MATLAB is a platform where programming and numeric computing occurs by millions of scientists and engineers. As the algorithmic trading opportunity increases, investors are focusing on building an automated trading system. In this way, the MATLAB platform has become popular in building algorithmic trading methods.

However, trading in the financial market needs deep backtesting before applying with real money. In that sense, a profitable and stable trading strategy is needed before implementing it on the MATLAB platform. In the following section, we will see a MA trading guide applicable to MATLAB.

What is MATLAB MA?

MATLAB is not a trading tool or indicator; instead, it is a programming language developed by Mathworks where investors can make their trading strategy automated.

The MATLAB programming language has several unique functionalities like metrics manipulation, algorithm implementation, and user interface facilities in different languages. As a result, engineers and scientists can create a sophisticated automated trading system through this platform.

On the other hand, the MA is a trading tool that defines the overall sentiment in a trading instrument. The primary use of a MA is to see how the price is trading compared to the current MA level to anticipate the future trend. In the MATLAB moving average method, we will see a profitable crypto trading strategy that applies to building through the MATLAB language.

How to trade using MATLAB moving average in trading strategy?

The MA is one of the most used trading indicators globally as it is flexible and easy to understand. The main approach in MA trading strategy is to find the average price of a time frame and see how buyers and sellers move the price compared to the average level.

The basic MA trading strategy is that when the price is moving above the MA level, we look for by trades. On the other hand, if the price moves below the MA, it will indicate a selling opportunity. Moreover, the MA often works as dynamic support and resistance levels from where a reversal may happen. However, the drawback of this trading tool is that it is lagging. Therefore, in any moving average-based trading strategy, we should include other trading tools to increase accuracy.

In the MATLAB moving average trading method, we will use volume profile and VWAP.

A short-term trading strategy

The short-term trading approach is applicable on the intraday chart, whereas automated trading applies from one minute to 15 minutes time frame.

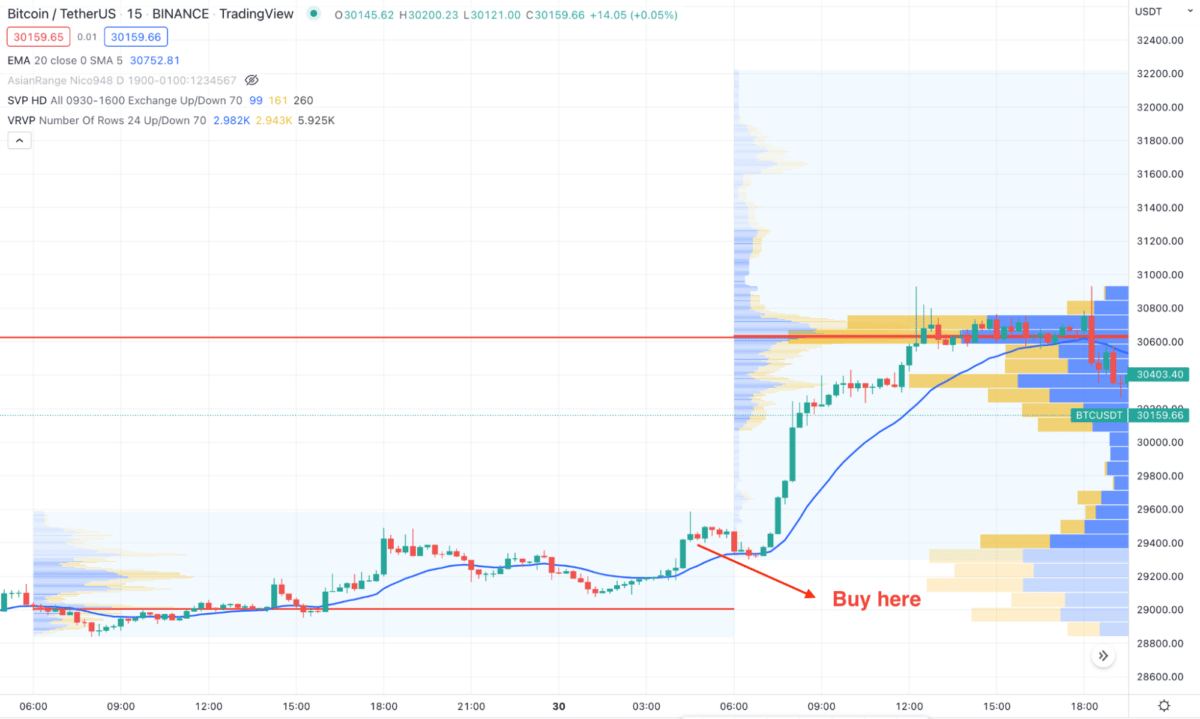

Bullish trade scenario

The buy trade needs the price to move within the daily order flow. Therefore, the MATLAB program should be written in this way to filter daily trends using higher highs and lower lows.

Entry

The intraday buy trade is valid once these conditions are present:

- The higher timeframe is bullish in the daily chart.

- The price moved down in the 15 minutes time frame but failed to hold the bearish momentum below the intraday support level.

- The highest volume level from the visible range is below the price.

- After getting the rejection from the support level, the price moved up and closes a 15-minutes candle above the dynamic 20 EMA.

Stop-loss

The program should be set the trade invalid if the price breaks below the near-term swing low.

Take profit

The easiest way to set the stop loss is based on 1:2 risk vs. reward.

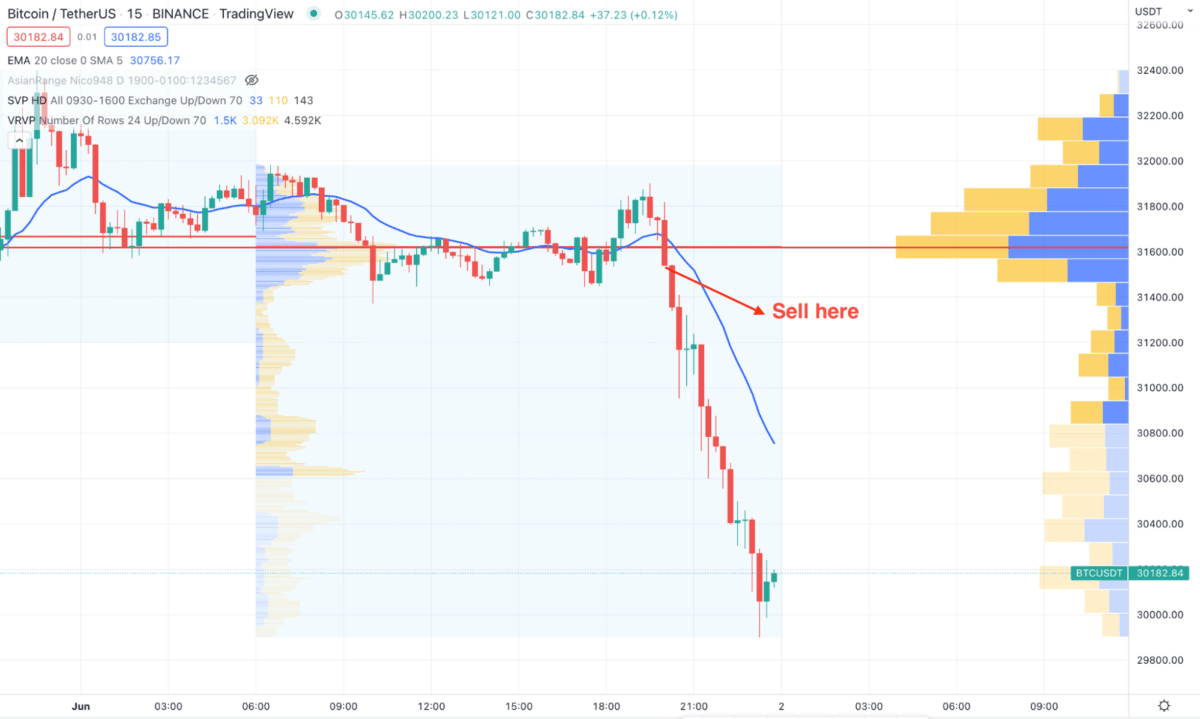

Bearish trade scenario

Like the bullish trade, the bearish opportunity should come within the higher time frame bearish order flow. Therefore, the MATLAB program should be written in this way so that it can filter daily trends using higher highs and lower lows.

Entry

The intraday bearish trading opportunity is valid once these conditions are present:

- The higher time frame is bearish in the daily chart.

- The price moved up in the 15 minutes time frame but failed to hold bullish momentum above the near-term resistance level.

- The highest volume level from the visible range is above the price.

- After getting the rejection from the resistance level, the price closes a bearish candle below the dynamic 20 EMA.

Stop-loss

The program should set the stop loss above the near-term swing high.

Take profit

The easiest way to set the stop loss is based on 1:2 risk vs. reward.

A long-term trading strategy

The long-term trading method should come in the daily chart, where investors should use swing levels to find the trend.

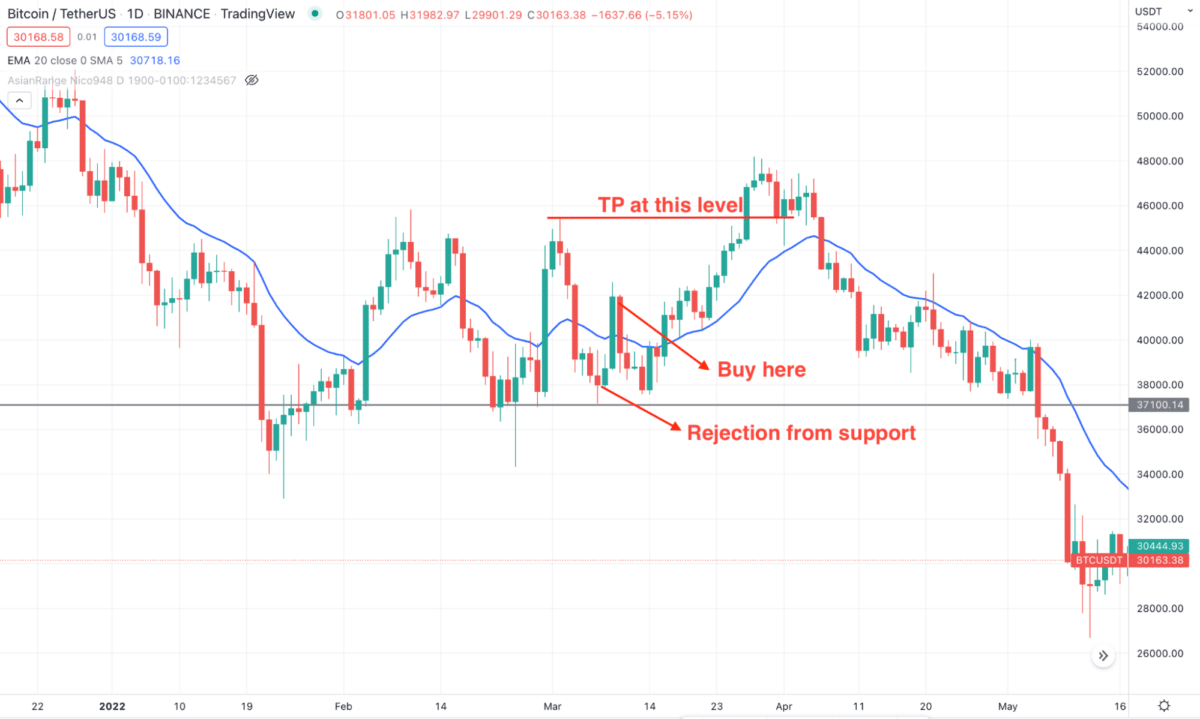

Bullish trade scenario

The bullish opportunity is valid once the overall market sentiment shows a buying opportunity in the daily chart. As it is a trend trading method, the MATLAB language should make sure that the price trades within the weekly order flow.

Entry

The bullish trading opportunity is valid once these conditions are present:

- The price corrected lower but failed to break the previous swing low.

- A bullish daily candle appeared with a rejection from the support level.

- The bullish trade is valid once a daily candle closes above the dynamic 20 EMA.

Stop loss

The stop loss should be below the support level.

Take profit

The MATLAB language should close the trade if it reaches any near-term swing high.

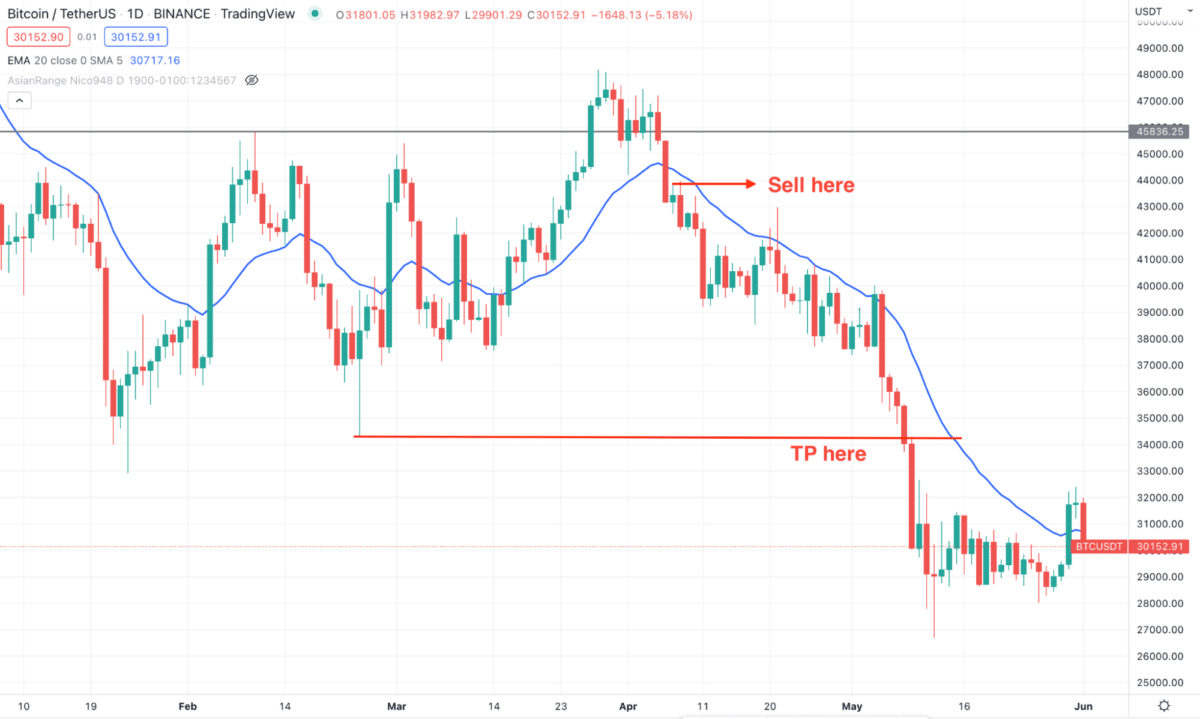

Bearish trade scenario

The long-term sell trade should come up within the long-term bearish order flow in the weekly chart. Moreover, a bullish correction is also important before moving to the MA.

Entry

The bearish opportunity is valid once these conditions are present:

- The price moved up lower but failed to break the previous swing high.

- A bearish daily candle appeared with a rejection from the important resistance level.

- The bearish trade is valid once a daily candle closes below the dynamic 20 EMA.

Stop-loss

The stop loss should be above the resistance level.

Take profit

The MATLAB language should close the trade if it reaches any near-term swing low.

Pros and cons

| Pros | Cons |

| MATLAB programing language are applicable to build complex automated trading strategies | Close attention to trade management is needed to apply the MA strategy. |

| The use of MA in the platform would boost a programmer’s performance. | The platform cannot detect the uncertainty related to the crypto market. |

| MATLAB’s moving average strategy is applicable to all cryptos. | The massive market crash could initiate slippage. |

Final thoughts

In the final section, we can say that investors can build profitable algorithmic trading strategies with the platform. However, it is crucial to find its effectiveness in the past trading chart before implementing any strategy.