There are tons of strategies available in the trading space. Many people either use other’s strategies by going through videos on Youtube channels and books or making their trading strategy. Lots of traders and investors are on the constant watch of discovering new techniques and strategies to make their trading one step ahead towards perfection.

Trading is a game of probability, and nothing is 100% here, making it hard to deal without a good strategy. But yes, choosing a strategy is an overwhelming task because of the availability of numbers. Few strategies work well in a volatile market, while just some work in a less volatile one.

Now, apart from selecting from someones’ existing forex trading strategy, you could also choose to make your FX trading strategy. It sounds like a difficult task to do, right?

Making a forex trading strategy is not challenging. It is fun, easy, and flashing. To make it, you need a trading plan that fits your style by keeping in mind the forex market factors. Traders can make their plans the way they want, but to help, we have listed down a few crucial steps.

№ 1. Preparing yourself mentally

Trading is all about feeling good before entering the market. In other words, trading is physiological. How do you think that particular day before trading is more important than deciding which asset to trade?

Before trading, you must set aside for a while, think about how you feel, and ask a few questions — are you angry? Are you upset? Did you sleep well? Are you all set to handle the challenges ahead? If you are not emotionally and psychologically ready to do battle in the market, take the day off — otherwise, you risk losing your capital.

№ 2. Setting your goals

Goal setting is not only crucial in trading but also in real life. Without a goal, your trading career will not go too far. Set your goals — how much you want to make at the end of the month, quarterly, yearly. Also, set your realistic goals and not something you cannot achieve.

№ 3. Deciding on the trading style

Before you start making your strategy, you first need to understand and decide what type of trader you want to be. Either you could be a scalper, a day trader, or a swing trader. This will help you to focus on one style by using your strategy on it.

The trading style is just deciding on the time frames of charts for trading. There is a lot of recommendation that using 15 min for scalping is the best time frame, followed by 4hr for day trading and weekly for swing trades.

Also, it is essential to notice the higher the time frame, the better is the signal. Lower time frames have a lot of noise and indecision candles, making it hard to trade using price action strategies.

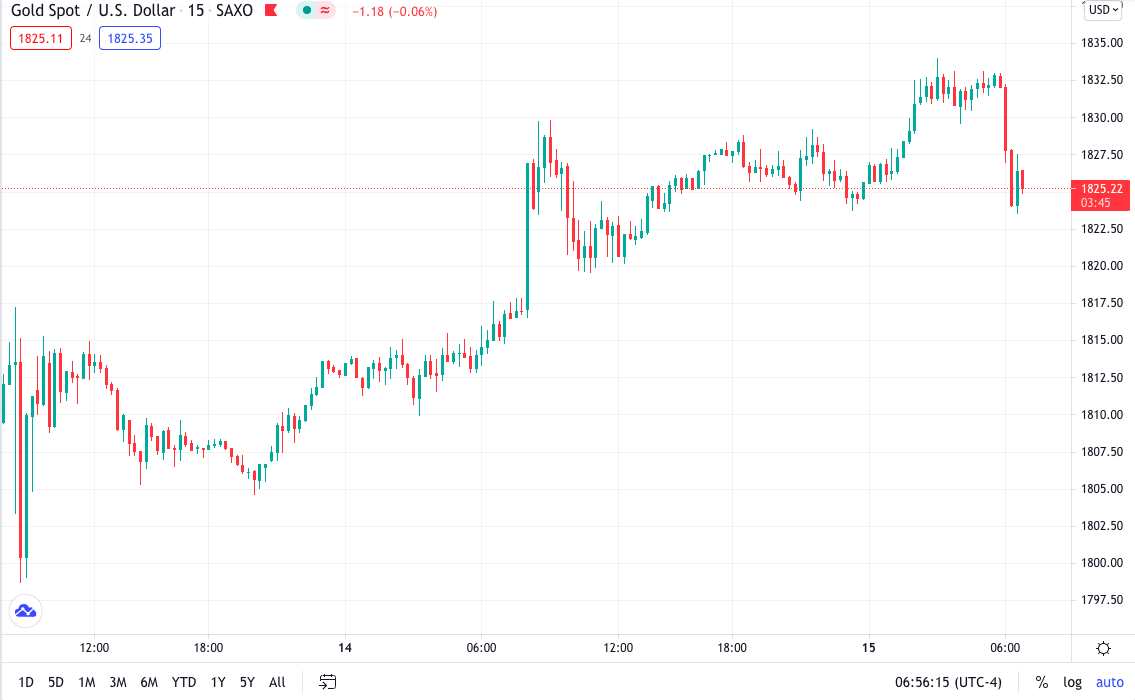

15 minutes time frame for scalping

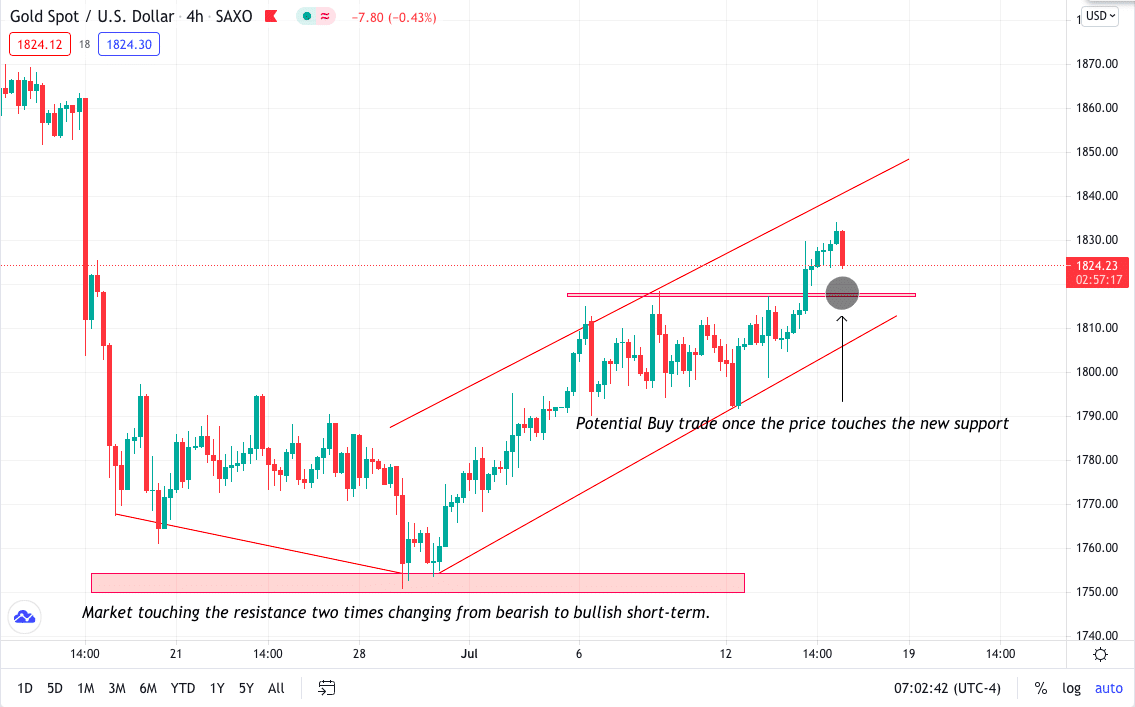

4hr time frame for day-trading

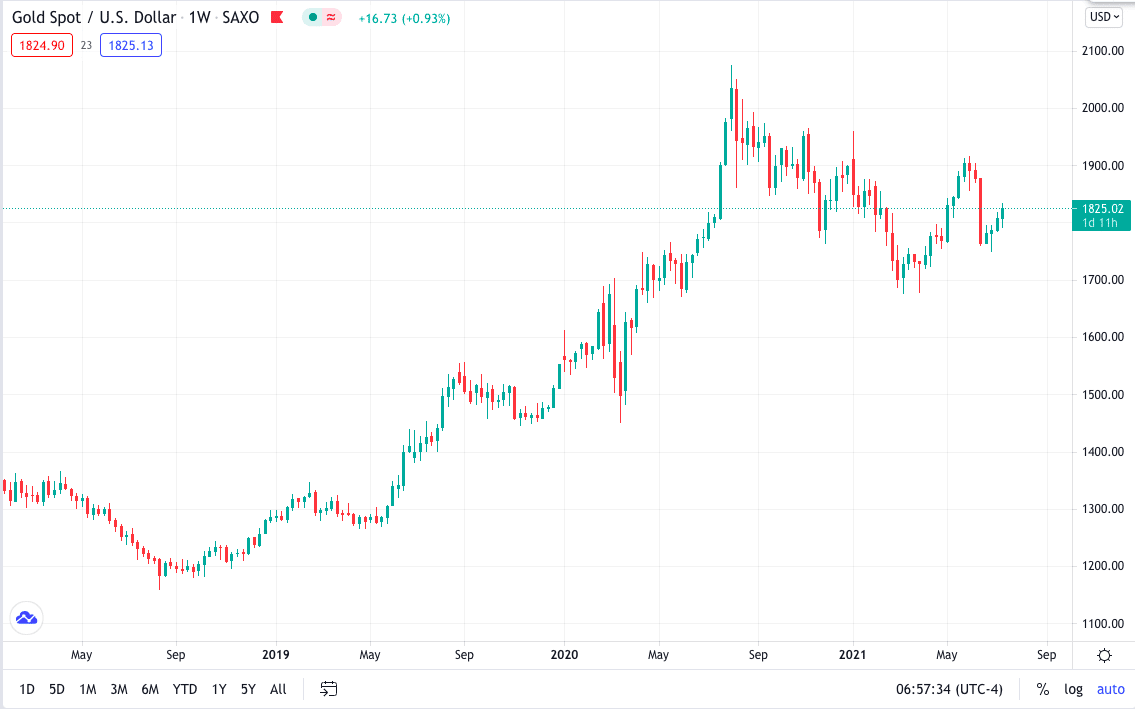

The weekly time frame for swing trading

№ 4. Deciding on the forms of forex trading

You know yourself better than anyone else. You know what insists you the most — is it the fundamental or the technical analysis?

- If you want to trade fundamentals, you need to maintain a journal and write down the important news events that come in a year, followed by half-yearly, quarterly, monthly, and weekly.

- If you want to trade technicals, learn and use a few of the indicators you wish to use. Apart from indicators, you could also use technical trading techniques like Elliott wave, price action, harmonic pattern trading, etc.

№ 5. Deciding on the asset, time frame, and trading strategy

In both forms of trading, you will need to master the charts and time frame. My suggestion would be to use the top-down trading approach. In the top-down trading strategy, you will be using the higher time frame, say daily and 4hourly to decide the overall market’s trend, followed by 1hourly and 30min TF for rejection and trade executions.

It will always be better to decide on what asset you will be trading the most. For example, let’s say you want to make a trading strategy for gold, then you need to focus on every aspect of trading gold using both fundamentals and technicalities. It is important to note that a gold strategy might not work for other currency pairs because gold is too volatile. In the same way, a less volatile pair’s trading strategy might not work for gold.

Price action trading is a form of technical trading wherein you don’t use any indicators; you use the price movements and the pattern keeping just the chart. For your technicals, you could either use indicators for price action as I do. Trading using price action will keep you ahead of any indicators as more of them are lagging indicators.

The above chart shows deciding on the asset — XAU/USD here according to the strategy and personality. Here we have taken a 4hr time frame for day-trading gold using the price action strategy.

As you can see, the price at first was under bearish pressure, followed by touching the resistance twice without breaking it. The price here then converted to bullish, respecting the trendline. There can be a potential buy trade once the price touches the new support. Once seen, we will need to move to the lower time frame, say 30 or 15, to look for rejection and trade execution.

№ 6. Setting your exit and entry rules

Whatever your trading style may be, you will always need a good entry and exit plan. You cannot enter the market just for the sake that you think the market will go up. You also need pure evidence that will say the market will go in any specific direction.

Before entering, you always need to strategize when to exit the market and hedge the position if required.

№ 7. Trading and backtesting

Once you have your strategy, you need to take your trades in the demo account and see how it works. Once confident enough that the strategy is working, you can move into a real account. Keep backtesting the strategy as much as possible. Try testing it in a less volatile and volatile market to ensure it works in all market conditions.

№ 8. Managing risk and keeping the record

Just like any other industry, trading is also a challenge. A challenge to become the better version of yourself. Always keep a journal and record how much trade you took, the amount you lost and won at the end of the trading session.

Try to maximize your risk-reward as much as possible. Over-trading is a significant reason why maximum traders blow their accounts. Therefore it is crucial to keep your risk low.

№ 9. Sticking to the plan and making corrections if required

Always remember, everything takes time. Nothing is quick, and nothing is permanent. You must be consistent in your trading approach by sticking to your plan. Do not divert from your plan, and do not change it too frequently.

Go slow, and steady wins the race. Try beating the market but not by cashing it but instead using your analysis and strategy. If required, you can make changes to the plan but not always.

Final thoughts

Trading and winning in a demo account will help you but will not guarantee success while trading with real money. That is because of the emotions that come with real money. Trading in the demo will give you an edge to learn and become confident in the system.

Having a trading plan is essential to be in the trading game for a long time. Traders have to have skills and also a winning attitude leaving emotions aside. When to enter and exit the market is vital to know for every trader. Some traders, especially day traders, treat trading as a doable daily job, but this should never be the case.

As a professional trader, you must also stay away from the market when your analysis says the market is not favorable. Do not force yourself into the trade just for the sake that you have to. Confidence in your strategy, patience, and consistency is the key to success in trading.