The Warren Buffett claim

Warren Buffett is one of the biggest names in the investment business. The Oracle of Omaha still runs his Berkshire Hathaway conglomerate and is quite successful at it.

All of those things considered, it does bode us well to listen to what he has to say and maybe learn something from his investment strategies. Buffett made his fortune slightly differently, primarily by picking undervalued stocks and giving them time to grow in price.

On the other hand, the very fact that he instructed the trustee in charge of his fortune to invest a majority of his assets in index funds once he has passed should be enough for us to believe that the future does lie with index funds indeed. Let’s take a closer look.

What are index funds?

An index fund is an exchange-traded fund or a type of mutual fund with one key difference. Its portfolio mimics the constituents of a financial market benchmark or index, hence the name. Some of the most successful index funds track Standard & Poor’s 500 benchmark components, the S&P 500.

What are the benefits of index funds?

First up, index mutual funds have a specific purpose: to provide you with a broad exposure to the market or at least one of its sectors. That way, you can benefit from advancements made in the markets or the niche you picked without having to pay too much attention to individual companies and stocks. This is what makes it an excellent investment for retirement plans.

Apart from exposing you to a variety of stocks in a simple way, index funds do so at a pretty low operating cost. Since the index fund managers are just replicating the index’s performance that the fund is mimicking, they do not require analysts and other people to pick the right shares for your portfolio.

According to one theory, the entire market will almost always outperform any single investment over the long term, so the idea of taking up index funds as a way to save some money for the future could be a great one.

How to be part of the index fund market?

Like with other benefits of index funds, purchasing them has also been made easy for you. You can buy index funds through a broker that offers it, like with other securities, but you can make the purchase directly from an index-fund provider, such as BlackRock or Vanguard.

What are some excellent index funds to invest in?

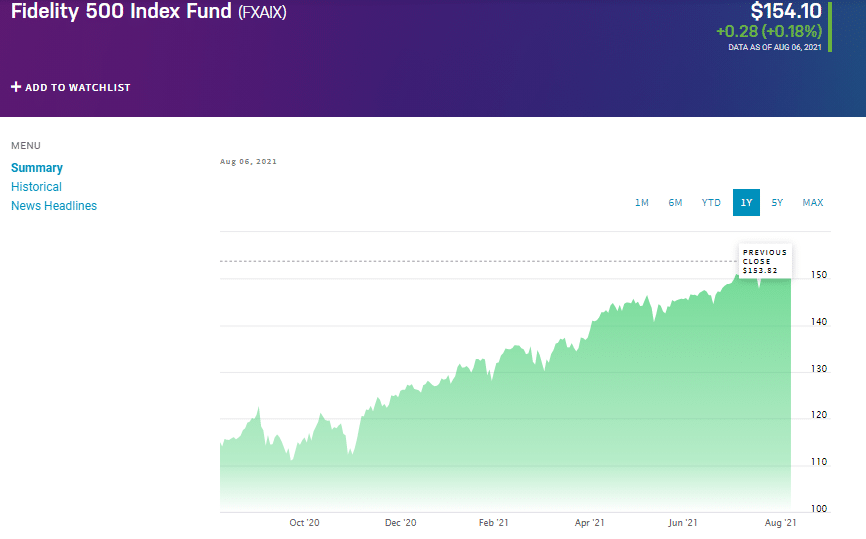

1. Fidelity 500 Index Fund (FXAIX)

FXAIX is not an exchange-traded fund but a mutual fund. With the critical differences between the two in mind, the first thing that stands out is the price. With most funds tracking the same stocks and companies, looking for one that will offer that service at the lowest cost makes sense.

If the price is your main criterion, FXAIX is the one to consider. It is the lowest manager’s cost, with its expense ratio at just 0.015%. Its annual return came in at 18.4%, while its assets under management surpassed $343 billion. There is no minimum investment for this fund, so it’s fair game for anybody who would like to give it a go.

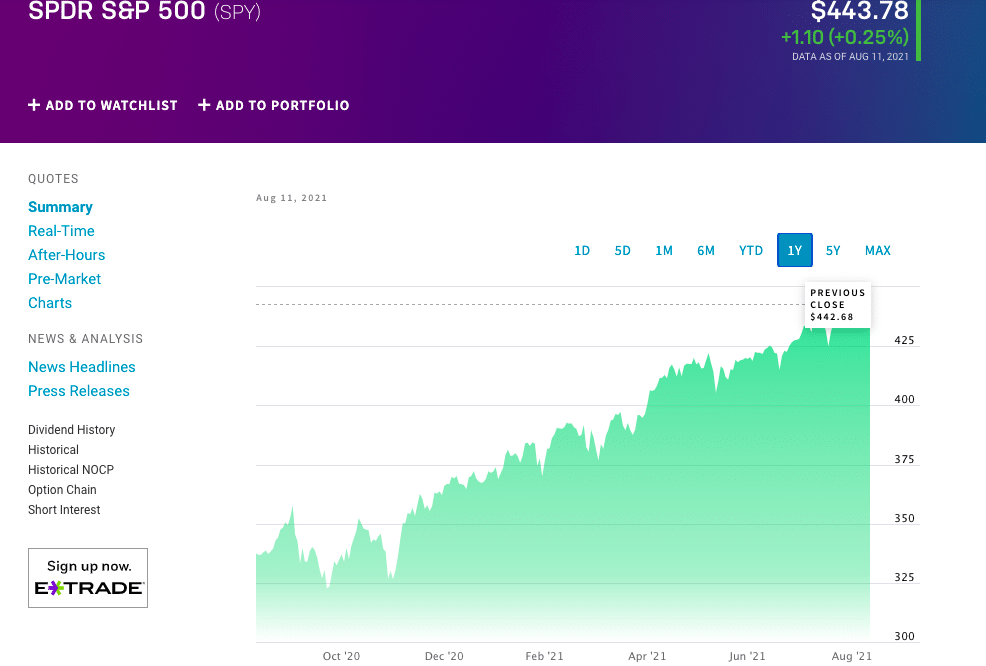

2. SPDR S&P 500 ETF (SPY)

The second one on the list, the SPDR S&P 500 ETF SPY, is, as the name implies, an exchange-traded fund. While it may not be the most inexpensive option, it boasts the highest liquidity among the index funds.

That means that the trading costs are also likely to be lower, which might not mean much if you are in it for the long-term gains and following a buy-and-hold strategy. On the other hand, if you are looking for a fund that will give you a bit of a more active role, the SPY ETF could be the right fit for your portfolio.

The SPY is one of the most well-known ETFs in the United States, and it constantly tops lists regarding assets under management and the trading volume. Its expense ratio stands at 0.095%, while its assets under management came in at $378.7 billion.

Its MSCI ESG rating is 5.84/10, while its return in the past year amounted to 34.32%.

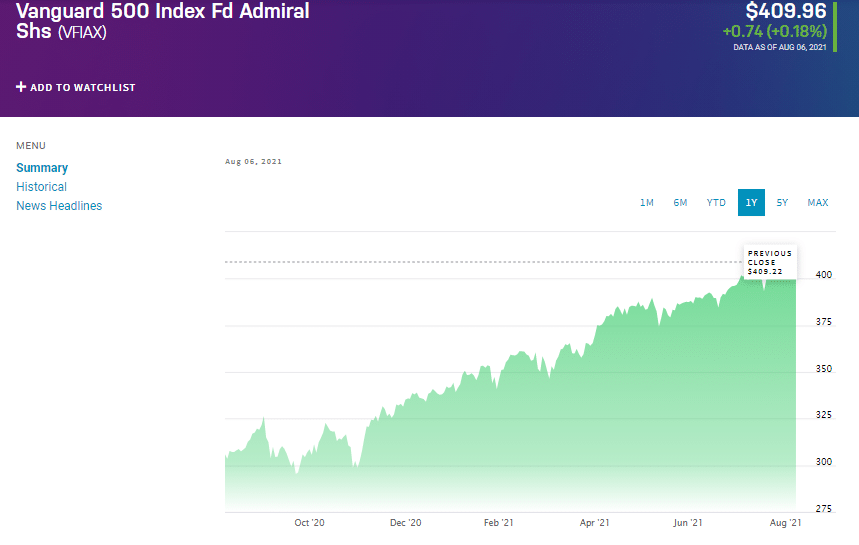

3. Vanguard 500 Index Fund Admiral Shares (VFIAX)

Vanguard 500 Index Fund Admiral Shares (VFIAX) is not the cheapest option amid index funds, and it is not the most liquid, but what sets this fund apart from the competition is its sheer size.

Its net expense ratio came in at 0.04%, while its yearly return amounted to 40.28%, and those figures are admirable. But the real head-scratcher is the fund’s asset under management figure. To date, this fund has over $700 AUM, making it the largest fund of this kind. It tracks the index meant to provide exposure to some of the large-cap stocks.

It has a 5-star rating by Morningstar and a rating of five by MarketWatch. Its quarterly dividend stood at $1.33.

Final thoughts

While we are not trying to say that index funds are overrated, we still have to point out some cases when investing in them is not the most optimal solution.

Firstly, broad exposure to the markets can leave you vulnerable to volatility. That means you will feel any sudden downturns in the market without too many solid options and plans of action. Of course, some people decide to hedge against them by shortening the index funds, but we call it a “breakeven strategy” that doesn’t bring you much good in the long run.

Secondly, index funds are ideal for investors looking for buy-and-hold securities. If you are looking for a higher-return fund or something that would put you in the driver’s seat in choosing the shares you want to back, there are certainly better options.

Lastly, buying index funds can leave your hands tied when it comes to executing some known strategies. Investors have historically combined different approaches to maximize gains. Still, you are just allowed to lay back, enjoy the ride, and hope it doesn’t get too bumpy with index funds.

To sum things up, all the negative aspects aside, the benefits of index funds seem to outweigh their downsides, primarily if you aim to increase your income to steadily save enough money for retirement. When we consider that index funds are one of the simplest ways to do so and one of the cheapest, they seem like a logical solution.