Index funds have gained the attention of investors due to the diversification and risk mitigation benefits of these security baskets. These funds are either ETFs or mutual funds that track the performance of benchmark indices.

Mutual funds allow investors to collectively trade shares of numerous evolving and progressive companies through one fund. Due to the heterogeneity and cost-effectiveness, investors continuously strive to find the most profitable Index funds according to their individual goals.

This article has reviewed the historical data, features, and performance of the Russell 2000 Index, a US small market-cap Index.

Three things to know before starting:

- The Index contains stock shares of US companies with small market capitalization.

- It is a more extensive Index component containing small and large-cap US companies, the Russell 3000 Index.

- FTSE Russell group regularly keeps updating the companies in the Index according to their market capitalization.

What is the Russell 2000 Index fund?

The Index tracks the performance of 2,000 small market-cap, US public companies. Small market capitalization companies refer to the institutions with less than $2 billion value of their stock shares.

The fund is a constituent of the parent Russell 3000 Index, which consists of additional 1000 large-cap US companies. In addition, Russell 2000 companies represent a lower percentage of the US stock market and contribute around 10% in the total US market capitalization.

This Index constitutes companies from eleven sectors, including healthcare, financials, consumer discretionary, industrials, and many others. According to the September 2021 report, the top three companies are:

- AMC Entertainment (consumer discretionary)

- Intellia Therapeutics Inc. (healthcare)

- Crocs Inc. (consumer discretionary)

The Russell group reviews all the 3000 companies of the Russell indices yearly and evaluates their placement in the Index. The group re-arranges, adds and expels the companies according to outstanding shares and market capitalization. Moreover, there are some occasional quarterly additions of newly public companies that fulfill the index criteria.

History of the Russell 2000 Index fund

Russell Investments inaugurated the first small market-cap Index, Russell 2000 Index, in January 1984. The first passive mutual fund linked to the Russell 2000 Index became operational five years after the Index’s inception.

FTSE Russell, a leading investment management company that is in the ownership of the London Stock Exchange Group maintains and oversees the Russell 200 benchmark Index.

Pricing & performance

The Index’s price started from under $150 in 1988 but grew extensively to reach the current range of above $2000. As of September 2021, the fund’s average market cap ($-WTD) stands at $3.352 billion, with its largest stock share by market cap at $19.53.

Moreover, the 2019 and 2020 yearly returns of Russell 2000 investments were 25.52% and 19.96%. The return of the ongoing year is around 12.41% which is susceptible to change by the end of 2021.

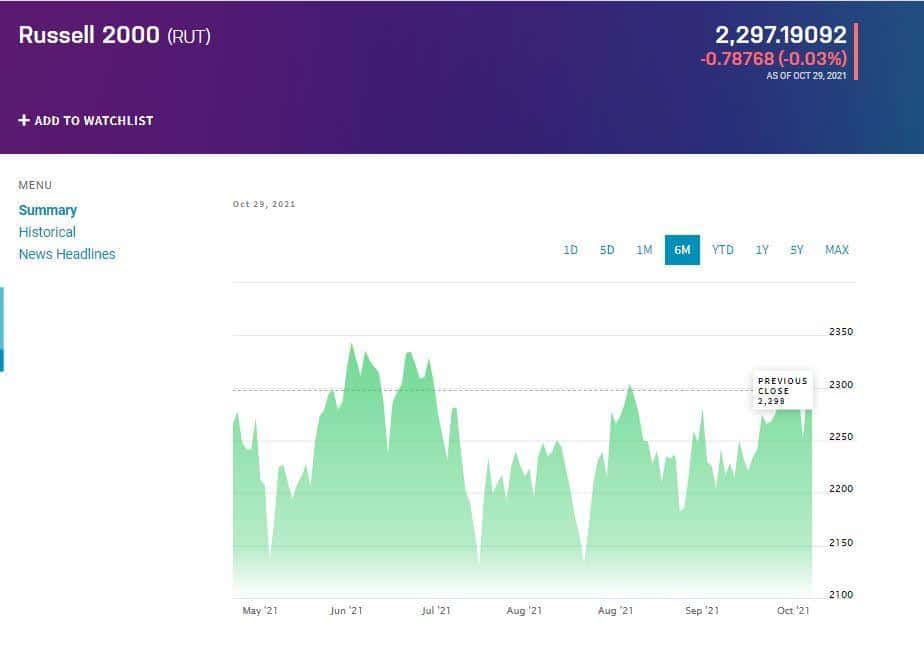

In addition, shareholders with long-term investment in this fund have remained profitable with a 10-years return of 14.63%. Currently, the Index is trading at $2,297.

Strategy & benefits

This fund contributes to the diversification of investors’ portfolios as it provides exposure to a wide array of small-cap companies. Furthermore, as this Index focuses on domestic new and evolving companies, it indicates US economic conditions.

Investing in it is prudent for long-term investors with an outlook for more than five years. It is because Russell 2000 companies have significant growth potential compared to the large-cap stock market due to their high volatility and margin of expansion. For instance, it would be difficult for Amazon’s stock price to double or triple compared to a new company with a lower market cap.

As a result, small-cap companies carry the potential to succeed on a long-term basis. In addition, the Russell 2000 Index is well-adjusted and well-balanced as it does not heavily depend on two or three large companies.

Fees

For investing in this Index, you need to invest in the relative ETFs or mutual funds that track the performance of the Russell 2000 Index.

Various brokerage platforms are offering the Russell 2000 mutual funds with reasonable regulatory fees. Following are the expense ratios specified by major brokerage platforms:

- Vanguard Russell 2000 Index Fund: 0.08 %

- iShares Russell 2000 Small-cap Index Fund: 0.37%

- Fidelity small-cap Index Fund: 0.25%

It is important to note that active funds have comparatively higher managing fees ranging from 1% to 2%.

Risks

During periods of economic hardship, small-cap stocks face significant adverse effects as compared to their large-cap counterparts. Moreover, the volatility of this fund carries a high risk as it can result in wild price swings.

As of September 2021, the following are some of the key risk and volatility measures of the Russell 2000 Index fund:

- Sharpe ratio: 0.43

- Standard deviation: 25.71

- Max drawdown: -33.76%

Russell 2000 fund 2021/2022 forecast

The fund showed magnificent performance in the year 2020. Despite pandemic disruptions, the price crossed the $2000 mark by the end of 2020. It was around $1200 at the start of 2020.

According to technical market indicators, the Index has positive future dynamics. The price can reach around $2350 by the end of 2021. Moreover, the forecasts show an overall promising price spike by the end of 2022, i.e., approximately $2890.

However, the price could face ups and downs and significant fluctuations in the upcoming year.

Pros & cons

Timely investment in correct securities provides remarkable future profits. However, it is advisable to evaluate the pros and cons before investing as it also involves numerous risks. Here are some pros and cons of the fund.

| Worth to invest | Worth to getaway |

| Impartial access to small-cap market FTSE Russell yearly or quarterly re-balances and re-arranges the small-cap companies in the Index. | High volatility Due to the enhanced volatility of small companies, it is not suitable for risk-averse investors. |

| High liquidity The fund has high liquidity and negligible bid-ask spreads due to large trading volumes. | Does not compose an absolute/complete portfolio This small-cap Index is not enough for an ideal diversified portfolio as it does not contain any large-cap stocks. |

| Cost-effective Most broker platforms allow the trading of Russell 2000 index funds with minimal management rates and expense ratios. | Affected by an unfavorable economic environment Tough economic times negatively affect the Russell 2000 Index companies as they are usually US domestic companies. |

Final thoughts

The decision to invest in the fund depends on investors’ risk tolerance and long-term goals. The volatility of this Index provides investors a high reward opportunity but correspondingly exposes them to volatility risks.

Nonetheless, adding this Index to your portfolio is a good choice for diversifying your investments and investing in small-cap companies with substantial growth potential.