IShares Russell 3000 ETF (IWV) is an affordable option for broad, diversified exposure to the US stock market. It is an all-encompassing fund that cuts across the cap divide, albeit with a skewness towards large and mega-cap equities. The result is a diversified fund across the US economy, exposing investors to 2765 best publicly traded US equities.

Three things to know about the fund before starting:

- It invests in 3,000 stocks representing 98% of the whole US market.

- Offers high potential for investment growth; share value typically rises and falls more sharply than that of funds holding bonds.

- The goal is to keep pace with US stock market returns.

About the IWV

To understand why the Russell 3000 ETF is an earnings solution in 2022, we know the pros and cons. The Russell 1000 ETF, IWV, is a fund launched on May 22, 2000, making it the pioneer ETF to track the Russel 3000 index.

This exchange-traded fund pools together, at any given time, between 2700 and 3000 of the largest and best-performing equities in the United States; 1000 of the best large-cap blue-chip companies, and the remaining 2000 a mix of the most liquid and best performing mid and small-cap equities.

The investment seeks to track the investment results of the Russell 3000® Index, which measures the performance of the broad US equity market. The fund generally invests at least 80% of its assets in the component securities of its underlying index and in investments with economic characteristics that are substantially identical to the component securities of its underlying index.

It may invest up to 20% of its assets in certain futures, options and swap contracts, and cash equivalents.

Role in portfolio

The capital outlay needed to invest in 3000 of the best publicly traded companies in the US while buying a single share per organization would be relatively high. Through this fund, investors gain access to approximately 3000 of the best US equities under a single investment asset, resulting in instant diversification and a play on the entire US economy – 98% of the US publicly traded companies. The underlying holdings are equities primarily over the $10 billion market capitalization threshold, providing stability and capital outlay to weather market downturns.

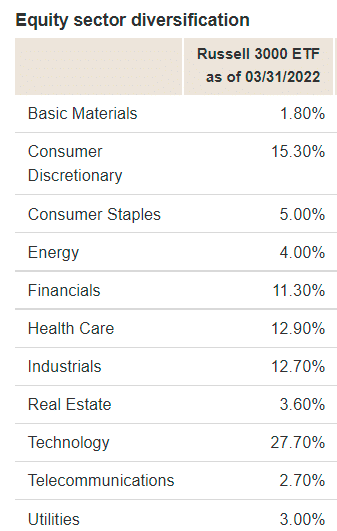

Market-cap weighting may expose the index to significant stock- or sector-level concentration during the market’s periodic frenzies. This can tilt the portfolio toward richly valued names or sectors during the late 1990s technology bubble. Nonetheless, broad diversification, low turnover, and a low fee outweigh these drawbacks.

Management

iShares Russell 3000 ETF (IWV), launched in 2000, has been managed by Greg Savage since January 1, 2008, at iShares.

Risk

An investment in the fund could lose money over short or even long periods. You should expect the fund’s share price and total return to fluctuate within a wide range, like the fluctuations of the overall stock market. Although the fund is listed for trading on the Nasdaq, it is possible that an active trading market may not be maintained. Trading of the fund on the Nasdaq may be halted if Nasdaq officials deem such action appropriate, if the Russell 3000 ETF is delisted from the Nasdaq, or if the activation of market-wide “circuit breakers” halts stock trading generally.

Performance

- Inception date: 2000

- Expense ratio: 0.20%

- Yield: 1.2%

- Total assets: $10.783 M

- Number of holdings: 2765

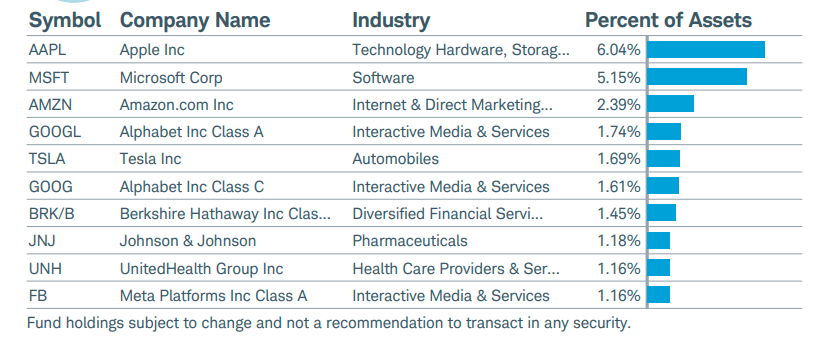

- % in top 10 holdings: 23.6%

- Dividend yield: 1.29%

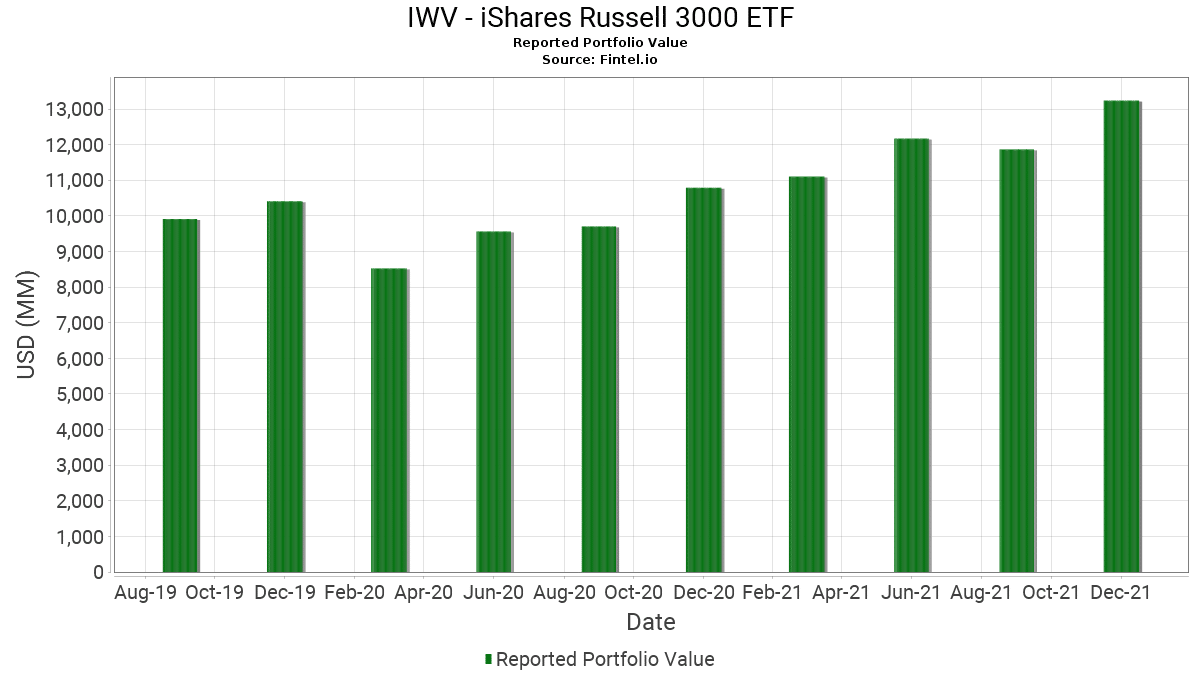

- Assets under management (AUM): $12.16 billion

- Leveraged: no

- As of writing, it was trading at $225.80

The fund has returned -3.3% over the past year and 12.9% annually over the past three years, 12.8% per year over the past five years, and 13.1% per year over the past decade. In April 2022, it returned -9.0%.

Is it worth buying?

The IWV ETF is simplified to play the entire US equity market. However, investors should know that despite incorporating equities from the small and mid-cap categories, this fund is still heavily skewed towards large and mega-cap stocks. In addition, it is also relatively more expensive than some funds plying their trade in this segment.

Net expense ratio

Its expense ratio is below average compared to funds in the Large Blend category. IWV has an expense ratio of 0.20%, which is 52% lower than its category.

Volatility measurement

The Russell 3000 Index fund risk statistics over the last three years are as follows:

- Beta: 1.04

- R-Squared: 99%

- Standard deviation: 19.4%

Pros and cons

Overall, the fund has a good marking, but you must consider the upsides and downsides before investing in it.

| Worth to buy | Worth to getaway |

| Index funds track an index; they are not typically actively managed. This allows fees to stay on the low side. | Index funds are market-cap-weighted, meaning they invest more of their money in companies with higher market caps. |

| The Russell 3000 has had a positive annual return for the last ten years. | The long-term undervaluation of value stocks can mean investors need to hold their funds for more extended periods to observe significant gains. |

| This fund allows investors to diversify in small-cap stocks. | No ability to select stocks in the index. |

Final thoughts

With $12.16 billion in assets under management, and a dividend yield of 1.29%, the IWV fund can provide portfolio growth and value. Its holding base of 3000 equities and a pretty even weight distribution provides for a resilient fund with the ability to weather market storms and avoid concentration risk in 2022. You can check out all the significant index funds we offer by going here.