If you are an active trader or investor, you know that the financial markets are highly unpredictable. Profits you thought you had could be wiped out in a blink of an eye. So many traders lose their money because they fail to manage their risk profile. Professional traders know how to manage risk; their livelihood depends on the success rate of their investments.

Anyone can follow instructions, but the proper discipline lies in following the rules and not allowing your emotions to interfere with your decisions.

Yes, investing is all about taking risks. Otherwise, no one would do it. If you cannot take some risk, then you will never make any money. But the excessive risk is not reasonable, and we will give you pro tips to manage risks and protect your profits.

An overview on managing risk

Risk management is a set of rules that an investor or trader uses to protect their capital, minimize losses, and maximize profits. As much as it rules, it has a lot to do with your emotional state of mind, as this often determines your decisions.

Managing risk is significant because, as we all know, one cannot win every trade just as you will not profit from all of your stock investments.

Risk management is all about strategizing and planning. Once you have a good strategy, you need to create a plan around it and stick to the rules that govern it.

Five pro tips for managing risks

Now that you understand what risk management is, let us share some clever techniques you can use to keep your losses at a minimum and grow your capital.

Tip 1. Follow the 1% rule

This rule is essential since you can minimize the drawdown on your account significantly. For example, if you have a capital of $5000, you will not risk more than $50 on a single position. Therefore, if you open multiple positions, you will ensure that the risk per order is not more than $50. It’s safe to go up to 2%, but it’s good to keep it between 1% and 2%.

Tip 2. Control your losses

Controlling losses is made by determining a stop loss. But the stop loss should not be excessive or too far away from your entry price. This can be achieved by knowledge of the market and applying technical analysis. You have to identify the right price to mark as stop loss, and you can do this by calculating the risk to reward ratio. A good ratio is 1:2 or 1:3, meaning you risk $1 to make $2 or $3, respectively.

Tip 3. Consider spreads

Spreads are not just an opportunity cost but also a risk factor. High spreads can result in pending orders not being triggered, hitting stop-loss targets, as well as missing take profit targets. Often it happens that the market reaches your target price and reverses back, and does not close your order.

Sometimes you will be holding trades overnight when spreads are notably higher since the liquidity is low. The brokers’ only way of making money is by increasing spread at this time. A way to counteract high spreads is to open an ECN trading account with low or fixed spreads. ECN brokers do not work with a dealing desk; they make money by charging swap fees and commissions.

Tip 4. Use leverage moderately

Leverage can be a good thing but in moderation. If you choose high leverage, you will be able to make a lot of profit quickly; however, in the same way, you can lose as well. Remember that leverage is a loan given by the broker; therefore, you can potentially lose all your money if you do not have sufficient margin in your account.

Tip 5. Volatility is good and bad

The market needs volatility: otherwise, there will be few good trading opportunities. Volatility can be good, but there are times that the market can move rapidly in a matter of seconds. Usually, significant economic news events trigger this. Experienced traders know when to approach the market and when to wait. It’s best to wait for the extreme volatility to pass before taking any trades.

How to protect your profit

Now that you know how to minimize risk, you also need to safeguard your profits. When you are in profit, and it hasn’t reached the target profit level, you can do one of four things:

- Close your position and cash out

- Set your trade to break even

- Trail your profit

- Or wait and see if the market will reach your target profit level

We will illustrate how to apply points two and three with a practical example.

How to set break even

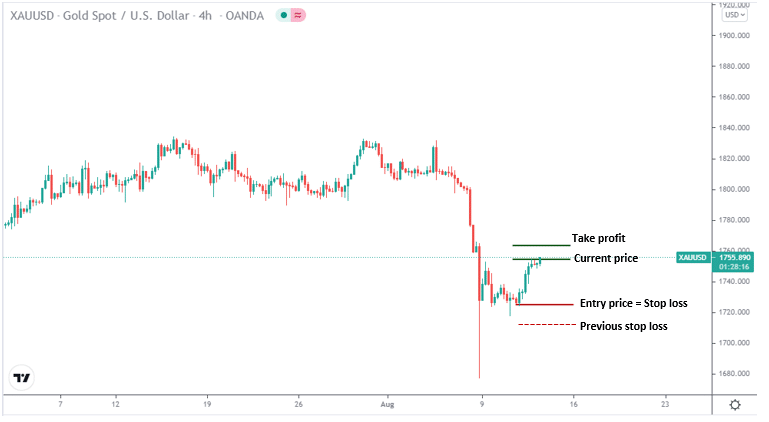

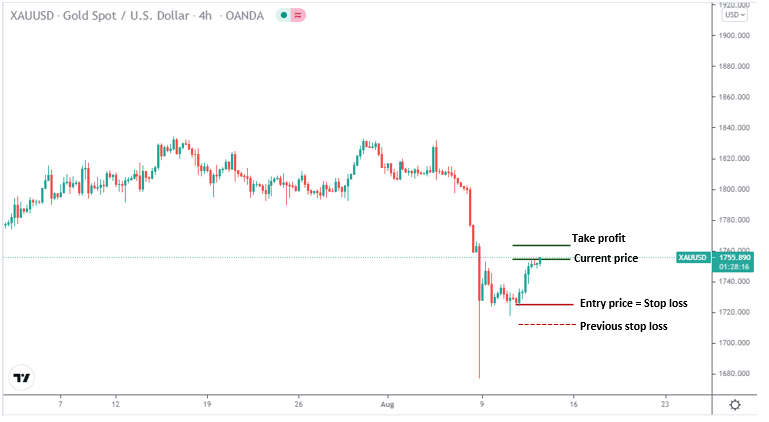

To set your position to break even, you have to move your stop loss to the entry price; this way, the trade is risk-free. We illustrate this in the below chart.

This is the current status of your position; you are in profit and a few pips away to reach the target price. However, you decide to set your trade to break even, which we will illustrate below.

Now the stop loss has been moved to the entry price. If the market reverses and reaches entry price again, the position will close with zero profit and loss. Just note that there might be a slight loss due to spreads or broker’s commissions and swap fees.

How to trail your profits

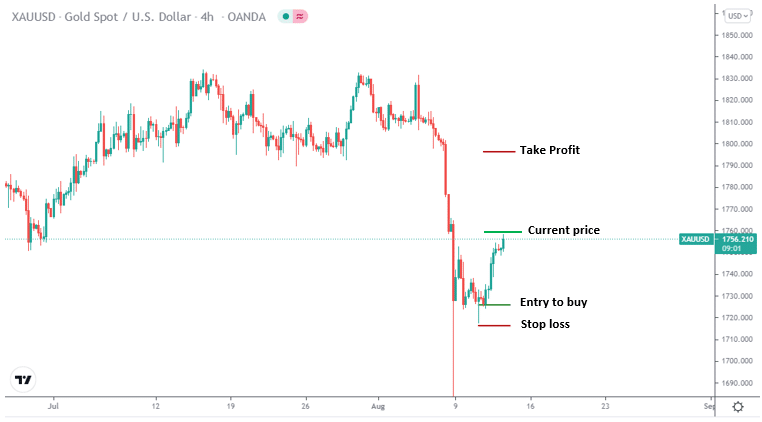

We’ve explained how to break even, but another powerful strategy you can use to ensure you maintain some or all of your profits is to trail it. In this example, we use the same XAU/USD pair with a sell entry, stop loss, and take profit levels.

In this scenario, we decide to buy the XAUUSD pair. Stop loss and take profit levels are marked on the chart. You have to be well in profit already to trail your profit, and it is not possible to trail while you are at a loss.

So, we will show on the following chart how to trail profit.

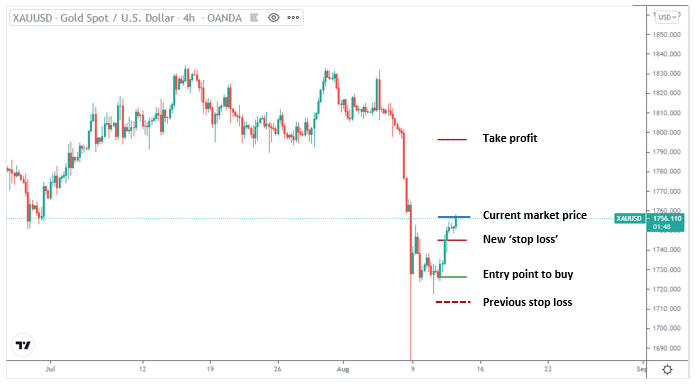

- As you can see, we have now moved our stop loss above our entry price.

- As we mentioned, it is only possible if your trade is in profit.

- We will assume for this example that the position is 40 pips in profit, and we place the stop loss indicated in the chart.

- So now you secure 40 pips of profit; therefore, if the market should reverse back down and hit this new stop loss, you would still have made some money.

Protecting profits is all about using the stop loss wisely, and professional traders use it all the time; in addition, it is helpful if you do not want to hold positions for too long or don’t have time to monitor the charts often.

Final thoughts

Risk management is not a choice; in fact, it’s a compulsory strategy that you can use just like any other trading discipline. Without managing risks, you will not have much success as we can only rely on luck so many times.

Therefore, follow these tips we have shared and make them your top priority before even taking any trades; whether you trade on your own or follow a professional, risk management is unavoidable.