There are many instruments in the FX market that make it accessible for every trader. Moreover, it is easy to enter the market as it does not require any qualifications. Therefore, market participants often become confused to see a bunch of trading instruments after joining the FX.

It is not wise to trade all instruments as most of them are useless. Finding a list of profitable trading pairs and applying a good strategy is the ultimate way to succeed. The following section will see the list of currency pairs that are profitable to trade 24/7.

What are the best forex pairs to trade 24/7?

Some traders are comfortable in trading major pairs only, while others like to expand their portfolio in majors, minors, and exotics. Therefore, it depends on the trader’s personality and strategy.

However, we suggest you stick to major currency pairs only based on the average daily movement, volatility, liquidity, and profitability.

But why?

The price in a currency pair changes with the change in buyers’ and sellers’ activity. It is a game of supply-demand levels where any discrepancies between them make the market move. As a result, the presence of buyers and sellers is the most important fact about currency trading. Therefore, investors should closely monitor how much trading volumes are present in a pair to find profitability.

How to identify the best forex pairs?

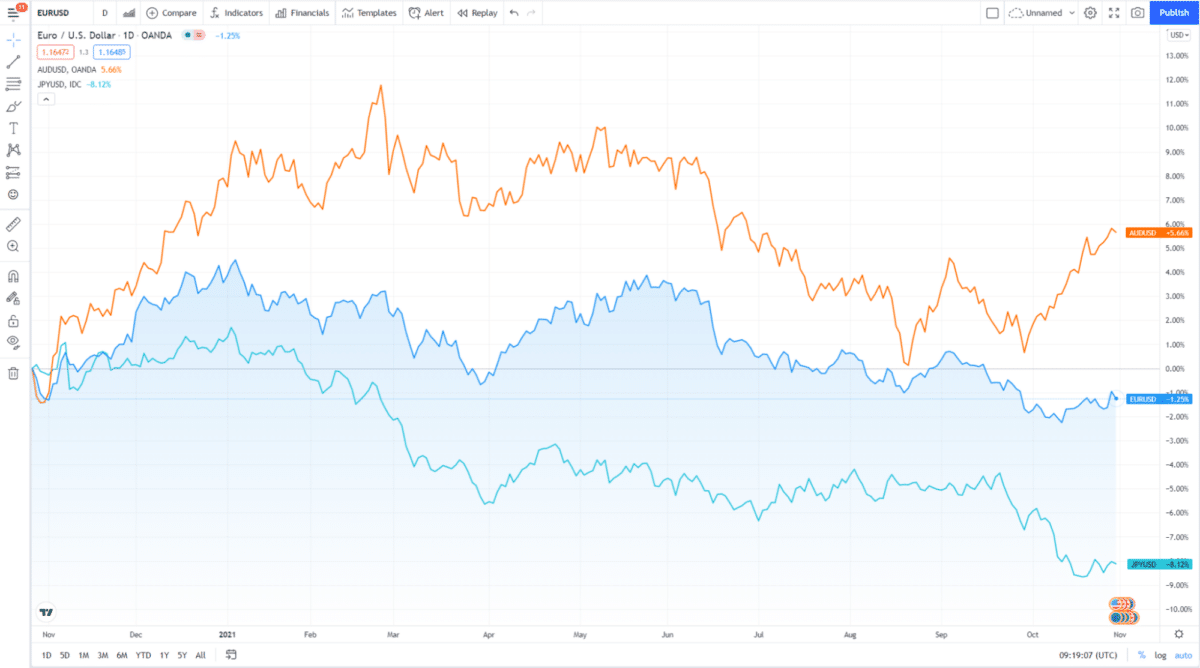

First, the most profitable forex pairs are USD and USD-related pairs. The USD is the global reserve currency that made it dominate the FX market. More than 80% of the market liquidity comes from the US. Therefore, investors find USD related pairs are profitable due to having enough liquidity in the price.

Second, the Eurozone is the world’s biggest trading hub. It works as a connector between Asia and the US. Most businesses and industries use the Eurozone as a medium to exchange currencies. Therefore, after the USD, the second largest currency is the euro. Any currency pair with EUR is profitable after the USD. Based on this concept, we can mention the EUR/USD as the most active currency pairs.

Apart from these, AUD represents the Australian economy, which is based on commodities. Moreover, the Canadian dollar, the loonie, is another dominant currency related to crude oil. Among export-oriented countries, Japan is remarkable, where currency pairs with JPY are often profitable.

Therefore, based on the above knowledge, we can distinguish these pairs as highly profitable:

- High profitable — major pairs

- Medium profitable — cross pairs

- Low profitable — exotic pairs

A short-term strategy

In this section, we will see a short-term bullish and bearish trading system in profitable currency pairs. Make sure that this system applies to major pairs only. In particular, it is highly profitable in EUR/USD and GBP/USD.

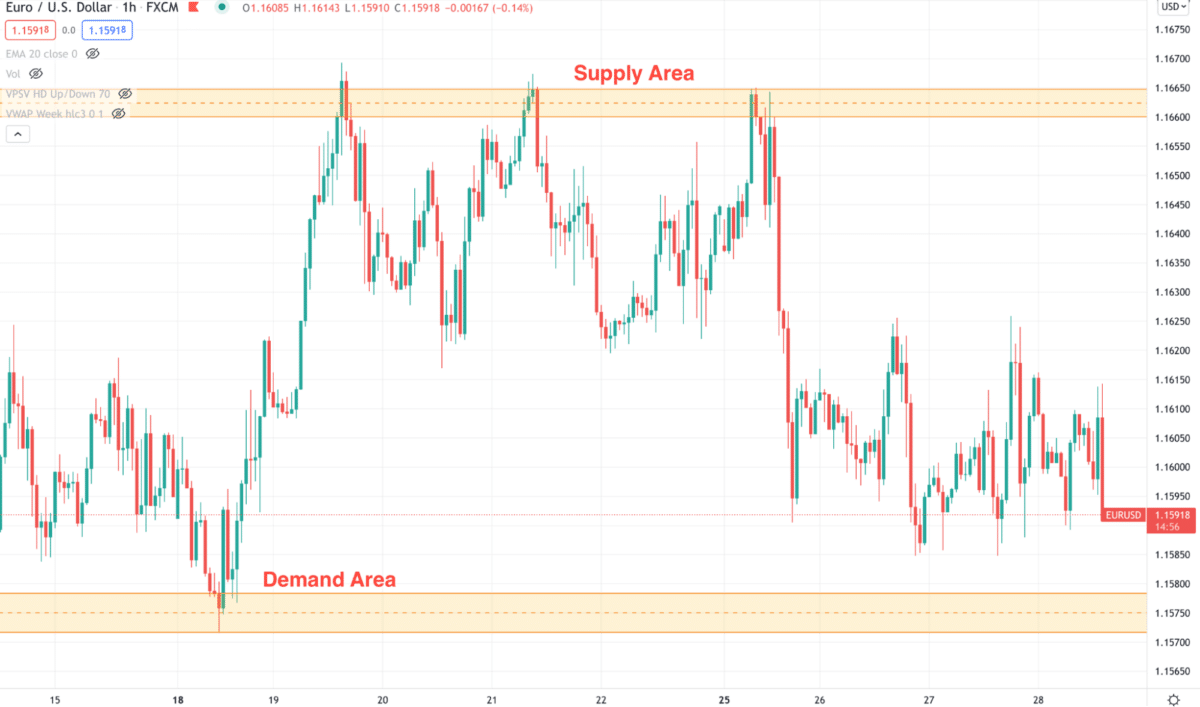

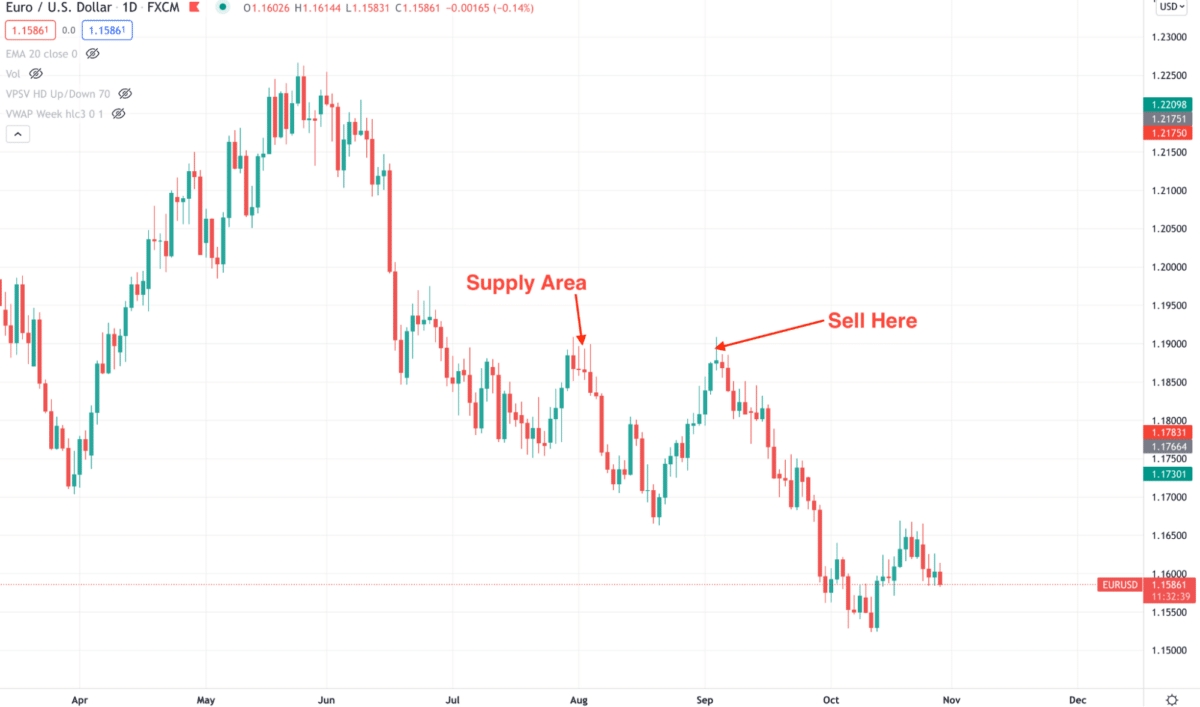

It is a trend trading method where we will focus on the supply-demand concept. Make sure to follow where the major market trend is heading. Later on, find the supply and demand zone where the price showed an aggressive movement and violated near-term highs and lows.

The above image shows the H1 chart of EUR/USD, where the price moved lower from a zone known as the supply zone. On the other hand, the price moved higher from the demand zone. Institutional traders and banks open trades from these zones that make them perfect for trend trading.

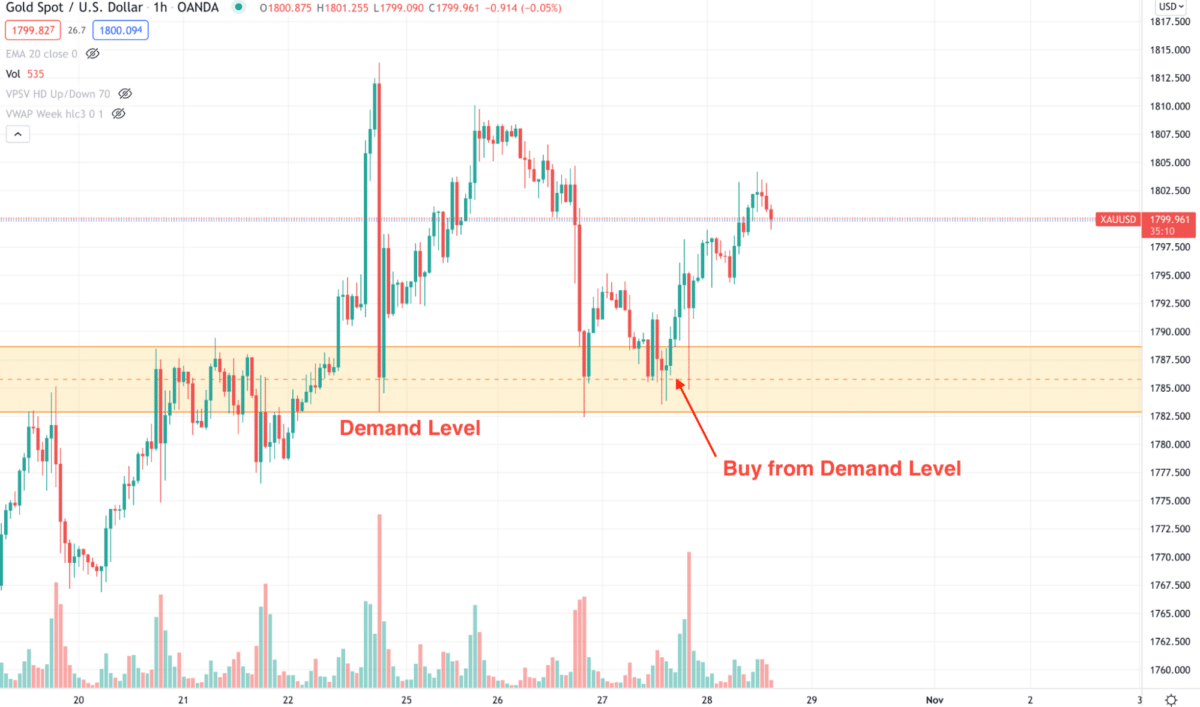

Bullish trade setup

Before opening a buy trade, make sure that the daily price is above any strong daily demand level and supply level is far from the price. After that, open the H1 chart and find the following conditions:

- The price moved up from an area that breached the near-term resistance level.

- Instead of making further highs, the price returned to the demand zone and formed a bullish reversal candle.

- Open a buy trade after the H1 closes with the stop loss below the demand area.

- Take profit is based on the near-term resistance level.

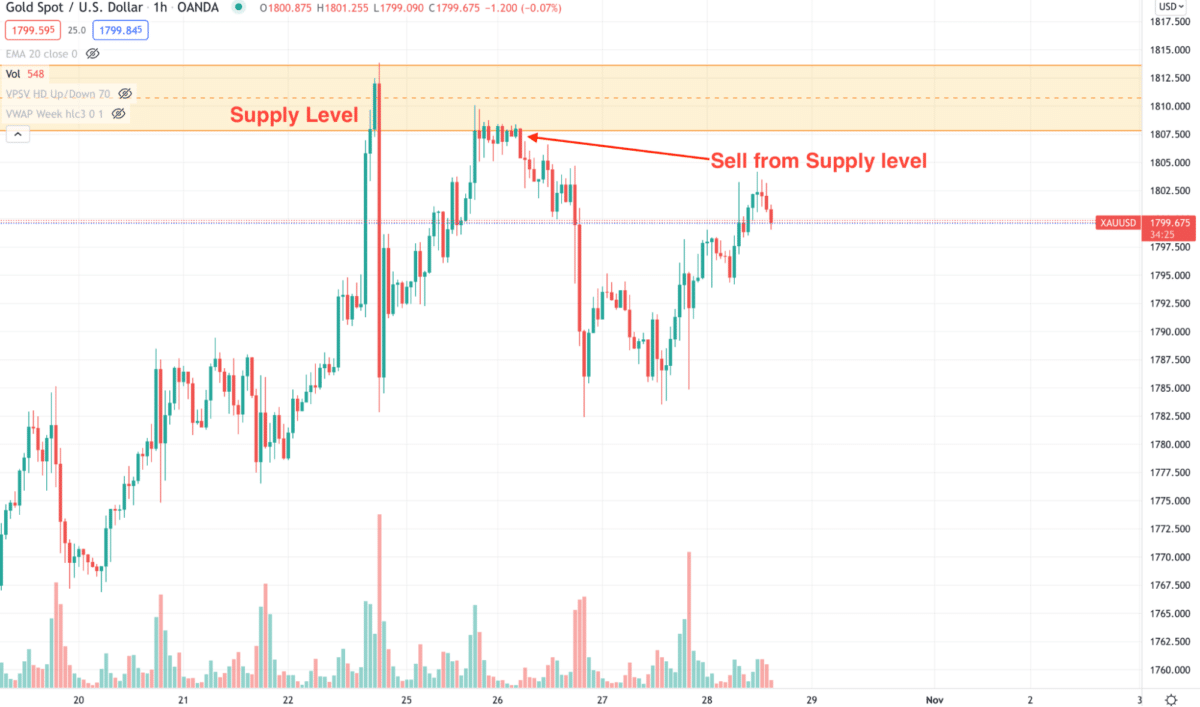

Bearish trade setup

It is the opposite version of the bullish trade setup. Before opening a buy trade, make sure that the daily price is below any strong daily supply level and find the following conditions:

- The price moved down from an area that breached the near-term support level.

- Instead of making further lows, the price returned to the supply zone and formed a bearish reversal candle.

- Open a sell trade after the H1 closes with the stop loss above the supply area.

- Take profit is based on the near-term support level.

A long-term strateg

The long-term method is more profitable than the short-term one, where we should focus on where the daily trend is heading. Moreover, this method should match the trend direction from the weekly chart. Traders can use this strategy as a swing trading or investment method.

Bullish trade setup

Find the following conditions in the price to open a buy trade:

- The weekly trend is higher, above the demand level.

- Price formed a demand zone in the daily chart.

- After making a new swing high, the price came lower and was rejected from the demand zone.

- Open a buy trade from the rejection with proper trade management.

Bearish trade setup

Find the following conditions in the price to open a sell trade:

- The weekly trend is lower, below the supply level.

- Price formed a supply zone in the daily chart.

- After making a new swing low, the price moved higher and was rejected from the supply zone.

- Open a sell trade from the rejection with proper trade management.

Pros & cons

Let’s see the pros and cons of the best forex pairs to trade 24/7.

| Worth to use | Worth to getaway |

| Best pairs have higher liquidity that makes trading profitable. | Any specific strategy for a pair might not work in major pairs. |

| Price action, swings, trend, and candlestick analysis works well in major pairs. | Country-specific analysis needs additional attention to associated countries. |

| Opening and closing trades with a logical explanation are possible in best forex pairs. | Minor and exotic pairs often provide more profits than majors. |

Final thoughts

The FX is open for all 24/5. No matter where you live or what your occupation is. People from all countries see the same chart in trading platforms that makes this market very competitive. Besides following the best forex pairs, make sure to manage your trade properly. The ultimate success depends on how you minimize the loss in forex trading.