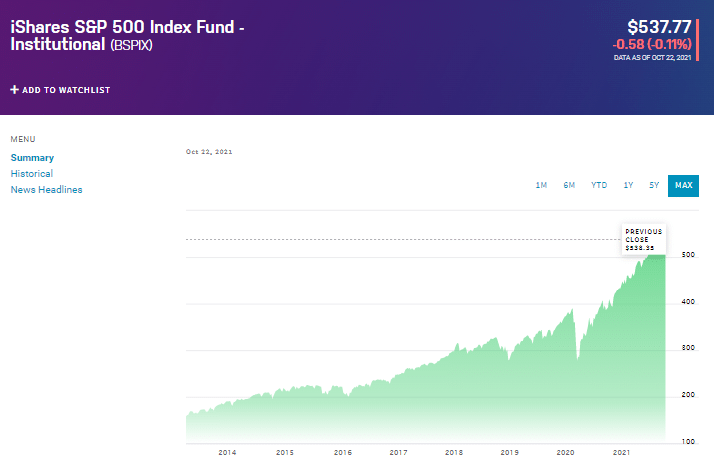

The Blackrock S&P 500 index fund’s inception was on 11 April 2013. The fund family is BlackRock, and they are also the sponsor.

Pricing & performance

The Blackrock S&P 500 index fund has had an annual return of 29.83% vs. the S&P 500 benchmark, which had 30% returns.

Since its inception, the fund had its highest return of 20.42% in the quarter ending 30 June 2020. It had its lowest return of -19.60% for the quarter ending 31 March 2020. The fund’s latest dividend payout is $1.66 per share.

The BlackRock S&P 500 Index Fund is currently trading at $537.77 per share.

Strategy & benefits

The fund strategy aims to track the S&P 500 performance by investing in stocks listed on the index. Therefore, the fund has invested the same value in the stocks as represented on the S&P 500.

This investment strategy allows investors to benefit from the exposure without owning actual shares of the companies. The strategy shields investors from the unpredictable fluctuating prices of individual stocks.

Fees

The Blackrock S&P 500 index fund has a gross and net expense ratio of 0.10%. The expense ratio is significantly lower than the category average, which is 0.89%.

The fund charges management fees of 0.01%, which is lower than the category average of 0.52%.

Risks

Morningstar rated risk for the fund above average compared to other funds in the same category.

The Blackrock S&P 500 index fund volatility measurements as of 31 July 2021:

- Standard deviation – 18.454

- Mean – 1.533

- Sharpe ratio – 0.93

Potential investors need to consider the risks associated with the market, such as equity securities risks, index fund risks, passive investment risks, to name a few.

Blackrock S&P 500 fund 2021/2022 forecast

The fund has achieved an annual average return of over 10%. Therefore, it is considered a good fund to invest long term. Furthermore, the leading assets on the fund’s holding list perform exceptionally well despite the pandemic’s threat to the stock markets.

Wall Street analysts predict that the stock price of the Blackrock S&P 500 fund will remain bullish and will continue to increase. Furthermore, there were predictions made for the price to reach over $700 per share by 2025.

Pros & cons

Investing in the stock market is risky, and index funds are no exception to the rising and falling prices. The volatility can impact your portfolio significantly. Therefore, investors should consider the pros and cons of index funds before investing in inequities.

| Worth to invest | Worth to getaway |

| Consistent returns The Blackrock S&P 500 index fund has had consistent returns since its inception. | Stock market volatility The stock market is highly volatile, and the rising and falling of prices can be daunting to new investors. |

| Low fees The fund has a low expense ratio and management fees. Furthermore, it is significantly lower than its category average. | S&P 500 index volatility Stock indices are highly volatile, and the S&P 500 is one of the leading indices in the market. The Blackrock S&P 500 index fund benchmarks the S&P 500, which means its assets will replicate the index’s performance, creating additional risk to your portfolio. |

| Diversification The fund offers diversification across well-performing sectors. | The leading assets dictate performance The stocks which hold the most significant assets dictate the direction of the index fund, and in this case, it is technology stocks. Therefore, investors should be aware that if the top sectors perform poorly, the fund will also perform poorly. |

Final thoughts

Considering all the facts, the Blackrock S&P 500 index fund seems like a viable option for long-term investing. The fund has performed solidly since its inception and appears to be robust against stock market crashes.

Investors looking for consistent gains while diversifying their money among the best performing sectors consider the Blackrock S&P 500 index fund.